Dollar, Bonds, & Bitcoin Snooze As Tech Stocks Soar To Record-er Highs

Young NFL players (and leveraged-to-the-gills stock market longs) “need to start taking care of their chicken…”

Marshawn Lynch dropping jewels for NFL players in what could be his final presser as a player pic.twitter.com/N8qOl6vcyC

— Donté Stallworth (@DonteStallworth) January 13, 2020

Chinese markets surged overnight with small-cap, tech dominant…

Source: Bloomberg

Europe was mostly lower with UK’s FTSE bucking the trend with a gain…

Source: Bloomberg

In the US markets, The Dow underperformed (weighed down by UNH) as Nasdaq soared… (S&P and Nasdaq new record highs)

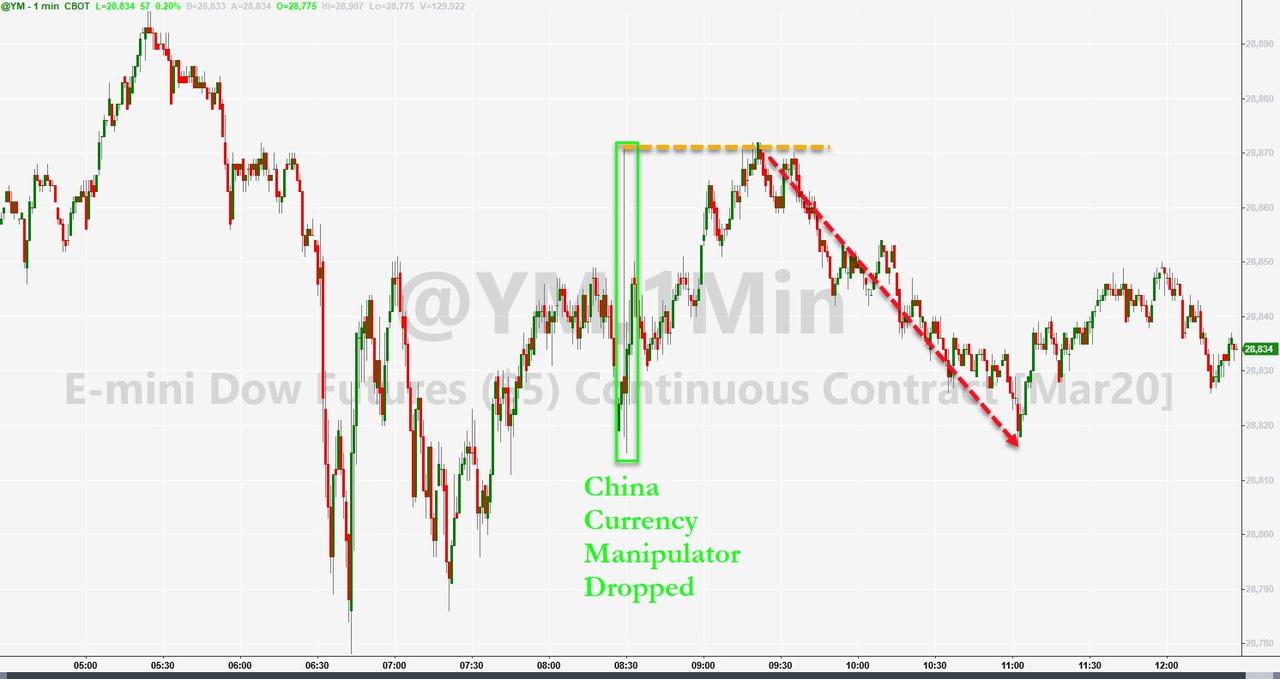

Dow futures spiked instantly on the “China removed as currency manipulator” headlines, then fell back, then the machines lifted the market back to run those stops, and then the market fell back… again…

