Beware The Ghosts Of Artificial Liquidity-Fueled Melt-Ups Past

Authored by Sven Henrich via NorthmanTrader.com,

Finally. A glimmer of cognition. An admission. A sense that the Fed knows, but is largely unwilling to admit it.

But Dallas Fed president Kaplan let it slip, the truth everybody already knows: It’s the Fed’s pumping of its balance sheet that has brought about this party like it’s 1999.

Via Reuters:

“I do think the growth in the balance sheet is having some impact on the financial markets and on the valuation of risk assets…I want to be cognizant of not adding more fuel that could help create further excesses and imbalances.”

“Some”. Cute. How about all as the correlation has been well established and the Fed is recognized as the only game in town. But at least it’s an admission and a recognition that excesses and imbalances are being created and are already in place.

Last night’s discussion on CNBC Fast Money by all participants shows how pervasive this recognition is, that the Fed is driving everything, it’s not just yours truly that keeps highlighting this point:

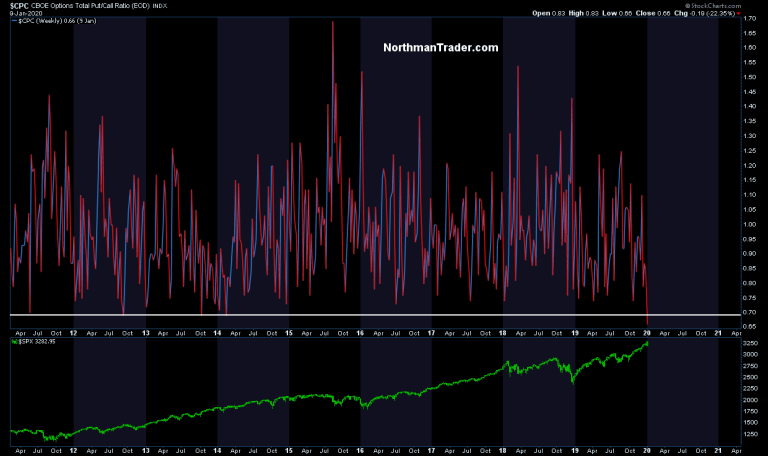

And so the artificial liquidity keeps driving equity prices above fundamentals and complacency takes on ever more extremes in its own right.

Here is the weekly put/call ratio at it slowest in 8 years:

In party like it’s 1999 I made the point that the action by the Fed is similar to what it did in the run up to Y2K. Once that was over Greenspan withdrew liquidity and markets crashed.

Already the Fed is backpedaling on reducing liquidity knowing full well it would cause trouble in equity markets:

And here they go again, kicking the can again.

Record high Fed balance sheet guaranteed.Clarida says Fed’s repo operations could continue at least through April https://t.co/hTRqd2bYPk

— Sven Henrich (@NorthmanTrader) January 9, 2020

And don’t think it’s not all about keeping markets calm and assured. They are literally giving out guarantees:

The Fed’s prime directive:

“Richard Clarida reassured traders and investors that the stock market won’t be derailed”. https://t.co/PpCNxPXtmy— Sven Henrich (@NorthmanTrader) January 9, 2020

And it’s perhaps the most crucial decision the Fed faces this year. It’s not rates stupid, it’s the balance sheet stupid.

The Fed has set equities on fire:

How much more are they willing to let the fire run out of control?

And how they can extract themselves out of the bubble they have created as the ghosts of 2000 are all around us:

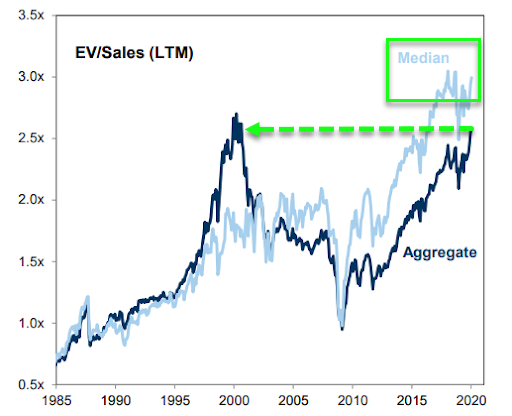

Price to sales valuations of the market higher than even 2000:

EV/EBIDTA as high as the year 2000:

EV/Sales at 200 record highs:

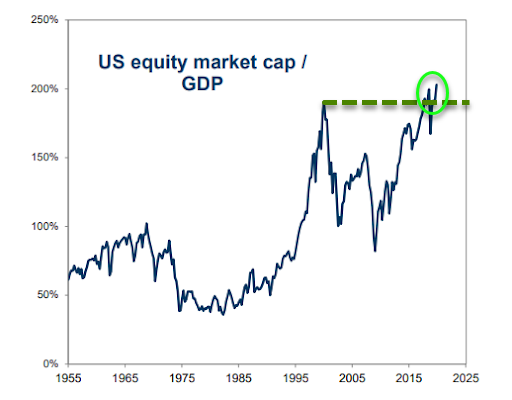

Market cap to GDP higher even since the year 2000:

And consumers? As comfortable as the put/call ratio is about risk (via Sentimentrader:):

What else did we see in 1999/2000?

Nobody caring about risk, value or valuations, just get me into stocks, even into stocks that have a lot to prove, awarding valuations not reflective of fundamentals, but chasing vertical charts without discipline or fear:

$AAPL

Weekly RSI 87.57

Market cap $1.3T

PEG ratio 2.13

Quarterly revenue growth 1.8% (yoy)

Quarterly earnings growth -3.2% (yoy) pic.twitter.com/GK2dgif8ux— Sven Henrich (@NorthmanTrader) January 8, 2020

In a bubble environment, especially one that’s driven by artificial liquidity and hype,valuations don’t matter until they do.

The Fed knows that its balance sheet operations are creating excess and imbalances. Now their job is to let the air out the bubble gently or face a 2000 repeat, a reversion to the mean that would bring about the very recession it tried to avoid in the first place. The ghosts of 2000 are all around us. Yet investors don’t seem to have any appetite for protection. In Fed we trust.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Fri, 01/10/2020 – 16:25

via ZeroHedge News https://ift.tt/2R4wdXp Tyler Durden