Has The Fed Trapped Itself?

Authored by Lance Roberts via RealInvestmentAdvice.,com,

“Don’t fight the Fed”

That’s how I started out last week’s “Macroview.”

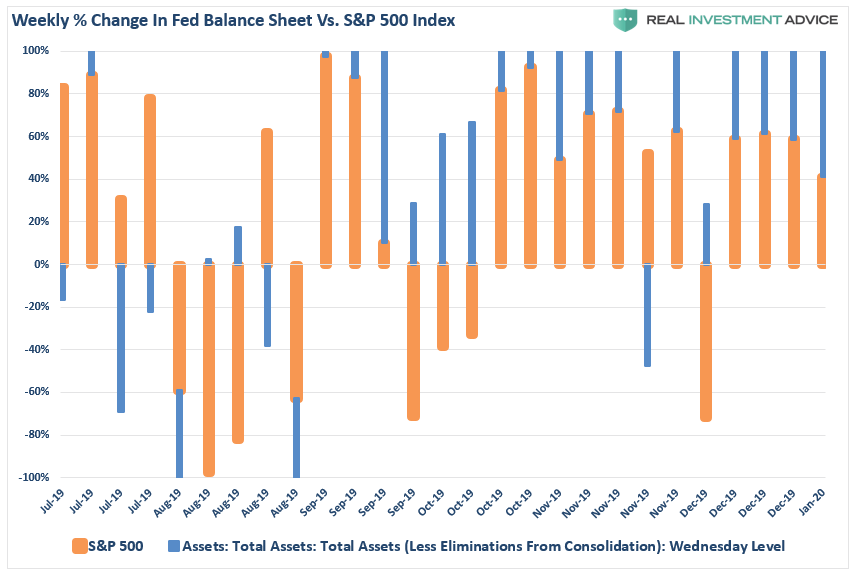

“That is the current mantra of the market as we begin 2020, and it certainly seems to be the right call. Over the last few months, the Federal Reserve has continued its ‘QE-Not QE’ operations, which has dramatically expanded its balance sheet. Many argue, rightly, the current monetary interventions by the Fed are technically ‘Not QE’ because they are purchasing Treasury Bills rather than longer-term Treasury Notes.

However, ‘Mr. Market’ doesn’t see it that way. As the old saying goes, ‘if it looks, walks, and quacks like a duck…it’s a duck.’”

As we discussed, there is something “broken” in the financial system when it requires massive injections of capital to maintain sufficient liquidity. This was a point noted by Curvature Securities’ Scott Skyrm in his daily “Repo Market Commentary” via Zerohedge:

