Futures Jump On “Trade Optimism” As Phase 1 Deal Signing Looms

With the Fed’s liquidity deluge ongoing, stocks predictably are up on Monday and back to all time highs and since traders always need a “narrative” what better time to use the old standby “U.S. Stock-Index Futures Gain Amid Trade Optimism” (which is how Bloomberg “explained” the market action) especially since the signing of a Phase 1 China-U.S. trade deal is set for this Wednesday, even though markets have yet to see details of the agreement.

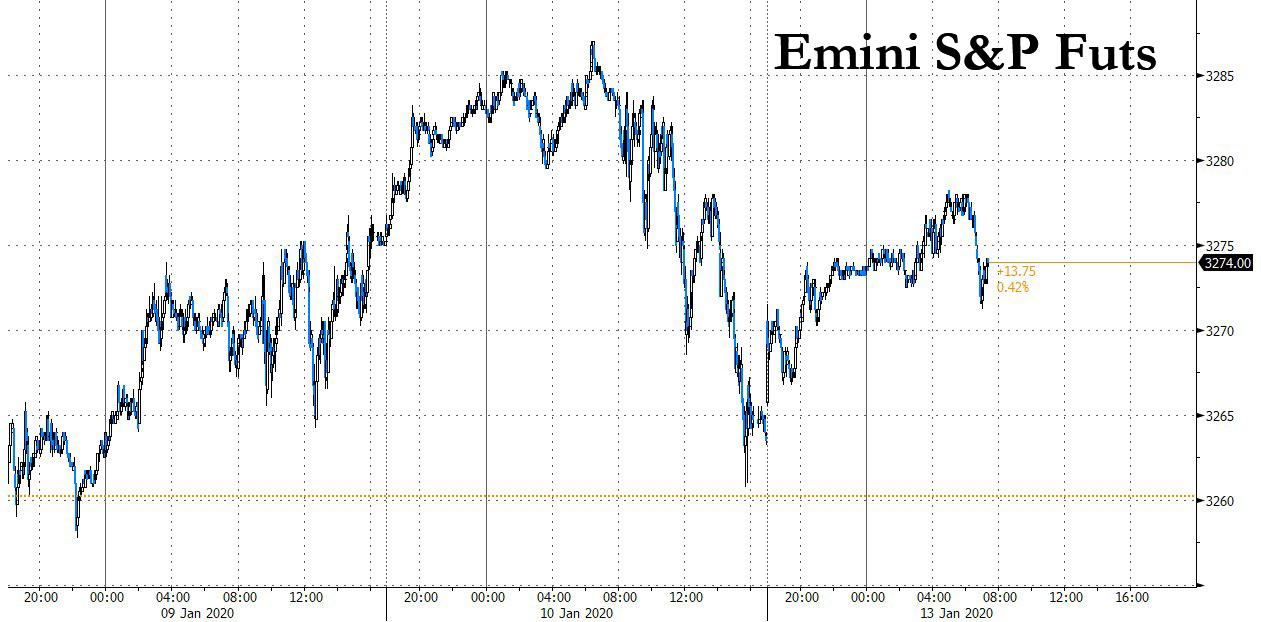

With December’s disappointing nonfarm payrolls report largely forgotten, half the Friday drop was erased overnight in very thin volume, and the S&P e-mini stock futures rose 0.31% to 3,274.8, just 10 points shy from reclaiming its all time high.

Ironically, Friday’s market reaction to the poor payrolls report was bizarre: as DB’s global FX strategy head Alan Ruskin said, “This is the perfect employment report for the Fed to continue to run the economy ‘hot’, as views on the natural rate of unemployment continue to drop,” adding “this is perfect for risky assets.”

MSCI’s All Country World Index was up 0.02%, also just short of a record high hit last week. After rising in early trade, European shares were last down 0.2% by midday. Germany’s DAX fell 0.3%, France’s CAC 40 gained 0.05% and Britain’s FTSE 100 added 0.19% amid speculation for rate cuts by the BOE. Europe’s Stoxx 600 index fell 0.22%.

