Beyond Meat Soars 40% In Days As Record Shorts Scramble To Cover… Again

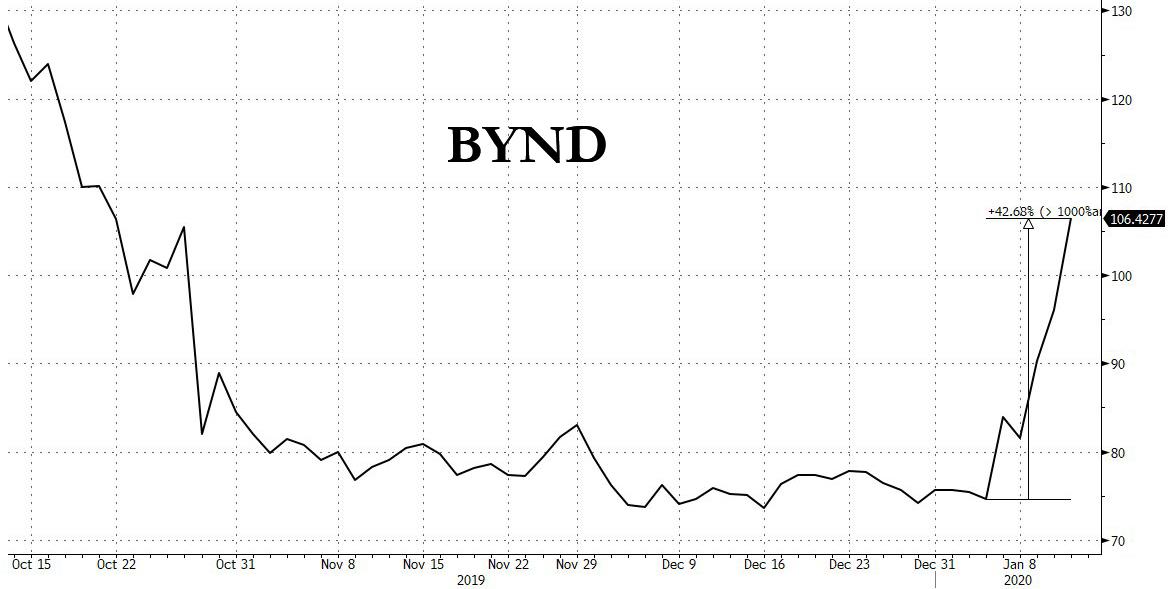

After it lost over two-thirds of its market cap since peaking in late July, fake meat company Beyond Meat was left for dead, trading at $75 for the past two months. Which is why some may have failed to notice that in the past week, BYND has staged another impressive surge, rising over 40% in just a few days, and hitting $106 today.

What is the reason for this impressive rebound? Some speculated that whereas investors had lost faith in the underlying narrative – and the tailwind behind meat alternative names – namely the transition away from meat to “fake meat”, over the weekend Panera Bread reminded the market just how strong of a secular shift this is, when it announced it would reduce the proportion of meat-based items on its menu by a third, as the US soups-to-sandwich chain anticipates that the rising demand for alternative ingredients will gather pace.

As the FT reported, the St Louis-based company which is owned by the food and consumer goods empire JAB Holdings, alongside Pret A Manger and Keurig, has drawn up plans to make the shift and introduce more plant-based options over about two years.

Yet while Panera reaffirmed the underlying industry trends, and fuelled demand for alternative proteins from providers such as Impossible Burger and Beyond Meat, Panera has no plans to introduce these products. At least not yet.

So while this story is certainly beneficial to the narrative, it is hardly the catalyst.

So what is?

The answer is likely the same one that allowed the stock to soar as high as $234.90 on July 26: a massive buildup of short in the name, which were getting crushed for much of the post-IPO period then took the upper hand after August when the stock finally buckled. The problem, however, is that as BYND tumbled, even more shorts piled on, and as of Dec 31, there were a record 10.1 million shorts, representing a quarter of the company’s float according to Bloomberg, and 36% of the float per S3’s Ihor Dusaniwski.

One big reason for the record pile up in shorts: the borrow rate has plunged to 2%…

$BYND short int is $839mm ; 9.29mm shs shorted; 36.26% of float; 2.04% borrow fee. Shs shorted UP 952k shs, +11.4%, over last 30 days as price rose +21% & up just +86k shs, +0.9%, last week. Shorts down -$180mm in January mark-to-market losses; after being down -$392mm in 2019 https://t.co/HW1UXMs16H pic.twitter.com/YSbVNsa1KE

— Ihor Dusaniwsky (@ihors3) January 10, 2020

… with some brokers offering the stock to short for as low as 0.5% after hitting an unprecedented 144% in late July. Which has made shorting the name far less painful from a theta, or bleed, perspective, but not less painful if and when a short squeeze is triggered… just like the one that appears to be taking place right now.

Needless to say, the slow motion meltup will only accelerate if the jog to cover becomes a full-blown panic, and the borrow fee returns to where it was 6 months ago around 100%. In that case, expect the stock to quickly soar back to its all time highs (as described in “BYND Shorts Crucified As Borrow Fee Hit 144%“), as first the shorts, then the longs, and then the short again get pulverized.

Tyler Durden

Mon, 01/13/2020 – 11:08

via ZeroHedge News https://ift.tt/2QOrquj Tyler Durden