Wells Reports Dismal Q4 Earnings: Huge Earnings Miss, NIM Tumbles As Expenses Soar

If JPMorgan was the posted child for how one should frontrun the Fed’s QE4 (which JPMorgan triggered thanks to the repo market crisis it itself created by pulling liquidity from the market and investing it in risk assets) and report blowout Q4 earnings, Wells Fargo was the polar opposite.

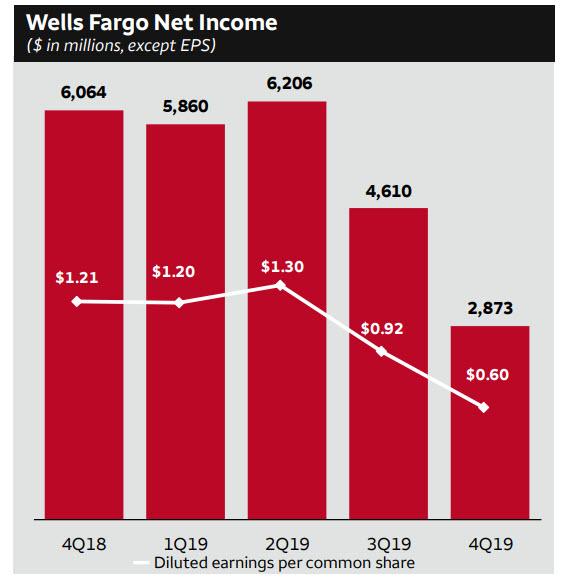

Warren Buffett’s favorite bank reported revenue and EPS which both missed estimates, with Q4 revenue sliding 5.1% to $19.9BN, below the $20.1BN estimate, while Net income of $2.9 billion and diluted EPS of $0.60 (which included the impact of $1.5 billion, or $(0.33) per share, of litigation accruals) also missed estimates of $1.10, even with the one-time adjustment. There were several other adjustments including i) $362 million gain from the sale of our Eastdil Secured (Eastdil) business; ii) $166 million of expenses related to the strategic reassessment of technology projects in Wealth and Investment Management (WIM); iii) $153 million linked quarter decrease in low-income housing tax credit (LIHTC) investment income; iv) $134 million gain on loan sales predominantly junior lien mortgage loans. All this was offset by a $125 million reserve release.

However one defines it, the Net Income trend is hardly Wells Fargo’s friend:

