Phase One And Done: Key Events In The Busy Week Ahead

With the market’s fascination with events in the middle east appears to be fading fast in the absence of any material escalation, the main highlights for the week ahead will be the signing of the Phase One trade deal between the US and China (Wednesday). Even though Steven Mnuchin said over the weekend that an English-language version of the agreement will be released this week, DB’s Jim Reid notes that it’s quite remarkable that we still don’t know much in the way of details so eyes will be on this.

We’ll also see the start of US earnings season with a number of banks reporting. On Tuesday we’ll hear from JPMorgan Chase, Wells Fargo and Citigroup. Then on Wednesday we’ll get Bank of America, UnitedHealth Group, Goldman Sachs, US Bancorp and BlackRock. Finally on Thursday, we’ll hear from Morgan Stanley and BNY Mellon.

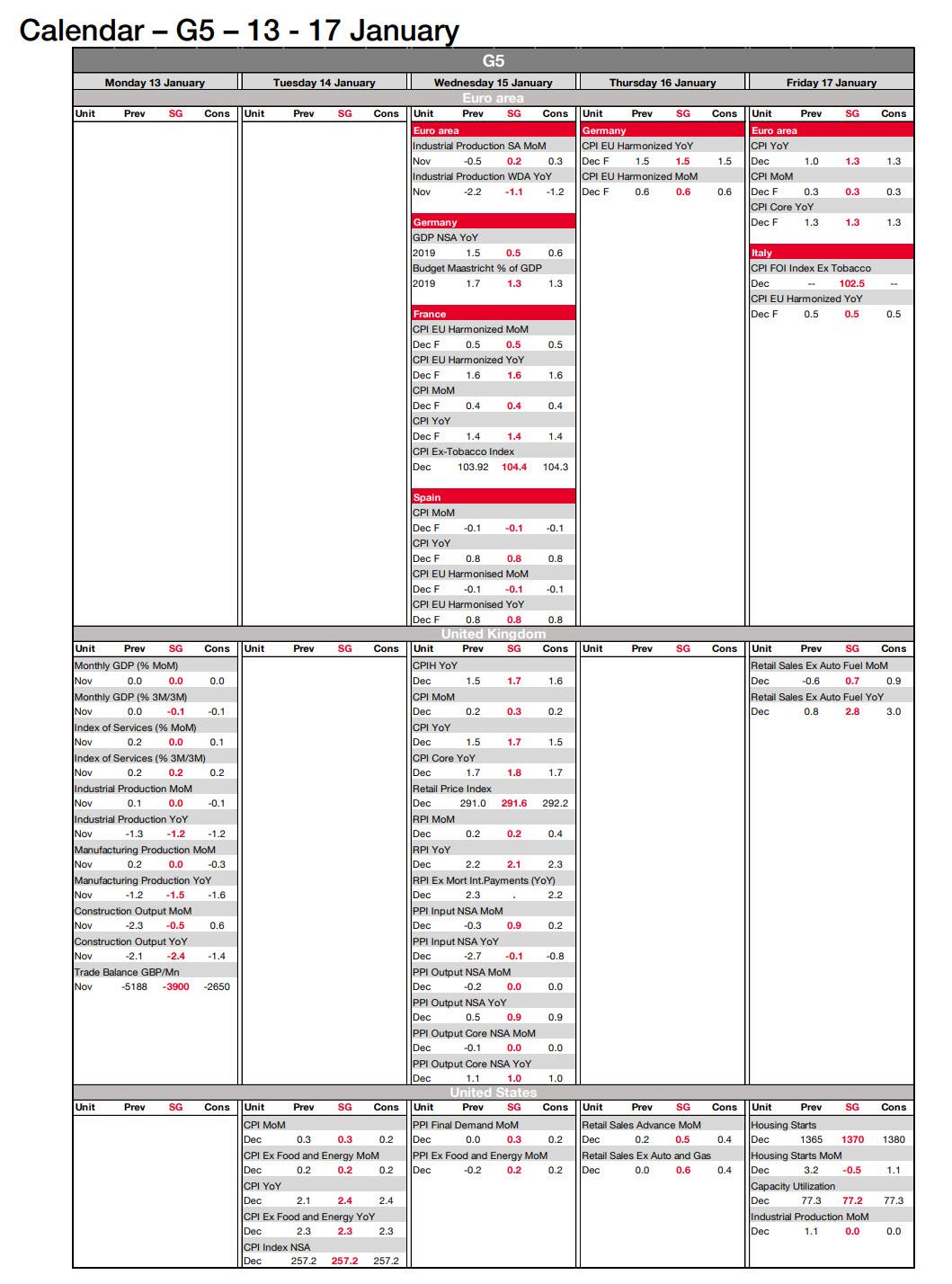

In terms of data CPI (Tuesday), retail sales (Thursday), and consumer confidence (Friday) are the main highlights in the US. In China we have trade data (Tuesday) and Q4 GDP/retail sales/industrial production (Friday). So we’ll have quite a good idea about momentum in the Chinese economy by the end of the week. In Europe industrial production numbers (Tuesday), and the flash CPI (Friday) are the highlights. The UK also sees CPI (Wednesday) and retail sales (Friday).