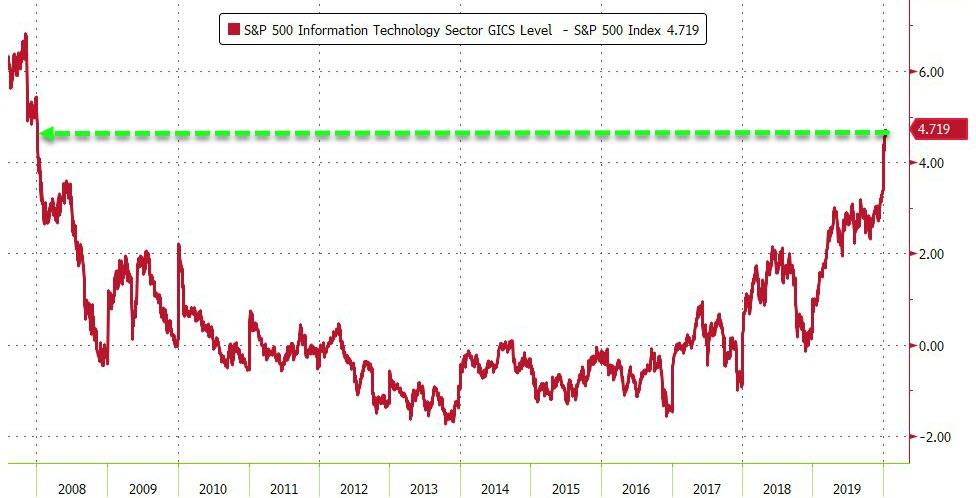

The tech sector is now trading at its most expensive to the broad market since the highs in 2007…

Source: Bloomberg

And then there’s TSLA, which exploded higher today, “coincidentally” correlated with AAPL and the expansion of global liquidity…

Source: Bloomberg

And then there’s this masterpiece of analysis from Morgan Stanley: “Our ‘analysis’ of Fed balance sheet expansions suggests it does boost asset prices.”

Will TSLA hit $1000 before this is over?

Source: Bloomberg

Seriously… this is just a joke!

Source: Bloomberg

It’s not just TSLA, BYND soared over 30% today and up over 55% in the last 3 days as another massive squeeze has been engineered…

