“There’s Always A Bubble In The ’20s”: These Are The Top Bull And Bear Arguments

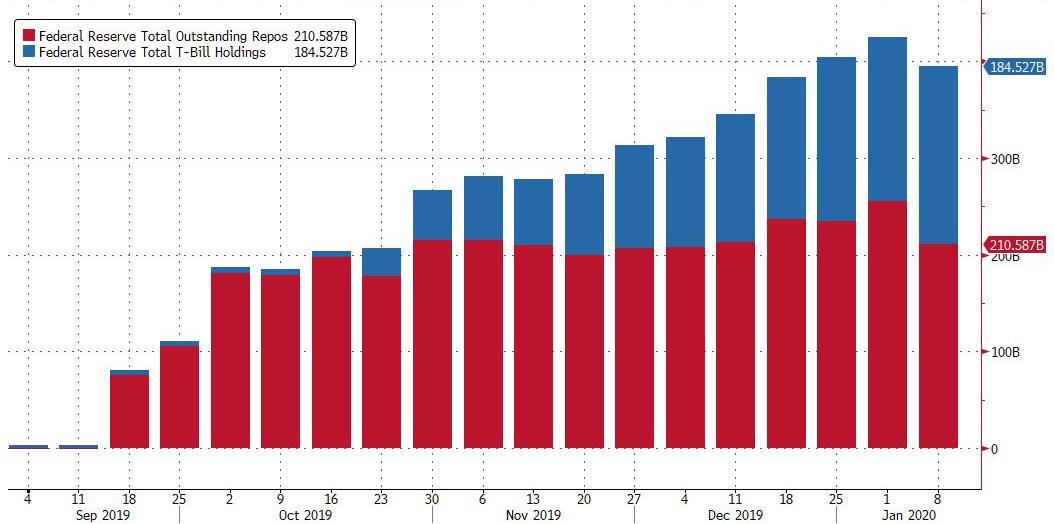

Earlier today we discussed why BofA’s chief investment strategist, Michael Hartnett, remains stoically bullish on the market, at least until March 3, when he sees the S&P hitting the nice, odd number of 3,333: as he defines the current period, it is one of “maximum liquidity, minimal growth”, as a result of a firehose of QE liquidity from the ECB, BOJ and the Fed (yes, the Fed is engaging in QE) with “QE annualizing a stunning $1.1 trillion in the past 4 months” even as global central banks have cut rates 80 times past 12 months, in the process “reducing concerns of recession, default, inflation in 2020.” One look at the chart below of the correlation between the global liquidity proxy and the S&P500 explains why all the market’s fears have been drowned, so to speak, in the past year.

However, the BofA strategist is far less sanguine about what happens after March, when the Fed is expected to start draining its repo liquidity, a process which began this week when the Fed’s “emergency” liquidity boost launched in the aftermath of the September repo debacle posted its first shrinkage in four months. It is also why Hartnett believes that “asset upside will be very front-loaded in 2020.”

And so, as we approach that moment in 2020 when the Fed’s liquidity glut turns from a massive risk tailwind into a headwind, and as the tension between market optimists and pessimists braces for a return, below Hartnett outlines the more interesting bull and bear arguments for risk assets in 2020.

Bulls say…

- There’s always a bubble in the ’20s: South Sea Company bubble in 1720s, UK mining stock bubble in 1820s, Dow Jones bubble in 1920s; big overshoot of asset prices (SPX 4,444) possible so long as Fed fixes rates at low & stable levels.

- There’s no inflation: Japanese wage growth YoY in December was negative in both nominal and real terms; this in an economy in which the population declined by 512k last year, the unemployment rate fell to its lowest rate in 30 years, and the assets owned by the central bank ($5.3tn) now larger than Japan GDP ($5.2tn); no inflation in Japan, Europe, US means no rate rises and cheap financing for populist politicians.

- There’s lots of liquidity: central banks net purchases were $92bn in Q3, $326bn in Q4 and are forecast to total $447bn in the next 6 months; global central banks cut rates 80 times in past 12 months, 789 times since Lehman (that’s 1 rate cut every 3½ trading days).