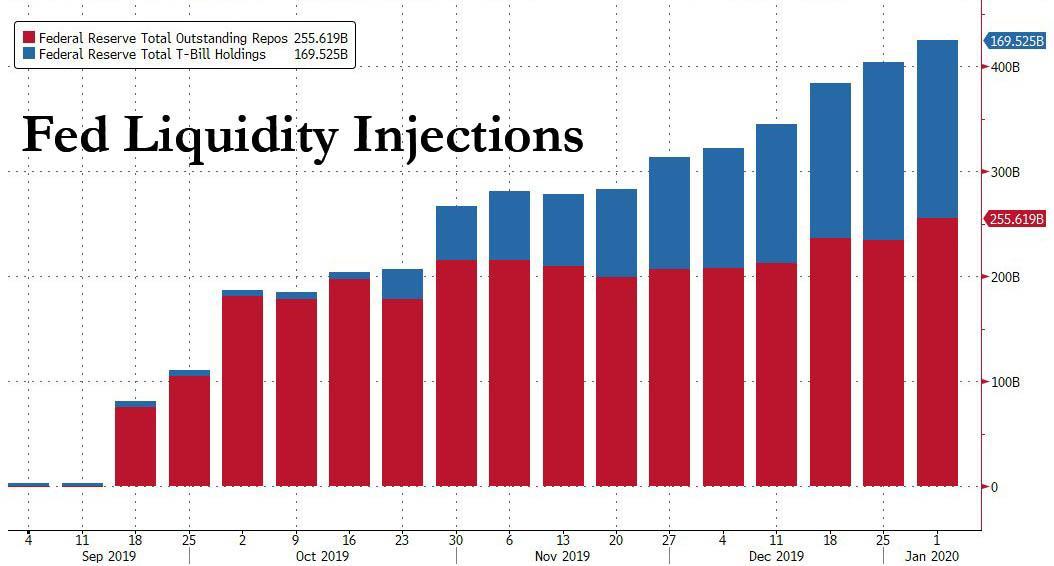

“Indeed, something appears amiss, because the total overnight and term Fed RP operations on Friday were greater than on year end! On year-end, the Fed had pumped a total of $255.95 billion into the market verses $258.9 billion on Friday.”

When these excessive “Repurchase Operations” initially began in late September, we were told they were to meet corporate tax payments. The issue with that excuse is that corporate tax payments come due every quarter and are easy to forecast weeks in advance. Why was last October’s payment period so different? But, following October 15th, the “repo” operations should have been no longer needed, however, the funding not only continued, but grew.

As the end of the year approached, we were told liquidity was needed to meet “the turn,” as 2019 ended, and 2020 began. Once again, this excuse falls short as, without exception, every year ends on December 31st. So, after nearly a decade of NO “repo” operations, as shown below, what is really going on?

What is clear, is the Fed may be trapped in their own process, a point made by Mark Cabana of BofAML:

“It seems implausible to me that the Fed will be able to stop their repo operations by the end of January.”

The Fed’s New Liquidity Trap

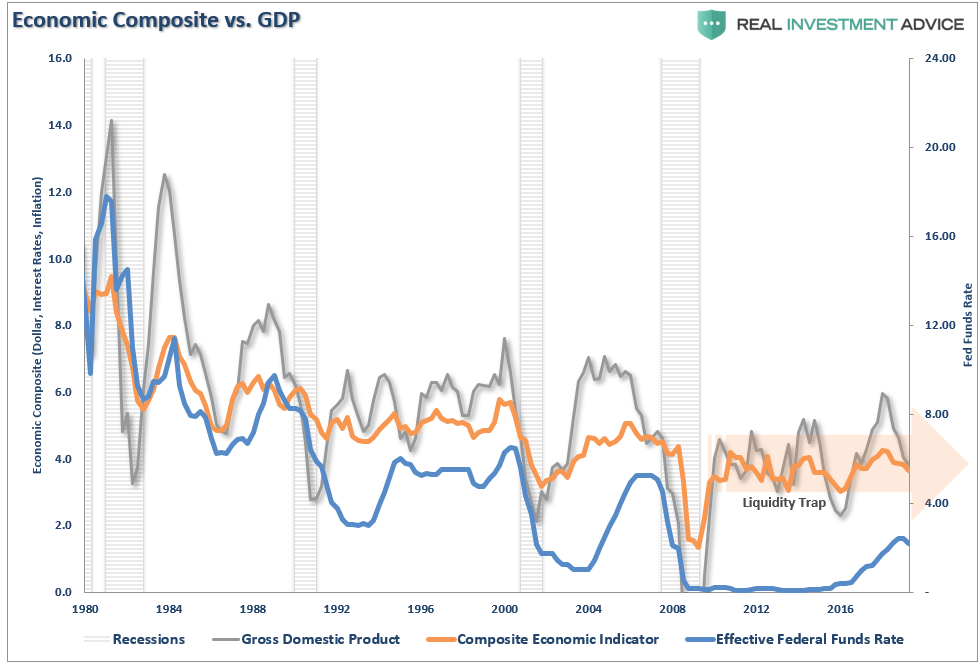

We previously discussed the “liquidity trap” the Fed has gotten themselves into, along with Japan, which will plague economic growth in the future. To wit:

“The signature characteristics of a liquidity trap are short-term interest rates that are near zero and fluctuations in the monetary base that fail to translate into fluctuations in general price levels.”

