Global Market Meltup Fizzles Ahead Of US-China Trade Deal

US equity futures and European bourses were struck by a rare bout of weakness on Tuesday, as traders cashed in on recent record highs and waited for the details from the long-awaited U.S.-China Phase One trade deal and the official start of Wall Street earnings season.

After hitting a new all time high on Monday in a tech-led meltup, the main US equity benchmarks traded modestly lower with the S&P hitting session lows around the time Europe opened, then fading a modest rebound.

The Stoxx Europe 600 Index also drifted lower, with losses in banks offsetting gains in retail and mining shares. Dealers struggled to put their finger on the exact cause but London, Frankfurt and Paris all took an early dip to leave the regional STOXX 600 as much as 0.5% lower and bonds and other safe-haven assets suddenly back in demand. The reversal coincided with the arrival of a Chinese delegation in Washington ahead of Wednesday’s signing of the Phase 1 trade agreement, seen as calming a dispute that has upended the world economy.

It had been smooth sailing in Asia, where stocks were slightly higher and MSCI’s world stocks index set a new record high despite trimming gains as data showed China’s trade with the U.S. slumped last year. In contrast to Europe’s swoon, Japan’s Nikkei had added 0.7% overnight to hit its highest in a month. Australian shares rose by the same margin to close at a record. Hong Kong’s Hang Seng and Shanghai blue chips also hit multi-month peaks before running out of steam.

“There have been a number of false starts,” said Vishnu Varathan, head of economics at Mizuho Bank in Singapore. “The fact that this is really coming to the moment when the rubber hits the road is the most tangible evidence of traction in starting to resolve issues, that’s what’s driving optimism.”

United States Trade Representative Robert Lighthizer told Fox Business late on Monday that the Chinese translation of the deal’s text was almost done. “We’re going to make it public on Wednesday before the signing,” he said.

“You had some good news in terms of China coming off the list of currency manipulators and so you would have expected bond prices to extend losses,” said Andy Cossor, a rates strategist at DZ Bank in Frankfurt. “So, I think it might be a case that people got ahead of themselves yesterday and are covering short positions.”

In FX, the Chinese yuan held most of its surge from Monday, when Washington lifted its designation of the country as a currency cheat. Beijing, meanwhile, had given its approval too by fixing the yuan’s official trading-band midpoint at its firmest in more than five months. China has also pledged to buy an additional almost $80 billion of U.S. manufactured goods over the next two years, plus more than $50 billion extra in energy supplies, according to a source briefed on a trade deal. In currency markets, the yen also stabilized after weakening past the 110 yen-per-dollar mark, and the Swiss franc was marginally higher against a lifeless euro.

The pound flirted with a possible sixth day of declines, which would be the longest losing streak since May. A number of heavyweight emerging market currencies were on the ropes too. The highly-sensitive South African rand hit a three-week low and Turkey’s lira took its biggest tumble since mid-December.

Treasuries nudged up, and the dollar rose versus its biggest peers. Ten-year Treasury note yields dropped a couple of ticks 1.8319% compared with the 1.85% they had been at in Asia.

Besides the trade deal, investors are also looking to U.S. inflation data due at 830am ET – with consensus expectations for it to hold steady at 0.2% in December – and the beginning of the fourth-quarter U.S. company results season. Big banks JPMorgan, Citigroup and Wells Fargo are due to report earnings before market open on Tuesday.