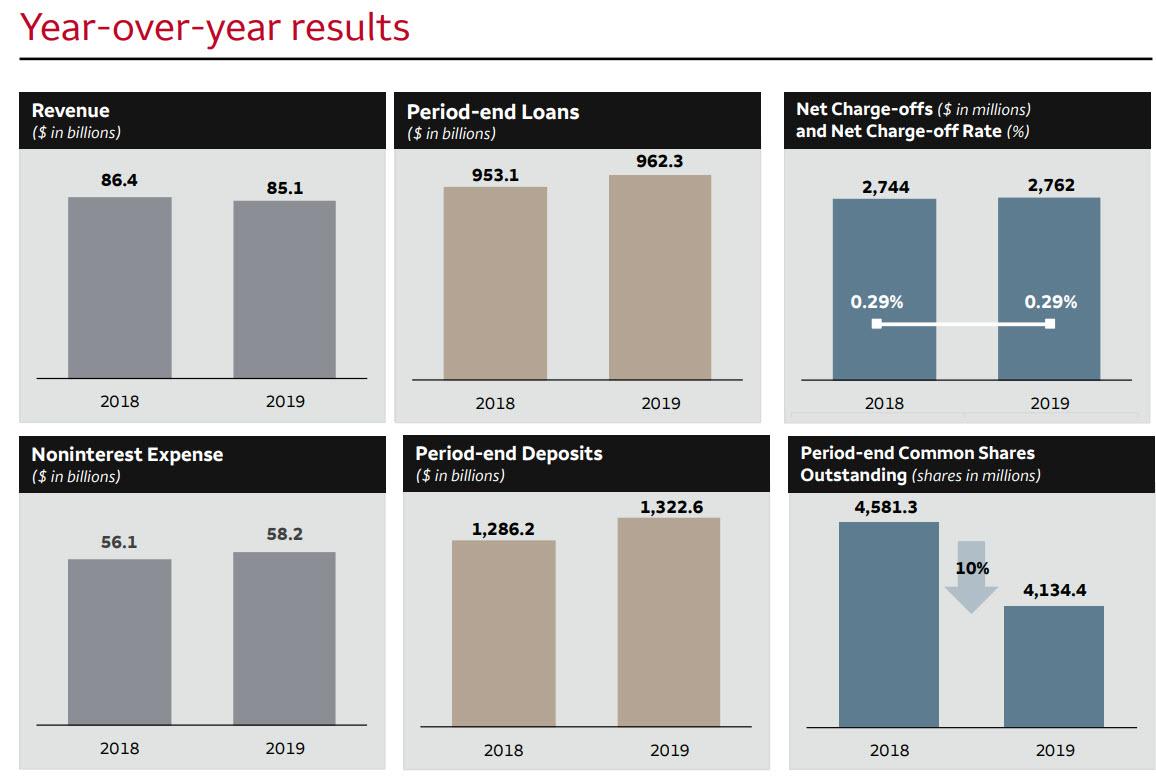

Despite the dismal Q4 results, Wells was proud to announce it returned $9.0 billion to shareholders through common stock dividends and net share repurchases, up from $8.8 billion in 4Q18. Of note, Wells common shares outstanding tumbled 10% to 446.8 million shares, as the bank continued to aggressively buyback shares.

The full year results were not much better, with total revenue shrinking by $1.3 billion to $85.1BN, despite an increase in total loans and deposits, as non-interest expense surged. Not even the 10% drop in common shares outstanding – i.e., thank you massive buybacks – could help the bank’s bottom line.

What was the main reason behind Wells’ dismal performance?

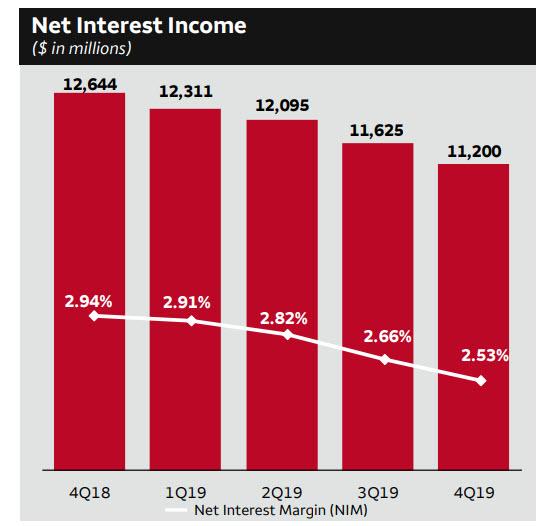

As has been the case for the past year, the company’s Net Interest Income just refuses to stop shrinking, and in Q4 it dropped to a new multi-year low of just $11.2BN, down $1.4BN or 11%, largely due to “the impact of a lower interest rate environment.” Not even the impressive increase in earning assets, which rose $18.7 billion Q/Q, could offset the drop: i) Debt securities up $13.7 billion; ii) Loans up $6.7 billion; iii) Mortgage loans held for sale up $1.3 billion; iv) Equity securities up $1.2 billion; v) Short-term investments / fed funds sold down $3.4 billion.

Instead, what was far more notable – and cringeworthy – was that Wells’ Net Interest Margin tumbled to 2.53%, sharply lower than the 2.66% reported last quarter, and missing expectations of a 2.54% print.

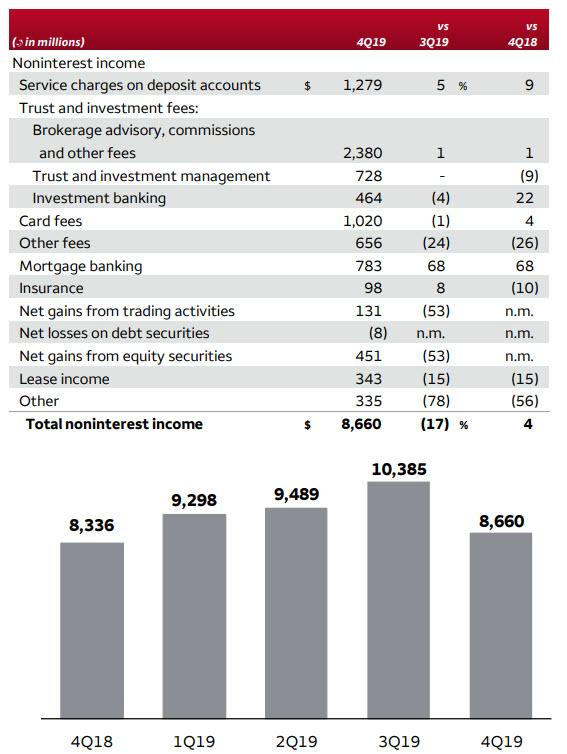

It wasn’t just Interest Income that was disappointing: the bank’s non-interest income barely changed Y/Y at $8.66BN, and down 17% from the prior quarter.

