WTI Extends Losses After Massive Product Inventory Build, New Record Production

Oil prices are extending losses after last night’s surprise crude build reported by API, with WTI trading below $58 following OPEC’s latest forecasts suggesting a weaker outlook for global oil markets this year as surging supplies from competitors from Norway to Guyana threaten the group’s efforts to defend crude prices.

API

-

Crude +1.1mm (-1.1mm exp)

-

Cushing -69k (-1.0mm exp)

-

Gasoline +3.2mm (+3.4mm exp)

-

Distillates +6.78mm (+1.1mm exp)

DOE

-

Crude -2.55mm (-1.1mm exp)

-

Cushing +342k (-1.0mm exp)

-

Gasoline +6.678mm (+3.4mm exp)

-

Distillates +8.171mm (+1.1mm exp)

The prior week was dominated by a surprise crude build and huge product inventory builds. This week saw crude inventories drop modestly (-2.55mm) but gasoline and distillates inventories soar (and the first Cushing build in 9 weeks)

Source: Bloomberg

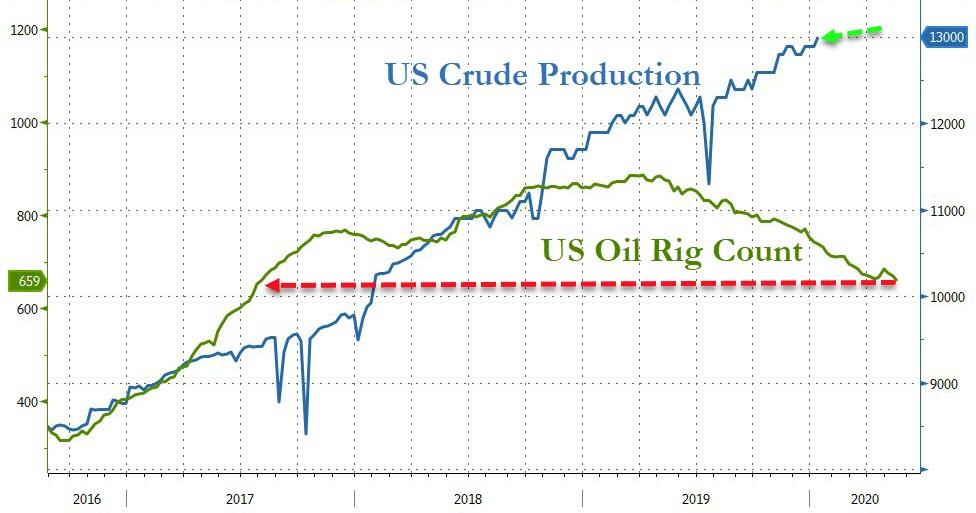

US Crude production pushed higher, hitting 13mm b/d for the first time…

Source: Bloomberg

WTI traded sub-$58 ahead of the API print, and dropped notably after the huge buiulds in products

WTI trading $57.50 is the lowest in 5 weeks…

Tyler Durden

Wed, 01/15/2020 – 10:35

via ZeroHedge News https://ift.tt/2u0n0aY Tyler Durden