“This Is Nuts!”, Part Deux

Authored by Lance Roberts via RealInvestmentAdvice.com,

In this past weekend’s newsletter, we discussed the exceedingly deviated price, and overbought conditions, not to mention valuations, as key reasons why we slightly reduced risk in our portfolios.

“On Friday, we began the orderly process of reducing exposure in our portfolios to take in profits, reduce portfolio risk, and raise cash levels.

In the Equity Portfolios, we reduced our weightings in some of our more extended holdings such as Apple (AAPL,) Microsoft (MSFT), United Healthcare (UNH), Johnson & Johnson (JNJ), and Micron (MU.)

In the ETF Sector Rotation Portfolio, we reduced our overweight positions in Technology (XLK), Healthcare (XLV), Mortgage Real Estate (REM), Communications (XLC), Discretionary (XLY) back to portfolio weightings for now.”

Not surprisingly, I received more than a few emails chastising me for “bailing on the bull market, which is clearly going higher.”

Such is hardly the case. We simply reduced our weighting in some of the companies which have had substantial gains over the last year. We remain primarily long-biased in our portfolios, but given the extreme technical overbought, and deviated conditions, it was prudent to raise some cash and protect our gains.

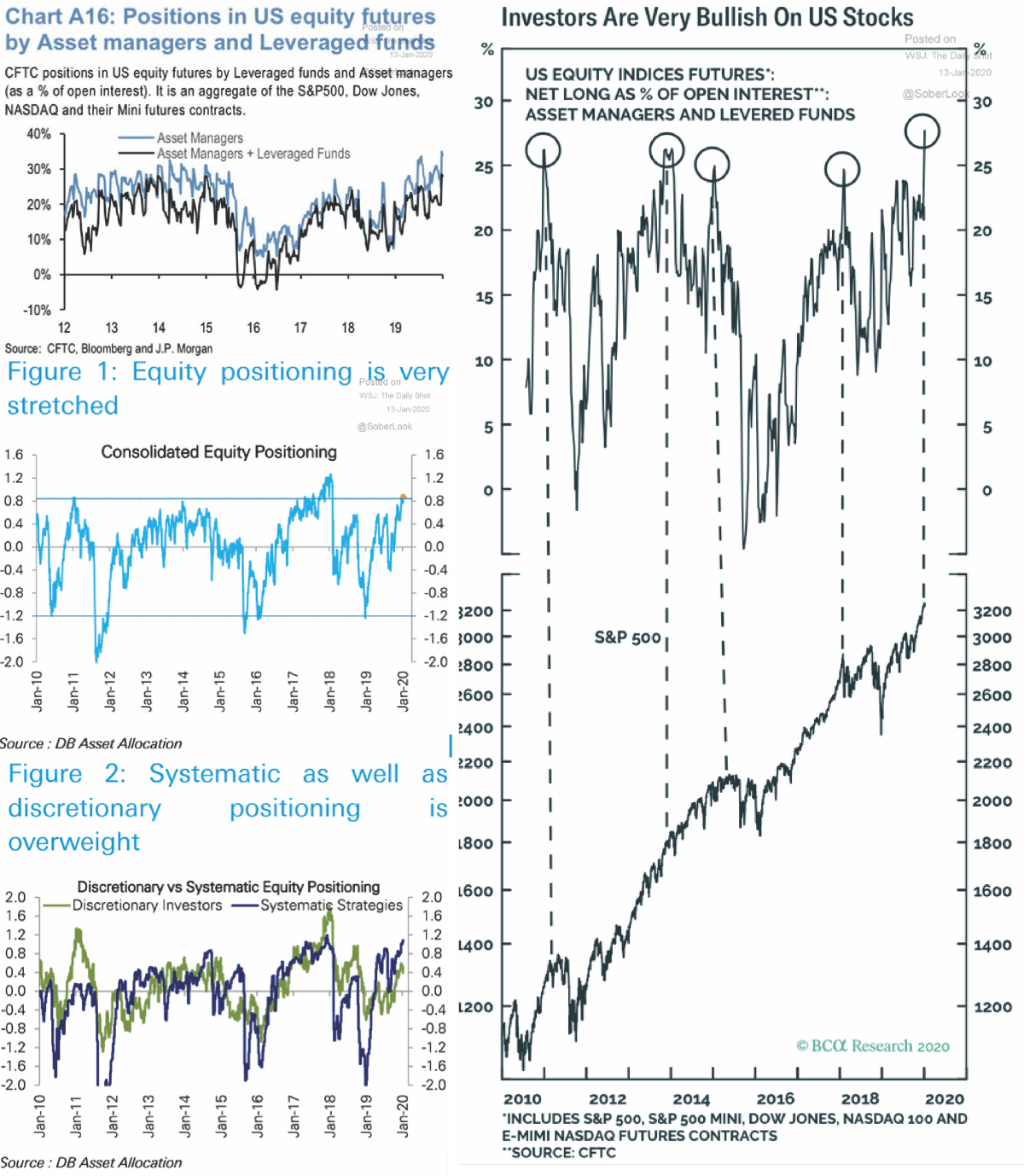

However, it wasn’t just the conditions we discussed which have us concerned about the markets in the short term. Investor positioning has also reached rather extreme levels. As Bob Farrell once wrote:

“When all experts agree, something else is bound to happen.”

Currently, with investors all extremely long equity exposure, the risk of a correction has become elevated.

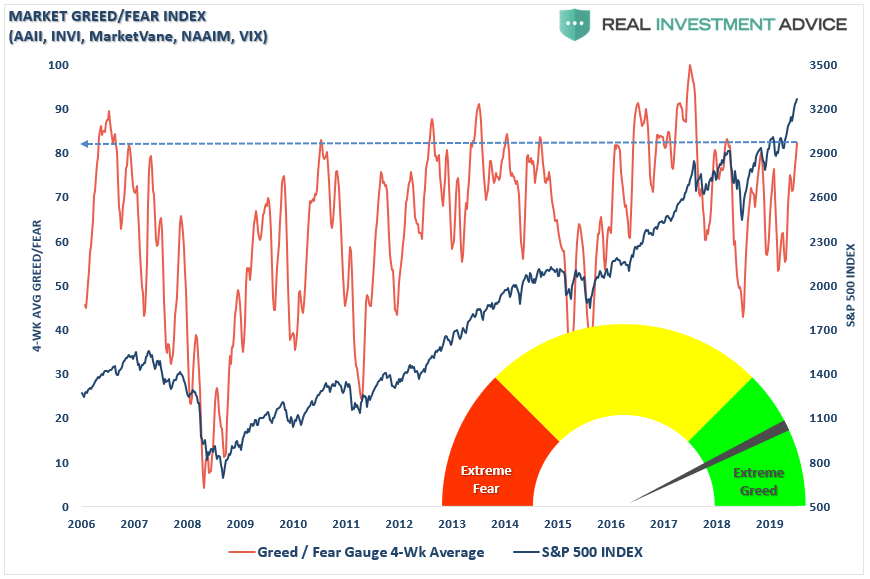

Our composite “fear/greed” indicator, which is comprised of investor positioning, shows much the same as “bullish sentiment” has become rather extreme.