In Asia, MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.64%, touching its highest level since June 2018. South Korea’s trade-sensitive Kospi added 1.04% and Hong Kong’s Hang Seng was up 1.11%, while Taiwan shares increased 0.74% in the first trading day after Taiwan re-elected President Tsai Ing-wen by a landslide on Saturday. Mainland Chinese shares lagged the regional index after China’s major equity indexes logged their sixth consecutive weekly rise last week, the longest such streak since the first quarter of 2019. The benchmark Shanghai Composite Index was up 0.8% in the afternoon, turning around from losses earlier in the session. Investors in China are looking ahead to trade and economic growth data due this week, which is expected to shed more light on early signs of economic improvement after the country logged its slowest pace of growth in nearly three decades in the third quarter. China’s fourth-quarter and 2019 full-year GDP figures, due on Friday, are also likely to draw scrutiny as investors look for signs that improvements seen in recent manufacturing surveys are reflected in broader growth and investment figures.

Japan’s Nikkei was closed for a holiday. It fell sharply early last week when Iran attacked bases hosting U.S. military in Iraq, only to rally almost a thousand points when the two countries stepped back from hostilities.

Trading in stocks, bonds and currencies was suspended in the Philippines because the Taal volcano to the south of the capital is belching out ash.

It wasn’t just Japan: tensions between the U.S. and Iran after the U.S. killing of a top Iranian general put investors on guard against risk last week, knocking global stocks off a record high set in the first trading week of the year. But with no further escalation in conflict and focus shifting toward this week’s trade deal, markets have rebounded.

“Last week there was a lot of focus on the conflict between Iran and the U.S. However, the ‘modest’ Iranian response to the killing of Suleimani and even some more conciliatory comments from Trump have taken the U.S.-Iran conflict more or less away from the financial agenda,” said Arne Rasmussen, chief analyst at Danske Bank in a note to clients.

And so, with optimism over a potential World War III surging, attention turned to Trade War I, where Reuters reported that China’s commitments in the Phase 1 trade deal with the United States were not changed during a lengthy translation process and will be released this week as the document is signed in Washington, U.S. Treasury Secretary Steven Mnuchin said on Sunday.

“Even getting to this phase-one agreement, when we weren’t sure we would get here, really shows that there’s political will to de-escalate trade tensions between China and the U.S.,” Lucy Meagher, investment adviser at Evan’s & Partners Pty., told Bloomberg Television. “We expect that to be a positive.”

To be sure, the main event of the week will be the signing of the Phase 1 trade deal between the United States and China on Wednesday. The Trump administration has invited at least 200 people to the White House for the ceremony.

“A calmer geopolitical backdrop and the signing of the U.S.‑China Phase 1 agreement is, on balance, favorable for global growth,” said Joseph Capurso, an FX strategist at CBA. “However, the 86-page Phase 1 agreement has not yet been made public. There are doubts how comprehensive the deal is, and whether the Phase 1 agreement will be implemented in full by both governments.”

Yet while geopolitics simmers in the background, Trump tweeted his support for protesters in Iran angered at their country’s mistaken downing of a Ukrainian jet, which could potentially add to middle east instability. Additionally, earnings from some of the biggest U.S. companies are due, amid forecasts they will show the smallest growth in three years.

Elsewhere, Germany’s benchmark bund yield headed for its least negative closing level since May. The offshore yuan strengthened past 6.9 per dollar for the first time since July in both onshore and offshore markets, as the signing of a preliminary trade deal with the U.S. nears. The People’s Bank of China set its daily fixing at the strongest level since August, nearly matching estimates by analysts and traders. The dollar rose and Treasuries fell across the curve as the completion of the first trade deal nears. President Donald Trump has said the U.S. and China will sign the accord on Wednesday.

The euro was flat on Monday at 1.1121, up from a $1.1083 low on Friday. Support comes in around $1.1060, while the recent peak at $1.1239 marks stiff resistance. The dollar rose 0.14% against a basket of currencies, up to 97.488, well within the recent trading range of 96.355 to 97.817; it was firmer on the yen at 109.87 but faces tough resistance around 109.70 where rallies have repeatedly failed in the past couple of months according to Reuters. The pound slipped 0.86% to $1.2963 after Bank of England policymaker Gertjan Vlieghe said he will vote for a cut in interest rates later this month, barring an “imminent and significant” improvement in the growth data.

