“This Is Nuts” – Why One Asset Manager Reduced Risk On Friday

Authored by Lance Roberts via RealInvestmentAdvice.com,

Market Review & Update

When you sit down with your portfolio management team, and the first comment made is “this is nuts,” it’s probably time to think about your overall portfolio risk. On Friday, that was how the investment committee both started and ended – “this is nuts.”

We have been discussing the overbought, extended, and complacent market over the last couple of weeks, but on Friday, I tweeted out a couple of charts that illustrated the excess.

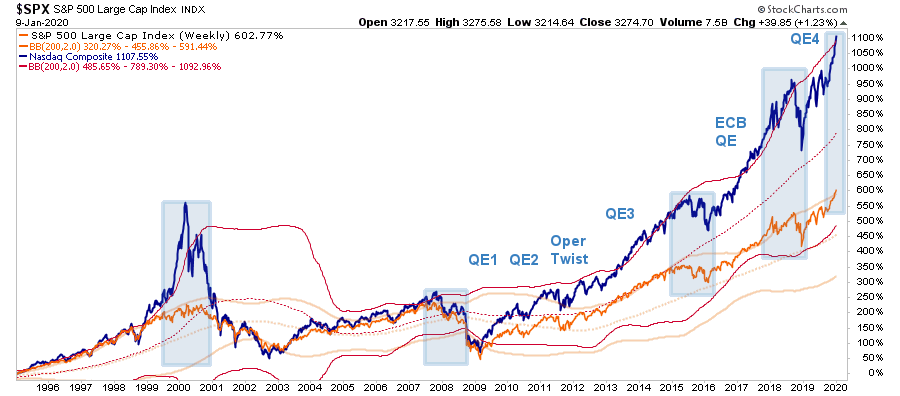

The first chart was comparing the Nasdaq to the S&P 500 index. Both are banded by 2-standard deviations bands of the 200-WEEK moving average. there are a couple of things which should jump out immediately:

-

The near-vertical price acceleration in the markets has been a historical hallmark of late-stage cycle advances, also known as a “melt up” phase.

-

When markets get more than 2-standard deviations above their long-term moving average, reversions to the mean have tended to follow shortly after that.

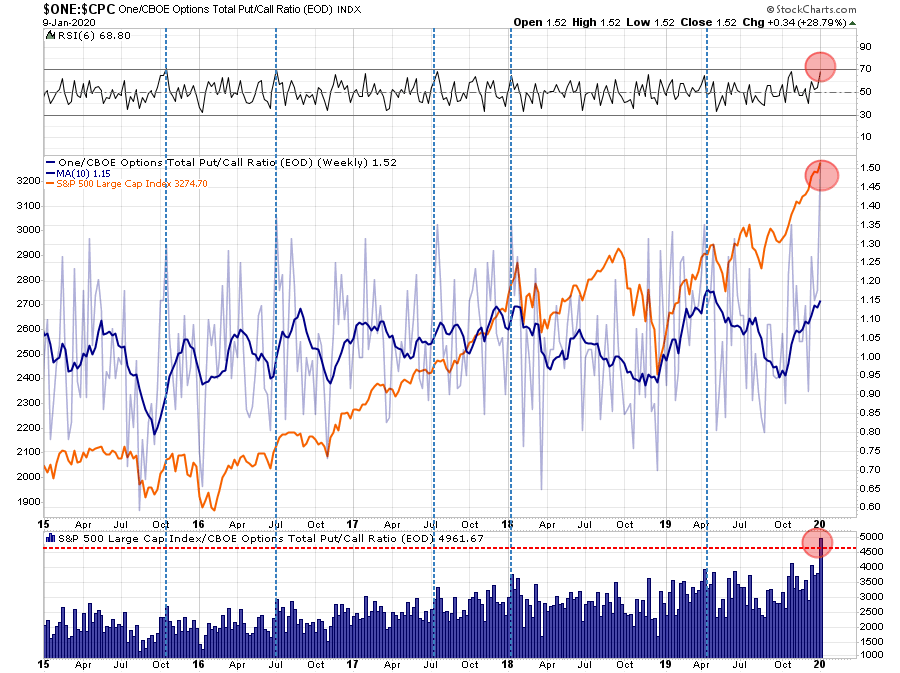

Currently, both of those conditions exist in the chart above. However, if it were only price acceleration, we would just be mildly concerned. However, investor complacency has also reached more extreme levels with PUT/CALL ratio now hitting historically high levels. (The put/call ratio is the ratio of “put options” being bought on the S&P 500 (theoretically to hedge risk) versus the number of “call” options purchased to “lever up” risk.)

