Japan Widens Lead Over China As Top Foreign Holder Of US Treasuries

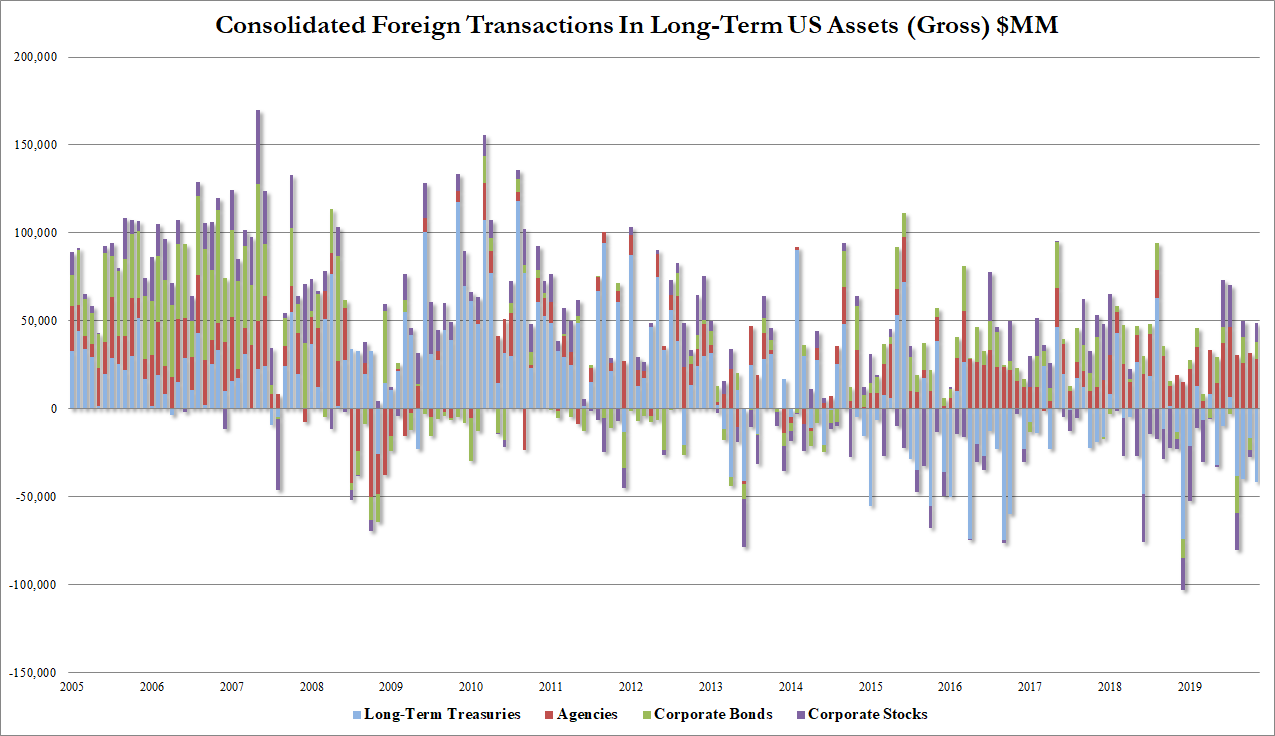

November – the latest data point – saw surprisingly large net capital inflow to US markets, the biggest since Oct 2018 after two notable outflow months…