In commodities, oil prices were slightly firmer after suffering their first weekly loss since late November. Brent crude futures were down 0.25% at $64.82 a barrel, while U.S. crude fell 0.15% to $58.96 a barrel. Spot gold slipped 0.6% to $1,552.30 per ounce, having hit a seven-year top last week of $1,610.90 at the height of Iran-U.S. tensions.

Fed’s Rosengren and Bostic are set to speak, economic data include monthly budget statement. Shaw Communications is due to report

Market Snapshot

- S&P 500 futures up 0.3% to 3,275.75

- MXAP up 0.4% to 173.67

- MXAPJ up 0.7% to 568.36

- Nikkei up 0.5% to 23,850.57

- Topix up 0.4% to 1,735.16

- Hang Seng Index up 1.1% to 28,954.94

- Shanghai Composite up 0.8% to 3,115.57

- Sensex up 0.6% to 41,832.58

- Australia S&P/ASX 200 down 0.4% to 6,903.67

- Kospi up 1% to 2,229.26

- STOXX Europe 600 up 0.1% to 419.66

- German 10Y yield rose 2.1 bps to -0.178%

- Euro down 0.01% to $1.1120

- Italian 10Y yield fell 5.7 bps to 1.151%

- Spanish 10Y yield rose 2.5 bps to 0.466%

- Brent Futures up 0.2% to $65.11/bbl

- Gold spot down 0.9% to $1,547.98

- U.S. Dollar Index up 0.1% to 97.49

Top Overnight News from Bloomberg

- Iran witnessed a second night of protests, some violent, after the governmentadmitted it had mistakenly downed a Ukrainian passenger jet

- Riksbank Deputy Governor Per Jansson says his reservation against the rate hike in Dec. doesn’t necessarily mean he will advocate a cut if development ahead is in line with forecasts

- The U.K. economy unexpectedly shrank ahead of the general election, casting doubt over whether there was any growth at all in the fourth quarter

- Conditions boiled over as Iranians gathered for a second night of protests after the governmentadmitted it had mistakenly downed a Ukrainian passenger jet, triggering global outrage as well as internal dissent

- Oil was steady after the biggest weekly drop since July as an easing of geopolitical tension in the Middle East turned attention back to a flood of new supply set to hit the market this year

- Argentine President Alberto Fernandez said in an interview with local media that his administration aims to “resolve” how much external debt the country needed to repay by March 31

- Troubles at aircraft maker Boeing could trim about half a point from U.S. GDP in 2020 but economic growth should still come in at about 2.5%, said Treasury Secretary Steven Mnuchin

- U.K. job postings fell by the most in a decade last year as Brexit uncertainty whipsawed business planning, according to a report from BD

- Xi Jinping’s goal of bringing Taiwan under his control moved further out of his grasp as the island re-elected a president who has vowed to defend its sovereignty

- Prime Minister Scott Morrison’s personal ratings have tumbled over his handling of Australia’s wildfire crisis, adding to pressure on his government to shift course on its climate change policies

- The executive director of campaign group Human Rights Watch said Sunday that he was prevented from entering Hong Kong, where he intended to release a report critical of the Chinese government

Asian equity markets began the week somewhat mixed with the region indecisive and Japanese participants away for a national holiday, with this week’s US-China Phase 1 deal signing adding to the tentativeness. ASX 200 (-0.4%) suffered from broad losses across its sectors led by underperformance in energy and defensives, while Westpac recently estimated losses from the ongoing bushfires at AUD 5bln and a total impact to domestic GDP of between 0.2%-0.5%. The TAIEX (+0.7%) was lifted following a landslide victory by Taiwanese President Tsai and with several encouraging monthly revenue updates including Acer, Pegatron and TSMC. Shanghai Comp. (+0.8%) and Hang Seng (+1.1%) were varied with early underperformance in the mainland after the PBoC once again refrained from open market operations and as the looming Phase 1 signing kept participants on the fence. Furthermore, the sides were said to have agreed to launch a new semi-annual dialogue mechanism, although not also was rosy with the US to drop its civilian drone programme amid security concerns regarding Chinese tech and with officials to visit the UK in which they are expected to pressure the UK against the use of Huawei equipment.