Our “economic composite” indicator is comprised of 10-year rates, inflation (CPI), wages, and the dollar index. Importantly, downturns in the composite index leads GDP.

The Fed’s problem is not only are they caught in an “economic liquidity trap,” where monetary policy has become ineffective in stimulating economic growth, but are also captive to a “market liquidity trap.”

As Mr. Skrym noted:

“The problem with the broken repo market, and the Fed’s respective Repo operations, is similar to the problem observed with QE, and the Fed’s balance sheet in general, over the past decade. The market has gotten addicted to the easy Fed liquidity.”

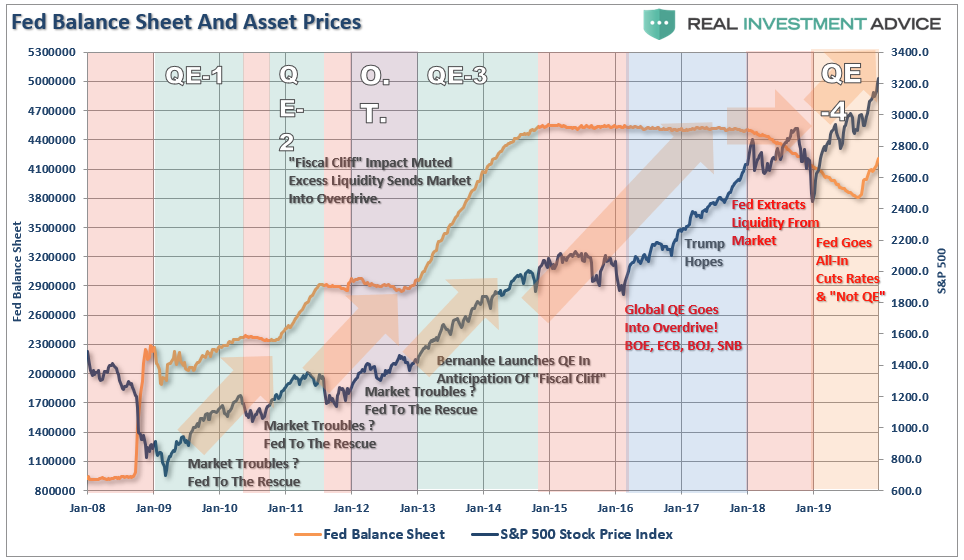

This can be seen in the chart below.

Whenever the Fed, or other Global Central Banks, have engaged in “accommodative monetary policy,” such as QE and rate cuts, asset prices have risen. However, as denoted by the “red” shaded areas, when those activities are not present, asset prices have declined.

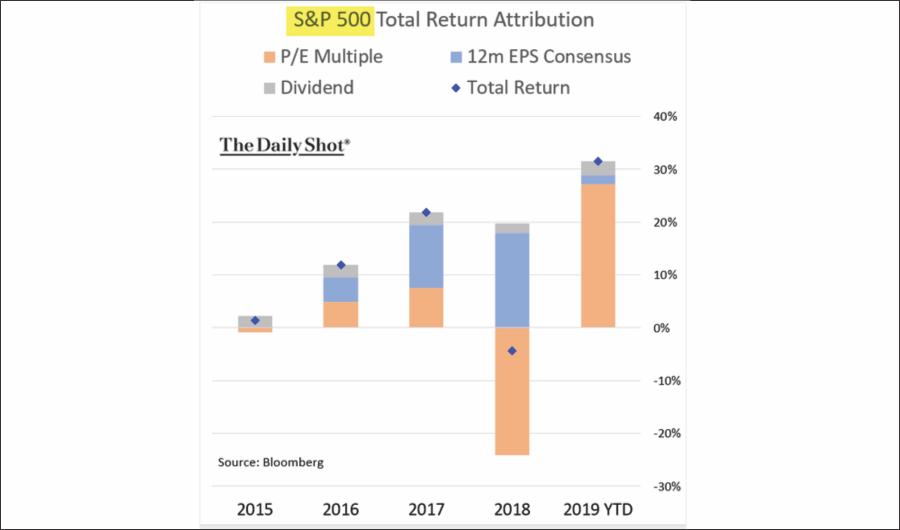

In short, the market has become addicted to QE, and like any drug addict, when the drug was taken away in 2018, as the Fed hiked rates and reduced their balance sheet in an attempt to normalize policy, the market dropped by nearly 20%.