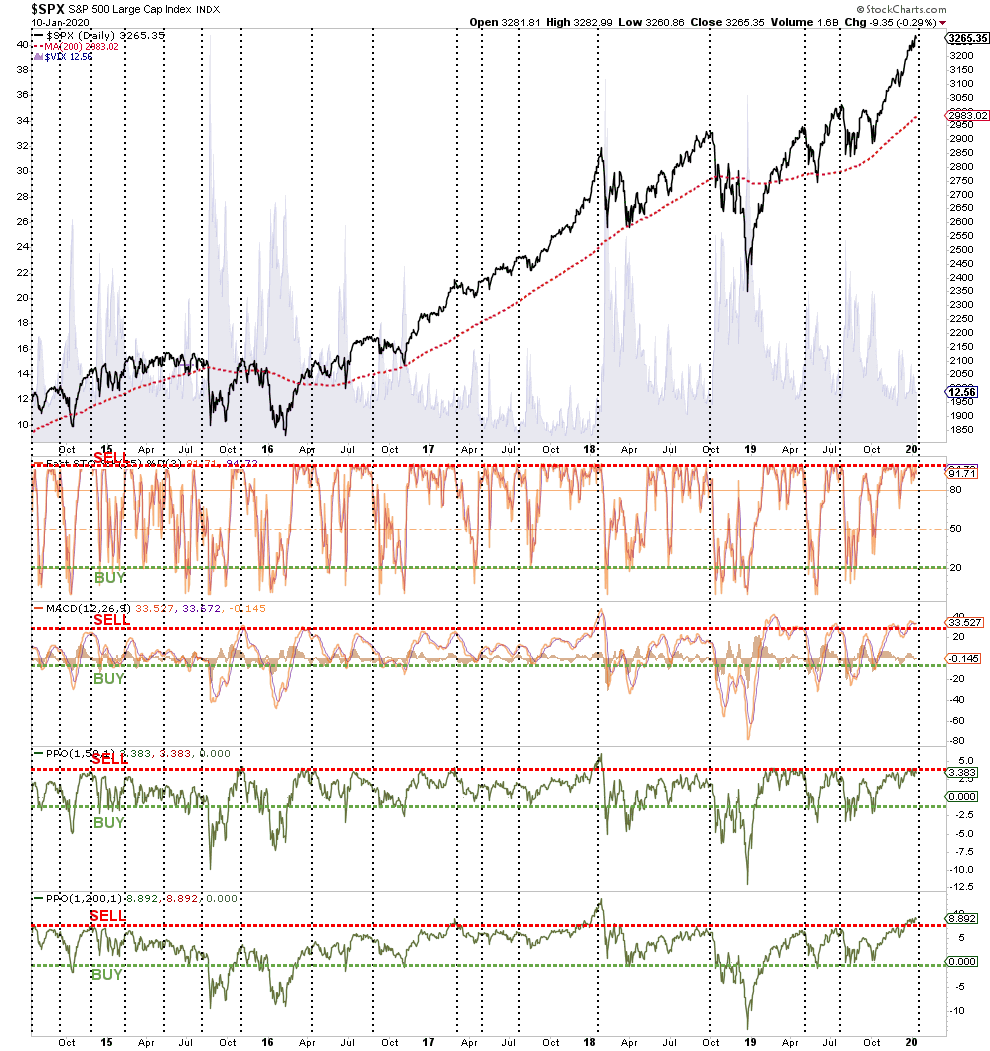

Lastly, all of our indicators from momentum to relative strength are all suggesting risk substantially outweighs reward currently.

While none of this means the market will “crash,” it does suggest the risk/reward ratio is not in favor of the bulls short-term.

However, we are mindful that in the short-term, the market is currently obsessed with the Fed’s monetary interventions (the topic of this week’s MacroView), which are supportive of the markets currently. However, as my friend and colleague Doug Kass summed noted this week:

“It is growing increasingly clear to me that global stock markets are in the process of making a speculative move (driven by global liquidity) that may even compare to the advances that culminated in the seminal market tops in the Fall of 1987 and in the Spring of 2000.

As today’s trading day comes to a close, it is apparent that, like the 1997 Long Boom paradigm expressed in a column in Wired Magazine during the dot.com bubble –– the current market is similarly viewed as in its own, new liquidity-based paradigm.

No longer is the market hostage to the real economy or sales and profit growth – stuff I have spent four decades analyzing. Instead, liquidity is seen as an overriding influence, actually it has become the sine quo non.

As such, historical valuations become increasingly irrelevant, and price momentum is the lodestar.“

He is right.