Top Asian News

- New SARS-Like Virus Found in Traveler From China, Thailand Says

- Blackstone Is Said to Near Deal to Buy Allcargo’s Unit Stake

- Trump Trade Deal Raises Issue of Trusting China to Deliver

- ‘Digital Currency for Cadres’ Is China’s Latest How-To Book Hit

A tentative start to the week for European equities thus far [Euro Stoxx 50 +0.1%], following on from a similarly mixed APAC session ahead of the looming US-China Phase One deal signing. UK’s FTSE 100 [+0.5%] outperforms its regional peers as a weaker GBP bolsters exporters in the index following further dovish comments from BoE MPC members – this time Vlieghe – in the run up to the Jan 30th BoE confab; as well as UK today’s poor UK GDP numbers. Sectors are relatively mixed with no clear under/outperform in a reflection of the broad overall sentiment. The tech sector [+0.6%] outperforms with some tailwind heading into the Phase One deal signing as US business executives suggest the deal shows some advances on some sticking points such as intellectual property protection, significant agricultural purchases and recued export barriers. In terms of individual movers, UCB (+3.1%) remains one of the winners in the Stoxx 600 after the Co. upgraded its FY19 core EPS and revenue outlooks. Wirecard (+1.7%) is the top gainer in the DAX after Chairman Matthais and the supervisory board chairman stepped down. On the other end of the spectrum, Renault (-3.8%) shares fell to the foot of the pan-European index amid reports that Senior Nissan executives have stepped up the contingency planning regarding a possible split from Renault.

Top European News

- Pound Falls After Vlieghe Joins BOE Chorus on Potential Rate Cut

- Aston Martin Said to Hold Funding Talks With Stroll, Geely

- Norway’s Arctic Oil Vision Suffers Another Blow From Lundin

- New German Coal Plant Could Threaten Merkel’s Final Climate Push

In FX, the Pound was already under pressure and underperforming G10 peers after BoE’s Vlieghe joined the growing ranks of dovish MPC members by signalling his leaning towards a rate cut as soon as this month barring an imminent and significant pick-up in UK growth. However, November GDP fell 0.3% m/m vs the flat consensus to lift January and 2020 easing expectations and push Sterling down further through 1.3000 vs the Dollar and through 0.8570 against the Euro, with the former testing December 27 lows circa 1.2970 and latter approaching Xmas Eve peaks after breaching the 55 DMA (0.8534) and 0.8550.

- JPY – The next weakest major link, as stops set around mid and early December highs were tripped to leave the Yen eyeing lows not seen since May 30 last year (109.93) ahead of big 110.00 barriers and technically bearish having fallen below the 200 WMA (109.70). From a fundamental perspective, broadly risk on sentiment awaiting the signing of US-China trade pact Phase 1 and no further US-Iran hostilities has prompted Jpy selling, while Usd/CNH has continued its downtrend to multi-month lows under 6.9000.

- AUD/EUR/NZD/CHF/CAD – All narrowly mixed vs the Greenback, as the DXY regains more composure off post-NFP lows within a 97.327-535 range, albeit partly on the aforementioned Pound and Yen depreciation. Aud/Usd is pivoting 0.6900, Eur/Usd is hovering above 1.1100 flanked by hefty options (1.6 bn between 1.1095-1.1100 and the same size from 1.1120-40), Nzd/Usd is meandering within 0.6625-52 parameters in the run up to NZIER confidence and building consensts, Usd/Chf is sitting tight in a 0.9723-36 band and Usd/Cad is equally restrained between 1.3046-67 ahead of Canada’s LEI and the BoC’s outlook survey.

- SCANDI/EM – The Norwegian Krona has weakened further alongside oil prices and from a chart perspective as Eur/Nok trades above the 200 DMA to 9.9100+ at one stage, while its Swedish counterpart is also on the back foot close to 10.5900 in wake of comments from Riksbank’s Jansson reiterating his opposition to December’s 25 bp repo hike. However, the Turkish Lira is consolidating recovery gains vs the Buck through 5.9000 even though the current account balance swung into arrears in November and the CBRT is widely forecast to ease again this week, with the Try still cheering cheaper crude costs and the overall appetite for risk noted above.

