Beige Book Cites Even Worse Labor Shortages (But No Wage Increases), Some Tariff Costs Passed On To Consumers

Three months after the Fed “modestly” downgraded its outlook on the US economy from “modest to moderate” growth to “slight to modest pace”, and two months after Fed appeared to give its outlook a modest uptick saying that at the national level, economic activity expanded “modestly” from October through mid-November, in the just released January Beige Book, the Fed kept its economic assessment broadly unchanged, saying “economic activity generally continued to expand modestly in the final six weeks of 2019″ with the Dallas and Richmond Districts noting above-average growth, while Philadelphia, St. Louis, and Kansas City reported sub-par growth.

In welcome news for the economy, the primary driver behind US GDP, consumer spending grew at a modest to moderate pace, with a number of Districts noting some pickup from the prior reporting period. On balance, holiday sales were said to be solid – although Target may beg to differ – with several Districts noting the growing importance of online shopping.

Some more big picture details:

- Vehicle sales generally expanded moderately, though a handful of Districts reported flat sales.

- Tourism was mixed, with growth reported in the eastern seaboard Districts but activity little changed in the Midwest and West.

- Of note, manufacturing activity was essentially flat in most Districts, as in the previous report, while business in non-financial services was mixed but, on balance, growing modestly.

- Transportation activity was also mixed across Districts, with a majority reporting flat to weaker activity.

- Banks mostly characterized loan volume as steady to expanding moderately.

- Home sales trends varied widely across Districts but were flat overall, while residential rental markets strengthened.

- Some Districts pointed to low inventories as restraining home sales. New residential construction expanded modestly.

- Commercial real estate activity varied substantially across Districts. Agricultural conditions were little changed, as was activity in the energy sector.

- In many Districts, tariffs and trade uncertainty continued to weigh on some businesses.

- Expectations for the near-term outlook remained modestly favorable across the nation.

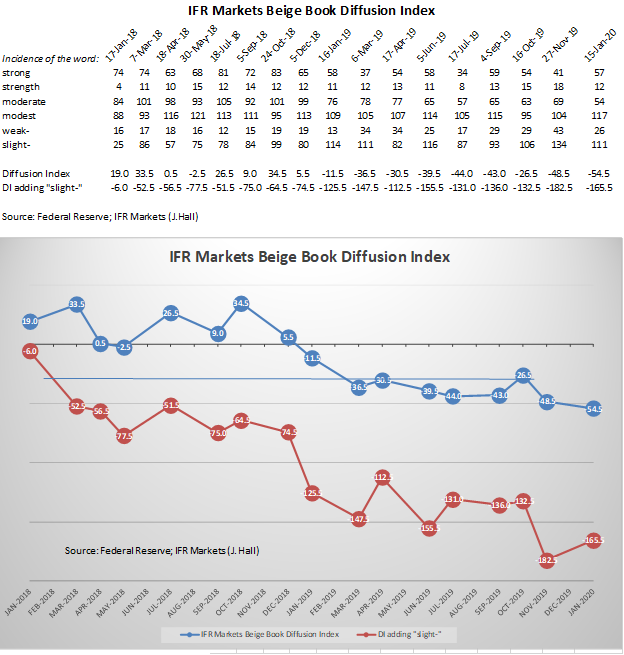

Still, even though the Fed said there was no material change from December, an analysis by IFR observed that the latest Beige Book depicted economic activity that was “more modest and less moderate” based on a word count analysis. In this way, Reuters analysts said that they viewed the latest Beige Book “as a deterioration from the last version on November 27, 2019.”

Focusing on the labor market, the Beige Book found employment “steady to rising modestly in most Districts, while labor markets remained tight throughout the nation.” More notably, “most Districts cited widespread labor shortages as a factor constraining job growth, and, in a few cases, business expansion”, yet once again few businesses were willing to boost wages to attract workers.

It’s gotten so bad that according to Kansas Fed contacts there were “shortages for hourly retail and food services positions, mechanics, truck drivers, skilled construction, software developers, pharmacists and nurse practitioners“, the Chicago Fed said that “manufacturers facing slow demand again reported cutting hours rather than laying off workers because they were worried the tight labor market would make it too difficult to hire when demand recovered” while the St. Louis Fed pointed out that “firms continue to raise benefits, lower hiring standards, automate positions, and increase existing employees’ responsibilities due to chronic worker shortages.“

And to think, all this could be avoided if they only hiked wages…

A few Districts noted brisk demand for professional, technical, and managerial workers. A number of Districts reported job cuts or reduced hiring among manufacturers, and there were scattered reports of job cuts in the transportation and energy sectors.

