Platts: 5 Commodity Charts To Watch This Week

Via S&P Global Platts Insight blog,

In this week’s pick of energy and commodities trends, European wind generation storms into 2020 and oil refiners in Asia and Europe feel the impact of US-Iran tensions. Plus, S&P GSCI index performance in 2019 reveals investors’ darlings among commodities.

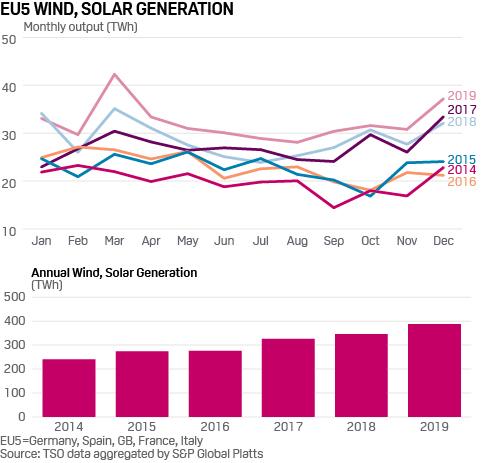

1. European wind charge sweeps away nuclear concerns

What’s happening? Wind generation records tumbled across Europe last year and 2020 got off to a flying start in week 1 with fresh output highs across Nordic markets. There are now over 200 gigawatts of wind capacity installed across Europe, up from 189 GW a year ago. Stormy weather, further spikes in green generation and continuing low gas prices are expected in the short term. These factors drove week 3 German power down 30% in value year on year versus January 2019’s average Eur49.40/MWh.

What’s next? This week also marks the start of a wave of 10-year overhauls to French reactors, at a time of reduced availability across Europe’s dominant nuclear generation fleet. Normally this would have a bullish impact on power price but the reality is that near term curve contracts are wilting as the mild, windy winter proceeds.

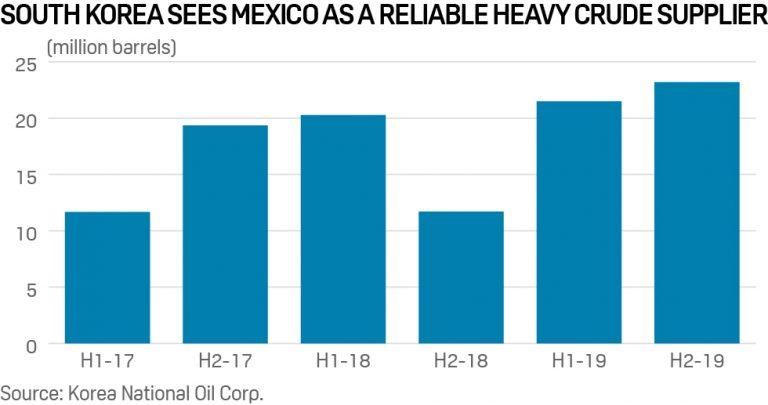

2. Asia looks to LatAm for heavy crude amid Iraqi supply risk

What’s happening? Major Asian importers of Iraqi Basrah crude including Taiwan’s Formosa, Indonesia’s Pertamina, Japan’s Itochu, South Korea’s GS Caltex and SK Innovation, China’s PetroChina and Unipec told S&P Global Platts that their cargo loadings for January have not been affected by recent events in the Middle East. However, Iran’s recent missile attacks on US military bases in Iraq raises the possibility of Baghdad becoming a proxy battleground between the US and Iran for months to come, jeopardizing regular flow of Basrah crude to the Far East.

What’s next? Several Asian refiners are poised to venture into Latin America, as they prepare a contingency plan to ensure adequate supply of medium and heavy crude feedstocks. State-run and independent Chinese refiners, as well as major South Korean end-users, are increasingly focusing on heavy crude supplies in Latin America, with Brazilian Lula, Colombian Castilla Blend and Mexican Maya top potential substitutes for Basrah.