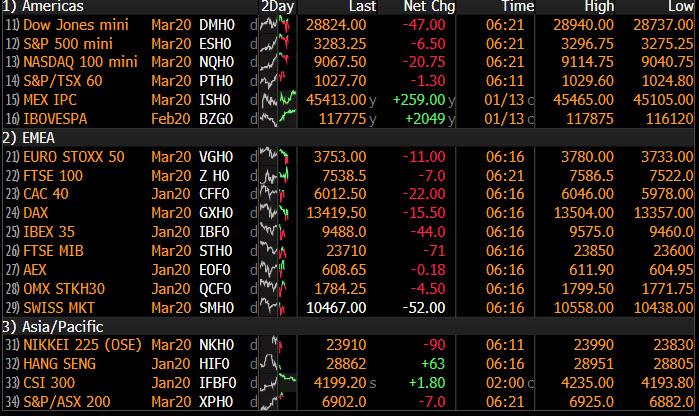

Market Snapshot

- S&P 500 futures down 0.08% to 3,287.25

- STOXX Europe 600 down 0.01% to 418.35

- MXAP up 0.3% to 174.36

- MXAPJ up 0.2% to 570.84

- Nikkei up 0.7% to 24,025.17

- Topix up 0.3% to 1,740.53

- Hang Seng Index down 0.2% to 28,885.14

- Shanghai Composite down 0.3% to 3,106.82

- Sensex up 0.3% to 41,992.00

- Australia S&P/ASX 200 up 0.9% to 6,962.20

- Kospi up 0.4% to 2,238.88

- German 10Y yield fell 1.1 bps to -0.17%

- Euro unchanged at $1.1134

- Brent Futures unchanged at $64.20/bbl

- Italian 10Y yield rose 5.5 bps to 1.206%

- Spanish 10Y yield fell 1.1 bps to 0.468%

- Gold spot down 0.3% to $1,543.80

- U.S. Dollar Index up 0.07% to 97.41

Top Overnight News

- The Trump administration on Monday lifted its designation of China as a currency cheat, saying the nation has made “enforceable commitments” not to devalue the yuan and has agreed to publish exchange-rate information. China’s 2019 exports edged up as total trade with U.S. declined

- The Swiss franc hovered near its strongest levels since 2018 as the U.S. Treasury Department added Switzerland back to its currency watch list

- British Prime Minister Boris Johnson faces his first battle of the next stage of Brexit, after the European Commission warned that a trade deal this year must include a fisheries accord. The prime minister’s office was quick to fire back Monday night, issuing a blunt statement: “We have been clear that once we leave the EU, we will be taking back control of our fishing waters.”

- With Britain on the verge of quitting the European Union, global investment banks are stepping up lobbying efforts to maintain easy access to the bloc’s lucrative market.

- Oil remained under pressure in Asian trade amid easing geopolitical tensions in the Middle East, although the continued improvement in U.S.-China trade relations offered the market some support

- Global debt will exceed $257 trillion in the first quarter of 2020, driven mainly by non-financial sector debt, due to low interest rates and loose financial conditions, according to Institute of International Finance

- Life insurers in Japan, one of the biggest investors in global bonds, sold the most foreign debt since 2015 last month as they pivoted back to domestic assets. The insurers dumped 451.1 billion yen ($4.1 billion) of sovereign and corporate bonds in December, according to data from the Ministry of Finance

- President Donald Trump’s impeachment trial is likely to get fully underway next week. Senator John Cornyn of Texas said he expects opening arguments on Jan. 21. “Tuesday is what it’s feeling like,” he said

- U.K. Prime Minister Boris Johnson says he is “very very very confident” the U.K. will reach a “comprehensive trade deal” with the European Union by end of 2020

- German bond yields are creeping back toward positive territory for the first time in eight months, a sign that investors are growing more buoyant about the state of Europe’s economy. A deluge of supply from European governments so far this year is also damping the allure of the region’s safest bonds

- The seventh Democratic presidential debate will take place in Des Moines on Tuesday — the last such forum before the Iowa caucuses next month. A winnowed slate of six candidates — Joe Biden, Elizabeth Warren, Bernie Sanders, Pete Buttigieg, Tom Steyer and Amy Klobuchar — will gather for a televised event that will likely expose the growing rifts between and within the Democratic Party’s moderate and progressive flanks

- Gold sagged again as the soon-to-be signed Sino-American trade deal, release of decent monthly economic figures from China, and steady easing of tensions in the Middle East all combined to undermine the case for havens just as U.S. equities romped to records

Asian equity markets were somewhat mixed as the region took its cue from the fresh record levels on Wall St amid the backdrop of the trade optimism heading into this week’s Phase 1 deal signing and after the US removed its designation of China as a currency manipulator. ASX 200 (+0.9%) followed suit to its US peers and posted a fresh all-time high led by tech and defensives, as well as the broad sectoral gains aside from gold miners which lagged due to losses in the precious metal, while Nikkei 225 (+0.7%) tested the 24k milestone on return from an extended weekend and with early advances spurred by a predominantly favourable currency. Hang Seng (-0.2%) and Shanghai Comp. (-0.3%) also initially benefitted from the trade developments in which the US backtracked just 5 months after it had labelled China a currency manipulator and with the initial details of the Phase 1 deal said to confirm China’s pledge to buy USD 200bln of US goods over a 2-year period, while the latest Chinese trade data added to the encouragement as Trade Balance, Exports and Imports mostly surpassed estimates for December although Chinese markets eventually gave back their gains and the data had also showed trade with the US contracted by 10.7% Y/Y throughout 2019. Finally, 10yr JGBs were lower and slipped below the 152.00 with demand dampened by the gains across stocks and with a relatively tepid BoJ Rinban announcement for just JPY 130bln of JGBs doing little to underpin prices.

