Financial Markets Don’t Have The Faintest Inkling Of Potential Geopolitical Risk

Authored by MN Gordon via EconomicPrism.com,

The procession of news through the week – namely that chronicling the aftermath of the targeted drone strike and killing of Iranian General Qasem Soleimani – advanced with an agreeable flow. The reports at the start of the week were that Orange Man Bad had spun up a Middle East mob of whirling dervishes beyond recall. World War III was imminent.

But after Iran’s token missile launch on Tuesday, with no American causalities, President Trump Tweeted: “All is well!”

Then, on Wednesday, major U.S. stock indices gave the “all clear” signal. By Thursday, the Dow Jones Industrial Average (DJIA), the S&P 500, and the NASDAQ were all marching to record highs. The DJIA even came within a horse’s hair from taking out 29,000.

What’s more, the price of crude oil fell below where it was before Soleimani was killed. No harm, no foul. What to make of it?

According to traders, everything is awesome. Still, we have some reservations. Our best guess is that this week’s agreeable flow of news will be followed by a disagreeable ebb. Conceivably, it marks the first paragraph of a new chapter in America’s forever war in the Middle East.

In the interim, however, we’ll consider the events of the last 10 days an experiment. Here, with little consequence (at least for now), we’ve been gifted a sampling of how financial markets behave when a burgeoning geopolitical crisis hits.

We posit that during the initial fog of a geopolitical crisis financial markets don’t have the faintest inkling of potential risk.

Hyperventilating Minds

Financial risk, for our purposes today, is not a quantified statistical measurement. We’re not concerned with the risk differential between high beta and low beta stocks. Rather, at the commencement of a major conflict, risk is specific to the probability of a foundational change resulting that permanently wipes away capital.

Author Fred Sheehan wrote a piece titled, “War of the Nerds,” for the December, 2006, edition of Marc Faber’s Gloom, Boom & Doom Report. Several years ago the article was still posted at Sheehan’s now defunct AuContrarian website. By chance, before the site vanished, we preserved the following excerpt:

“Every generation suffers its particular fantasies. So it was a century ago. Investors had grown so immune to the consequences of war that bond markets from London to Vienna didn’t flinch after the assassination that provoked World War I.

“Three weeks later, in the summer of 1914, the fear premium amounted to a total of one basis point. Then, in quick order, European markets ceased to function. A notable feature of this paralysis is that nothing of substance had changed – war had not been declared by any of the parties, but by now, minds were hyperventilating.”

Perhaps the motivation for the cerebral excitement was the rapid realization during the July 1914 Crisis that complex political alliances had turned the European continent into a giant Mexican standoff. The risk of a stock or bond market selloff was quickly overshadowed by the prospect of something much greater. That the diabolical self-annihilation of European society itself was, in fact, just moments away.

Geopolitical Shocks and Financial Markets

It would be wrong to draw close parallels between the geopolitical landscape in Europe circa 1914 and the Middle East circa 2020. This is not our intent. We’re merely citing this as an example of how quickly financial markets can go from full functioning to complete breakdown.

The question, again, is how financial markets behave when a burgeoning geopolitical crisis hits. The events of the last 10 days serves as our experimental test trial. Here’s a summary of our findings, albeit of a grim comparative nature…

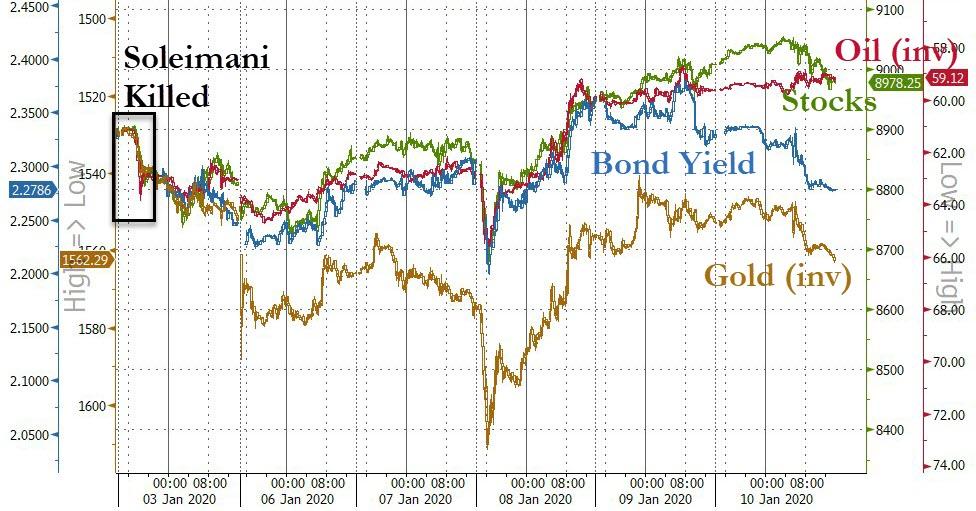

As far as we can tell, bond markets are quick to dismiss the risk of a foundational change resulting in the permanent destruction of capital. For example, the yield on the 10 Year Treasury note briefly dipped below 1.8 percent on January 3 – the day of Soleimani’s death. Since then, the yield has walked back up to 1.85 percent, which is about where it was at the start of the year. This fear premium – as bond prices move inverse to yield – was next to nothing and transitory.

After a brief selloff, stocks, as noted above, were quick to recover and move to new highs. Defense sector stocks like, Lockheed Martin, were the real winners. On news of the Soleimani’s death they jumped upward. Then, in the aftermath, they continues to gain. Year-to-date, Lockheed Martin is up 6.56 percent.

Gold, while exhibiting more caution than Treasuries, has been moderately indifferent of potential risk. On January 2, the price of an ounce of gold was about $1,528. On January 3, it jumped to over $1,550 an ounce. Then, on January 7, gold nearly hit $1,600 an ounce.

But after President Trump Tweeted “All is well!” the price of an ounce of gold slid to just below $1,550 an ounce on January 9 – roughly $20 an ounce higher than before Soleimani’s death.

Geopolitical shocks, as we understand them, generally increase the demand for gold. A threat to stability, quite naturally, challenges the durability of fiat money. Those who see through the thin veneer of full faith and credit desire to hold more gold and less fiat.

Presently, gold, as opposed to stocks, Treasuries, and crude oil, is still holding some of the fear premium it added over the last 10 days. Make of it what you will…

Of course, there’s plenty that can go wrong out there these days – all is not well. Another dustup in the Middle East financed via the printing press, is certainly among them. Place your chips accordingly.

Tyler Durden

Sat, 01/11/2020 – 11:30

via ZeroHedge News https://ift.tt/2tc20xR Tyler Durden