Rediscovering “Gravity”: Nomura Explains The Melt-Up (& Where It Reverses)

Once again, it’s all about the options market tail wagging the entire market’s dog, and as Nomura’s MD of cross-asset strategy details below, we remain a long way from investors rediscovering “gravity”…

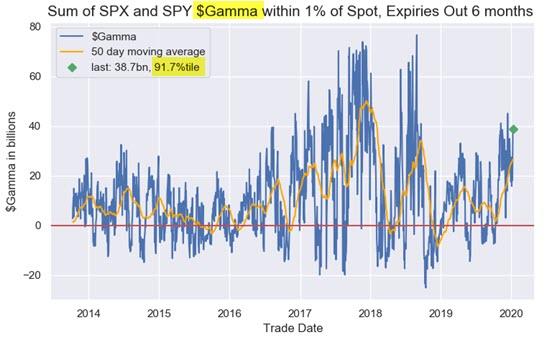

Consolidated S&P options are seeing both $Delta- and $Gamma- testing recent extremes (partially as a function of the market’s move higher), with $Gamma at 92nd %ile (rel 2014) and $Delta at 99th %ile now…

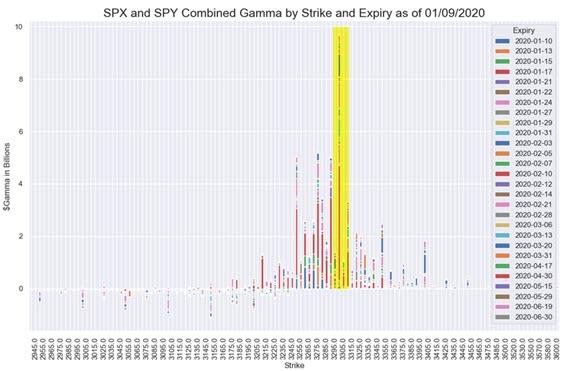

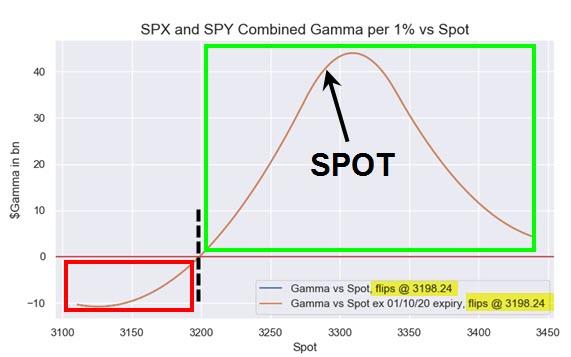

…and seeing “gravity” building at the massive 3300 strike in SPX (a whopping $10.5B-worth of $Gamma)…

…helping keep us so “sticky” between there and the next-largest $Gamma strike at 3250 ($6.7B)

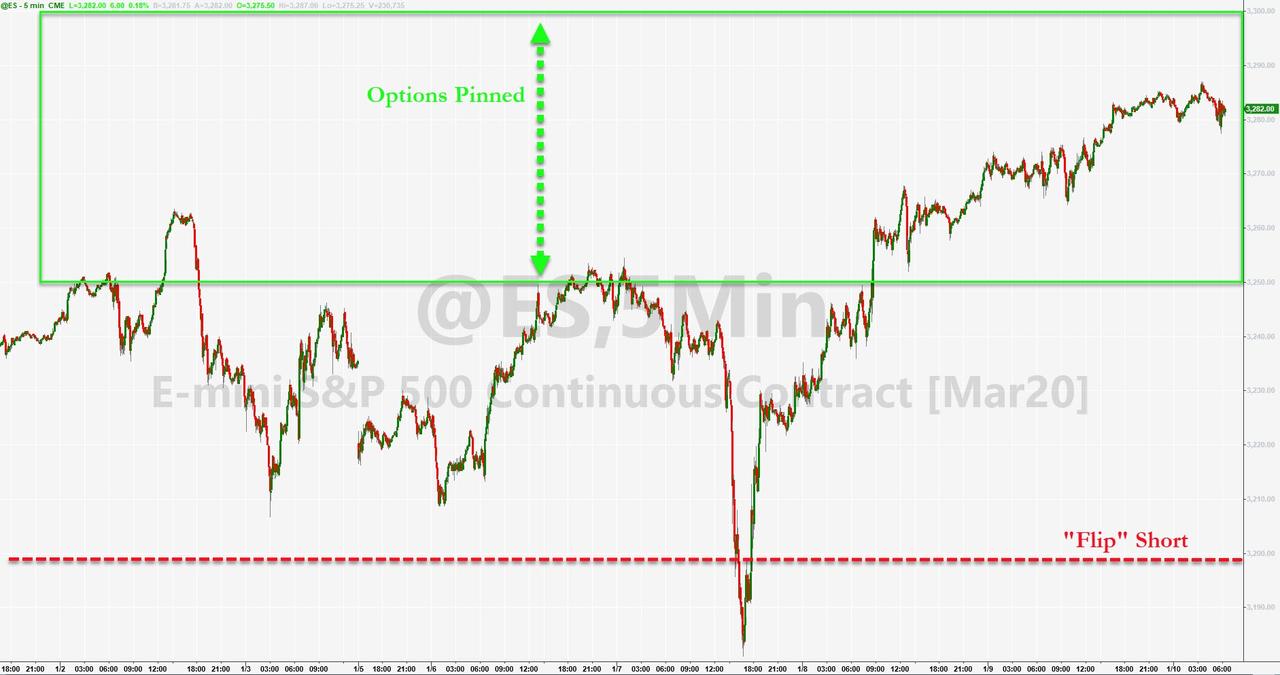

This VERY “Long Gamma” dynamic continues to act as a market shock-absorber (alongside recently accelerated “Buyback” flows ahead of the imminent rolling “blackouts” into EPS).

The bottom line is that it will require an enormous “macro shock” catalyst to push us down to levels where we would see the Dealer position “flip” (down at 3198)…

Additionally McElligott notes that we sit even further away from our estimated levels where Systematic Trend CTA would likely see deleveraging “triggered” (SPX level under 3142).

If missile strikes on US military bases don’t trigger the ‘gravity’, we wonder what will? China trade deal fail? Unexpected impeachment vote? AAPL miss and downgrade… again?

Tyler Durden

Fri, 01/10/2020 – 14:07

via ZeroHedge News https://ift.tt/2t8fhHz Tyler Durden