Top Asian News

- Chow Tai Fook to Shut Stores as Protests Hit Hong Kong Retailers

- How World’s Fastest-Growing Economy Plunged Into Stagflation

- Kasikornbank Says Myanmar Plan Pending Regulators’ Approval

- Thailand Expects Population Decline of 0.2% Per Year From 2028

A choppy session thus far for European equities [Euro Stoxx 50 +0.3%], in what started off on more of a downbeat note for the region, following on from a mixed APAC trade. Equity markets remain on standby ahead of US earnings season, which is set to kick off today, and with traders also eyeing tomorrow’s US-China Phase One deal signing. Sectors are largely in the green with no clear reflection of the overall risk sentiment. Individual movers have garnered more attention – with reports of credit card gambling to be banned in April this year weighing down on the likes of William Hill (-1.2%) and GVC (-0.8%), albeit the shares are off lows seen at the open. Meanwhile, Dialog Semiconductor (-1.4%) fell post-earnings after reporting a deterioration in EPS. Renault (-0.2%) failed to gain much traction after yesterday’s reports of a supposed end to the Nissan-Renault alliance were dismissed. Evonik (-4.2%) fell and remains at the foot of the Stoxx 600 after noting that revenue will be slightly below the prior YY and after RAG-Stiftung proposed the sale of around 24mln shares in the Co. On the flip side, miners are benefitting from yesterday’s surge in copper prices with Antofagasta (+1.7%), Glencore (+0.6%) also experiencing tailwinds from broker upgrades. Head-up, US earnings season will unofficially commence with earnings from JP Morgan, who accounts for around 3.2% of the DJIA, Wells Fargo and Citi.

Top European News

- U.S., EU Square Up for Trade Brawl After Trump’s China Deal

- Heathrow Airport Gets Thales Anti-Drone System to Detect Threats

- Total Moves London Cash-Management Team to Paris on Brexit

In FX, the Dollar is holding a modestly firm line, with the DXY just shy of the 97.500 level ahead of US inflation data that is forecast to accelerate in headline terms and remain steady at the core. However, the Greenback’s stability between 97.455-339 owes much to weakness elsewhere as only the Swiss Franc is stronger amongst major currency peers, with Usd/Chf back below 0.9700 and Eur/Chf sub-1.0800.

- GBP/CAD/AUD/NZD/JPY/EUR – The Pound is still succumbing to downside pressure on downbeat UK data and dovish BoE policy implications, as Cable extends declines through 1.3000 to circa 1.2955 and Eur/Gbp breaches December peaks before running into resistance ahead of 0.8600 and highs from November just pips above the round number. Elsewhere, the Loonie has lost mild traction gleaned from Monday’s relatively encouraging Q4 BoC business survey findings, with Usd/Cad back above 1.3050, while the Aussie and Kiwi have also handed back some gains made on the back of strong Chinese trade data overnight and confirmation that China has made enough FX pledges within the Phase 1 trade accord for the US to retract it from the currency manipulation list. Aud/Usd is under 0.6900 again, but may derive underlying support given hefty option expiry interest at 0.6900-05 (1.3 bn) and Nzd/Usd is losing altitude between 0.6634-17 parameters ahead of December’s NZ food price index. Conversely, the Yen is trying to pare losses within a 109.90-110.20 range amidst a degree of consolidation in broad risk sentiment, and the Euro is firm on the 1.1100 handle, albeit failing to sustain gains beyond 1.1145 after eclipsing the 200 DMA and flanked by more big expiries (2.2 bn between 1.1160-70 and 2.5 bn at the 1.1100 strike).

- SCANDI – The Crowns are narrowly mixed with Eur/Sek elevated in a circa 10.5590-10.5285 band vs Eur/Nok straddling 9.9000 after weaker than forecast Swedish household consumption metrics and with the latter keeping tabs with oil prices.