- Unlike JPM, Wells’ trading gains were down $145 million from a strong 3Q19

- Net gains from equity securities down $505 million “as lower gains from our affiliated venture capital and private equity partnerships were partially offset by $240 million higher deferred compensation gains”

Other income was down $1.2 billion on lower gains from the sale of businesses ($362 million gain from the sale of Eastdil in 4Q19 vs. $1.1 billion gain from the sale of our IRT business in 3Q19), lower gains on the sale of loans ($134 million in 4Q19 vs. $314 million in 3Q19), and $153 million lower LIHTC investment income.

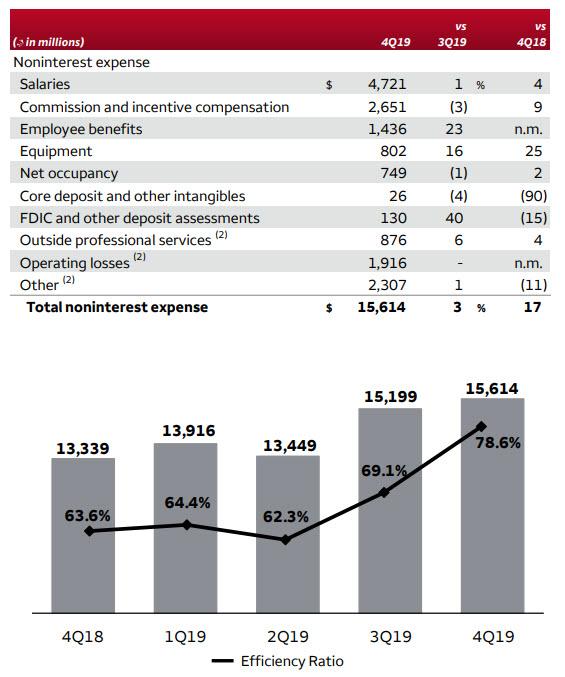

The big problem for Wells is that even as revenues continue to shrink, expenses continue to rise, and noninterest expense was up $415 million Q/Q and $2.3BN, or 17%, Y/Y due to:

- Personnel expense up $214 million

- Salaries up $26 million

- Commission and incentive compensation down $84 million and included lower revenue-related incentive compensation

- Employee benefits expense up $272 million and included $258 million higher deferred compensation expense

One reason for the surge in expenses is that this is where Wells lumped the “$1.5 billion of litigation accruals for a variety of matters, including previously disclosed retail sales practices matters, as well as higher customer remediation expense.”

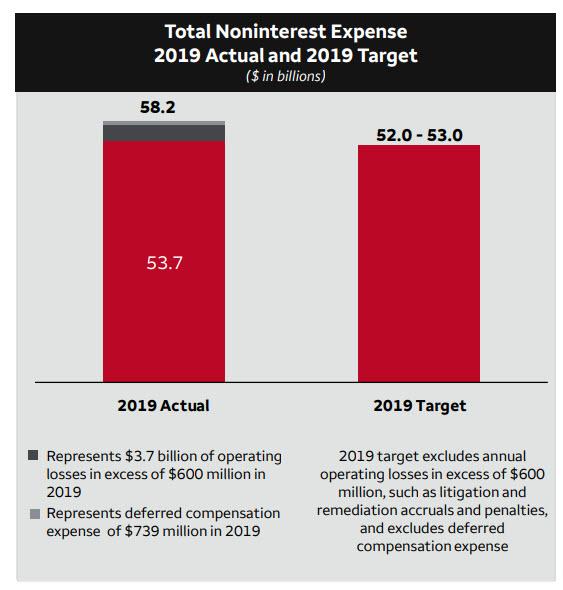

Even Wells notes that its 2019 Actual noninterest expense was $5-$6BN above the internal target, however a lot of this was due to what Wells defined as one-time expenses.

