Global Markets Soar To Record Highs On Trade War, World War Optimism

So much for the risk of a Iran-US conflict spilling over into World War 3, at least according to markets which soared yesterday after Trump refused to re-escalate the armed conflict with Tehran, and have continued to surge since.

“Iran appears to be standing down, which is a good thing for all parties concerned and a very good thing for the world,” Trump said. He announced economic sanctions on Iran without giving details. Meanwhile, Iranian Foreign Minister Mohammad Javad Zarif had earlier said the strikes “concluded” Tehran’s response to the killing of its general, Qassem Soleimani.

As a result of this “all clear”, in Europe the Stoxx Europe 600 Index rose for third session as every major national benchmark increased in a burst of euphoria. In Asia, stock markets also surged higher as MSCI’s broadest index of Asia-Pacific shares ex-Japan rose 1.3%, its biggest gain in almost a month led by IT and communications companies. The MSCI Asia Pacific index headed for its highest level since June 2018, with all markets in the region up, except New Zealand and Singapore. Japanese shares were among the top performers, with SoftBank Group Corp. and Sony Corp. driving gains for the Topix. The Shanghai Composite Index also reversed some of Wednesday’s losses, with Kweichow Moutai Co. and Foxconn Industrial Internet Co. up. Hong Kong’s Hang Seng and Shanghai blue chips each added more than 1.2%. Japanese stocks gained 2.3% to their highest for the year. Australian stocks rose 0.8% to a record closing high.

China’s consumer inflation steadied in December after hitting the highest since 2012 the previous month, while pressure remains ahead if oil prices continue to rise. Overnight China’s NBS reported that the latest, December, CPI, came in at 4.5% slightly below the 4.7% (vs prev. 4.5%), while PPI for December also missed at -0.5% vs. Exp. -0.4%, if better than the previous -1.4%.

Indeed, as Reuters notes, global markets looked to have overcome their new year wobbles on Thursday, as the United States and Iran backed away from conflict in the Middle East.

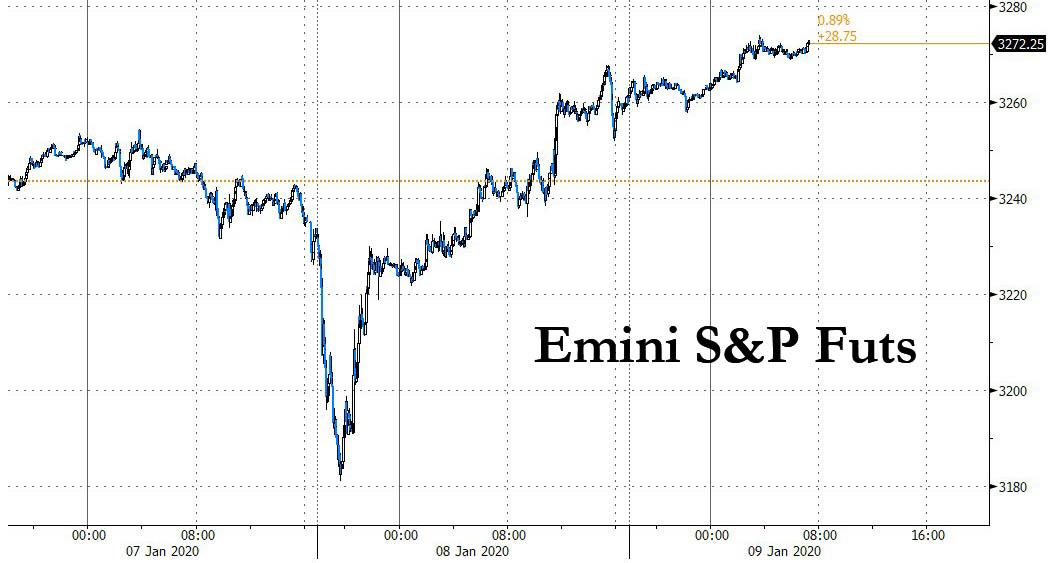

As a result, after hitting an all time high on Wednesday, the ramp continued overnight, and US equity futures markets pointed to gains continuing in the United States, with S&P 500 futures up 0.3% and Dow futures 0.4% higher.

“I think today is a bit of a relief rally,” said AMP Capital chief economist Shane Oliver in Sydney. “Yesterday, investors were fearing the worst, that this was the escalation now underway. “The news overnight has been more along the lines that Iran pulled its punches and Trump is toning things down, which is seen by investors as substantially reducing the risk of a war.”