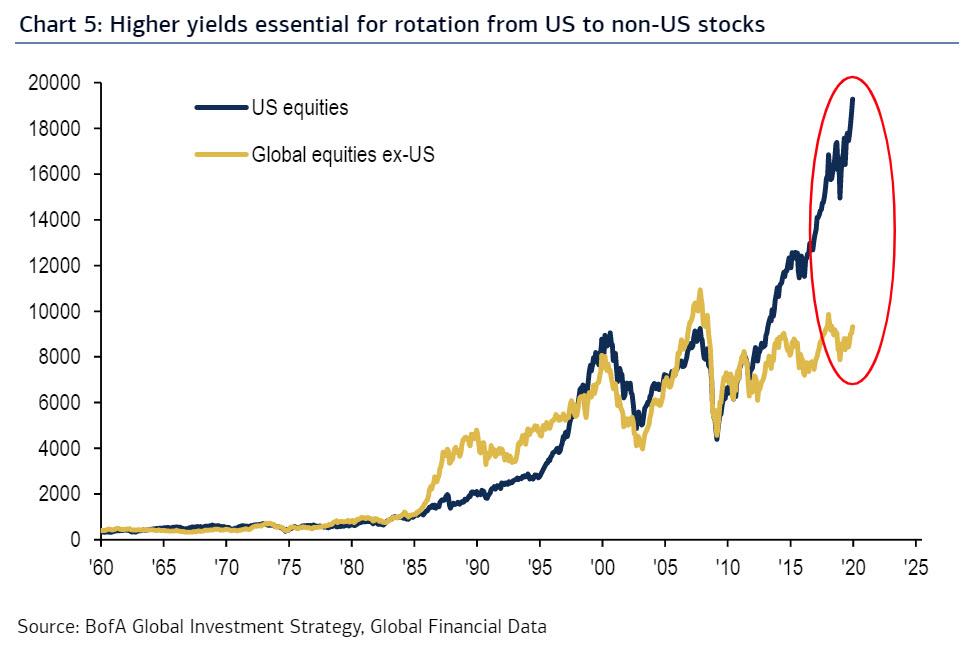

- There’s the Great Rotation: for all the bubbly stock market talk, global equities have only just exceeded their 2007 highs versus global bonds, and remain below their 2000 highs versus global bonds; and higher yields can cause Great Rotation from bonds to stocks, credit to commodities, US to non-US, large to small, growth to value, tech to banks and so on.