Source: Bloomberg

Overall foreigners dumped $41.5bn in Treasuries but bought everything else…

-

Agencies: +$28.3BN

-

Corporate Bonds: +$10BN

-

Stocks +$10.5BN

Source: Bloomberg

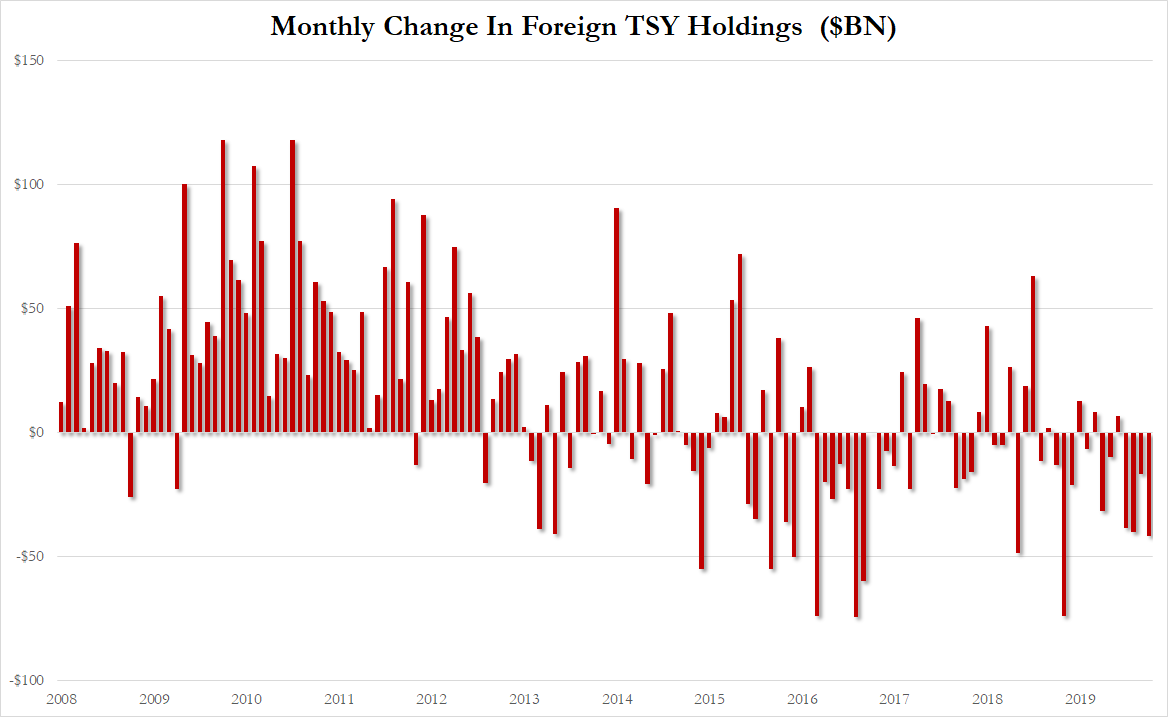

That is the biggest Treasury sale since Dec 2018…

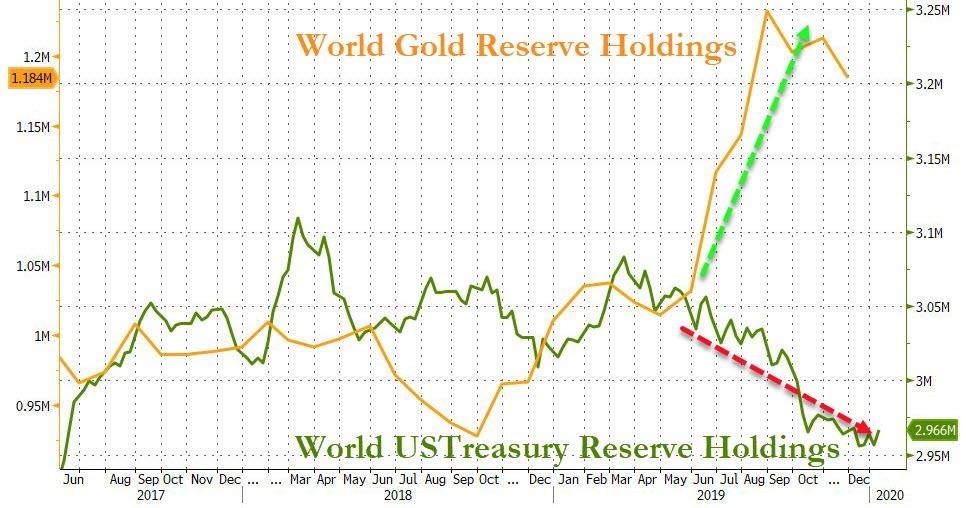

While both Japan and China reduced their holdings in November, Japan’s lead over China as the biggest foreign holder of USTreasuries has increased…

