China’s Vice Premier To Sign Trade Deal In Washington Next Week

China’s Vice Premier Liu He, the country’s top trade negotiator, is expected to sign the Phase 1 trade deal in Washington next week, Gao Feng, a spokesman at the commerce ministry, told Reuters at a press event on Thursday. Gao said Liu and his trade team would visit Washington on January 13-15 to sign the deal: “Negotiating teams from both sides remain in close communication on the particular arrangements of the signing,” Gao said.

- COMMERCE MINISTRY, ASKED ABOUT TRADE DEAL WITH U.S., SAYS VICE PREMIER LIU HE TO GO TO WASHINGTON TO SIGN PHASE ONE DEAL

- CHINA COMMERCE MINISTRY, ASKED ABOUT TRADE DEAL WITH U.S., SAYS VICE PREMIER LIU TO TRAVEL TO WASHINGTON BETWEEN JAN 13 AND JAN 15

- CHINA COMMERCE MINISTRY, ASKED ABOUT TRADE DEAL WITH U.S., SAYS TWO SIDES’ NEGOTIATING TEAMS REMAIN IN CLOSE COMMUNICATION ON PARTICULAR ARRANGEMENTS ON SIGNING

So far, there’s no public version of the trade deal. While President Trump has declared China will buy “massive” amounts of agricultural products, Liu’s trade team has yet to state hard commitments publicly. Han Jun, the vice-minister of agriculture and rural affairs, was quoted by Caixin on Tuesday saying that Beijing won’t increase its annual import quotas for wheat, corn, and rice. This could complicate things for the trade deal as Trump administration officials have pressured China to double its $24 billion pre-trade war purchases of U.S. farm goods to nearly $40 billion.

Han is also part of the trade negotiating team, said last month that China would increase annual quotas on wheat, rice, and corn. But as of Tuesday, Han and the trade team have changed their minds saying the quotas “won’t adjust for one country.” Refinitiv data shows purchases of the three grains from the U.S. totaled around $534 million.”

Although there’s certain types of high-quality wheat that China would look to import, maxing out the tariff rate quota would also weigh on domestic producers,” Darin Friedrichs, senior Asia analyst at INTL FCStone, said in a note Monday.

“China will be facing a tough balancing act of trying to satisfy the U.S. demands for large agriculture purchases, while also not hurting the rural population,” Friedrichs added.

Last month, we said with absolute certainty that China couldn’t uphold the trade agreement, even if it wanted to. Simply, there’s no way that China could increase U.S. farm good imports by 235% in 2020. It’s not just because China is protecting its domestic agricultural markets, but rather, it’s because Brazil and Argentina have ramped up shipments of grains to the Asian country, and due to the sticky contracts behind China’s new supply chains.

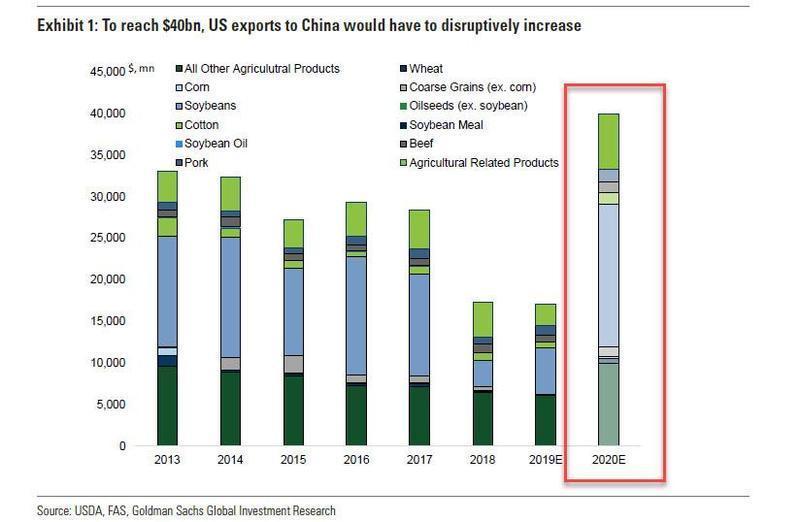

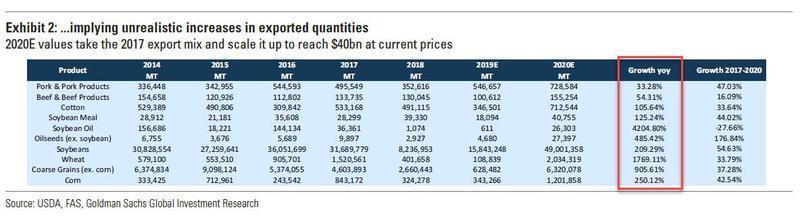

Goldman Sachs pointed out in a recent note that any massive increase in Chinese purchases from the U.S. “would likely be hugely disruptive to global agriculture markets, primarily crowding out Argentine and Brazilian supplies that have taken substantial market share since 2017 due to the trade war and much weaker currencies.” To get a sense of just how improbable such a surge in Chinese imports from the U.S. is, here is a visual representation of what this “disruptive increase” in U.S. agriculture exports to China would look like…

… and also why the assumption in exported quantities to China is, as Goldman points out, thoroughly “unrealistic.”

Tyler Durden

Thu, 01/09/2020 – 07:11

via ZeroHedge News https://ift.tt/2uqxvnY Tyler Durden