87% Of Participants At Goldman Conference Say Trump Will Get Re-elected

If Wall Street is where, for better or worse, the forward-looking “creme de la creme” of US society resides, then Democrats may as well pack it in: as Goldman strategist Lilia Peytavin writes, yesterday Goldman Sachs held its annual Global Strategy Conference in London, which was attended by over 250 clients. During two of the sessions the bank surveyed audience members on their views and outlook.

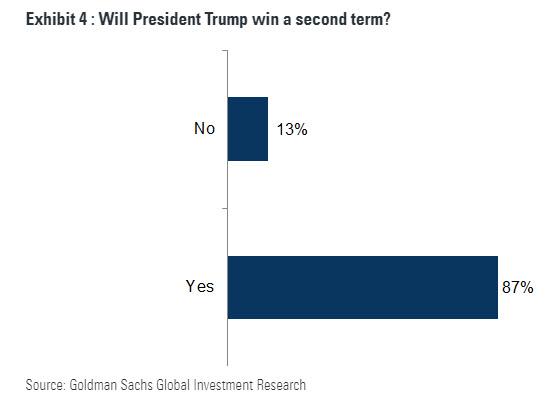

And while Goldman asked a bevy of interesting questions, the most interesting one was “Will President Trump Win A Second Term?” The answer? A whopping majority (87%) of respondents believe so, even though the S&P 500 12-month 25-delta skew stands in its 97th percentile (73th percentile in 3 months), suggesting that demand for equity put options has increased as investors seek protection against a post-election drawdown (then again, Wall Street was convinced that Hillary Clinton would win in 2016 so nobody really has any idea).

Some other questions asked at the conference:

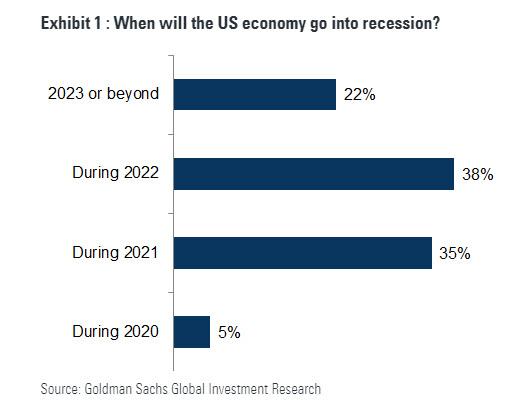

When will the US economy go into recession? Recession fears have been pushed further out. 2022 is the modal expectation (38%), but only marginally more than 2021 (35%). Very few participants (5%) expect a recession this year, as is often the case. Recession fears have been pushed further out compared with last year. Indeed, while this year the modal result is 2022 (n+2), last year the mode was 2020 (n+1), with 45% of responses.

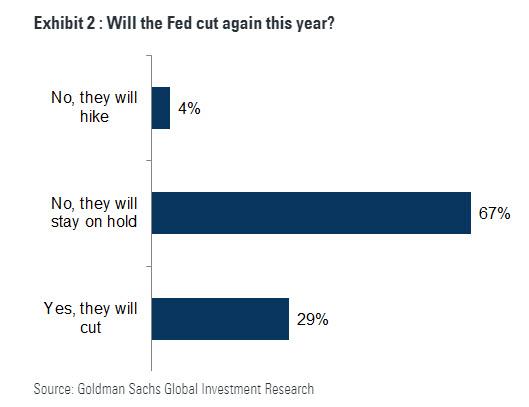

Will the Fed cut again this year? A large majority of clients (67%) expect the Fed to remain on hold in 2020, in line with the Fed’s guidance and our expectation. The distribution of answers is skewed towards a cut rather than a hike, as slightly fewer than one-third of respondents believe that the Fed will cut. This is the opposite of last year’s results: while just 4% of respondents expect the Fed to hike this year, 71% of respondents were expecting at least one hike in 2019. The bond market was pricing zero cuts and just 2% of respondents thought the Fed would cut interest rates. This a posteriori inadequate positioning triggered a sharp re-rating for equities following the dovish ‘pivot’ in the Fed’s guidance in January 2019 and the actual three cuts of the Fed through the course of the year.