Commodities are largely mixed with WTI and Brent front-month futures choppy but ultimately flat in intraday trade, following last week’s vehement price action amid the heating and then cooling of geopolitical tensions in the Middle East. Over the weekend, focus somewhat shifted from the US/Iran conflict after Iran admitted it unintentionally shot down the Ukrainian Boeing 737-800 – which prompted mass protests in Tehran. WTI futures oscillate on either side of USD 59.0/bbl having already dipped below its 50 DMA at USD 58.81/bbl. Meanwhile, Brent Mar’20 contracts fell below the USD 65/bbl level and briefly dipped below Friday’s low of USD 64.88/bbl ahead of the current 2020 low-print at USD 64.58/bbl. SocGen notes that if the 200DMA (~USD 64.30/bbl) fails to hold, then oil will be put in ranges seen last September- after Saudi managed to put production back online surprisingly quickly after the attacks on Aramco facilities. Elsewhere, spot gold continues to trickle lower and prices temporarily lost the USD 1550/oz psychological figure amid a firmer Buck. Technicians will be eyeing USD 1540/oz for support marks the current YTD low. The firmer Dollar also provoked copper prices, which eased from highs north of USD 2.81/lb+ back to ~USD 2.80/lb – with the red metal on standby for the US-Sino deal signing later this week.

US Event Calendar

- 2pm: Monthly Budget Statement, est. $15.0b deficit, prior $13.5b deficit

Central Banks

- 10am: Boston Fed’s Rosengren Discusses Economic Outlook

- 12:40pm: Fed’s Bostic Discusses Economic Outlook and Monetary Policy

DB’s Jim Reid concludes the overnight wrap

I will be in Davos next week at the annual World Economic Forum. I’m still hopeful that Bono will want to come to one of my presentations one year on the off chance that he still hasn’t found what he’s looking for. With or without Bono, today’s new piece will be the basis of our conversations in Davos and is on the subject of growth. The general premise is that economic growth has been a wonderful game changing development for humans but only started with the first industrial revolution (c.250 years ago). Health, life expectancy, poverty etc. hardly improved for centuries before this and only saw huge improvements once the second industrial revolution (c.100 years later) changed sanitation and medicine forever. So the last 100-150 years has seen a rate of progress like nothing in history for the human race. The development has been near exponential since. However the side effects of this has been increasingly seen over the last few decades in terms of debt, regional inequality and most importantly the climate. The climate gets special focus in the note and we conclude that while the awareness of human’s impact on the environment has reached a tipping point, we feel that there is limited appreciation of the economic and personal trade-offs and sacrifices that will be needed if we want to seriously limit global warming. Will human’s sacrifice economic growth and even human development to halt environmental damage? That will probably be the question of our age but we shouldn’t lose stock of the uncomfortable truth that polluting growth has been essential for human progress after centuries (perhaps longer) of it going nowhere. Without it none of us would be here.

As discussed the first and last question in this month’s survey (link here) ) is related to climate change and asks how much economic growth you would be prepared to give up to help the environment and at the end asks whether you’ve changed your behaviour in a number of activities to limit the damage. It’s totally anonymous so feel free to be honest. Alongside this there are the usual market related questions. Results will be published on Thursday morning. We’d be grateful to get as many replies as possible before we close it at 5pm Wednesday. You only have to answer the questions you want and can skip any you don’t. Last month’s results are here.

The main highlights for the week ahead will be the signing of the Phase One trade deal between the US and China (Wednesday). US Treasury Secretary Steven Mnuchin said over the weekend that an English-language version of the agreement will be released this week. It’s quite remarkable that we still don’t know much in the way of details so eyes will be on this. We’ll also see the start of US earnings season with a number of banks reporting. On Tuesday we’ll hear from JPMorgan Chase, Wells Fargo and Citigroup. Then on Wednesday we’ll get Bank of America, UnitedHealth Group, Goldman Sachs, US Bancorp and BlackRock. Finally on Thursday, we’ll hear from Morgan Stanley and BNY Mellon. In terms of data CPI (Tuesday), retail sales (Thursday), and consumer confidence (Friday) are the main highlights in the US. In China we have trade data (Tuesday) and Q4 GDP/retail sales/industrial production (Friday). So we’ll have quite a good idea about momentum in the Chinese economy by the end of the week. In Europe industrial production numbers (Tuesday), and the flash CPI (Friday) are the highlights. The UK also sees CPI (Wednesday) and retail sales (Friday).