- EM – A decent pick-up in Turkish IP has not really helped the Lira to escape more geopolitical jitters as efforts to broker peace in Libya have been scuppered by the Hafta group leaving talks in Russia without signing on the dotted line. Usd/Try is hovering just below 5.9000 and extending its rebound in contrast to Usd/Cnh that continues to probe lower after breaching 6.9000 on the aforementioned US-China trade and FX positivity. Note also, Nomura notes that CTAs have flipped positions to net Yuan long vs the Buck for the first time since the start of Q2 last year, while covering shorts in the non-US Dollar commodity bloc

In commodities, WTI and Brent front-month futures are ultimately on a firmer footing after erasing overnight losses – with the former rebounding off its 200 DMA (USD 57.74/bbl) whilst the latter found a base around the psychological USD 64/bbl mark. News flow has been light for the session thus far, although eyes remain on macro developments such as Middle Eastern tensions and US-China trade. Desks note that expectations for a well-supplied market are not currently reflected in the time spreads, with ICE Brent spreads still in deep backwardation, suggesting the physical market remains tight. On a more micro-level, traders will be looking for the EIA Short-Term Energy Outlook and API releases later today, with ING noting that participants would be eyeing the former for its forecast of US production growth; “with the falling rig count, the positive supply growth estimates for the US are increasingly coming under question”, the Dutch bank says. Wednesday will see the release of the OPEC monthly report, followed by the IEA’s report on Thursday to round up this month’s oil market releases. Elsewhere, spot gold remains tentative just below USD 1550/oz amid a lack of fresh fundamental catalysts, albeit the yellow metal printed a fresh YTD low ~USD 1536/oz overnight. Copper meanwhile holds onto a lion’s share of yesterday’s gains after prices briefly topped USD 2.85/lb – with traders citing an overall more positive macro sentiment, with the Phase One deal signing inching closer. Finally, industry sources note that Chinese demand for high-grade iron is poised to drop as steel mills attempt to cut costs and raise profit margins.

US Event Calendar

- 6am: NFIB Small Business Optimism, est. 104.6, prior 104.7

- 8:30am: US CPI MoM, est. 0.3%, prior 0.3%; CPI Ex Food and Energy MoM, est. 0.2%, prior 0.2%;

- 8:30am: US CPI YoY, est. 2.39%, prior 2.1%; CPI Ex Food and Energy YoY, est. 2.3%, prior 2.3%; 8:30am:

- 8:30am: Real Avg Weekly Earnings YoY, prior 1.1%; Real Avg Hourly Earning YoY, prior 1.1%

DB’s Jim Reid concludes the overnight wrap

Markets were in a bit of a holding pattern yesterday, with little economic data to speak of and investors awaiting the start of earnings season today. That said, sentiment was boosted by reports that the US would lift the currency manipulator label that it has placed on China. These reports were confirmed in the US Treasury Department’s semi-annual foreign-exchange report, originally due in mid-October, released overnight. The report stated that it is lifting China’s designation as a currency manipulator, placed in August last year, as the nation has made “enforceable commitments” not to devalue the yuan and has agreed to publish exchange-rate information. China’s commitments have been made part of the Phase 1 deal, according to the report. So we will have to wait till the Phase 1 deal agreement is published to know what these “enforceable commitments” actually are. Nonetheless, this can be seen as a positive sign ahead and beyond the signing of the Phase 1 deal tomorrow which Bloomberg reported that will take place in the East Room of the White House at 11:30 am.

Sticking with the foreign-exchange report, the document refrained from naming any major US trading partner as a currency manipulator among the 20 economies it monitors for potential manipulation. Switzerland was the new country added to the monitoring list, while China, Japan, South Korea, Germany, Italy, Ireland, Singapore, Malaysia, Vietnam remained. On the addition of Switzerland, the report highlighted that its foreign-exchange purchases have “increased markedly,” and encouraged Swiss officials to publish intervention data more frequently. Meanwhile, the report added that Thailand and Taiwan are not officially on the monitoring list but are close to breaching key thresholds.