Source: Bloomberg

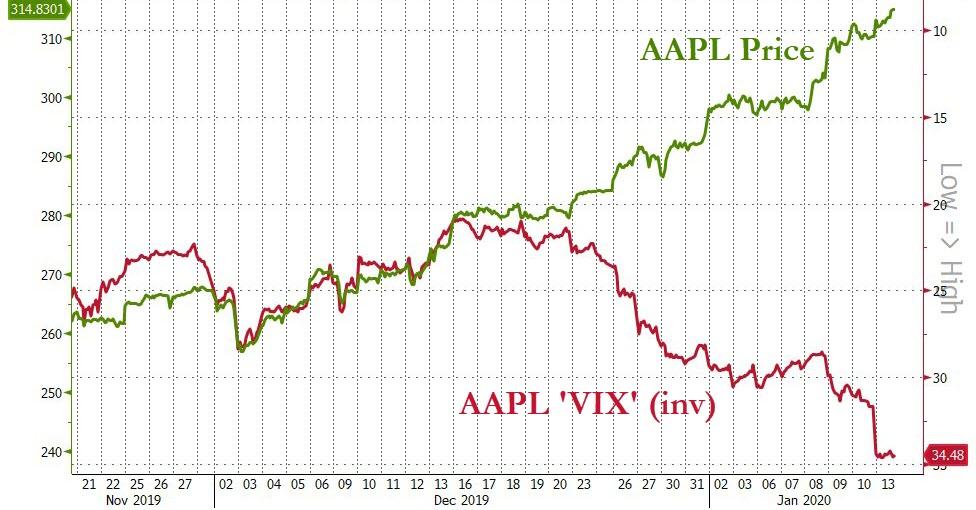

The decoupling between AAPL stock price and its implied vol is shocking…

Source: Bloomberg

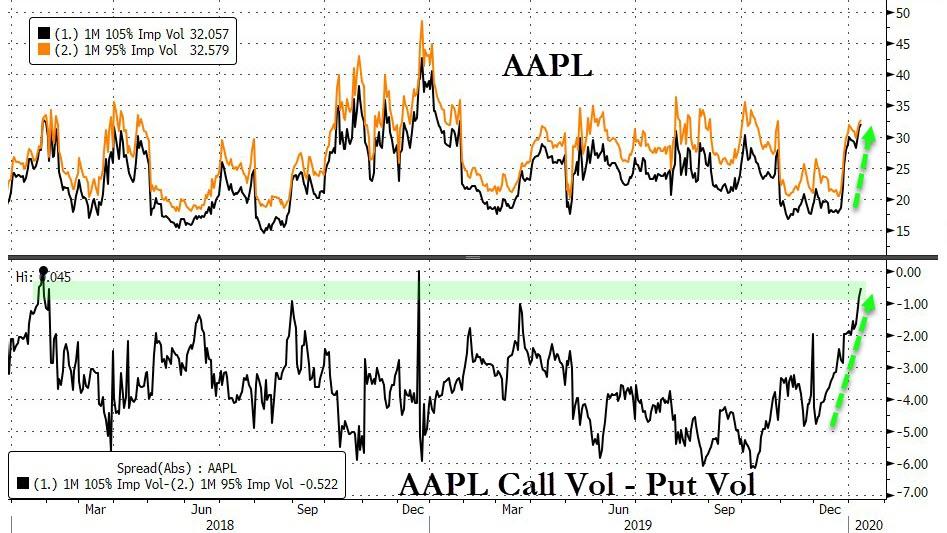

The divergence is being driven by soaring demand for calls (levered longs), not puts (hedges)…

Source: Bloomberg

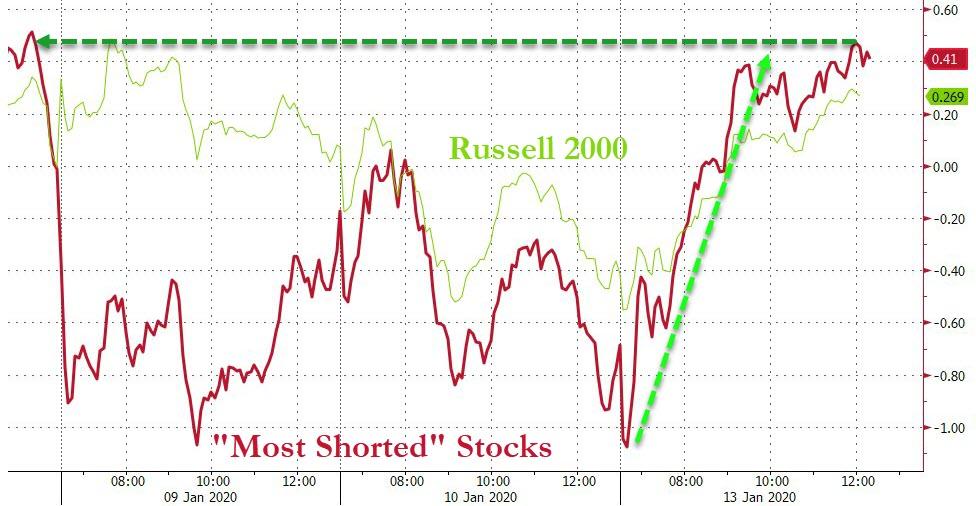

Shorts were squeezed (once again) with “Most Shorted” stocks soaring back last Wednesday highs…

Source: Bloomberg

Defensive stocks dominated cyclicals for the 2nd day in a row…

Source: Bloomberg

Stock prices relative to bond prices are back at their historical highs seen just before the collapse in Q4 2018…

Source: Bloomberg

Treasury yields limped higher today by 1-2bps across the curve…

Source: Bloomberg

The Dollar was a smidge weaker on the day, but basically trod water…

Source: Bloomberg

Amid the “currency manipulator” headlines, Yuan has rallied back to pre-Muchin label levels…