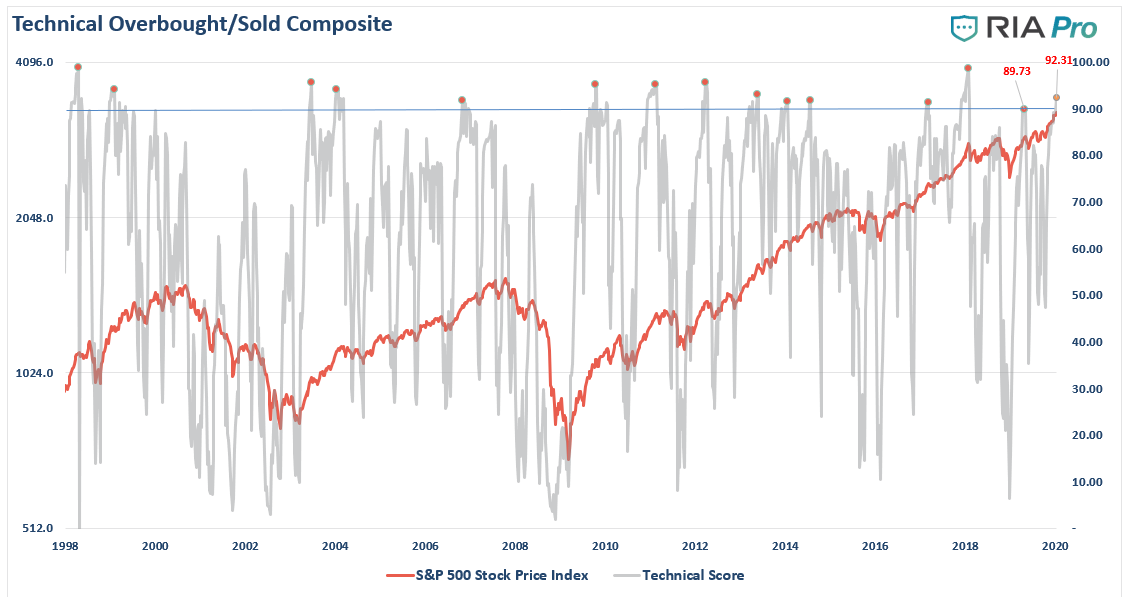

Every week, we provide RIAPRO subscribers (Try Free for 30-Days) with the latest updated technical composite score as well. This composite gauge combines extension, deviation, and momentum into a single weekly measure. Readings above 90 (Currently 92.31) are always associated with corrective actions in the market.

With all of these conditions aligned, the “probability” of a short-term correction has increased. Given that risk outweighs reward in the short-term, we decided it was prudent to reduce the numerator of that equation.

Why We Reduced Risk

It may seem irrational that we would reduce our risk exposure as the market continue to rise. Less exposure to equities, means less upside performance of the portfolio, or rather, “opportunity cost.” As I noted:

“While the markets could certainly see a push higher in the short-term from the Fed’s ongoing liquidity injections, the gains for 2020 could very well be front-loaded for investors. Taking profits and reducing risks now may lead to a short-term underperformance in portfolios, but you will likely appreciate the reduced volatility if, and when, the current optimism fades.”

However, the problem for the majority of investors is the inability to predict whether the next correction will be just a “correction” within an ongoing bull market advance or something materially worse. Unfortunately, by the time most investors figure it out – it is generally far too late to do anything meaningful about it.

By reducing risk now it provides us three benefits for the future.

-

Less equity risk, and higher cash levels, lowers the volatility of the portfolio which will allow us to navigate a correction process, and protect our investment capital.

-

It gives us capital to reinvest back into positions we currently own at better prices; or,

-

Buy new positions which have corrected in price.

While it is entirely true that “you can not time the market,” you can do some analysis and make deliberate changes to avoid problems.

