50 Million Americans Are Still Paying Down Debt From 2018 Holiday Shopping Season

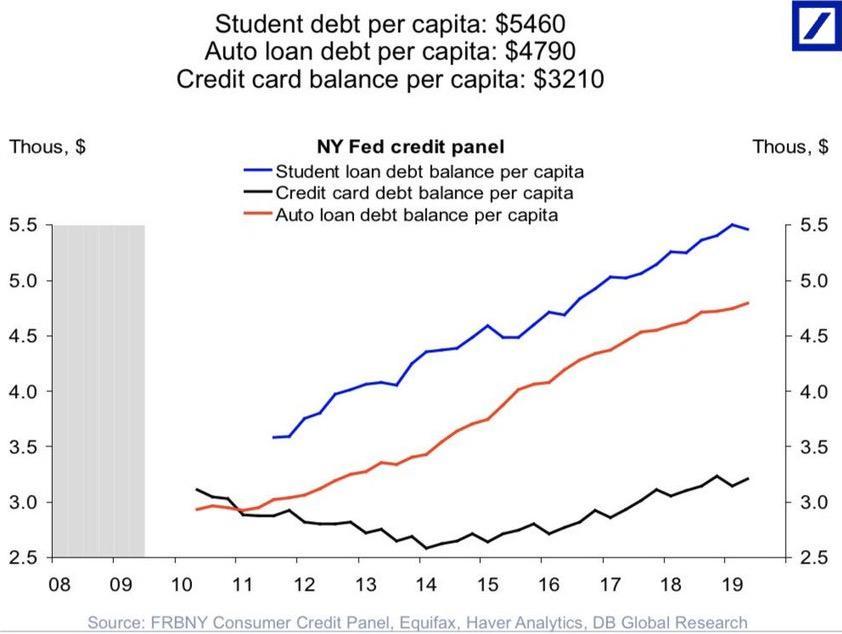

American consumers are some of the most debt-burdened and financially irresponsible on the planet – and it’s not just because of the stagnant wages and hefty student loan burdens. Truly, millions of Americans are addicted to easy credit provided by the credit card companies, and the low interest rates available over the past decade have only made things worse.

As we reported back in October, nearly half of American consumers report that their incomes simply don’t cover their expenses.

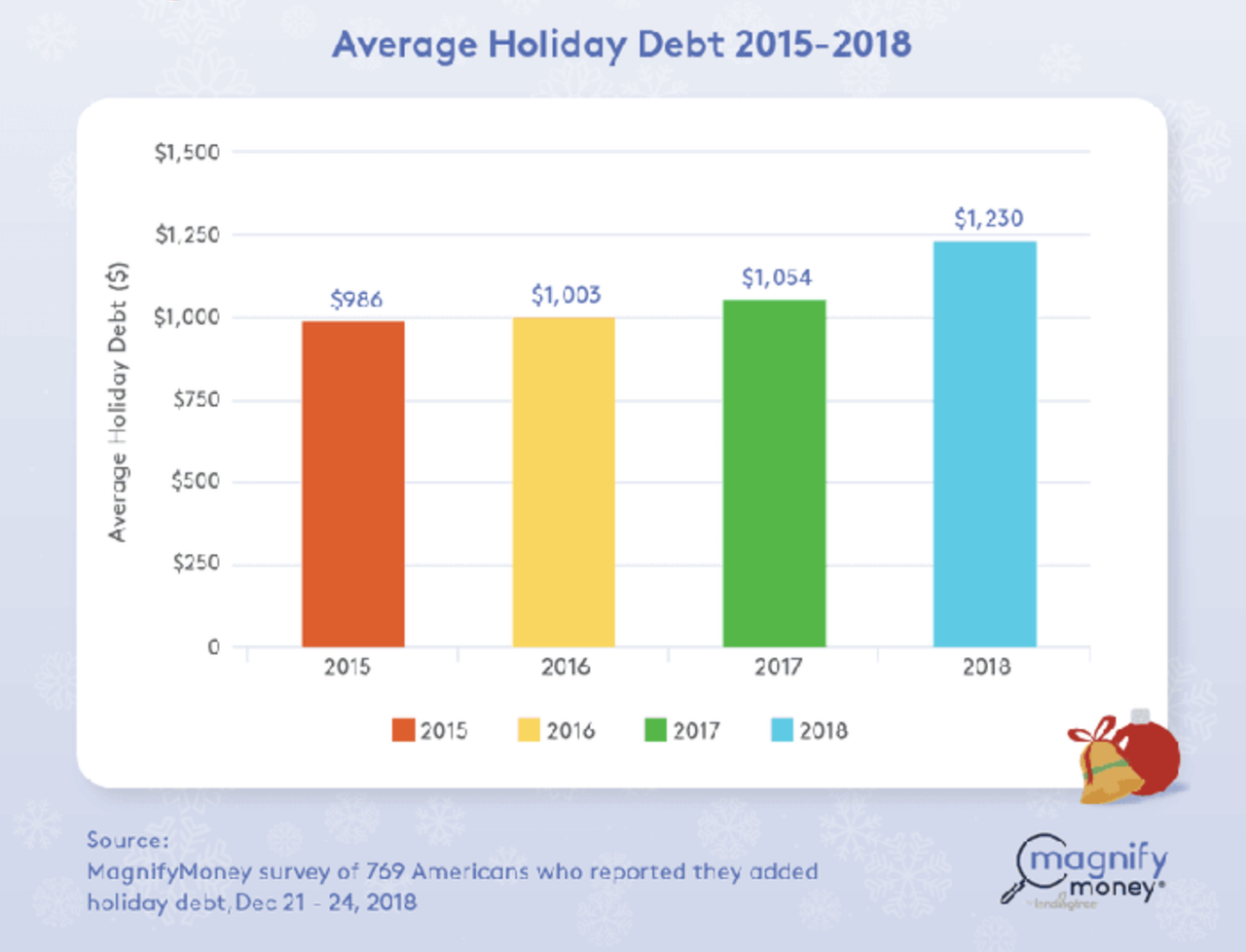

But the latest staggering stat about Americans’ seemingly endless capacity to take on debt comes to us from Magnify Money. Last year, MM carried out a survey of Americans who took on debt during the holiday season.

They found that the amount Americans spent in 2018 eclipsed the previous three years.

But in a scoop provided to the Today Show, MM reports that just under half of those it surveyed last year – roughly 48% – haven’t finished paying off that debt.

The average American racked up $1,230 in debt over the 2018 holiday season, and going into last year’s buying season, 48 million Americans were still paying it off!@SRuhle is here with financial fitness tips to get you out from under that debt. pic.twitter.com/JSRvYQuSQv

— TODAY (@TODAYshow) January 14, 2020

Today also reported that the average American household has roughly $7,000 in credit card debt.

For any Americans who are tired of living with all this debt, Stephanie Ruhle is here with some financial fitness tips.

But there’s really only one that matters: Stop buying shit you don’t need.

Tyler Durden

Wed, 01/15/2020 – 18:45

via ZeroHedge News https://ift.tt/3agAgsm Tyler Durden