Where The December Jobs Were: Who Is Hiring And Who Isn’t

After the “bang” of a November jobs juggernaut, when the US economy added a whopping 256K jobs (revised lower from 266K) largely on the back of a surge in mfg jobs as GM workers returned from strike, the December jobs report was decidedly a whimper, with just 145K jobs added, a sharp 111K drop from the prior month and below the 160K consensus estimate.

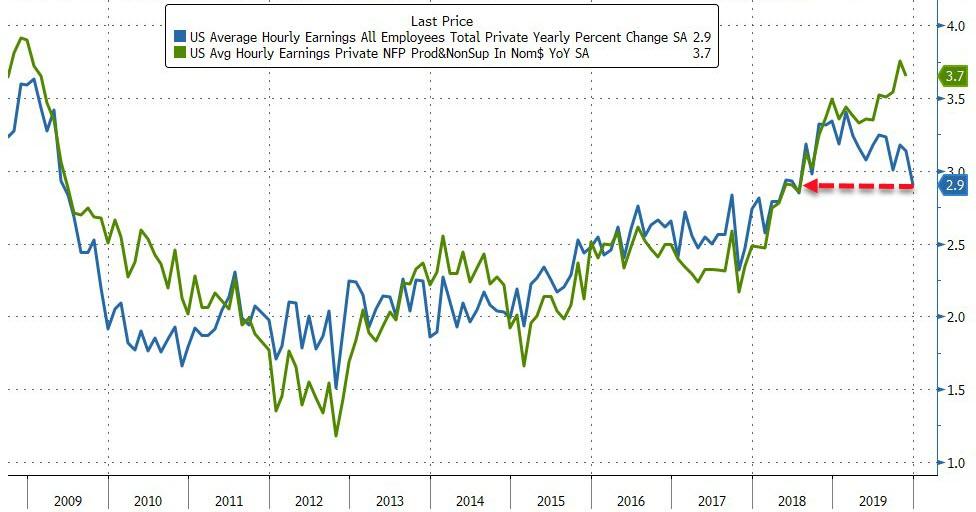

What is more concerning than the headline payroll, was the parallel drop in average hourly earnings, which posted the lowest annual increase since July 2018.