In rates, Treasuries, which had soared in the flight to safety, also settled back. Yields on the benchmark 10-year U.S. Treasury note were at 1.8633%, after dropping as low as 1.705%. European bond yields were also at one-week highs, with the benchmark German Bund yield almost 4 basis points higher on the day at -0.22%, albeit still below last week’s seven-month highs.

In FX, the flight to safety trade unwound aggressively, and the yen continued to reverse its 2020 gains in European trading. It was last down 0.2% at 109.36, its lowest in a week and a half. Another safe currency, the Swiss franc, also fell against both the dollar and the euro. The Bloomberg dollar spot index rose a third day as the greenback advanced against most Group-of-10 peers amid positioning ahead of a Fed-heavy day and non-farm payroll data tomorrow. The pound weakened against all other major currencies after Bank of England Governor Mark Carney said the central bank has at least 250 basis points of additional policy space, acknowledging the possibility to use both conventional non- conventional tools. The Australian dollar rose from a three-week low as haven bids waned amid easing tensions between the U.S. and Iran. Risk appetite was also evident in emerging-market currency markets. China’s trade-exposed yuan reached a five-month high of 6.9281 per dollar and hard-hit currencies like South Africa’s randand Turkey’s lira also gained.

“The obvious first conclusion to make is that we see the potential for further yen depreciation going forward,” said MUFG’s EMEA head of research, Derek Halpenny, adding that $1.10 could be possible and that the euro might lose ground, too.

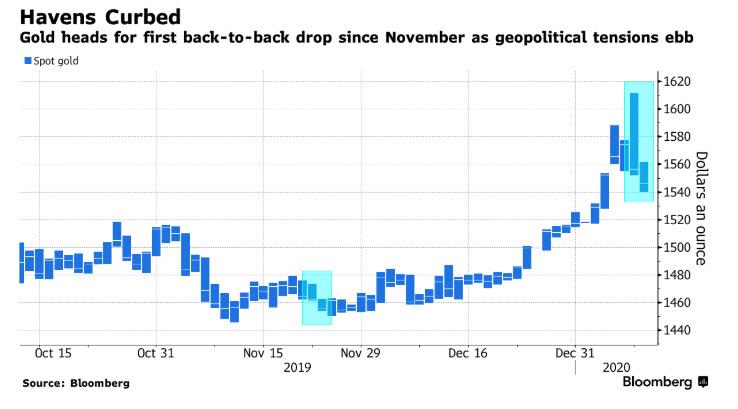

As risk soared, commodities tumbled, and oil is now somehow cheaper than it was before the killing of Soleimani. Brent futures steadied at $65.41 per barrel, about where they began the year. Gold fell to $1,544.80 per ounce before rebounding back to $1550, giving back Wednesday’s gains but remaining more expensive than it was before Soleimani’s death, suggesting investors’ fears have not evaporated.

If the geopolitical calm holds it will allow traders to switch focus to the next clue on the health of the world’s biggest economy, which will come with the U.S. non-farm jobs report on Friday: “The backdrop remains benign for equities,” Mona Mahajan, an investment strategist at Allianz Global Investors, told Bloomberg TV. “Low rates, low inflation and low growth. A mild Goldilocks in many ways.”

“All is well – so says Trump! That is the mood today,” said Bank of Singapore currency strategist Moh Siong Sim, and so it shall be until something more than just a headline breaks the cycle of stocks rising to new all time highs amid optimism the either a trade war, or world war, has been delayed.

Economic data include initial jobless claims, and several Fed speakers are on the agenda. Intuitive Surgical and Acuity Brands are due to report earnings.

Market Snapshot

- S&P 500 futures up 0.3% to 3,271.00

- STOXX Europe 600 up 0.5% to 420.36

- MXAP up 1.3% to 172.00

- MXAPJ up 1.5% to 559.85

- Nikkei up 2.3% to 23,739.87

- Topix up 1.6% to 1,729.05

- Hang Seng Index up 1.7% to 28,561.00

- Shanghai Composite up 0.9% to 3,094.88

- Sensex up 1.5% to 41,431.85

- Australia S&P/ASX 200 up 0.8% to 6,874.23

- Kospi up 1.6% to 2,186.45

- German 10Y yield rose 1.3 bps to -0.194%

- Euro up 0.05% to $1.1110

- Brent Futures up 0.5% to $65.78/bbl

- Italian 10Y yield rose 3.6 bps to 1.243%

- Spanish 10Y yield rose 1.6 bps to 0.449%

- Brent Futures up 0.1% to $65.49/bbl

- Gold spot down 0.7% to $1,546.08

- U.S. Dollar Index up 0.07% to 97.36

Top Overnight News from Bloomberg

- President Trump vowed more sanctions on Iran as part of his “maximum pressure” campaign against the Islamic Republic. The sanctions will likely be aimed at non-oil sectors of the economy and fit into a plan to choke off other sources of revenue