Total noninterest expense in 2019 of $58.2 billion included $4.3 billion of operating losses and $739 million of deferred compensation expense; 2019 noninterest expense excluding $3.7 billion of operating losses in excess of $600 million and excluding; $739 million of deferred compensation expense (P&L neutral) = $53.7 billion

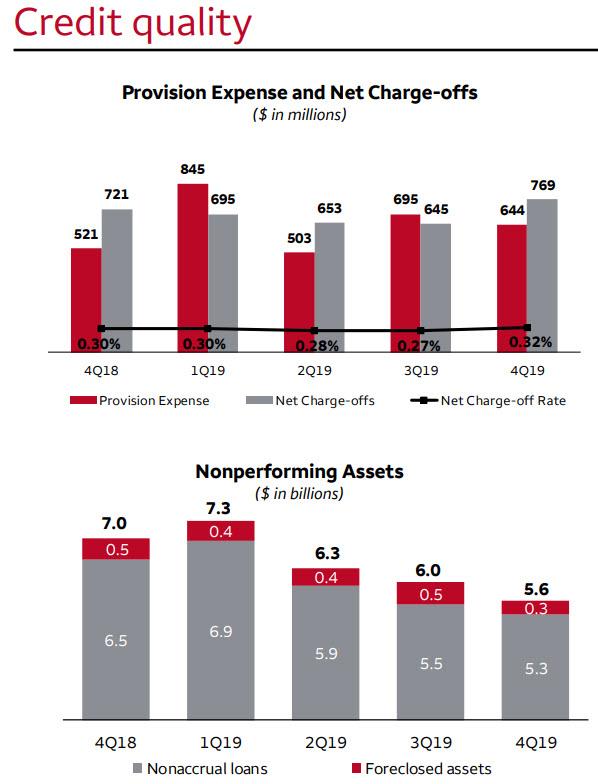

There was some good news in Wells’ credit quality report, where despite jumping 24% Y/Y, provisions for credit losses of $644MM were below the $754MM expected. At the same time, net charge-offs were $769 million, up $124 million from Q3 and the net charge-off rate was 0.32%, up 5 bps.

Also notable, non-performing assets decreased $333 million from Q3, as nonaccrual loans decreased $199 million, including a $141 million decline in consumer nonaccruals reflecting improvement in all asset classes, while foreclosed assets were down $134 million. As a result, Wells recorded a (much needed) $125 million reserve release “on improved credit performance in the consumer loan portfolio and a higher probability of slightly more favorable economic conditions.”

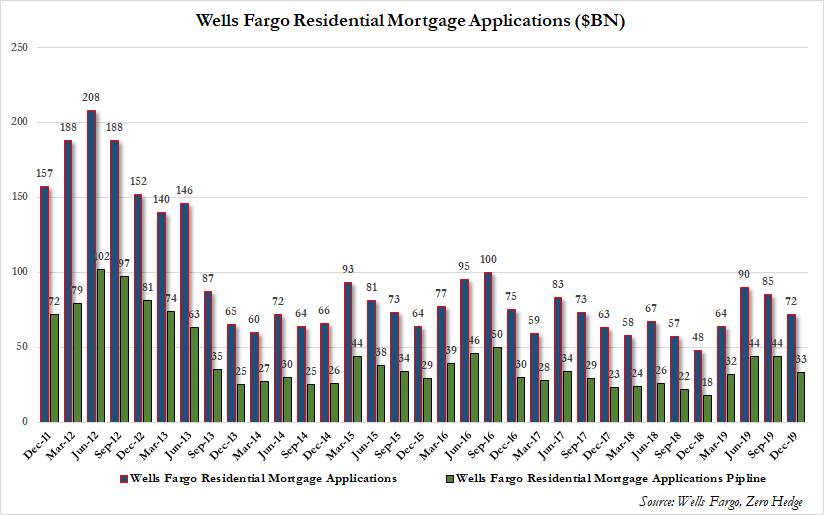

And some more bad news: after Wells Mortgage applications and applications pipeline spiked in Q2 as rates tumbled, this number has since drifted lower for 3 consecutive quarters, as Wells’ “bread and butter” mortgage pipeline appears to be getting clogged again.

Overall, Wells continues to diverge from its trading peers, and as a result of lacking a viable trading desk, Wells continues to get hammered by the ongoing collapse in Net Interest Margin which is depressing the bank’s revenues and earnings. Absent a spike in rates, Wells will likely be the first US “Deutsche Bank” once the Fed cuts rates to negative some time in early 2021. And, not surprisingly, Wells stock is reflecting just these investor concerns as it slides nearly 4% in the premarket.

Tyler Durden

Tue, 01/14/2020 – 08:34

via ZeroHedge News https://ift.tt/36Qz8Kc Tyler Durden