Reality Versus The Repo Lightening

Authored by Sven Henrich via NorthmanTrader.com,

We’re still only a few days into 2020 but a very reliable trend has already emerged and bears watching. The trend: No matter what happens anywhere in the world or even if markets flush a quick 50 handles in overnight (i.e. on the recent Iran mini crisis) by morning all is well. Why? Because the Fed’s daily liquidity injections are filtering into market behavior every single day and you can see it in the chart action.

Every trading day this year the Fed has unleashed repo operations of varying size in premarket. These are the daily liquidity injections the New York Fed provides in overnight repo markets to keep overnight rates artificially suppressed and to meet rising demand of banks for liquidity. The temporary liquidity crisis has apparently become permanent.

What do you call all this? Some call it a subsidy:

The New York Fed is basically giving big banks a subsidy with its ongoing repo operations because its rate is below the market’s rate: @irajersey of Bloomberg Intelligence on @BloombergRadio

— Lisa Abramowicz (@lisaabramowicz1) January 14, 2020

I call it a perversion of financial markets. Why? Because it has now become permanent and it distorts everything.

See here’s the thing: Every day is the same. Whether markets open down (up mostly) the ample liquidity appears to make it immediately into markets.

The New York Fed publishes its running repo operations and sizes for each day on their website. You can see the daily operations there every day.

All these operations occur prior to US market open, and then lightning strikes. Spot the trend:

Each market open gets vertically jammed higher. The only obvious exception was the first trading day of the year, also the smallest repo operation of the year. Initial selling came in, but not to fear, the lightning effect took hold after all with a vertical ramp into close.

Correlation does not necessarily equate causation, but we can observe regular, get me in at all cost, vertical jams in prices with little to no price discovery in between except the now also regular tight intra day ranges.

How to test the theory? Simple. Try not doing repo for a few days and watch what happens. Just try it. But of course they won’t. Too scary.

This has been going on for a while, since September and in full force with $60B per month in treasury bill buying on top of that.

Why are markets not going down? Perhaps because they can’t. Fed liquidity is too overwhelming and the Fed, all too eager to toss cash around like a drug dealer coke packets at a frat party, does not appear to want to stop.

The Fed once was an insurance vehicle for the economy. No longer:

I’m so old I remember when the Fed was to be a lender of last resort. An emergency backstop.

Now they’re just reckless liquidity hacks.— Sven Henrich (@NorthmanTrader) January 14, 2020

And don’t think they are content to stop here. Now that they see themselves as the permanent intervener in everything one can never be sure of what they’ll come with next.

Since the Fed has so much cash to throw around to lend to banks worth hundreds of billions of dollars how how about some cash for the most needy in society?

Fear not, the Fed has apparently already identified the needy, the most obvious next choice: Hedge funds.

Federal Reserve officials are considering lending cash directly to hedge funds through clearinghouses to ease stress in the repo market. But that could be a tough sell for policy makers. https://t.co/CUlI4o943Q

— WSJ Markets (@WSJmarkets) January 14, 2020

Good, because I was really worried about needy hedge funds:

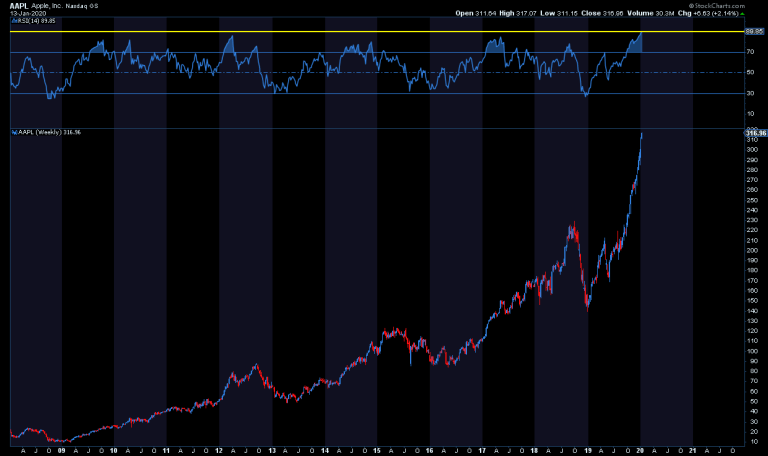

The Fed has appointed itself to be the fighter of danger everywhere in the world not realizing itself has become the danger. The danger that fuels asset bubbles in markets and in stocks.

What? You think this one way asset price inflation nonsense they have unleashed is normal, safe or sound?

$AAPL:

$TSLA:

Yea I too remember two way price discovery. Repo striking like lightning before market open has killed it. For now.

At the heart of it the Fed is trying to keep the ball in the air and has done so for years and you all know it:

Market.

Fed.pic.twitter.com/6Jr9wgX8GR— Sven Henrich (@NorthmanTrader) January 13, 2020

In process they’ve now created a massive asset bubble. When and how will it pop? We can only know after the fact, but if it does you know who to blame:

If this market ever crashes you can blame the Fed who was too scared to endure a larger correction when trying to normalize and instead proceeded to blow an even bigger asset bubble with even more liquidity injections.

— Sven Henrich (@NorthmanTrader) January 13, 2020

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Tue, 01/14/2020 – 17:05

via ZeroHedge News https://ift.tt/36UDujh Tyler Durden