As usual, wage growth was characterized as modest or moderate in most Districts—similar to the prior reporting period—and there were scattered reports of wage increases from year-end hikes in minimum wages, but not too much as otherwise the Fed may be forced to hike rates and crash the market admitting that inflation is starting to emerge. A few Districts also noted the use of benefits, incentives, training programs, and automation to reduce vacancies.

And speaking of inflation, the Fed said that prices continued to rise at a modest pace during the reporting period, as did input costs. A number of Districts reported that retail selling prices rose at a slightly faster, but still subdued, pace. A few Districts indicated that some businesses were passing along tariff costs to consumers—mostly in retail but also in construction.

Furthermore, some Districts noted that restaurants were being pressured by rising food prices. which is in addition to nearly half of US restaurants feeling the heat from rising wages as we reported previously. Meanwhile, deflation was also present amid “scattered reports of declining prices in some manufacturing industries, as well as in the energy sector.” Those Districts reporting on price expectations indicated that prices were expected to continue to rise in the months ahead.

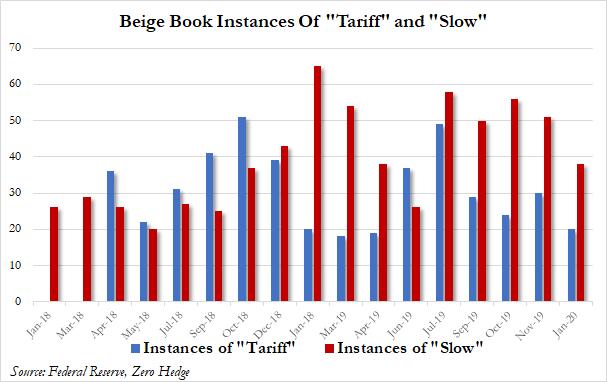

Quantifying the modest improvement in the economy, respondents’ concerns about both the trade war and the economy appeared to wane, with “Tariff” mentions dropping from 30 to just 20, the lowest since June, while mentions of “slow”-ness eased further, and dropped from 51 to 38, also the lowest since June, and generally expected in light of the modest improvement in the broader outlook.

Finally, here are some of the most notable Beige Book anecdotes from the various regional Feds, as picked by Bloomberg:

- Boston: A fish producer said that tariffs had stabilized but the resulting costs were difficult to pass on to supermarkets

- New York: Businesses in most sectors reported that wage growth has been modest and little changed, though contacts in finance reported flat wages overall

- Philadelphia: Proposed tariffs on European wine prompted an area merchant to stock up with over 35,000 cases to beat the February sanction and minimize price hikes

- Cleveland: One large department store contact said that Black Friday turnout lifted November sales to ‘abnormally strong’ levels

- Richmond: A couple of firms in D.C. noted that political uncertainties, including a potential government shutdown, hampered demand for IT consulting and teleservices

- Atlanta: Logistics firms noted substantial increases in e-commerce activity over the reporting period as compared with year-earlier levels

- Chicago: Contacts continued to report shortages of GM replacement parts following the UAW strike

- St. Louis: Firms continue to raise benefits, lower hiring standards, automate positions, and increase existing employees’ responsibilities due to chronic worker shortages

- Minneapolis: Poor snow conditions across much of Montana meant slower activity early in the ski season

- Kansas City: Contacts noted shortages for hourly retail and food services positions, mechanics, truck drivers, skilled construction, software developers, pharmacists and nurse practitioners

- Dallas: Agricultural producers expressed concern over dry conditions damping crop production next year

- San Francisco: A financier from Southern California mentioned slower demand for high-end properties, noting that their development was constrained by tighter financing options and longer processing times

The bottom line: the Beige Book was another goldilocks slamdunk, where labor shortages continue to get worse by the day yet where no employer has even considered hiking pay keeping wage growth at bay, which is sufficient to justify the Fed’s decision to stay “patient” on future interest-rate hikes (or cuts) amid a healthy, but modest economic expansion, one where the only thing that matters is the S&P500.

Tyler Durden

Wed, 01/15/2020 – 14:27

via ZeroHedge News https://ift.tt/35UM5kL Tyler Durden