Source: Bloomberg

-

China holds $1.09t of U.S. Treasuries, a decrease of $12.4b from last month

-

Japan sold too: $1.16t, a decrease of $7.2b from last month

As a reminder, in November, China criticized the U.S. for interference in its domestic affairs as President Trump prepared to sign legislation supporting the Hong Kong protesters.

Singapore (+11.8bn) and Ireland (+3.4bn) were the biggest Treasury buyers in November.

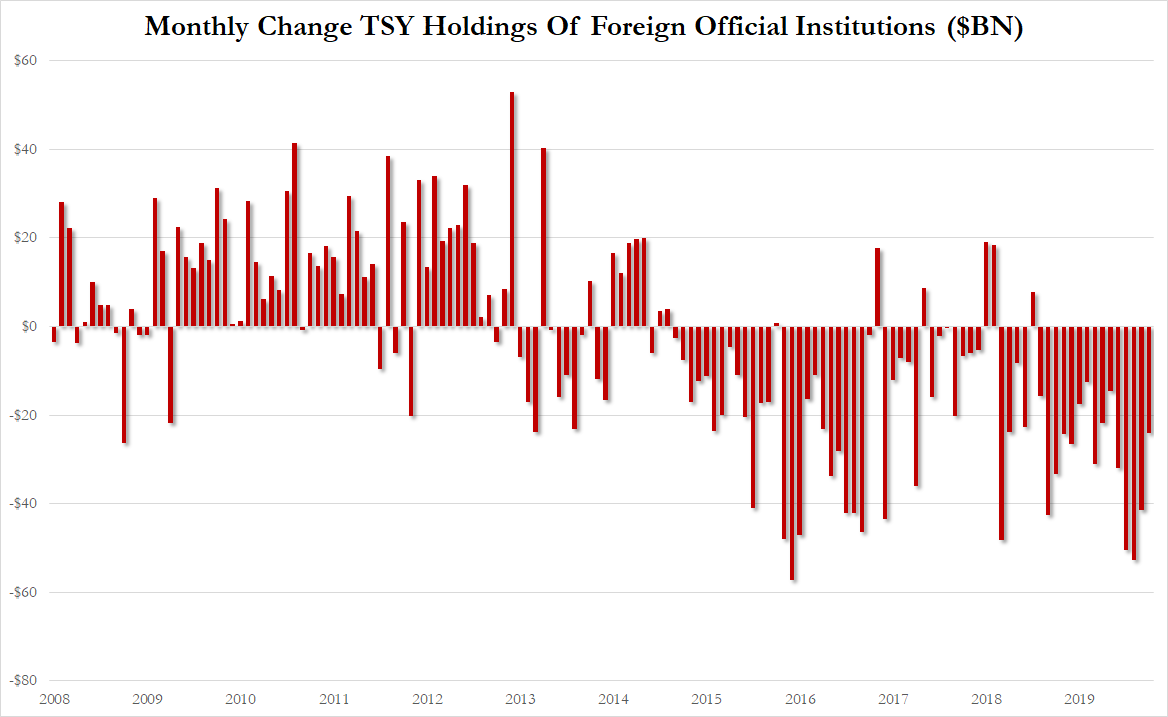

Foreign official institutions (central banks, reserve managers, sovereign wealth funds) have sold US TSYs for 15 consecutive months

…since Oct 2014, foreigners have sold TSYs on 56 of 62 months!!!

Probably nothing.

Tyler Durden

Thu, 01/16/2020 – 16:16

via ZeroHedge News https://ift.tt/30sN0rv Tyler Durden