“Nothing Can Go Wrong… Right?” Trader Warns Everyone’s All-In

As we noted over the weekend, everyone’s all-in…

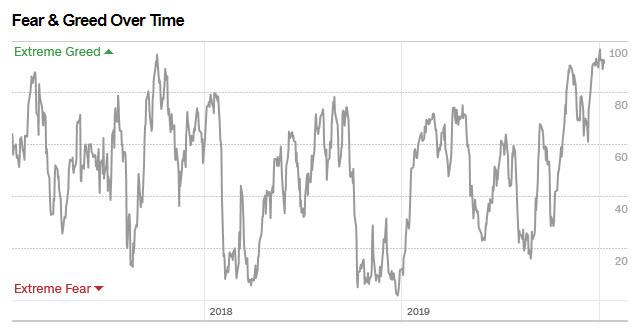

Despite 77% of CFOs now admitting the market is significantly overvalued, retail investor (super) sentiment, via the CNN Fear and Greed Index, has printed at all time series highs.

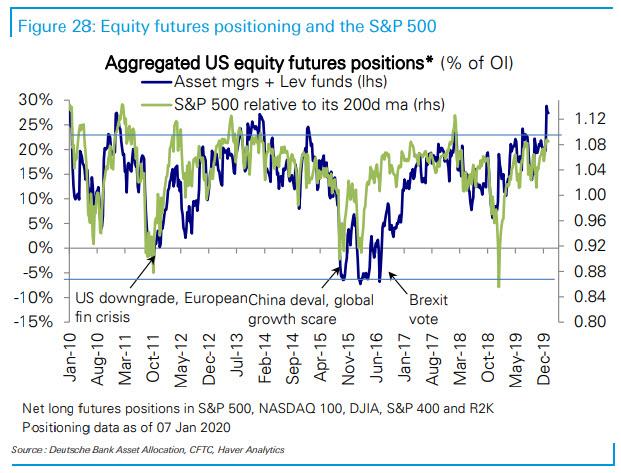

What about institutional sentiment? Well, contrary to several goalseeked indicators which erroneously repeat week after week that whales and other prominent institutional traders remain “on the fence” despite the now daily record highs in the S&P, the truth is that virtually everyone is now all in: from simple human-driven discretionary, to macro funds, all the way to algo and CTAs.

In fact, as Deutsche Bank’s Parag Thatte writes in his weekly flow report, “positioning in equities has been rising and is now in the 96th percentile on our consolidated measure, with a wide variety of metrics very stretched.”

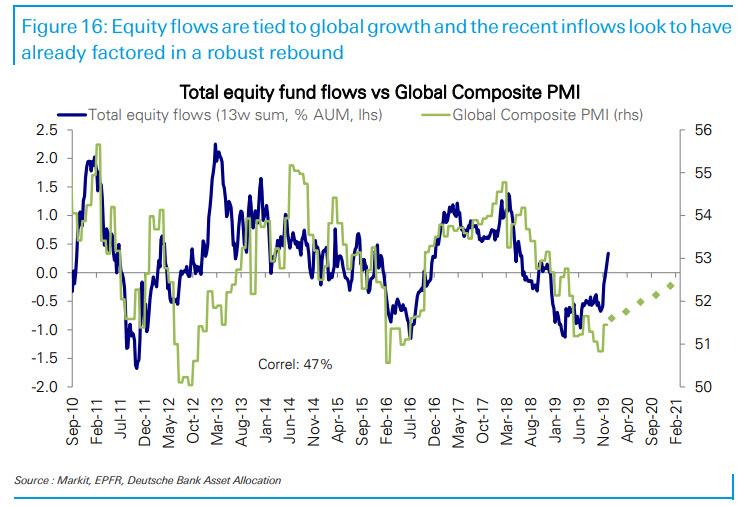

And, as we have noted previously, equity flows as well as “equity positioning, like the market itself, has run far ahead of current growth as investors price in a global growth rebound.“

And as Bloomberg’s Richard Breslow notes, last week highlighted this extremely well as the schizophrenic market crashed and roared back with irrational exuberance.

All-time highs are being racked up in U.S. equities with casual abandon. And if you didn’t buy the dip, it felt like a mistake rather than just a missed opportunity. As this week beckons, there is an optimism that has spread among investors which is sapping all of the fear side of the equation out of traders’ outlooks. It took 10 years to get here and everyone now wants to jump in. Nothing can go wrong.