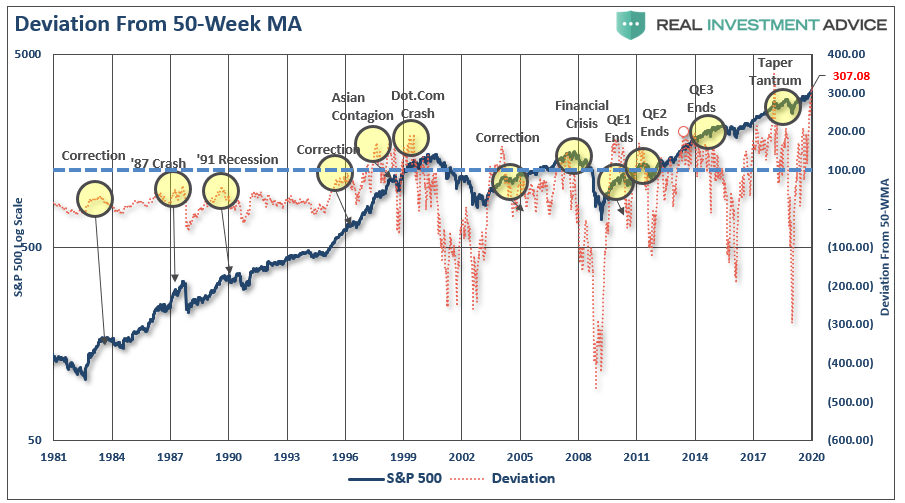

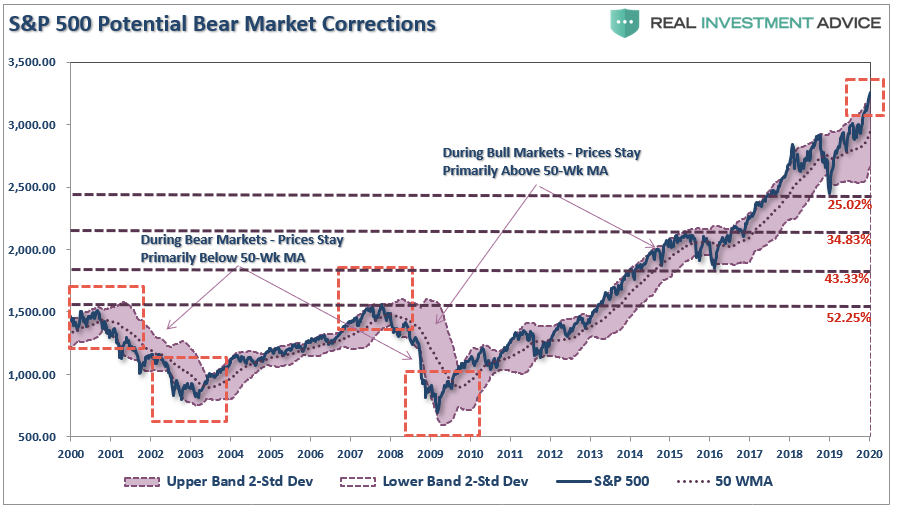

As shown below, price deviations from the 50-week moving average have been important markers for the sustainability of an advance historically. Prices can only deviate so far from their underlying moving average before a reversion eventually occurs. (You can’t have an “average” unless price trades above and below the average during a given time frame.)

Notice that price deviations became much more augmented heading into 2000 as electronic trading came online, and Wall Street turned the markets into a “casino” for Main Street.

At each major deviation of price from the 50-week moving average, there has either been a significant correction or something materially worse. Currently, the deviation from the 50-week moving average is the second-highest level in history, next to the 1999 “dot.com” mania.

How bad could it be?

Measuring The Mean Reversion

Given the current momentum of the market, combined with the Fed’s ongoing liquidity interventions, we only expect a correction of 5-10% to reset the overbought, optimistic, and deviated markets. Such a correction can be used to increase equity exposure and bring equity holdings back to target weights.

However, there is a risk of a larger mean reverting event, yet this is a possibility completely dismissed by the mainstream media under the guise of “this time is different.”

With the market trading more than 3-standard deviations above the 50-week moving average, historical reversions have tended to be more brutal. I have laid out support levels below.

At this juncture, a correction back to the 2018 lows would entail a 25% decline. However, if a “bear market” growls, the 2015-16 highs become the target which is 34% lower. The lows of 2016 would require a 43% draft, with the 2008 highs posting a 52% “crash.”

That can’t happen you say?