Source: Bloomberg

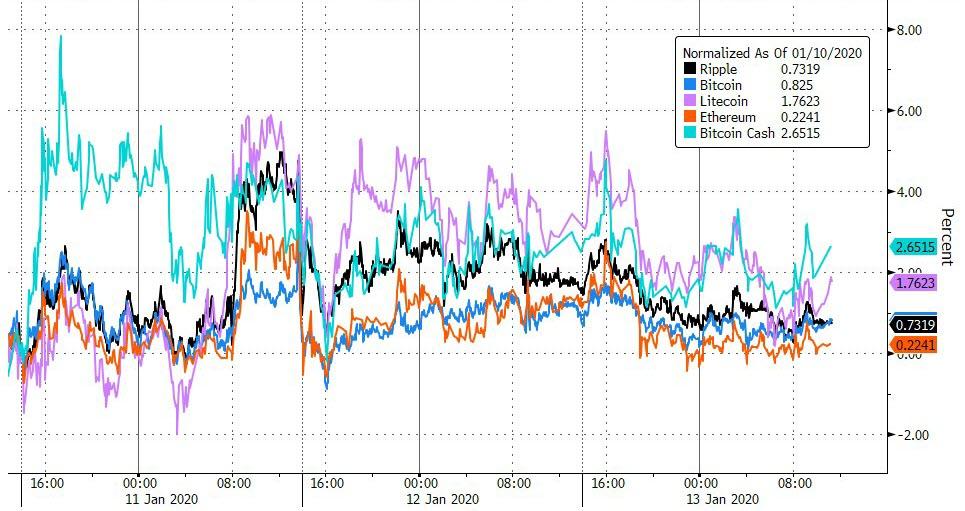

Cryptos are very marginally higher since Friday…

Source: Bloomberg

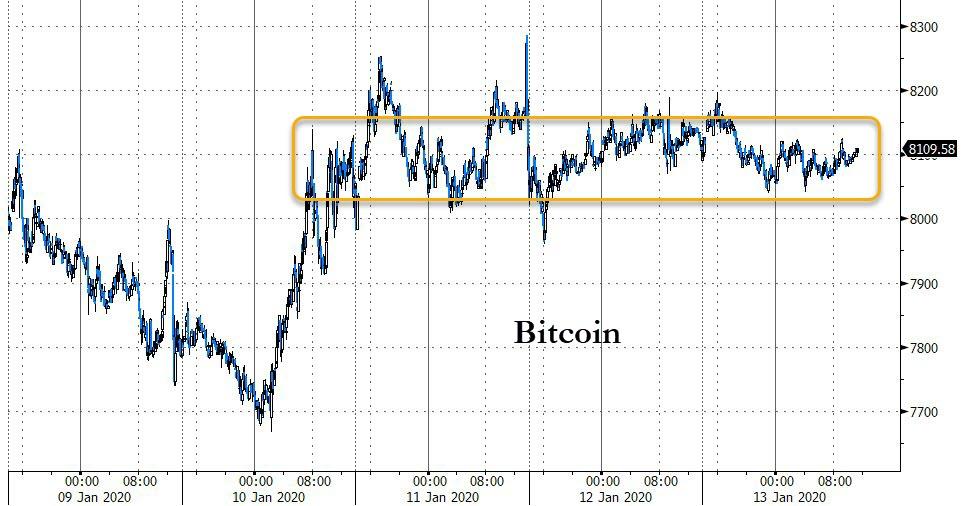

Bitcoin went nowhere, clinging to $8100…

Source: Bloomberg

Copper rallied strongly as crude crapped out today with PMs drifting lower…

Source: Bloomberg

Gold slipped lower today, with futures back at $1550 – pre-Soleimani levels…

And WTI tumbled to a $57 handle intraday…

