TSLA Tops $500 For First Time

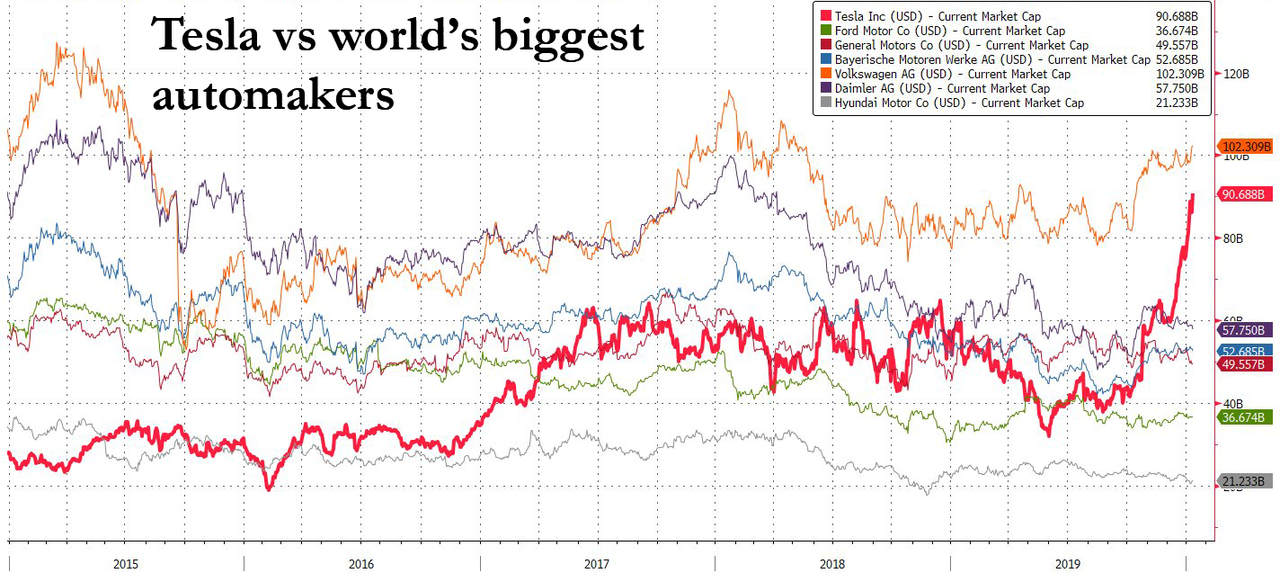

With a market cap over $90 billion now (almost as big as VW – the world’s largest market cap automaker – which sold 10.9mm cars in 2019, compared to TSLA’s 367,500…)

Source: Bloomberg

TSLA shares have gone even more parabolic-er, opening up over 5%, topping $500 for the first time in its history, as the algos run the stops from last week’s highs…

So what’s driving the surge?

It’s not fun-durr-mentals…

Source: Bloomberg

Even though Oppenheimer & Co analyst Colin Rusch raised his target on the stock to $612 from $385

“While TSLA has stumbled through growing pains, we believe the company has reached critical scale sufficient to support sustainable positive FCF,” Oppenheimer’s Rusch wrote.

“At the same time, we believe the company’s risk tolerance, ability to implement learnings from past errors, and larger ambition than peers are beginning to pose an existential threat to transportation companies that are unable or unwilling to innovate at a faster pace.”

Not everyone is a gung-ho…

(2) The new $612 price target comes from raising the multiple to 30x (from 25x)…on the 2024E estimate of $28.67, discounted back at 12%. At least he’s being conservative. $TSLA

— Diogenes (@WallStCynic) January 13, 2020

Whatever is driving TSLA higher seems to be the same thing that is forcing AAPL higher every day…

Source: Bloomberg

Correlation is not causation when your salary depends on it…

Source: Bloomberg

Tyler Durden

Mon, 01/13/2020 – 09:40

via ZeroHedge News https://ift.tt/3a6nEEk Tyler Durden