- Oil steadied as investors weighed the risk of further escalation in the U.S.-Iran conflict that has so far spared production and exports from the Middle East

- Boris Johnson and Ursula von der Leyen set out rival red lines for their visions of a post-Brexit deal in the first clash of a negotiation set to be thornier than the fraught talks to secure Britain’s divorce from the bloc

- ECB President Christine Lagarde used her first public remarks of 2020 to push for greater coordination between the region’s policy makers, saying a joint fiscal push would help jump-start the sluggish economy.

- China’s consumer inflation steadied in December after hitting the highest since 2012 the previous month, while pressure remains ahead if oil prices continue to rise.

- Sweden’s Riksbank is running into criticism from economists for not doing enough to explain last month’s historical decision to end five years of negative interest rates

- German industrial production rebounded in November after two months of declines, in a cautious sign that Europe’s largest economy may be near the bottom of its manufacturing slump

- India’s plan to sell $14.7 billion of government-owned assets to plug its budget deficit is seen falling short by nearly half, according to people familiar with the matter

- The Swiss National Bank plans to make a bigger payout to the government from its 49 billion-franc ($50 billion) profit, a move aimed at dousing some of the criticism of its monetary policy

Asia-Pac bourses kicked off the session with firm gains across the board after a positive handover from Wall Street – which saw the Nasdaq Comp notching intraday and closing records, whilst the S&P hit intraday all-time highs. Global sentiment was bolstered by what seems to be a simmering down in US-Iran tensions, with US President Trump also stating that the US is ready to embrace peace after saying that Iran appears to be standing down. US equity futures and cash experienced some losses heading into the Wall Street close amid reports of two rockets hitting Baghdad’s Green Zone near the US Embassy, although negative sentiment failed to materialise as no casualties were registered. ASX 200 (+0.8%) gleaned support from its largest weighted financials sector, but gains remained hindered as oil and precious metal names are pressured by recent price action in the respective complexes. Nikkei 225 (+2.3%) outperformed peers in the region as the index welcomed favourable JPY dynamics and with only a small fraction of its constituents in negative territory. Elsewhere, Hang Seng (+1.7%) and Shanghai Comp (+0.9%) echoed the performance in regional peers after the Mainland initially side-lined below-forecast Chinese inflation figures for a bulk of the session, with the US-China Phase One deal signing drawing closer.

Top Asia News

- South Korea’s Moon Reassigns Prosecutors Probing Government

- SoftBank-Backed Coupang Said to Prepare for IPO as Soon as 2021

- Uniqlo Sees Worst Overseas Sales Drop in Decade Amid Asia Unrest

European bourses are firmer this morning, in the next turn of what is proving to be a roller-coaster week for markets. This strength comes as comments from US President Trump yesterday intimated a de-escalation in tensions, more information available in the Commodity section below. This morning’s notable outperformer is the Dax, with the cash bourse having printed a high above the 13500 mark; marking a significant retracement/turnaround from the weeks low below the 12950 level, an over 500 point range already for the index. Sector wise, energy is this morning’s notable underperformer, on the aforementioned de-escalation in tensions in-line with the broader crude complex. Energy aside, the remaining bourses are in positive territory for the session. At the bottom of the Stoxx 600 this morning are Marks & Spencer (-9.4%), after providing a Q3 and Christmas Period trading update; in which, they did note that gross margins are expected at the lower-end of guidance, but this should be offset. In contrast, after also providing a holiday update, Tesco (+2.2%) are firmly in the green, the Co. highlighted that over the Christmas period they outperformed the market. UK supermarkets aside, flight names such as Air France (+4.3%) are benefitting on the reduction in oil-prices and calming of tensions; with Air France specifically having provided a strong December update this morning. EU antitrust regulators have now recommenced their investigation into the Boeing (BA) and Embraer deal, following on from Boeing presenting requested data, decision is due by the 30th of April

Top European News

- Tough Christmas Rounds Out U.K. Retailers’ Worst Year Ever

- Calisen Is Said to Weigh Seeking GBP1.3b-GBP1.5b IPO Valuation

- Estonia Warns Banks’ Anti-Laundering Measures Stifle Business

- Norway Raises Oil Production Forecasts Thanks to Sverdrup Giant

In FX, the great Greenback revival continues, albeit gradually, with the DXY nudging through 97.500 having picked off the next upside chart objectives at 97.344 and 97.350 to target December 27’s 97.552 high set before the broad Dollar was beset by portfolio selling for year end. The Buck is still forging gains or clawing back losses vs major rivals, and in particular those currencies deemed to be safer havens, with only a minor blip caused by several incendiary Iranian remarks earlier today, as investors take comfort from the fact that Tehran’s strike back did not irk US President Trump to the extent of further action beyond more sanctions.