To understand why this is important we have to go back to what Ben Bernanke said in 2010 as he launched the second round of QE:

“This approach eased financial conditions in the past and, so far, looks to be effective again. Stock prices rose and long-term interest rates fell when investors began to anticipate the most recent action. Easier financial conditions will promote economic growth. For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance. Lower corporate bond rates will encourage investment. And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending.”

I highlight the last sentence because it is the most important. Consumer spending makes up roughly 70% of GDP, therefore increased consumer confidence is critical to keeping consumers in action. The problem is the economy is no longer a “productive” economy, but rather a “financial” one. A point made by Ellen Brown recently:

“The financialized economy – including stocks, corporate bonds and real estate – is now booming. Meanwhile, the bulk of the population struggles to meet daily expenses. The world’s 500 richest people got $12 trillion richer in 2019, while 45% of Americans have no savings, and nearly 70% could not come up with $1,000 in an emergency without borrowing.

Central bank policies intended to boost the real economy have had the effect only of boosting the financial economy. The policies’ stated purpose is to increase spending by increasing lending by banks, which are supposed to be the vehicles for liquidity to flow from the financial to the real economy. But this transmission mechanism isn’t working, because consumers are tapped out.”

If consumption retrenches, so does the economy.

When this happens debt defaults rise, the financial system reverts, and bad things happen economically.

For this reason the Federal Reserve has been engaged in an ongoing campaign to “avoid the pain” experienced during the financial crisis. This was a question asked of Janet Yellen during her semi-annual Humphrey-Hawkins testimony by Rep. Edward Royce. I am going to break this down for clarity.

“ROYCE: I’m worried that the Federal Reserve has created a third pillar of monetary policy, that of a stable and rising stock market. And I say that because then-Chairman Bernanke, when he appeared here, stated repeatedly that, ‘the goal of QE was to increase asset prices like the stock market to create a wealth effect.’”

As stated, Ben Bernanke clearly states the goal of Q.E. was to increase asset prices. As Royce continues he clearly identifies the Fed’s “new liquidity trap:”

“ROYCE: That seems as though that was goal. It would stand to reason then that in deciding to raise rates and reduce the Fed’s QE balance sheet standing at a still record $4.5 trillion, one would have to be prepared to accept the opposite result, a declining stock market, and a slight deflation of the asset bubble that QE created.

Yet, every time in the past three years when there has been a hint of raising rates and the stock market has declined accordingly, the Fed has cited stock market volatility as one of the reasons to stay the course and hold rates at zero.

Read the last paragraph again.

Royce understands that in order to normalize monetary policy, and return markets to a more normal state of operation, some pain would have to be expected.

So, what was Yellen’s response.

YELLEN: It is not a third pillar of monetary policy. We DO NOT target the level of stock prices. That is not an appropriate thing for us to do.”

Yes, the Fed absolutely targets the financial markets with their policies. However, as Royce notes above, it will require a level of pain to wean the markets off of ongoing liquidity. In 2018, the Fed learned their lesson of what would happen as the small adjustment to monetary policy they did make resulted in a market decline of nearly 20%, yield curves inverted, and threats of a recession rose.

They aren’t willing to make that mistake again. The subsequent policy reversal pushed the markets to new record highs, which has been a function of valuation expansion due to the lack of improvement in underlying fundamentals and earnings.

The Inextricable Problem

The problem is that stopping the current “repo” operations is that it could well spark another “repo market crisis,” especially with $259 billion in liquidity pumped currently. Notably, that is even more than what was at year end to fulfill “the turn.”

The BIS recently explained why these operations lift asset prices.