We had two 50% declines since the turn of the decade, and the next major market decline will be fueled by the massive levels of corporate debt, underfunded pensions, and evaporation of “stock buybacks,” which have accounted for almost 100% of net purchases since 2018.

Then there is also the other possibility as noted by technical analyst J. Brett Freeze, CFA:

“The Wave Principle suggests that the S&P 500 Index is completing a 60-year, five-wave motive structure. If this analysis is correct, it also suggests that a multi-year, three-wave corrective structure is immediately ahead. We do not make explicit price forecasts, but the Wave Principle proposes to us that, at a minimum, the lows of 2009 will be surpassed as the corrective structure completes.”

Anything is possible, and if he is right, such a decline will eclipse the 85% decline of the Dow following the 1929 peak when stocks last reached what seemed to be a “permanently high plateau.”

We Play The Probabities

The probability is that we will see the 5-10% correction which will be used to increase our exposure.

Just don’t dismiss the possibilities.

“You play the probabilities; but prepare for the possibilities.”

No one knows with certainty what the future holds which is why we must manage portfolio risk accordingly and be prepared to react when conditions change.

While I am often tagged as “bearish” due to my analysis of economic and fundamental data for “what it is” rather than “what I hope it to be,” I am actually neither bullish or bearish. I follow a very simple set of rules which are the core of my portfolio management philosophy which focus on capital preservation and long-term “risk-adjusted” returns.

As such, let me remind you of the 15-Risk Management Rules I have learned over the last 30-years:

-

Cut losers short and let winner’s run. (Be a scale-up buyer into strength.)

-

Set goals and be actionable. (Without specific goals, trades become arbitrary and increase overall portfolio risk.)

-

Emotionally driven decisions void the investment process. (Buy high/sell low)

-

Follow the trend. (80% of portfolio performance is determined by the long-term, monthly, trend. While a “rising tide lifts all boats,” the opposite is also true.)

-

Never let a “trading opportunity” turn into a long-term investment. (Refer to rule #1. All initial purchases are “trades,” until your investment thesis is proved correct.)

-

An investment discipline does not work if it is not followed.

-

“Losing money” is part of the investment process. (If you are not prepared to take losses when they occur, you should not be investing.)

-

The odds of success improve greatly when the fundamental analysis is confirmed by the technical price action. (This applies to both bull and bear markets)

-

Never, under any circumstances, add to a losing position. (As Paul Tudor Jones once quipped: “Only losers add to losers.”)

-

Market are either “bullish” or “bearish.” During a “bull market” be only long or neutral. During a “bear market”be only neutral or short. (Bull and Bear markets are determined by their long-term trend as shown in the chart below.)

-

When markets are trading at, or near, extremes do the opposite of the “herd.”

-

Do more of what works and less of what doesn’t. (Traditional rebalancing takes money from winners and adds it to losers. Rebalance by reducing losers and adding to winners.)

-

“Buy” and “Sell” signals are only useful if they are implemented. (Managing a portfolio without a “buy/sell” discipline is designed to fail.)

-

Strive to be a .700 “at bat” player. (No strategy works 100% of the time. However, being consistent, controlling errors, and capitalizing on opportunity is what wins games.)

-

Manage risk and volatility. (Controlling the variables that lead to investment mistakes is what generates returns as a byproduct.)

The current market advance both looks, and feels, like the last leg of a market “melt up” as we previously witnessed at the end of 1999. How long it can last is anyone’s guess. However, importantly, it should be remembered that all good things do come to an end. Sometimes, those endings can be very disastrous to long-term investing objectives.

This is why focusing on “risk controls” in the short-term, and avoiding subsequent major draw-downs, the long-term returns tend to take care of themselves.

Everyone approaches money management differently. This is just the way we do it.

Tyler Durden

Tue, 01/14/2020 – 08:05

via ZeroHedge News https://ift.tt/2u1GI5S Tyler Durden