- GBP – Unexpectedly dovish commentary from BoE Governor Carney has pushed the Pound down to the bottom of the G10 rankings, as he raises some doubt about the anticipated 2020 economic recovery and reveals that the MPC is mulling whether it needs to help via additional stimulus. Moreover, he believes there is room to restart QE within a wider easing package equating to 250 bp and the APF more than twice the size of August 2016’s Gbp60 bn. Cable had already given up 1.3100+ status around the 9 am fix as Eur/Gbp squeezed up towards 0.8500, but Sterling declines subsequently extended to sub-1.3020 and circa 0.8530 respectively.

- NZD/JPY/AUD – The Kiwi and Yen are also underperforming, as Nzd/Usd retests support/bids ahead of 0.6600 and Usd/Jpy probes offers/supply into 109.50. However, the former appears weak partly, if not mainly due to relative Aussie resilience near 1.0350 and 0.6850 vs its US peer in wake of a much wider than forecast trade surplus, while the latter may yet be drawn back down towards a very large option expiry at 109.25 (2.4 bn).

- EUR/CHF/CAD/NOK/SEK – All softer against the Greenback or Euro in the case of the Scandi Crowns, but to varying degrees with the single currency and Franc holding up a bit better than others even though Eur/Usd has pulled back further from recent highs and into a heavy option expiry interest zone spanning the 1.1100 level (1.7 bn from 1.1090 to the round number and 1.5 bn between 1.1110-15). Meanwhile, Usd/Chf is trapped in a tight 0.9732-47 range following stagnant Swiss retail sales data (y/y) and Usd/Cad awaits Canadian housing starts and building permits before a late speech from BoC chief Poloz within 1.3026-56 confines, while Eur/Nok and Eur/Sek are both firmer circa 9.8700 and 10.5200, tracking overall risk sentiment, oil prices and for the Norwegian Krona also taking on board rather tepid monthly mainland GDP.

In commodities, today’s price action sees the crude complex in negative territory, as last nights remarks via US President Trump point to a de-escalation in the Middle East noting that he would prefer not to take a military response; albeit, POTUS did state the US is to implement further sanctions on Iran. However, subsequent remarks from a Iranian Commander state they will take ‘harsher revenge soon’ for the killing of Soleimani, following the missile strikes on US-Iraqi targets; recall, that Iran states these strikes were the least severe of the 13 options that they had considered. As such, this indicates that perhaps tensions have not entirely fizzled out, as the current market environment points towards. ING highlight that, recent price action, means speculators are now holding their largest net-long in Brent since October 2018; which they posit provides room for significant sell-off/liquidation of positions, particularly in the event that next week’s US-China signing disappoints. In-fitting with the de-escalation price action, spot gold has dropped below the USD 1550/oz mark, well off of yesterday’s USD 1600/oz+ highs. In other metals news, Brazilian state prosecutors intend to criminally charge Vale shortly regarding the Brumadinho dam collapse which resulted in the death of over 250 people.

US Event Calendar

- 8:30am: Revisions: Philadelphia Fed Manufacturing Index

- 8:30am: Initial Jobless Claims, est. 220,000, prior 222,000; Continuing Claims, est. 1.72m, prior 1.73m

- 9:45am: Bloomberg Consumer Comfort, prior 63.9

Central Banks

- 8am: Fed’s Clarida Discusses Economy, Monetary Policy in New York

- 9:30am: Fed’s Kashkari Speaks at Regional Economic Conference

- 11:30am: Fed’s Williams Speaks at BoE in London

- 12:45pm: Fed’s Barkin Speaks in Richmond

- 1:20pm: Fed’s Evans Speaks on Economic Outlook

- 2pm: Fed’s Bullard Speaks to Wisconsin Bankers

DB’s Jim Reid concludes the overnight wrap

Another 24 hours down and another 24 hours dominated by developments in the Middle East. The reality is that there hasn’t been much else for markets to feed off in the early going this year however we do have the welcome distraction of a decent slew of Fedspeak today with no fewer than six speakers. Clarida and Williams, both of whom are seen as dovish, will likely garner the most attention with the market likely to be particularly focused on their comments on inflation targeting. A reminder also that tomorrow brings the final US employment report of 2019.

