US To Remove China “Currency Manipulator” Designation Ahead Of Treade Deal; Yuan Jumps

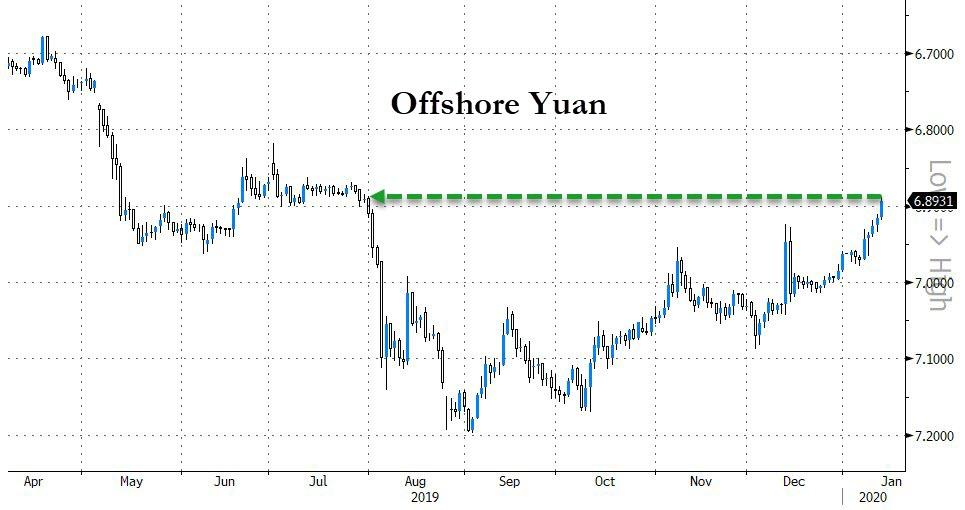

For anyone still seeking definitive confirmation that the Treasury’s “Currency Manipulator” designation is nothing more than a political tool, here it is: moments ago Bloomberg reported that just five months after the Treasury tagged China as a currency manipulator on August 5 – the first such designation in 25 years – when the trade war between the two nations was near its apex, the US would lift said “manipulator” tag hours ahead of the Phase One trade deal which is now set to be announced to much fanfare on Jan 15.

According to the report, the Treasury Department will make the move in the latest semi-annual currency report, which is expected to be released ahead of Jan 15 after being delayed as the U.S. and China finalize a “phase one” trade pact.

As we reported at the time, On August 5 Treasury Secretary Steven Mnuchin formally labeled China a currency-manipulator for the first time since the days of the Clinton administration, a move that further escalated the trade war with Beijing after the country’s central bank allowed the yuan to fall in retaliation to new U.S. tariffs. The designation followed just hours after the Yuan tumbled below the critical level of 7 against the dollar for the first time ever.

And since it is now clear that this designation was merely a political ploy to push China, now that a deal is in sight, the designation is being lifted.

The administration had at one point considered maintaining the label and instead announcing it would monitor the yuan with the possibility of lifting the designation in August of this year, according to the people.

Mnuchin’s August 2019 announcement prompted authorities in Beijing to increase transparency around how they manage the yuan. Some of that data has provided support for Treasury’s view that the People’s Bank of China engages in competitive devaluations of its currency, the people said.

Ironically, when China branded a currency manipulator it was for devaluing its currency when in reality Beijing has been fighting tooth and nail to keep its currency stronger than it should be based on the shadow outflows from the country’s closed capital account; as a result economists slammed the August decision: the IMF said in September the yuan is fairly valued and that there’s no evidence of manipulation, noting that China’s weakening currency could also be attributed to a slowdown in growth.

More to the point, China also doesn’t meet the criteria outlined in a 2015 U.S. law for formally designating a country a currency-manipulator. Mnuchin instead relied on a 1988 trade law that has a looser definition of currency manipulation to justify the claim. He did so after the yuan broke the 7 per dollar level for the first time since 2008, drawing Trump’s ire.

As a reminder, the August announcement was made in a press release, outside the normal issuance of the report. That left currency strategists and policy experts without a full explanation for the decision. Treasury’s currency report examines 20 countries for possible currency manipulation, a number that was increased from 12 in May.

And, as Bloomberg discloses, “Trump was involved in drafting the press release, which on his direction refers to China as a “Currency Manipulator,” using capital letters.”

Hinting at what’s to come, last October Mnuchin said that if a trade deal with China were signed, he would consider removing the manipulator tag, saying that signing an agreement would be “a big step in the right direction.” And now that a deal is imminent, this is precisely what has happened.

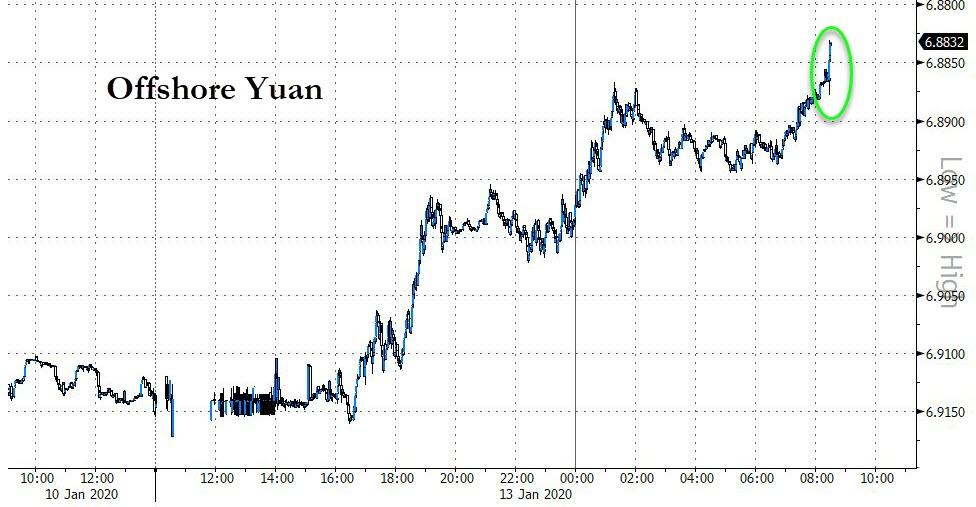

Following the bloomberg report, the Yuan rose to fresh session highs, with the USDCNH dropping to levels not seen since July.

Tyler Durden

Mon, 01/13/2020 – 11:44

via ZeroHedge News https://ift.tt/2uKY9Z2 Tyler Durden