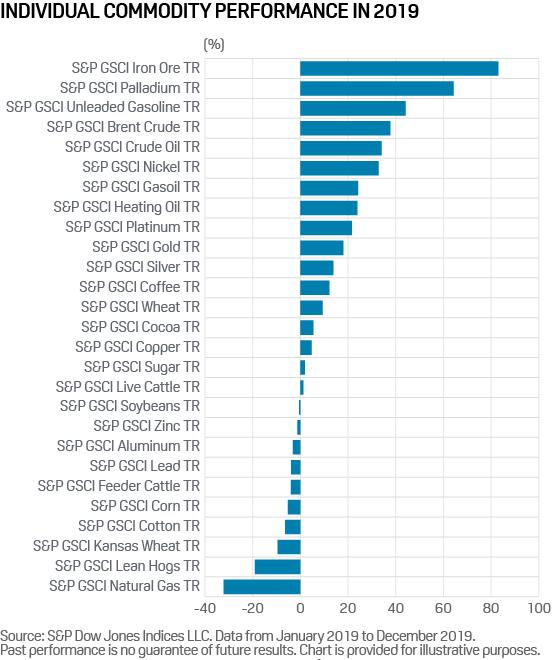

3. S&P GSCI records strongest performance since 2007

What’s happening? The S&P GSCI, one of the most widely recognized benchmarks of global commodity market beta, ended 2019 up 17.6%. This was the S&P GSCI’s 10th-strongest performance since 1990 and its best annual return since the heights of the commodity super cycle in 2007. Gains were driven by the petroleum complex and metals, while agriculture and livestock detracted from headline performance.

What’s next? The S&P GSCI Iron Ore was the best performing S&P GSCI single commodity index in 2019. It ended the year 83.1% higher, on the back of several significant supply curtailments and persistent Chinese steel demand. With global supply prospects improving, the performance of iron ore prices in 2020 will depend even more heavily on the strength of domestic Chinese steel demand.

4. Palladium keeps smashing records as regulators chase clean air

What’s happening? Palladium remains a standout performer across the metals sector, going from strength to strength. The main driver is increasingly stringent emissions standards: palladium’s main use is in autocatalysts for petrol-powered engines. The physical market has reportedly been tight for the last couple of years and this is helping to propel the metal to new records.

What’s next? With the $2,000/oz hurdle now easily cleared, the sky really is the limit according to market sources. Emissions standards are set to get tougher as global governments step up efforts to avert a climate catastrophe. This is likely to mean higher platinum content in converters, boosting overall demand for the metal and providing price upside. One potential disruption could be substitution, whereby the market opts to switch from expensive palladium to its more affordable sister metal platinum. However, according to industrial sources this could take two to three years to implement.

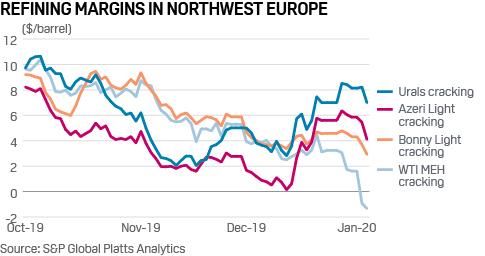

5. Brent crude spike puts pressure on NWE refinery margins

What’s happening? Refining margins in Northwest Europe slumped sharply early last week, squeezed by a Brent price spike as high as $72/b after Iran retaliated against US military targets in Iraq for the killing of General Qassem Soleimani. Despite expectations of sharply higher middle distillates margins due to support from the IMO 2020 marine fuel rules, European gross margins remained near the bottom of their five-year range. Regional margins have also been depressed by heavy production and stockpiling of low sulfur diesel by refiners ahead of the Jan 1 2020 IMO marine fuel spec change and milder than normal winter temperatures hitting heating oil demand.

What’s next? Regional traders are closely watching ongoing strikes over pensions in France which have hampered some refiners and disrupted fuel deliveries to the pumps. The strikes are scheduled to end on Monday but could be extended, forcing more draw-down from commercially held fuel stocks. Further out, surging demand for low sulfur fuel oil due to the IMO 2020 changes is widely expected to support refining margins for oil products in Europe in the first half of 2020 through stronger distillate cracks.

Tyler Durden

Mon, 01/13/2020 – 12:42

via ZeroHedge News https://ift.tt/2uGcSnT Tyler Durden