Ahead of tomorrow’s signing, Politico reported overnight that of the Chinese pledges to buy $200bn of US goods over a two-year period, the target for manufactured goods purchases will be the largest at c.$75 bn. China will also promise to buy $50 bn worth of energy, $40 bn in agriculture and $35 to $40 bn in services. Continuing with trade, the EU’s new trade chief Phil Hogan will be in Washington to meet US Trade Representative Robert Lighthizer and other American officials as part of a three day visit beginning today (Jan 14-16) .

Overnight, Asian markets are trading mixed with the Nikkei (+0.68%) leading advances as it re-opened post a holiday while the Kospi is also up (+0.48%) but with the Hang Seng (-0.06%) and Shanghai Comp (-0.08%) seeing modest loses. As for Fx, the onshore Chinese yuan is up a further +0.266% today to 6.8753 while, the Japanese yen is down -0.11%. Elsewhere, futures on the S&P 500 are trading flat. As for overnight data releases, China December trade balance came in at $46.79bn (vs. $45.70bn expected) with exports growing by +7.6% yoy (vs. +2.9% yoy expected) and imports coming in at +16.3% yoy (vs. +9.6% yoy expected).

Back to yesterday and the risk-on mood supported both the S&P 500 (+0.70%) and the NASDAQ (+1.04%) up to fresh records with the semiconductor and NYSE FANG indices also gaining +1.31% and +2.27% respectively, although Europe was somewhat more subdued, with the STOXX 600 down -0.18%. Ahead of US Q4 reporting that starts in earnest today, its interesting to feel the positive momentum and sentiment we’re seeing so far this year. On this, our US asset allocation team have put out a report suggesting that positioning in US equities is now in the 96th percentile. This covers systematic (near maximum allocation) and discretionary investors (highest since October 2018 and quite near the top of the historic range). In terms of market pricing they believe the market is already well ahead of the fundamentals. So a word of caution from a team that been extraordinarily bullish on US equities over the last decade. See their report here for more. This does feel a little like January 2018 when the “melt-up” was savagely ended in February by the higher US average earnings print and the subsequent collapse in the inverse volatility ETFs.

For now it’s risk-on and consistent with that there was a broad-based sell-off in fixed income yesterday, with 10yr Treasuries up around 2bps to 1.842%, supported in part by Bostic’s comments about there being a “high bar” to make policy more contractionary, and the 2s10s curve steepening just over 1bp. In fact, over in Germany, ten-year bund yields climbed 4.1bps to -0.162%, their highest level since May. One notable point from yesterday is that the rise in bund yields meant that the spread of 10yr Treasuries over bunds fell to 200bps, the first time the spread has been that tight since February 2018.

Over in commodity markets, with Brent Crude down another -1.20% yesterday to its lowest level in a month, it felt as though the geopolitical tensions that started the month were but a distant memory, while gold, which had risen to a 6-year high at the height of the tensions, fell back by another -0.93%. Meanwhile palladium continued to climb, up for an 8th consecutive session to another record high.

In other news, here in the UK, investors ratcheted up their chances of a rate cut from the Bank of England later this month, meaning that sterling was the worst-performing G10 currency, falling below $1.30 yesterday. The first catalyst behind the move was the FT interview with MPC member Gertjan Vlieghe over the weekend that we highlighted yesterday. He said that he’d need to see an improvement in the data if he was not to vote for an interest rate cut. The second was a poor set of UK data out yesterday, with the monthly GDP reading for November seeing a -0.3% contraction (vs. unchanged reading expected). Notably, the year-on-year change fell to just +0.6%, which was the worst monthly year-on-year performance for the UK economy since June 2012, so in line with some of the other deteriorating data we’ve seen lately. The effects could also be seen in gilts, with 10-year yields down -2.0bps yesterday, in stark contrast to all the other major European countries yesterday, which saw a rise in yields.

To the day ahead, and earnings season kicks off in earnest, with reports from JPMorgan Chase, Wells Fargo and Citigroup. In terms of data, the highlight will be December’s CPI release from the US this afternoon, while we’ll also get the December NFIB small business optimism index a bit earlier. From central banks, we’ll hear from the ECB’s Mersch, Villeroy de Galhau, and Hernandez de Cos, along with the Fed’s Williams and George. Finally, this evening sees the latest Democratic primary debate taking place in the US.

Tyler Durden

Tue, 01/14/2020 – 06:55

via ZeroHedge News https://ift.tt/386nOd8 Tyler Durden