In terms of central banks over the coming week, publications to watch for include the Beige Book from the Fed on Wednesday, and then the ECB’s monetary policy account of its December meeting (and Christine Lagarde’s first as ECB President) on Thursday.

Over to politics now, and there’s a number of upcoming events this week. In the US, it’s the last Democratic primary debate on Tuesday before primary voting kicks off in February. Former Vice President Biden is currently ahead in the national polling according to the average on RealClear Politics. However, the polls in the first two states to vote in February, Iowa and New Hampshire, are much tighter, with the RealClear Politics average putting the 3 top candidates in Iowa between 20% and 22%, so it’s a tight race going into the caucuses there on 3rd February.

A Des Moines Register/Mediacom/CNN poll out from Iowa (the first state to vote) put Senator Bernie Sanders in first place on 20%, a 5-point jump for Sanders since their last poll in November. Elizabeth Warren was in 2nd place on 17%, while Pete Buttigieg was on 16%, and Joe Biden on 15%. As discussed above, nationally Biden remains the frontrunner, but the big question will be whether he can maintain his momentum were he not to win either of the first 2 states. Given how quickly Warren’s support has fallen, and also the impressive rally in Sanders’s ratings over a relatively short period of time, its clear that it remains all to play for in this race.

Below is a day by day guide to the week ahead, courtesy of Deutsche Bank:

Monday

- Data: UK November GDP, trade balance, industrial production, manufacturing production, US December monthly budget statement, Japan November current account balance

- Central Banks: Fed’s Rosengren and Bostic speak

- Politics: House of Lords begins debate on Brexit Withdrawal Agreement Bill, deadline for UK Labour leadership contenders to receive nominations from at least 10% of MPs and MEPs

Tuesday

- Data: US December NFIB small business optimism index, December CPI, Japan December M2 money stock, M3 money stock, China December trade balance

- Central Banks: ECB’s Mersch, Fed’s Williams and George speak

- Politics: US Democratic primary debate

- Earnings: JPMorgan Chase, Wells Fargo, Citigroup

Wednesday

- Data: Japan preliminary December machine tool orders, France final December CPI, UK December CPI, RPI, PPI, Euro Area November industrial production, trade balance, US weekly MBA mortgage applications, US December PPI

- Central Banks: BoJ’s Kuroda, ECB’s Holzmann, BoE’s Saunders and Fed’s Harker and Kaplan speak, Federal Reserve releases Beige Book

- Earnings: Bank of America, UnitedHealth Group, Goldman Sachs, US Bancorp, BlackRock

- Other: Signing of the US-China Phase One trade deal

Thursday

- Data: EU27 December new car registrations, Germany final December CPI, US December retail sales, January Philadelphia Fed business outlook, weekly initial jobless claims, November business inventories, January NAHB housing market index, November net long-term TIC flows

- Central Banks: Policy decisions from the Central Bank of Turkey and the South African Reserve Bank, monetary policy account of the ECB’s December meeting released

- Earnings: Morgan Stanley, BNY Mellon

Friday

- Data: China Q4 GDP, retail sales, industrial production, Japan November tertiary industry index, Euro Area November current account, Italy November trade balance, UK December retail sales, Euro Area December CPI, Canada November international securities transactions, US December building permits, housing starts, capacity utilisation, industrial production, preliminary January University of Michigan sentiment, November job openings

- Central Banks: Policy decision from the Bank of Korea, Fed’s Harker speaks

Finally, looking at the key economic data releases in the US, Goldman notes that this week all eyes are on the CPI report on Tuesday and the retail sales report on Thursday. There are several scheduled speaking engagements by Fed officials this week.

Monday, January 13

10:00 AM Boston Fed President Rosengren (FOMC non-voter) speaks: Boston Fed President Eric Rosengren will speak at a Connecticut Business and Industry Association event in Hartford, Connecticut. Prepared text and audience Q&A are expected.

12:40 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will discuss the economic outlook and monetary policy with the Rotary Club of Atlanta. Audience and media Q&A are expected.

Tuesday, January 14

- 06:00 AM NFIB small business optimism, January (consensus 104.8, last 104.7)

- 08:30 AM CPI (mom), December (GS +0.33%, consensus +0.3%, last +0.3%); Core CPI (mom), December (GS +0.16%, consensus +0.2%, last +0.2%); CPI (yoy), December (GS +2.41%, consensus +2.4%, last +2.1%); Core CPI (yoy), December (GS +2.30%, consensus +2.3%, last +2.3%): We estimate a 0.16% increase in December core CPI (mom sa), which would leave the year-on-year rate unchanged at +2.3%. Our monthly core inflation forecast reflects a pullback in used car prices and a holiday-season-related decline in household furnishing prices. On the positive side, we expect a rebound in apparel and footwear prices reflecting residual seasonality and Nike price increases. We estimate a 0.33% increase in headline CPI (mom sa), mainly reflecting higher energy prices.

- 09:00 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will discuss behavioral science and organizational culture at an event organized by the Banking Standards Board, the New York Fed, and the London School of Economics. Prepared text and audience Q&A are expected.

