“Bonds Ain’t Buying It” – Trader Warns “A Lot Can Still Go Wrong” With China

Authored by Richard Breslow via Bloomberg,

It certainly doesn’t make you a cynic to poke holes in the idea that the trade dispute between the U.S. and China is coming to an end, courtesy of the phase-one deal being signed today. There’s an awful lot of questions left unanswered and a lot that can go wrong. Just read the Chinese media and you will get the point. And we all can acknowledge that any phase-two agreement is a long way off. On the other hand, putting this very public dispute in abeyance is a lot better than nothing.

Kicking the can down the road is a time-honored tradition in politics and, in most cases, financial markets are willing to go along with the practice if it lessens headline risk and lets us get on with looking for securities to buy.

Make no mistake, however, the two countries may be doing business with each other, but it doesn’t make their rivalry and level of distrust any less real.

The deal suits the needs of the principals involved on both sides and, at the least, may be a welcome distraction from the tawdry events and sniping back and forth that will be taking place on Capitol Hill.

In any case, we’ll see how this plays out over the coming months. And need to keep in mind the relationship between the two countries remains very much a campaign issue which will likely cause periodic lurches between extolling the virtues of progress made, and to come, with maintaining a hard line. Variations on the removal of the currency manipulation designation versus maintained tariffs through the election theme.

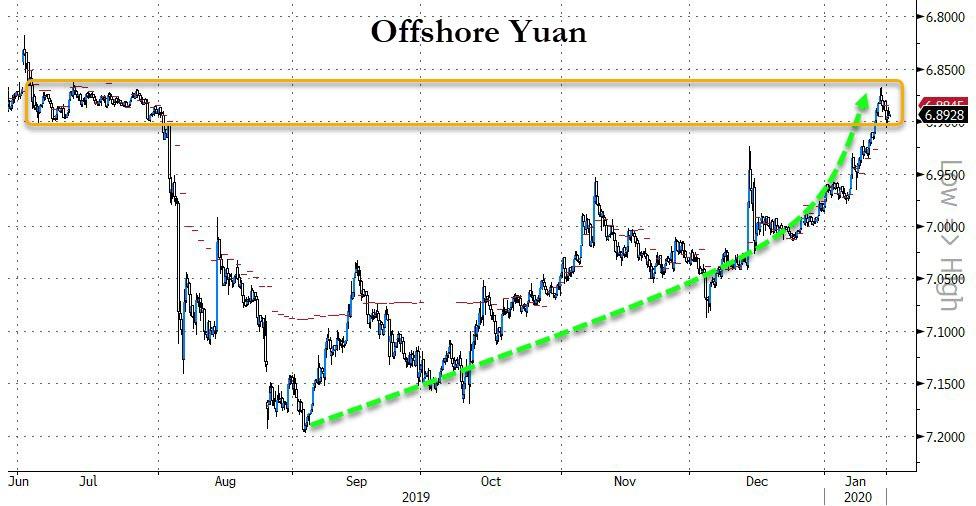

Having said that, one of the defining characteristics of markets has been the rapid appreciation of the yuan. Likely very much a part of the negotiating process. The move through 7 versus the dollar has been seen as an important signal for optimism about the global economy. Just as the reverse was true when it weakened through that level last August. It’s an understatement to say a lot of assets have moved in response. Quantitative, as well as discretionary, traders have taken notice. And as each day has passed featuring continued yuan strength, the forecasts for how far it could go have become more stretched. Why pass on a good opportunity to extrapolate?

Yesterday’s low in USD/CNY at 6.8670, however, brought the currency pair right into a potentially formidable band of support. And this needs to be watched carefully if the continuation of this move is the basis for your investing thesis. Getting through here opens up a look at 6.83, rather than simply clear sailing toward some of the more extreme predictions. The currency is most definitely in play. That doesn’t mean it will continue to be an easy one-way trade. This isn’t your typical free-floating currency and the Chinese will have a lot to say about how far it will be allowed to roam. They practice signaling on a regular basis.

Another development that definitely merits watching is the seeming failure of global bond markets to build on any momentum toward higher yields. It hasn’t been a dramatic turn around, and there are technical levels galore, but it definitely looks deflating when looking at the charts, if that was your view. Trade news is encouraging. Economic numbers less so. Treasury bears are unlikely to get much help from today’s slate of Fed speakers.

Ten-year Treasuries and bunds look like they are moving in lock-step and which direction the spread moves off of the circa 200-basis points wide level will be telling. There has been a lot of interest in trading these two bonds against each other. And it doesn’t look like bunds are going back to a zero yield in a hurry.

It may be grossly premature, but it is January and, therefor, always prudent, if nothing else, to question the moves that look like they will define the trends setting the tone for the year. You might want to start with the dollar. It has been confounding a lot of analysts and stopping out traders along the way.

The simplest way to follow developments may just be to see which end of the Bloomberg Dollar Index’s December 27 range ends up giving way.

Tyler Durden

Wed, 01/15/2020 – 10:45

via ZeroHedge News https://ift.tt/2swSgOs Tyler Durden