Hickman: A Recession Is More Likely Than You Think

Authored by Eric Hickman via AdvisorPerspectives.com,

Good economic news over the last couple months belies the fact that a recession could strike as soon as March 2020.

That good news has been plentiful: a phase one trade deal between the U.S. and China is presumably close to being signed, the December U.S. Labor jobs report exceeded expectations, the Federal Reserve didn’t lower rates at their December meeting, and developed-economy stock markets continue making new highs. The Fed’s mantra of, “the economy is in a good place” is the ethos of the moment.

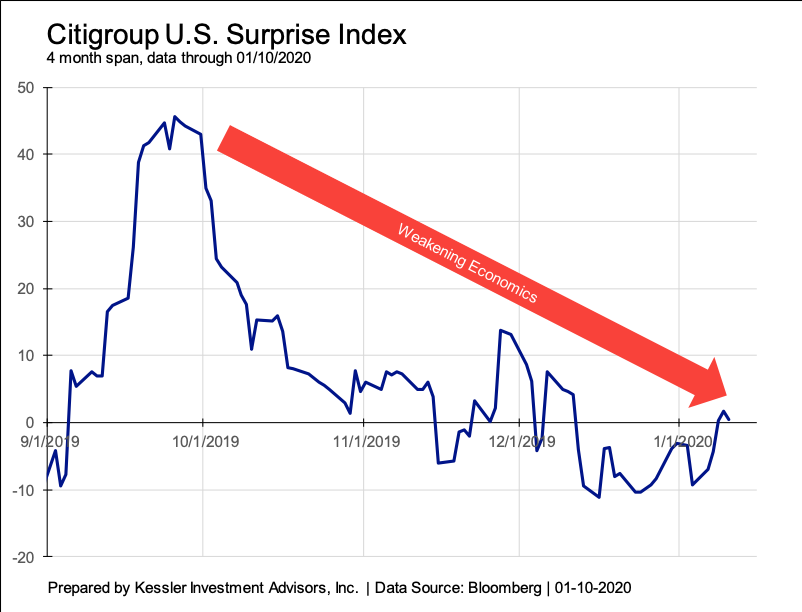

But just behind those data points, many more are suggesting a deteriorating economy. The Citigroup U.S. Surprise index (which measures how far the aggregate of economic releases are above or below where economists estimate them to be) has fallen in recent months (see below). ISM Manufacturing, Durable Goods, Retail Sales, Leading Economic Indicators, and Existing Home Sales have all been lower than expectations in December and early January.

And yet the Fed repeats a version of the statement, “the economy is doing well because consumer spending and the labor market are strong”. And they are right – for now. Real personal consumption is growing at a reasonably healthy 2.4% (YoY%) and the 3.5% unemployment rate is at a near-50 year low (49.6 years). The problem is that these are the last segments of the economy to falter historically at the start of a recession. To the extent that the recession hasn’t started yet (I don’t think it quite has), the consumer and labor market should still be strong. In other words, there is an expected gap of time from when leading indicators (manufacturing, yield curve) show weakness to when coincident indicators (consumer and labor) show weakness. There is nothing to suggest one should extrapolate this consumer and labor strength, especially given the many leading recession signals we’ve already gotten.

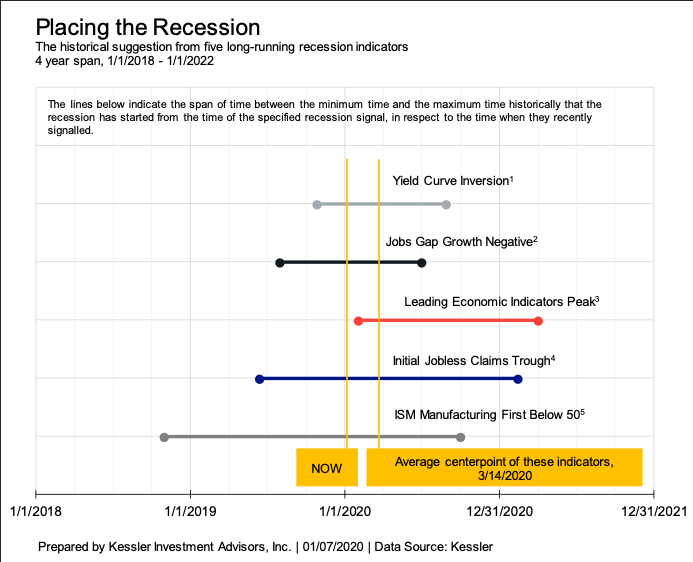

In fact, the following five long-running standard recession signals triggered in 2019:

-

Yield curve inversion, signaled 3/27/2019, data back to January 1971.

-

Conference Board Jobs Gap YoY growth negative2, signaled 11/30/2019, data back to February 1968.

-

Conference Board Leading Economic Indicators Peak3, signaled 7/31/2019 (tentative because it could make a higher peak), data back to January 1959.

-

Initial Jobless Claims Trough4, signaled 4/12/2019 (tentative because it could make a lower trough), data back to January 1967.

-

ISM Manufacturing first below 505 (contraction), signaled 8/31/2019, data back to January 1948.

The long history (49+ years) of these indicators can be used to get a sense of timing for when a recession may begin. I have measured historically how long these indicators signaled before (or after) the start of their accompanying recession. Comparing this time-frame to when these indicators triggered recently, suggests a range for when this recession may come. The chart below shows the time ranges (minimum amount of time historically to maximum amount of time historically) in which each indicator would suggest a recession start.

There are a few conclusions to this.

-

First, five recession indicators have signaled.

-

Second, there is nothing unusual in the timing that the recession hasn’t started yet.

-

Third, no matter which of the five indicators you use, a recession will likely begin in 2020 and the average center-point of the indicators is in March, just a little over two months away.

Don’t confuse the Fed’s “on-hold” stance to have any more meaning than the hope that the consumer and labor market’s strength will continue. History suggests that this is not a good bet to make.

* * *

Eric Hickman is president of Kessler Investment Advisors, Inc., an advisory firm located in Denver, Colorado specializing in U.S. Treasury bonds.

Tyler Durden

Tue, 01/14/2020 – 19:05

via ZeroHedge News https://ift.tt/2QX2vFf Tyler Durden