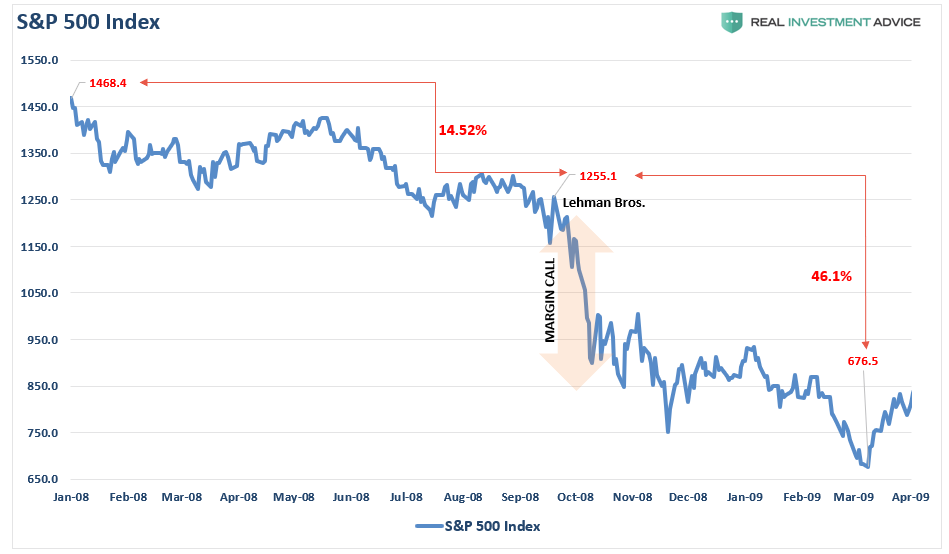

Repo markets redistribute liquidity between financial institutions: not only banks (as is the case with the federal funds market), but also insurance companies, asset managers, money market funds and other institutional investors. In so doing, they help other financial markets to function smoothly. Thus, any sustained disruption in this market, with daily turnover in the U.S. market of about $1 trillion, could quickly ripple through the financial system. The freezing-up of repo markets in late 2008 was one of the most damaging aspects of the Great Financial Crisis (GFC).

You really have to ask what is going on here. Wall Street veteran Caitlin Long provided a clue.

U.S. Treasuries are the most rehypothecated asset in financial markets, and the big banks know this. [They] are the core asset used by every financial institution to satisfy its capital and liquidity requirements, which means that no one really knows how big the hole is at a system-wide level.

This is the real reason why the repo market periodically seizes up. It’s akin to musical chairs – no one knows how many players will be without a chair until the music stops.

As ZeroHedge noted, this isn’t just a bank issue.

Hedge funds are the most heavily leveraged multi-strategy funds in the world, taking something like $20 billion to $30 billion in net assets under management and levering it up to $200 billion. As noted by The Financial Times:

“Some hedge funds take the Treasury security they have just bought and use it to secure cash loans in the repo market. They then use this fresh cash to increase the size of the trade, repeating the process over and over and ratcheting up the potential returns.”

So….it’s a hedge fund problem, right?

Probably.

“The repo-funded [arbitrage] was (ab)used by most multi-strat funds, and the Federal Reserve was suddenly facing multiple LTCM (Long-Term Capital Management) blow-ups which could have started an avalanche. Such would have resulted in trillions of assets being forcefully liquidated as a tsunami of margin calls hit the hedge funds world.”

Think “Lehman crisis” multiplied by a factor of four.

The Fed’s position is they must continue inflating a valuation bubble despite the inherent, and understood, risks of doing so. However, with no alternative to “emergency measures,” the Fed is trapped in their own process. The longer they continue their monetary interventions, the more impossible it becomes for the Fed to extricate itself without causing the crash they want to avoid.

Stated simply, the longer the Fed avoids normalizing monetary policy, and weaning the “crack addicted” markets off of their “liquidity drug,” the bigger the “reversion” will be “when,” not “if,” it occurs.

The only question is how much longer can Jerome Powell continue “pushing on a string.”

Tyler Durden

Sat, 01/11/2020 – 10:30

via ZeroHedge News https://ift.tt/2t8iBma Tyler Durden