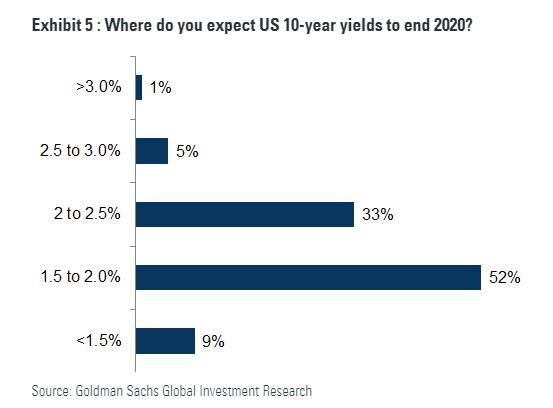

Where do you expect US 10-year yields to end 2020? Most clients (52%) expect US 10-year yields, currently trading at 1.79%, to remain in their current range (1.5% to 2.0%). The distribution of answers is skewed towards higher yields, given that 39% of clients expect them to be above 2.0%. Given that we saw in Question 2 that just 4% of clients expect the Fed to hike, this suggests that respondents expect a Goldilocks environment in 2020, with anchored policy rates and inflation/growth expectations pushing up bond yields modestly.

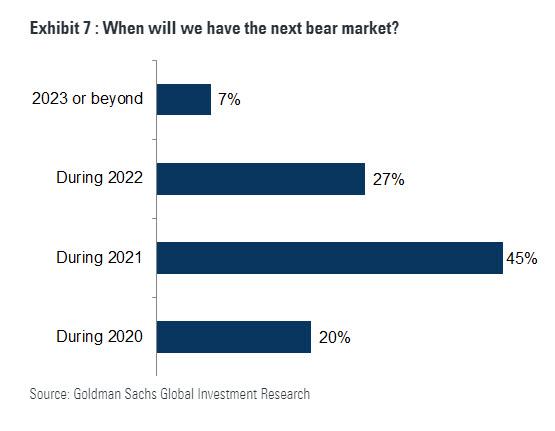

When will we have the next bear market? Two-thirds of respondents are constructive on global equities, expecting single-digit returns in 2020. That said, 45% expect a bear market in 2021.

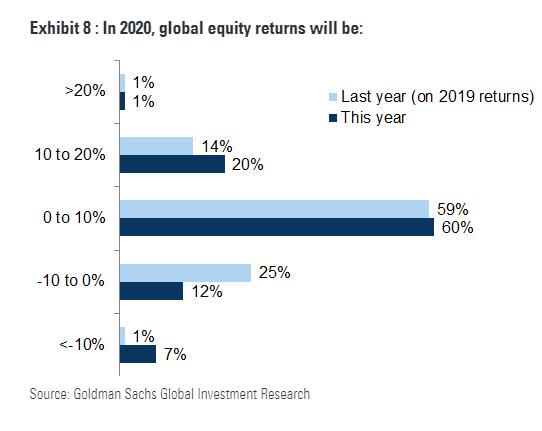

In 2020, global equity returns will be: There is little consensus: US, Asia ex Japan and Europe attracted a similar number of votes (around 25%, respectively). Japan is the least preferred region (only 10% of respondents expect it to outperform), followed by Other EM (17%).

Which equity region will perform best in 2020 (in local currency terms)? There is little consensus: US, Asia ex Japan and Europe attracted a similar number of votes (around 25%, respectively). Japan is the least preferred region (only 10% of respondents expect it to outperform), followed by Other EM (17%).

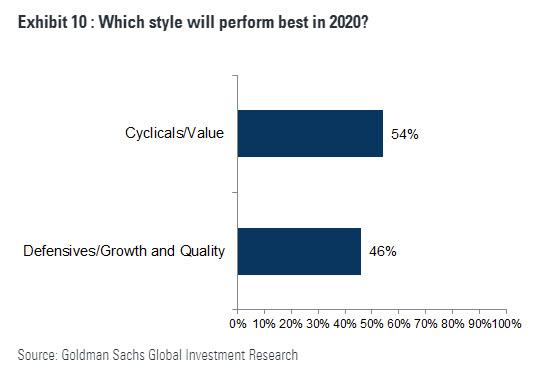

Which style will perform best in 2020? Views are fairly mixed. A slight majority (54%) expect Cyclical and Value stocks to outperform in 2020. About 46% of respondents expect Defensives, Growth and Quality stocks to do better.

Tyler Durden

Thu, 01/16/2020 – 14:20

via ZeroHedge News https://ift.tt/30t8DYO Tyler Durden