In the meantime, markets have essentially been one-way ever since we got the initial jerk sell-off to the missile strike on US bases in Iraq in the small hours of Wednesday out of the way. We spent most of yesterday waiting for President Trump’s statement which appeared to provide sufficient relief that the chances of a further ratcheting up of tensions has likely diminished for now. The President announced that he would impose further sanctions on the Iranian regime, thus avoiding further military escalation. He also confirmed that there were no American casualties as a result of the strikes and mentioned that “Iran appears to be standing down…which is a good thing for all parties concerned and a very good thing for the world”. Overnight, we’ve seen more positive headlines with US VP Pence saying that the US is receiving intelligence that Iran is sending messages to militias not to move against American targets, while the US also told the UN that it stands “ready to engage without preconditions in serious negotiations with Iran” to prevent escalation.

It would take a brave person to suggest that this is the last that we’ve heard of this geopolitical saga however for now there does appear to be comfort in the fact that any near-term re-escalation appears unlikely given the rhetoric over the last 24 hours from both sides. In markets the big mover has been the oil complex where Brent crude is now trading below $66/bbl – roughly $6 off the intraday highs of early Wednesday morning. That also means Brent is now trading back around the levels of last Friday and prior to the killing of Soleimani. Similarly the S&P 500 and NASDAQ, which rallied +0.49% and +0.67% respectively last night despite a late dip into the close on the back of reports of a rocket attack near the US embassy in Iraq touched new record highs intraday. As for safe havens, 10y Treasury yields rose +5.5bps to 1.875% meaning they’ve now fully retraced and even Gold is closing in on “pre-crisis” levels following a -1.14% decline yesterday. That was actually the first decline for Gold since December 27th and only the second in the last 13 trading sessions.

The risk-on trade has continued overnight in Asia where we’ve seen the Nikkei most notably climb +2.17%. There have also been decent gains for the Hang Seng (+1.06%), Shanghai Comp (+0.47%) and Kospi (+1.16%) while US equity futures have also nudged higher. There hasn’t been a huge amount else to report. Data in China showed that CPI held steady at 4.5% yoy in December albeit with the consensus expecting a rise to 4.7% yoy, while PPI rose from -1.4% yoy to -0.5% yoy (vs. -0.4% expected).

In other news, although Brexit has received less attention lately following Prime Minister Johnson’s decisive election victory, European Commission President von der Leyen was in London yesterday to meet with the Prime Minister. In a speech at the LSE, von der Leyen set out many of the EU’s existing positions, but notably said that “without an extension of the transition period beyond 2020, you cannot expect to agree on every single aspect of our new partnership. We will have to prioritise.” It comes as the UK government have refused to extend the transition period beyond the end of 2020 – a point made again by PM Johnson yesterday – even writing that into the text of the ratifying legislation. The pledge not to extend beyond 2020 was also made in the Conservative election manifesto, so it’s a pretty important one for the UK government, and comes in spite of the fact that under the Withdrawal Agreement, the two sides can agree to extend the transition period for up to 2 years before the start of July 2020. A big question for the upcoming trade negotiations will be to what extent the UK pursues alignment with the EU, and von der Leyen said that “The more divergence there is, the more distant the partnership has to be.” So it’s clear that Brexit isn’t going to go away as an issue over the coming year, with an important set of negotiations for the UK economy over the coming months.

Away from politics, the data yesterday was a bit of a mixed bag. In the US and ahead of Friday’s jobs report, the ADP’s report showed private payrolls rose by +202k in December (vs. +160k expected), while the previous month’s number was revised up to +124k (vs. +67k previously). However, in Europe, the final Euro Area consumer confidence reading for December fell to -8.1, the lowest since February 2017, while German factory orders were also down -1.3% in November (vs. +0.2% expected). In France too, the INSEE’s measure of consumer confidence fell to 102 in December (vs. 104 expected), its lowest level since July.

To the day ahead now, and we have a large number of central bank speakers, with BoE Governor Carney kicking off proceedings this morning. Later on from the Fed, we’ll hear from Vice Chair Clarida, Kashkari, Williams, Barkin, Evans and Bullard. From the ECB, we’ll hear from Weidmann, Villeroy de Galhau and Schnabel, and Bank of Canada Governor Poloz will also be speaking. Data releases include German industrial production and the trade balance for November, the Euro Area unemployment rate for November, as well as the preliminary Italian unemployment rate for the same month. Over in the US, we’ll get weekly initial jobless claims, while we’ll also get Canadian housing starts for December and building permits for November.

Tyler Durden

Thu, 01/09/2020 – 07:48

via ZeroHedge News https://ift.tt/2t0RadV Tyler Durden