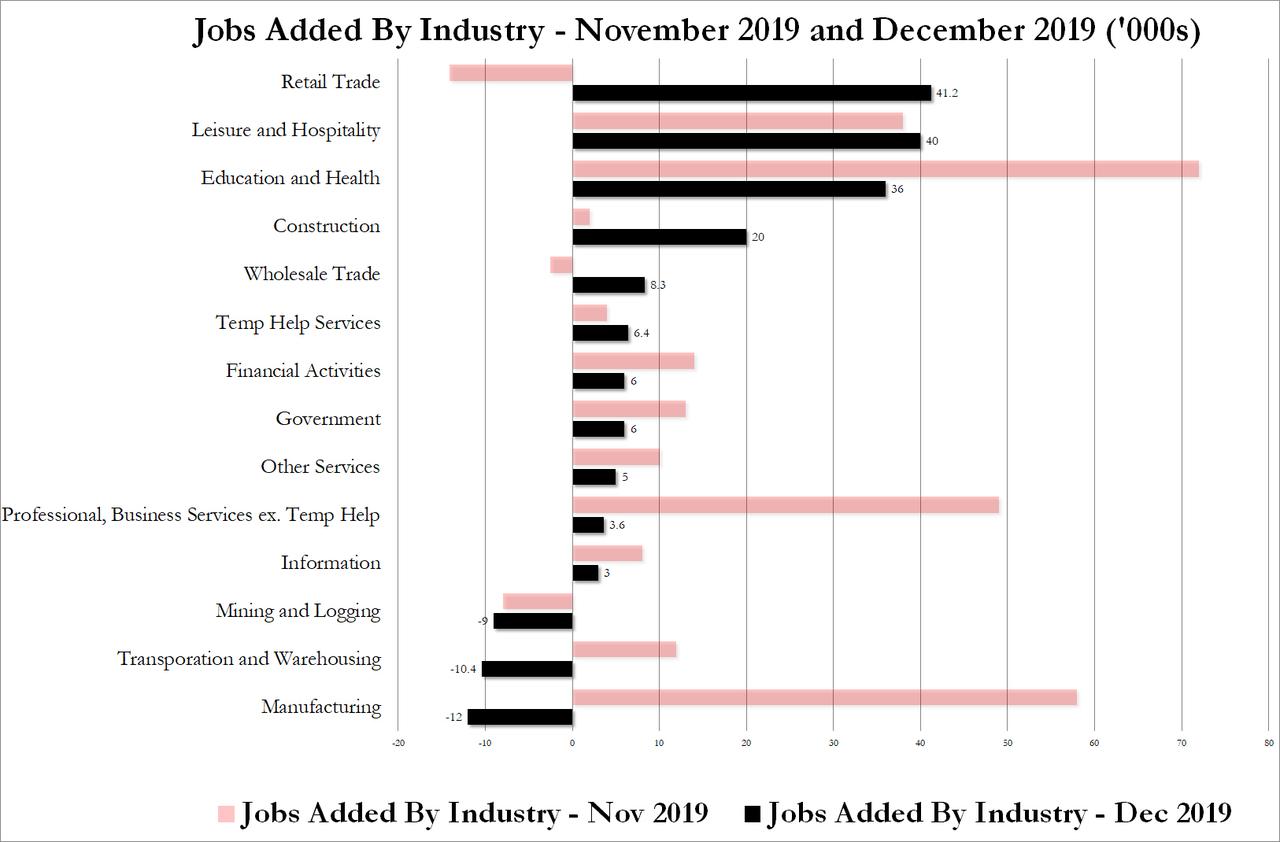

Why the wage weakness? One look at the composition of job gains in December reveals the reason for the latest poor wage print: Of the 145K December job gains, 80% went to minimum-wage and low-paying industries, namely 41.2K new retail workers, 40K Leisure and Hospitality workers and another 36K Education and health workers, a total of 117 minimum wage, or close to it, job gains.

Indeed, as shown in the chart below, unlike November’s blockbuster gains in professional & business service and manufacturing jobs, December’s job gains were mostly across low-paying jobs.

Worse, on the other ends, December also revealed big drops in some of the best paying jobs, namely manufacturing, transportation and mining, all of which shrank in December. In fact, as we showed previously, manufacturing just suffered its second worst month in 4 years, and November’s huge drop was largely a function of the GM strike, so one can argue that the December manufacturing slump is the starkest consequence yet of the ongoing trade war with China.

Some other observations on who is hiring, and who isn’t:

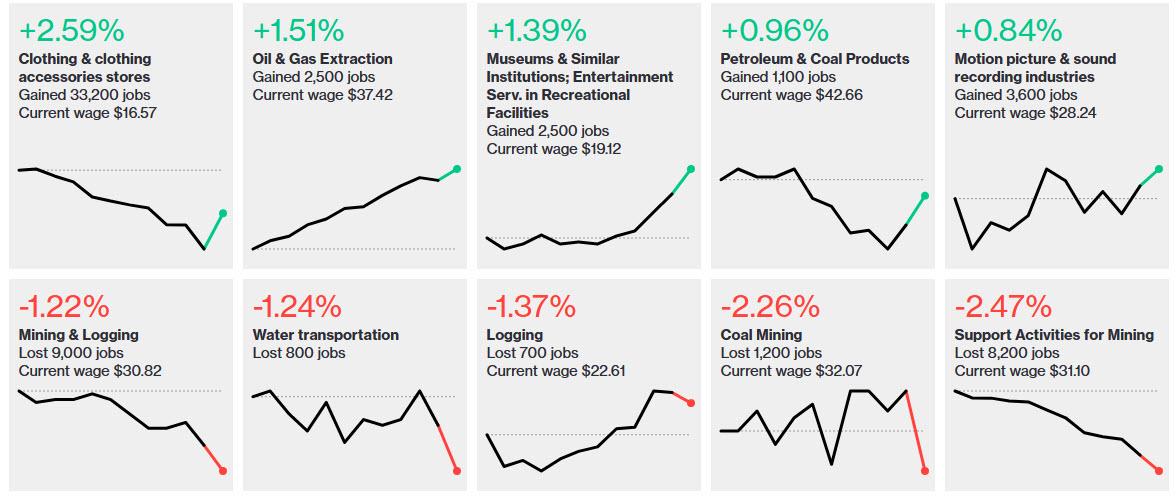

- Retail trade added 41,000 jobs. Employment increased in clothing and accessories stores (+33,000) and in building material and garden supply stores (+7,000); both industries showed employment declines in the prior month. Employment in retail trade changed little, on net, in both 2019 and 2018 (+9,000 and +14,000, respectively).

- Health care employment increased by 28,000 in December. Ambulatory health care services and hospitals added jobs over the month (+23,000 and +9,000, respectively). Health care added 399,000 jobs in 2019, compared with an increase of 350,000 in 2018.

- Leisure and hospitality jobs continued to trend up in December (+40,000). The industry added 388,000 jobs in 2019, similar to the increase in 2018 (+359,000).

- Mining employment declined by 8,000 in December. In 2019, employment in mining declined by 24,000, after rising by 63,000 in 2018.

- Construction employment changed little in December (+20,000). Employment in the industry rose by 151,000 in 2019, about half of the 2018 gain of 307,000.

- Employment in professional and business services showed little change (+10,000). The industry added 397,000 jobs in 2019, down from an increase of 561,000 jobs in 2018.

- Transportation and warehousing jobs were changed little in December (-10,000). Employment in the industry increased by 57,000 in 2019, about one-fourth of the 2018 gain of 216,000.

- Manufacturing employment dropped in December (-12,000). Employment in the industry changed little in 2019 (+46,000), after increasing in 2018 (+264,000).

Finally, courtesy of Bloomberg, here is a breakdown of the ten industries with the highest and lowest rates of employment growth for the most recent month; it shows that there was a renaissance in museum and actor jobs as we closed out 2019.

Tyler Durden

Fri, 01/10/2020 – 10:43

via ZeroHedge News https://ift.tt/2Nc143c Tyler Durden