Insurance For Oil Tankers Jumps Amid War Threat In Middle East

Escalating tensions in the Middle East and threats of war between the US and Iran have sent insurance rates for petroleum tankers higher, especially for vessels transiting the Strait of Hormuz, reported Reuters, citing industry insiders.

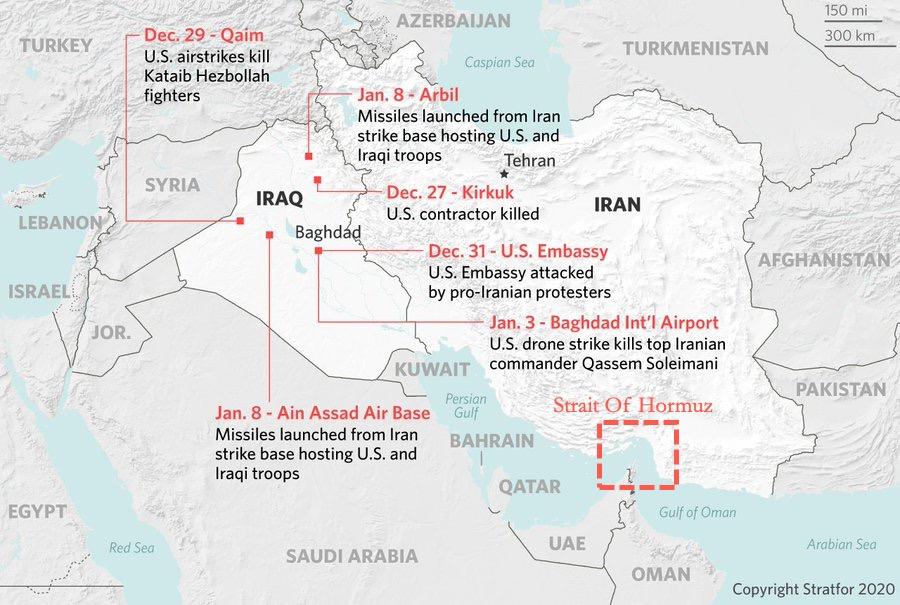

War risk premiums that oil tanker owners pay each time as they transit the Persian Gulf, Strait of Hormuz, and the Gulf of Oman are surging in the last ten days following Iran militia attacking the US embassy in Baghdad and Iran launching missiles at US military bases.

One Singapore-based LNG shipbroker told Reuters that war premiums are “adding about $150,000 to $200,000 (to overall costs) per trip.”

About a quarter of all the world’s crude and LNG transits on chemical tankers through the Strait of Hormuz and could be susceptible to attack as Iran has vowed to retaliate against the US for the airstrike that killed top Iranian Commander Qasem Soleimani last Friday. So far, the Iranians have launched more than a dozen missiles at two military bases in Iraq.

The latest indications from the Islamic Revolutionary Guard Corps (IRGC) Aerospace Force Commander Amir Ali Hajizadeh on Thursday said that more missile attacks on US bases could continue across the region.

This was the case on Wednesday when Iran-backed militia fired three rockets at the US embassy in Baghdad.

Increasing tension between Iran and the US and the threats of war across the region have led to the rise in war-risk insurance for oil tankers.

“We are obviously concerned with regard to the tension around the wider (Gulf) area,” said Svein A Ringbakken, managing director of Norwegian ship insurer Den Norske Krigsforsikring for Skib (DNK) told Reuters. “Ships’ transits in these areas have already for some time been subject to additional war risks insurance premiums, which may increase in light of the recent developments.”

A London-based shipbroker told Reuters that ship insurers had quoted the breach rate for seven days at around 0.35% of insurance costs, up from about 0.15% in December.

Saul Kavonic, an analyst with Credit Suisse, said escalating tensions in the Middle East could lead to a closure of the Strait of Hormuz: “A prolonged closure of the Strait of Hormuz could see LNG spot prices skyrocket, and see a demand destruction scenario emerge turning the current soft LNG market on its head,” he warned.

We reported on Wednesday that Petrobras, Bahri – Saudi Arabia’s state-run tanker operator – and other tanker companies had suspended sailing through the Straits of Hormuz.

Tyler Durden

Fri, 01/10/2020 – 21:25

via ZeroHedge News https://ift.tt/2R0VQZo Tyler Durden