Cryptos Are Surging: Bitcoin At 2-Month Highs After CME Options Start Trading

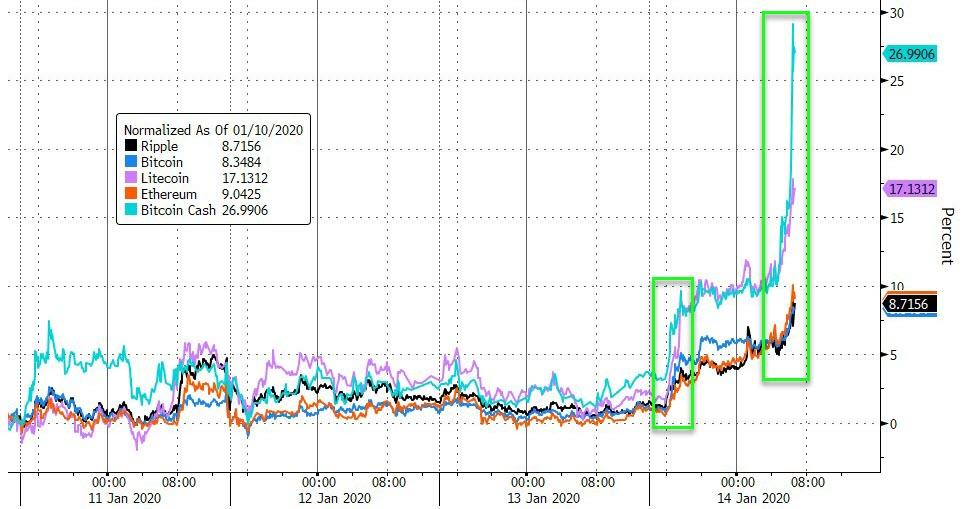

Cryptos rallied overnight and are accelerating their gains this morning with Bitcoin Cash leading the way…