The question is, are people starting to feel more upbeat about the global economy or is this just another round of central bank dovishness designed to propel asset prices higher? The answer appears to be, yes. Weakness will be met with overt accommodation. Strength with silence.

-

The numbers out of the U.K. have underwhelmed. There has been no shortage of BOE officials setting the table for a potential rate cut.

-

China has forecast that its economy will defy predictions and print a strong 6% or higher GDP number on Friday. No one expects them to put on the breaks.

-

German growth seems to be showing signs of stabilizing. The calls for additional fiscal stimulus are growing louder.

-

The latest U.S. non-farm payrolls report disappointed, but was no disaster. You can be sure that the Fed officials scheduled to speak in the next few days will intend to soothe any frayed nerves, should they actually exist.

It’s easy to conclude that economic numbers have less relevance for trading if they won’t get a balanced response from the authorities. The market will feast on that for a while. But letting things run hot, should it come to pass, won’t have an infinite shelf-life. Especially if it starts to manifest itself in the price data. Which makes tomorrow’s CPI data all the more interesting, where the economist estimates look mostly uniform but the whisper number hints at a possible upside bias. Retail sales on Thursday could also show enduring consumer strength.

It’s been a Japanless start to the week and volumes show it. Coming of Age Day seems like a quaint idea. What do markets look like as we get going and what’s in play? After last week’s dramatics, Brent crude has gone from threatening to blast-off to wondering if support will hold close to $64. Positions have probably been cleared out and this will be an important test of the market’s resiliency. And will go a long way in determining economic forecasts for the Asian economy.

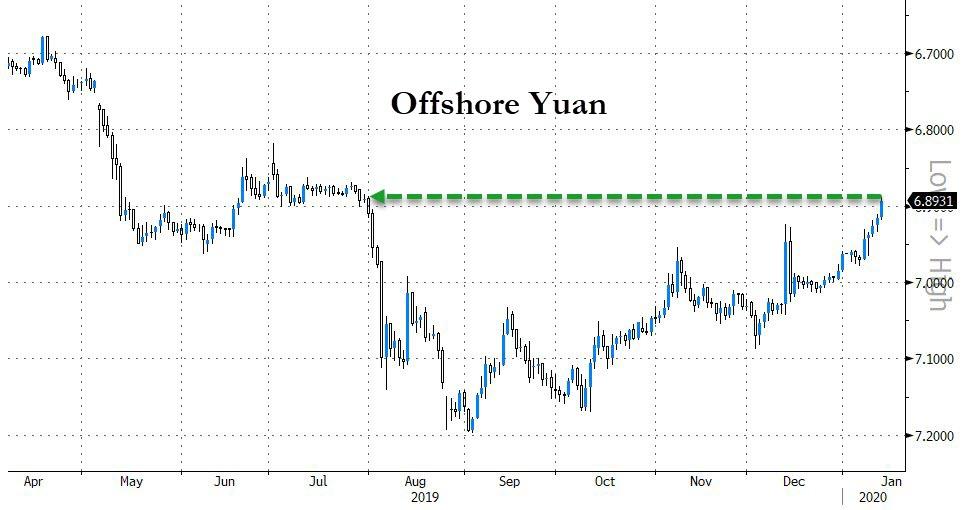

The Chinese yuan has been appreciating at an accelerating pace. It’s about to reach important support. Traders have gotten this one wrong. And are paying the price. It had better start to hold or analysts will have to consider reevaluating their outlook and understanding of the PBOC’s reaction function. The yuan crosses are certainly on the move. So much for yen strength. Another example of traders having positioned incorrectly.

Maybe I’m fooling myself, but global bond yields look like they just need to probe higher. Treasuries continue to frustrate those looking for a breakout, one way or the other. But bunds look like they want to try to test yields not seen since the first half of last year. Should they rise from right here, things could get interesting.

The dollar wants to trade great, but, in truth, is not doing as much as it seems. At the end of the day, it is probably range-bound. For the Dollar Index, 97-98 might be all we can muster for the week. Getting out of that range becomes fun.

As far as equities are concerned, it would be easier to like them if everyone would stop telling me it’s so obvious where they are going. No matter what the economic numbers bring.

This market is being described as remarkably straightforward (ZH: one might argue ignorant, but we are just splitting hairs)…

My guess is a lot more stop losses have been in play than is being credited. The year hasn’t been decided yet.

Tyler Durden

Mon, 01/13/2020 – 10:15

via ZeroHedge News https://ift.tt/3afBrsm Tyler Durden