US Consumer Prices Accelerate At Fastest Since Oct 2018

Headline consumer price inflation was expected to accelerate its recent trend higher in December, and it did, but slightly disappointing.

Headline CPI rose 2.3% YoY (below the +2.4% YoY) but above November’s +2.1% and the highest since Oct 2018. Core CPI also rose 2.3% YoY (as expected)…

Source: Bloomberg

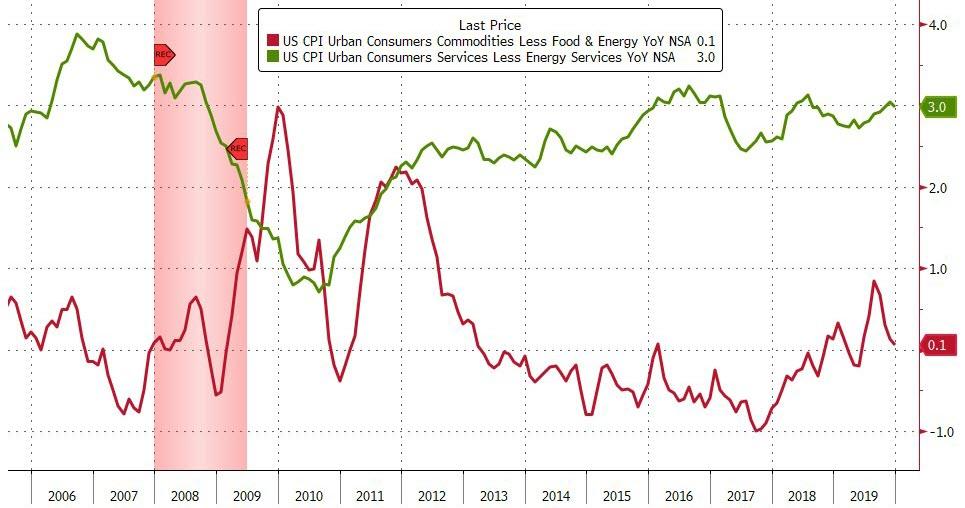

Goods prices barely managed to rise YoY in December as Services prices remained up around 3.0% YoY…

Source: Bloomberg

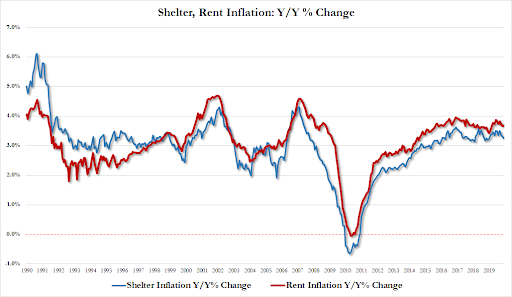

Notably, shelter costs, which make up about a third of total CPI, decelerated…

They rose 0.2% after a 0.3% gain in November, and were up 3.2% year-over-year for the smallest advance since January last year. Both owners-equivalent rent, one of the categories that tracks rental prices, and rent of primary residence climbed 0.2% from a month earlier (up 3.69% YoY – lowest since Feb 2019).

The Labor Department’s CPI tends to run higher than the Commerce Department’s personal consumption expenditures price index, which the Fed officially targets. The core PCE index that policy makers watch for a better read on underlying price trends softened in November, rising 1.6% from the same month in 2018. Core PCE has held below the 2% objective for the better part of seven years.

Having seen all that though, we suspect this push higher in inflation will be dismissed at “transitory” by The Fed as an excuse to keep the liquidity flowing as the asymmetric response function of Powell and his pundits becomes ever more obvious.

Tyler Durden

Tue, 01/14/2020 – 08:38

via ZeroHedge News https://ift.tt/2FLRe40 Tyler Durden