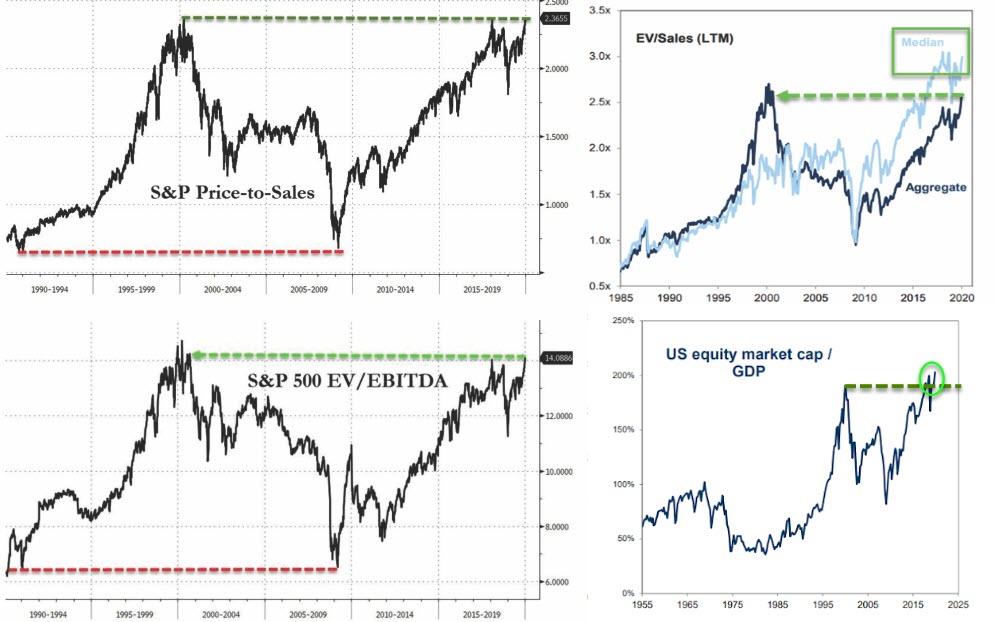

Currently, almost every single valuation metric is at historic extremes, yet investors continue to take on increasing levels of risk due to nothing more than “F.O.M.O – Fear Of Missing Out.”

As Doug goes on to note:

“We live in unusual times – in which central bankers have adopted policy unlike any point in history. Near-zero interest rates around the world have become commonplace and are accepted with little thought given to the adverse consequences. Forgetting history, central bankers seem to have no idea that they have created another monster again – just as they did in 1999.

Meanwhile, corporate profits are lower (year over year), and the rate of global GDP growth remains below the historic trendline – as it takes more and more debt to deliver a unit of production.

The climb in stocks will likely end badly as it is not supported by the fundamental (social, economic, political and geopolitical) backdrop and, increasingly, classical valuation metrics have moved to the highest percentiles in history (enterprise value/EBIT, price to sales, market capitalizations to GDP, etc.)

Yes, “this is nuts,” which is why we took profits out of portfolios on Friday.

3300 To 3500, And Back Again

In July of 2019, we laid out our prognostication the S&P 500 could reach 3300 amid a market melt-up though the end of the year. On Friday, the market touched 3280, which, as they say, is “close enough for Jazz.”

However, with the Federal Reserve having “turned on the liquidity taps,” it is entirely possible the markets could continue their upward momentum towards 3500.

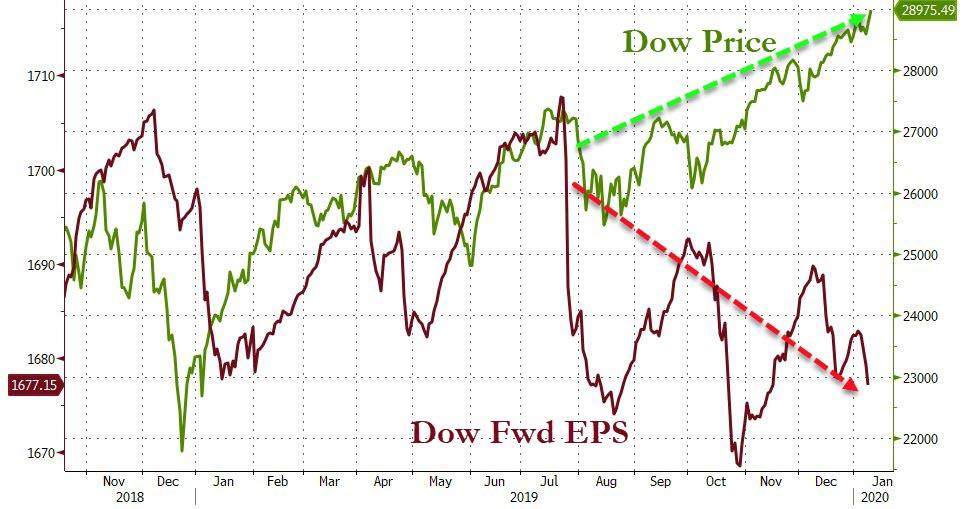

The potential “fly in the ointment” is if the economic, employment, and profit data fail to recover as anticipated. With 2020 earnings estimates already cut markedly heading into the year, further downward revisions will likely begin to weigh on investor sentiment.

Friday’s employment report was weak and exposed the anomaly caused by the autoworkers strike in the blockbuster November report. CEO and CFO confidence remain very suppressed currently, and if their views don’t start to improve markedly in the short-term we are likely to start seeing much weaker employment reports.

While the markets could certainly see a push higher in the short-term from the Fed’s ongoing liquidity injections, the gains for 2020 could very well be front-loaded for investors.

Taking profits and reducing risks now may lead to a short-term underperformance in portfolios, but you will likely appreciate the reduced volatility if, and when, the current optimism fades.

Tyler Durden

Sun, 01/12/2020 – 10:50

via ZeroHedge News https://ift.tt/2uCDfuV Tyler Durden