Musk Nears Massive Payday – Shorts Torched As Fed’s ‘Not QE’ Sparks Dash-For-Trash

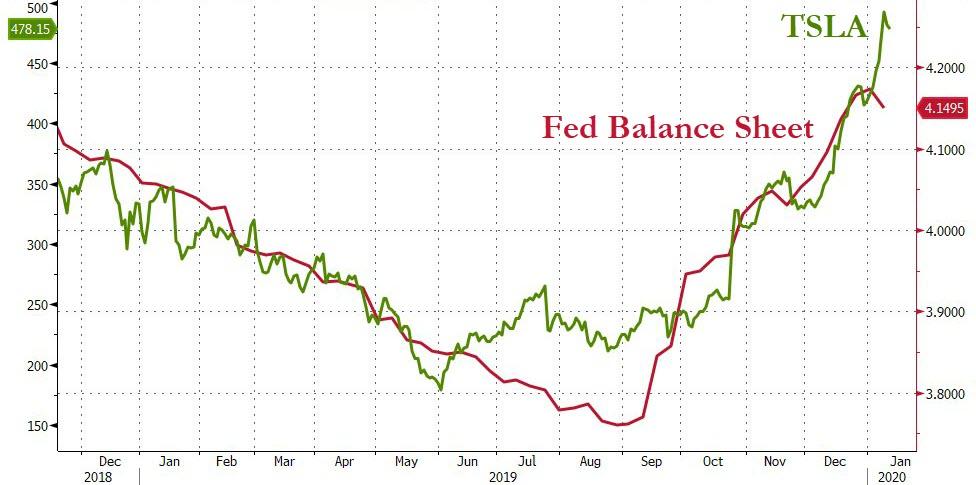

Tesla shares on Tuesday morning were trading around $542 – or about +150% from the levels when the Federal Reserve’s ‘Not QE’ started the dash-for-trash and provided liquidity to hedge funds to bid up stocks.

Tesla has been a significant beneficiary of the Fed’s money-printing as it resulted in a monstrous squeeze that allowed Elon Musk to wage nuclear war on short sellers.

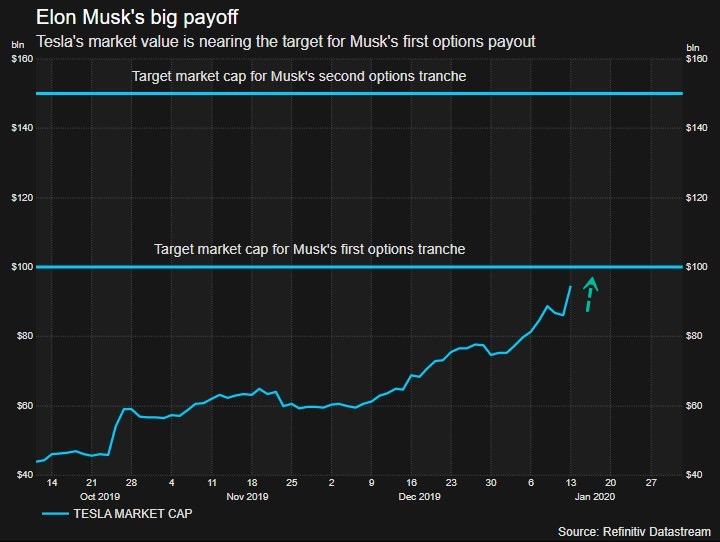

At the same time, Musk has come close to a whopping $346 million payday, in the form of equity options, if Tesla shares sustain a $100 billion valuation, or $554.80 per share, for a one-month and six-month average, according to Reuters.

Musk is nearing his first big payday:

We noted in early 2018 that Musk agreed to remain at the helm of Tesla for at least another 10 years. And in exchange for this commitment, the company’s board granted him 12 tranches of options to buy Tesla stock.

Musk currently owns 34 million Tesla shares, or about 19% of the company. His compensation package would allow him to purchase another 20.3 million shares if all options were vested.

When Tesla first unveiled Musk’s package in early 2018, it said Musk could make at least $56 billion if all milestones were reached.

The combination of Fed’s liquidity and a massive short squeeze has propelled Tesla’s stock to achieve a valuation higher than Ford and General Motors combined and could eclipse VW’s market cap (as the largest global automaker) if higher highs are seen.

In recent weeks, Tesla has had some good news of expansion in China. Still, in a period when the Fed and other major central banks are printing trillions of dollars and cutting rates at the fastest speed since the last recession, valuations and fundamentals don’t matter – it’s all about central bank liquidity.

And it could get a lot worse for the shorts before it’s over. Volkswagen’s massive and infamous short squeeze in 2008 was due to short interest rising above the total outstanding float.

The squeeze sent the stock up 500% in a few short weeks to become the world’s most valuable company briefly.

Tyler Durden

Tue, 01/14/2020 – 13:55

via ZeroHedge News https://ift.tt/2QQBX8r Tyler Durden