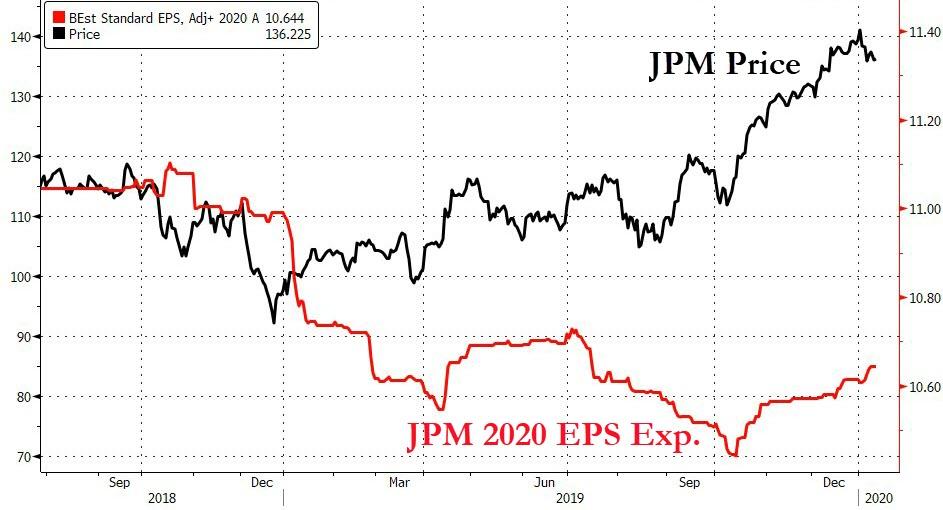

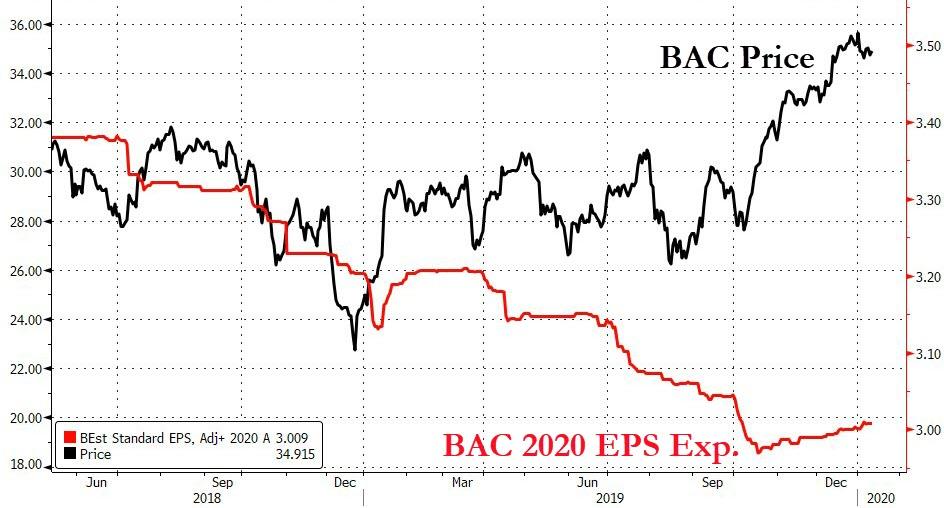

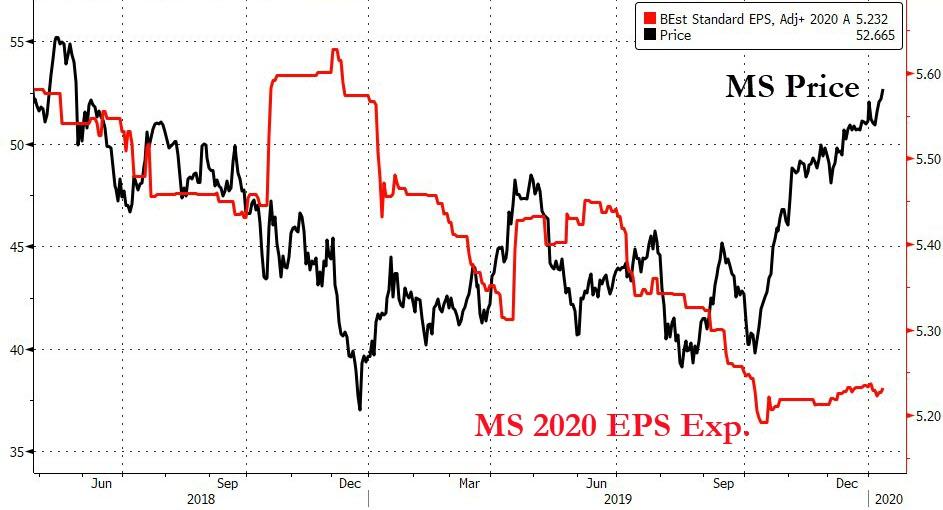

And finally, tomorrow we see the start of the financial earnings reporting cycle. We thought these charts might provide some sense of the farce that this so-called ‘market’ has become…

Source: Bloomberg

Notice a pattern in these charts? Fun-durr-mentals don’t matter!!

Tyler Durden

Mon, 01/13/2020 – 16:00

via ZeroHedge News https://ift.tt/2TlBA7i Tyler Durden