- 1:00 PM Kansas City Fed President Esther George (FOMC non-voter) speaks: Kansas City Fed President Esther George will discuss the economic outlook and monetary policy at an event hosted by the Kansas City Fed. Audience Q&A is expected.

Wednesday, January 15

- 08:30 AM PPI final demand, December (GS +0.2%, consensus +0.2%, last flat); PPI ex-food and energy, December (GS +0.1%, consensus +0.2%, last -0.2%); PPI ex-food, energy, and trade, December (GS +0.1%, consensus +0.2%, last flat); We estimate that headline PPI increased 0.2% in December, reflecting stronger energy prices but somewhat softer core prices. We expect a 0.1% increase in the core measure excluding food and energy, and also a 0.1% increase in the core measure excluding food, energy, and trade.

- 08:30 AM Empire State manufacturing index, January (consensus +3.6, last +3.5)

- 11:00 AM Philadelphia Fed President Harker (FOMC voter) speaks; Philadelphia Fed President Patrick Harker will discuss “Monetary Policy Normalization: Low Interest Rates and the New Normal” at the Harvard Club of New York. Prepared text and audience Q&A are expected.

- 12:00 PM Dallas Fed President Kaplan (FOMC voter) speaks; Dallas Fed President Robert Kaplan will speak to the Economic Club of New York. Audience and media Q&A are expected.

- 02:00 PM Beige Book, January FOMC meeting period; The Fed’s Beige Book is a summary of regional economic anecdotes from the 12 Federal Reserve districts. In the January Beige Book, we look for anecdotes related to growth, labor markets, wages, price inflation, and trade policy.

Thursday, January 16

- 08:30 AM Retail sales, December (GS +0.5%, consensus +0.3%, last +0.2%); Retail sales ex-auto, December (GS +0.6%, consensus +0.5%, last +0.1%); Retail sales ex-auto & gas, December (GS +0.5%, consensus +0.4%, last flat); Core retail sales, December (GS +0.5%, consensus +0.3%, last +0.1%): We estimate that core retail sales (ex-autos, gasoline, and building materials) increased 0.5% in December (mom sa), reflecting the solid monthly sales results of general merchandisers as well as a boost from the late Thanksgiving holiday, which may have shifted some holiday shopping into December. That being said, we believe uncertainty around this report is higher than usual, as the underlying cause of last December’s sharp and short-lived drop in retail spending remains unclear (potential explanations include the government shutdown, a particularly early Thanksgiving, and the secular trend towards earlier holiday shopping). We estimate a 0.5% increase in the headline measure in this week’s report, reflecting a rise in gas prices but a pullback in auto sales.

- 08:30 AM Philadelphia Fed manufacturing index, January (GS +4.4, consensus +3.1, last +2.4): We estimate that the Philadelphia Fed manufacturing index rebounded by 2.0pt to +4.4 in January after declining by 6.0pt in the prior month.

- 08:30 AM Initial jobless claims, week ended January 11 (GS 220k, consensus 217k, last 214k): Continuing jobless claims, week ended January 4 (last 1,803k); We estimate jobless claims ticked up 6k to 220k in the week that ended January 11. We expect a persistent winter seasonal bias to continue to exert upward pressure on the continuing claims measure between now and February.

- 08:30 AM Import price index, December (consensus +0.4%, last +0.2%)

- 10:00 AM Business inventories, November (consensus -0.1%, last +0.2%)

- 10:00 AM NAHB housing market index, January (consensus 74, last 76)

Friday, January 17

- 08:30 AM Housing starts, December (GS +2.5%, consensus +1.1%, last +3.2%); Building permits, December (consensus -1.5%, last +1.4%): We estimate housing starts increased by 2.5% in December. Our forecast incorporates stronger construction job growth but a drag from likely mean reversion in the noisy multifamily category.

- 09:00 AM Philadelphia Fed President Patrick Harker (FOMC voter) speaks: Philadelphia Fed President Patrick Harker will discuss the economic outlook at the New Jersey Bankers Association Leader Forum in Somerset, New Jersey. Prepared text and audience Q&A are expected.

- 09:15 AM Industrial production, December (GS -0.2%, consensus -0.1%, last +1.1%); Manufacturing production, December (GS flat, consensus +0.1%, last +1.1%); Capacity utilization, December (GS 77.0%, consensus 77.1%, last 77.3%): We estimate industrial production declined modestly in December, reflecting a pullback in the utilities category and a slight decrease in auto manufacturing. We estimate capacity utilization declined by three tenths in November to 77.0%.

- 10:00 AM University of Michigan consumer sentiment, January preliminary (GS 99.6, consensus 99.3, last 99.3): We expect University of Michigan consumer sentiment edged 0.3pt higher in the preliminary January reading to 99.6, reflecting increases in other confidence measures and higher stock prices.

- 10:00 AM JOLTS Job Openings, May (consensus 7,267k, last 7,267k)

Source: Deutsche Bank, SocGen, Goldman

Tyler Durden

Mon, 01/13/2020 – 09:02

via ZeroHedge News https://ift.tt/2QMwjUO Tyler Durden