In terms of central banks over the coming week, publications to watch for include the Beige Book from the Fed on Wednesday, and then the ECB’s monetary policy account of its December meeting (and Christine Lagarde’s first as ECB President) on Thursday.

Over to politics now, and there’s a number of upcoming events this week. In the US, it’s the last Democratic primary debate on Tuesday before primary voting kicks off in February. Former Vice President Biden is currently ahead in the national polling according to the average on RealClear Politics. However, the polls in the first two states to vote in February, Iowa and New Hampshire, are much tighter, with the RealClear Politics average putting the 3 top candidates in Iowa between 20% and 22%, so it’s a tight race going into the caucuses there on 3rd February.

A Des Moines Register/Mediacom/CNN poll out from Iowa (the first state to vote) put Senator Bernie Sanders in first place on 20%, a 5-point jump for Sanders since their last poll in November. Elizabeth Warren was in 2nd place on 17%, while Pete Buttigieg was on 16%, and Joe Biden on 15%. As discussed above, nationally Biden remains the frontrunner, but the big question will be whether he can maintain his momentum were he not to win either of the first 2 states. Given how quickly Warren’s support has fallen, and also the impressive rally in Sanders’s ratings over a relatively short period of time, its clear that it remains all to play for in this race.

A quick refresh of our screens this morning shows that most Asian markets are trading higher with the Hang Seng (+0.82%), Shanghai Comp (+0.30%) and Kospi (+0.87%) all making advances. Japan’s markets are closed for a holiday. As for Fx, the Chinese onshore yuan is up +0.293% to 6.8990, the highest since July, ahead of the signing of the Phase 1 deal. Elsewhere, futures on the S&P 500 are up +0.28%.

In weekend news the Financial Times reported that the BoE’s Gertjan Vlieghe said that he will vote for an interest-rate cut from 0.75% to 0.5% this month if there are no signs of the economy improving after the general election. He said, “I really need to see an imminent and significant improvement in the U.K. data to justify waiting a little bit longer.” His comments echo those from the BoE Governor Carney made earlier in the past week while, the MPC member Silvana Tenreyro has also said that she may support an interest-rate cut in the next few months if sluggish global growth and Brexit uncertainty persist. Meanwhile, the FT also reported overnight that the CBI has urged the UK government to include businesses in the UK’s post-Brexit trade talks with the EU and US.

Turning to geopolitics, Iran has faced significant internal protests over the weekend after the Iranian government admitted that it had mistakenly downed the Ukrainian jet last week.

Recapping last week now, and the theme was very much the return of investor risk appetite, thanks to declining tensions between the US and Iran. Brent Crude was down -5.28% last week (-0.60% Friday) to just below $65/barrel, putting it clearly below the pre-US strike price. Meanwhile US equities were just shy of record highs, thanks to a slight pullback on Friday following the jobs report (more on that below). The S&P 500 ended the week +0.94% (-0.29% Friday), while the STOXX 600 also advanced +0.19% (-0.12% Friday). Volatility was also down, with the Vix index -1.46pts last week (+0.02pts Friday). Investors continued to move out of safe havens, with the Japanese Yen ending the week -1.24% (+0.06% Friday) against the US dollar, while sovereign debt also sold off, with 10yr Treasury yields +3.1bps (-3.4bps Friday) and 10yr bunds +7.9bps (-2.0ps Friday).

Looking at the jobs report, the headline numbers were a little below expectations, as nonfarm payrolls grew by +145k in December (vs. +160k expected), though there was a downward revision of -14k to the prior 2 months. The unemployment rate remained at 3.5%, in line with expectations and remaining at its joint lowest level since 1969. The more negative news for the economy (but positive for carry) came from average hourly earnings growth, which rose by +2.9% (vs. +3.1% expected), the first time it’s fallen below 3% since July 2018. That said, in somewhat brighter news, the broader U6 measure that also includes the underemployed and those marginally attached to the labour force fell to 6.7%, its lowest level since the data series began in 1994. From the Fed’s perspective, the report could be taken as a sign that there’s still slack in the labour market, particularly with the declines in U6 and wage growth falling back somewhat.

Tyler Durden

Mon, 01/13/2020 – 07:56

via ZeroHedge News https://ift.tt/2NlVpaN Tyler Durden