Source: Bloomberg

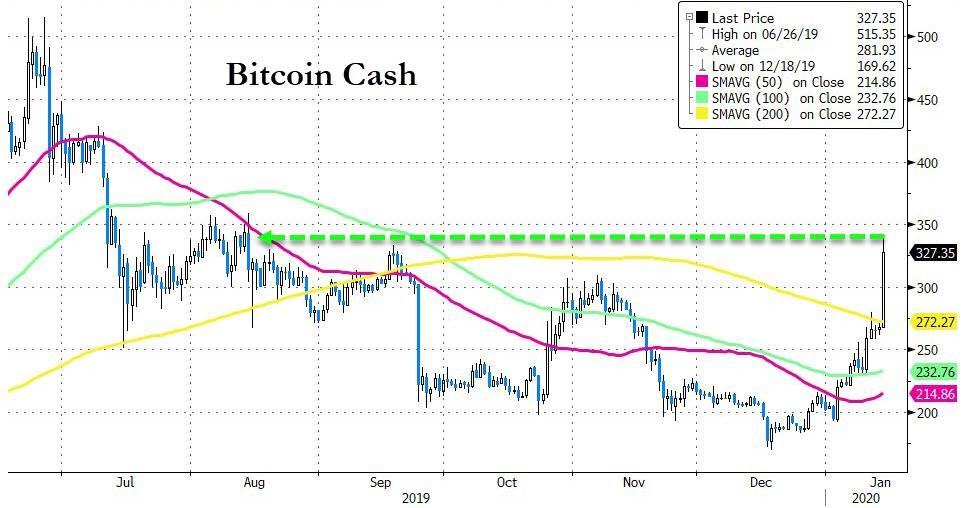

Bitcoin Cash has topped its 200DMA, back to its highest in 5 months…

Source: Bloomberg

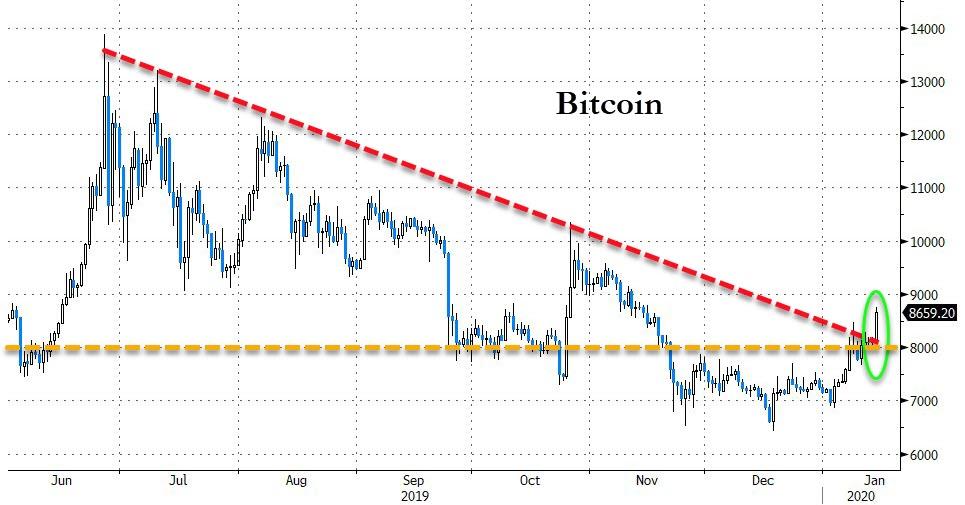

Bitcoin is at 2-month highs, pushing towarsd its 200DMA..

Source: Bloomberg

No immediate news catalyst for this morning’s surge but we note this is an extension of the post-Soleimani-killing rally.

Also, as CoinTelegraph’s William Suberg notes, Bitcoin futures options from CME Group saw volumes in excess of $2.3 million on the product’s first day of public trading, the company has confirmed.

image courtesy of CoinTelegraph

Data from CME’s official website confirmed the successful rollout on Jan. 13, which began as scheduled and ultimately saw 55 contracts change hands.

Investors lap up BTC options products

Each contract corresponds to 5 BTC, meaning that at current prices, the 55 contracts were worth $2.34 million.

Bitcoin markets rallied on release day, rising by more than 5% to hit highs of $8,550. Those levels had previously remained absent since mid-November.

As Cointelegraph reported, enthusiasm was palpable in advance of the options debut last week, with Bitcoin likewise gaining significantly in the run-up to Monday. CME, along with competitor Bakkt, reported increased interest in futures during that period.

For Monday, Bakkt’s futures delivered total volumes of 2,907 contracts worth $19.94 million, nonetheless down 10% on the previous session. At the same time, open interest was up 7% to $9.58 million.

FTX reported volumes spike

The past seven days have in fact seen two options releases, the other being from FTX, which began trading days before CME.

According to live company data, FTX saw reported volumes of 3,618 BTC ($30.8 million) for its options over the past 24 hours — conspicuously higher than others’ figures.

* * *

Finally, we note that for the second time in a week, the price rose above the oft-referenced descending channel trendline which has served as a long term resistance for the last 7 months.

Source: Bloomberg

Earlier in the day, Cointelegraph contributor filbfilb suggested that:

“Bitcoin price is currently consolidating above resistance and the most significant volume node on the visible profile visible range, or VPVR. If Bitcoin can complete bullish consolidation above $8,000, a measured move to the upside would take the price of Bitcoin to the top of the previous range at $9,500 and possibly as high as the next high volume node of $10,100.”

And as we noted previously, in their latest report, available only to clients, Fundstrat expects over 100% BTC gains with key findings uploaded to Twitter by co-founder Tom Lee on Jan 10.

“For 2020, we see several positive convergences that enhance the use case and also the economic model for crypto and Bitcoin – thus, we believe Bitcoin and crypto total return should exceed that of 2019,” an excerpt states.

Fundstrat continued:

“In other words, we see strong probability that Bitcoin gains >100% in 2020.”

The factors Lee and others identified focus on geopolitical tensions and the upcoming United States presidential elections, in addition to the halving.

Tyler Durden

Tue, 01/14/2020 – 10:06

via ZeroHedge News https://ift.tt/2FR1Pe5 Tyler Durden