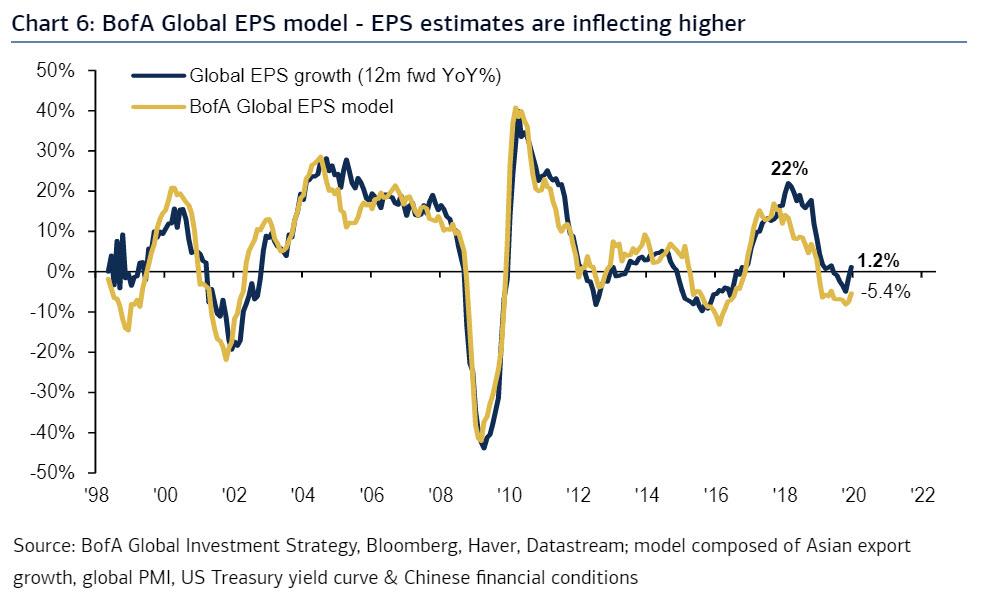

- There’s an inflection point in profits: BofA Global EPS Growth Model (function of global PMIs, Asian exports, Chinese financial conditions, and UST 2s10s yield curve) forecasts EPS growth of -5.4% in the next 12 months, below consensus of 1.2%; crucially for bulls both forecasts for 2020 EPS are inflecting higher.

Bears say:

- Impotence rising: equities are at highs & spreads at lows, but volatility in fixed income (MOVE Index) and equities (VIX Index) has crept higher in recent quarters despite renewed QE; higher risk prices and higher volatility a precursor to end of bull market.

- Inequality rising: S&P500 ended 2010s in longest bull market of all-time, & just 7% away from becoming the largest (3498); the absolute gains in stocks and bonds mean that the value of US financial assets (Wall St) grew to over 5.5x the size of US GDP (Main St) by 2019E, another all-time high; further Wall St gains, particularly via stock buybacks, increasingly politically unacceptable (note past 5 years 20 S&P500 companies spent $975bn on stock buybacks, that’s $381,000 for every person they employ).

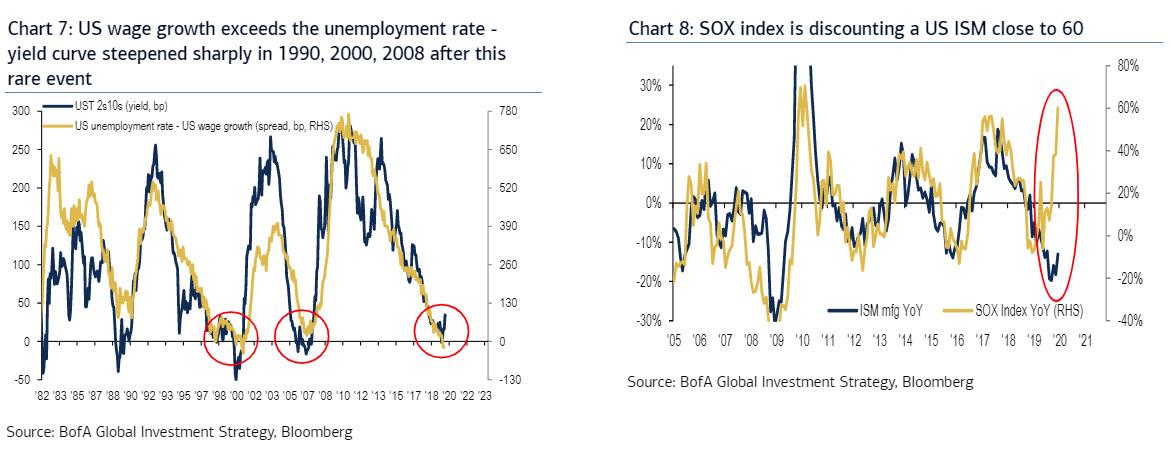

- Inflation rising: US wage growth exceeds unemployment rate for first time since 2000, has historically coincided with big steepening of the US yield curve either because of inflation, defaults, or recession (Chart 7); note in 2019 US budget deficit surpassed $1tn and US federal government spent $4.4tn, that’s $35,500 for every income tax payer.

- 2020 recovery “priced-in”: semiconductor prices are “pricing-in” US ISM of 60, the highest since the financial crisis (vs. 47.2 today – Chart 8); Global FMS profit expectations (Nov/Dec = biggest 2-month jump since May’09) “pricing-in” global PMIs of 55 next 6-months; Global FMS 2020 ISM expectations was 53.5 in Dec.

Tyler Durden

Fri, 01/10/2020 – 18:45

via ZeroHedge News https://ift.tt/2uDjiUY Tyler Durden