Here Is The Full Text Of The “Phase One” US-China Trade Deal

The full text of the 94-page US-China “Phase One” Trade deal is below, and here, courtesy of Bloomberg, are some of the top highlights:

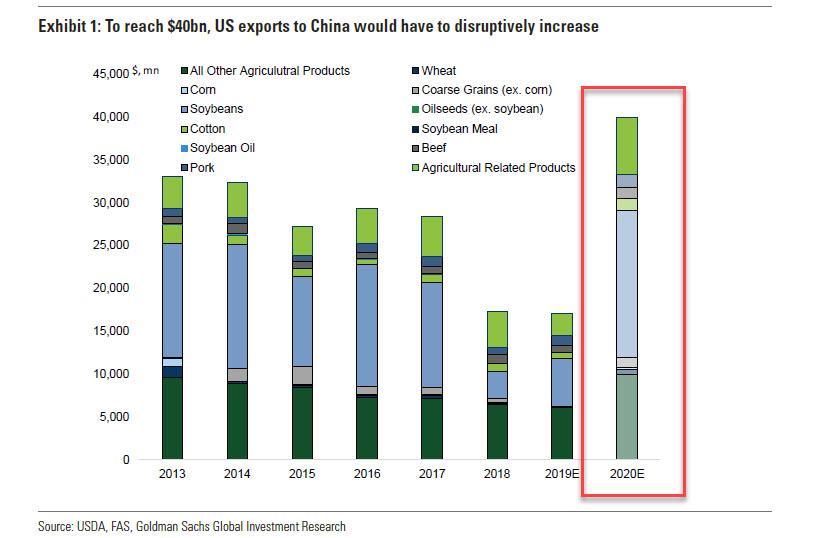

Agriculture details:

- China Purchases to Include Oilseeds, Meat, Cereals, Cotton

- China to Buy Add’l $19.5B U.S. Agriculture Products in 2021

- China to Buy Add’l $12.5B U.S. Agriculture Products in 2020

- China to Approve Pending Applications for U.S. Bond Raters

As Bloomberg notes, China is committing to buying about $32 billion in additional U.S. farm products over the next two years, that’s coming on top of levels seen in 2017 (pre-trade war). Specifically, China committed to importing at least $12.5 billion more agricultural goods this year than in 2017, rising to $19.5 billion next year.It’s unclear just how this will happen without China’s destroying existing supply chains. China will also “strive” to purchase an additional $5 billion a year in farm products.

Energy details:

- China to Buy Add’l $33.9B U.S. Energy Products in 2021

- China to Buy More U.S. Nuclear Power Equipment in Trade Deal

- China Energy Purchases to Include LNG, Oil, Products, Coal

- China to Buy Add’l $18.5B U.S. Energy Products in 2020

Chinese Purchases

- During the two-year period from January 1, 2020 through December 31, 2021, China shall ensure that purchases and imports into China from the U.S. of the manufactured goods, agricultural goods, energy products, and services identified in Annex 6.1 exceed the corresponding 2017 baseline amount by no less than $200 billion.

Intellectual Property

- The U.S. recognizes the importance of intellectual property protection. China recognizes the importance of establishing and implementing a comprehensive legal system of intellectual property protection and enforcement as it transforms from a major intellectual property consumer to a major intellectual property producer. China believes that enhancing intellectual property protection and enforcement is in the interest of building an innovative country, growing innovation-driven enterprises, and promoting high quality economic growth.

Tech Transfer

- The Parties affirm the importance of ensuring that the transfer of technology occurs on voluntary, market-based terms and recognize that forced technology transfer is a significant concern. The Parties further recognize the importance of undertaking steps to address these issues, in light of the profound impact of technology and technological change on the world economy.

Currency, Competitive Devaluation And Enforcement Mechanism

The text contains agreements not to engage in competitive devaluation, to respect one another’s monetary policy and to maintain transparency. Much of that, though, could probably have been inferred from what the U.S. Treasury said the other day in the FX report that saw it remove the tag of currency manipulator from China.

The big questions revolve around the enforcement mechanism. The FX section says points of contention can be referred to a new dispute resolution arrangement that’s being established by the agreement, and if that doesn’t work, the IMF can be called in.

- 1. Issues related to exchange rate policy or transparency shall be referred by either the U.S. Secretary of the Treasury or the Governor of the People’s Bank of China to the Bilateral Evaluation and Dispute Resolution Arrangement established in Chapter 7 (Bilateral Evaluation and Dispute Resolution).

- 2. If there is failure to arrive at a mutually satisfactory resolution under the Bilateral Evaluation and Dispute Resolution Arrangement, the U.S. Secretary of the Treasury or the Governor of the People’s Bank of China may also request that the IMF, consistent with its mandate: (a) undertake rigorous surveillance of the macroeconomic and exchange rate policies and data transparency and reporting policies of the requested Party; or (b) initiate formal consultations and provide input, as appropriate.”

The dispute arrangement itself is outlined in chapter 7, where some of the key sections appear to be as follows:

- If the Parties do not reach consensus on a response, the Complaining Party may resort to taking action based on facts provided during the consultations, including by suspending an obligation under this Agreement or by adopting a remedial measure in a proportionate way that it considers appropriate with the purpose of preventing the escalation of the situation and maintaining the normal bilateral trade relationship.

- If the Party Complained Against considers that the action of the Complaining Party was taken in bad faith, the remedy is to withdraw from this Agreement by providing written notice of withdrawal to the Complaining Party.

Financial Services

- China shall allow U.S. financial services suppliers to apply for asset management company licenses that would permit them to acquire non-performing loans directly from Chinese banks, beginning with provincial licenses. When additional national licenses are granted, China shall treat U.S. financial services suppliers on a non-discriminatory basis with Chinese suppliers, including with respect to the granting of such licenses.

- No later than April 1, 2020, China shall remove the foreign equity cap in the life, pension, and health insurance sectors and allow wholly U.S.-owned insurance companies to participate in these sectors. China affirms that there are no restrictions on the ability of U.S.-owned insurance companies established in China to wholly own insurance asset management companies in China.

- “No later than April 1, 2020, China shall eliminate foreign equity limits and allow wholly U.S.-owned services suppliers to participate in the securities, fund management, and futures sectors.

- China affirms that a wholly U.S.-owned credit rating services supplier has been allowed to rate domestic bonds sold to domestic and international investors, including for the interbank market. China commits that it shall continue to allow U.S. service suppliers, including wholly U.S.-owned credit rating services suppliers, to rate all types of domestic bonds sold to domestic and international investors. Within three months after the date of entry into force of this Agreement, China shall review and approve any pending license applications of U.S. service suppliers to provide credit rating services.

- Each Party shall allow a supplier of credit rating services of the other Party to acquire a majority ownership stake in the supplier’s existing joint venture.”

Full deal text below (pdf link)

Tyler Durden

Wed, 01/15/2020 – 13:19

via ZeroHedge News https://ift.tt/2TrSrWo Tyler Durden