No “Instant Push” In Shipping Demand From Phase One Trade Deal

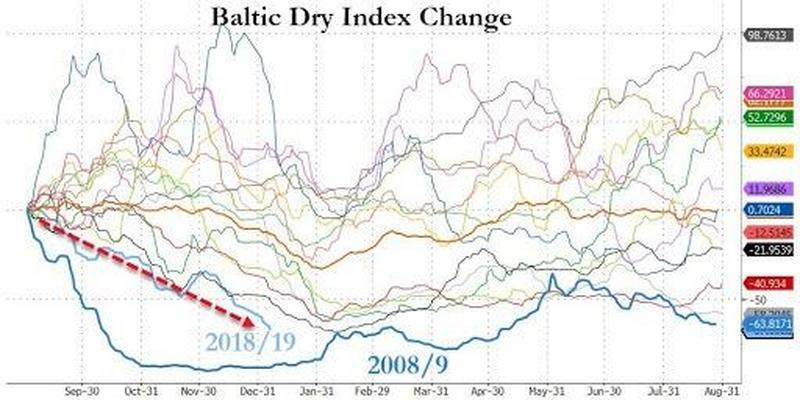

The Baltic Dry Index, which tracks rates for capesize, panamax and supramax vessels that ferry dry bulk commodities across the world, has plummeted in the last several months as tariff-frontrunning ends.

The synchronized global downturn is expected to persist in 2020 as the so-called “front-loading” effect ahead of tariff deadlines has ended.

The Phase one agreement between the U.S. and China was signed on Wednesday, but that doesn’t guarantee the shipping industry, including container, dry bulk, LNG, mixed fleet, and tanker demand will increase in the near term, reported Splash 247.

The full text of the 94-page US-China trade agreement specifies China will increase purchases of U.S. products and services by least $200 billion over the next 24 months.

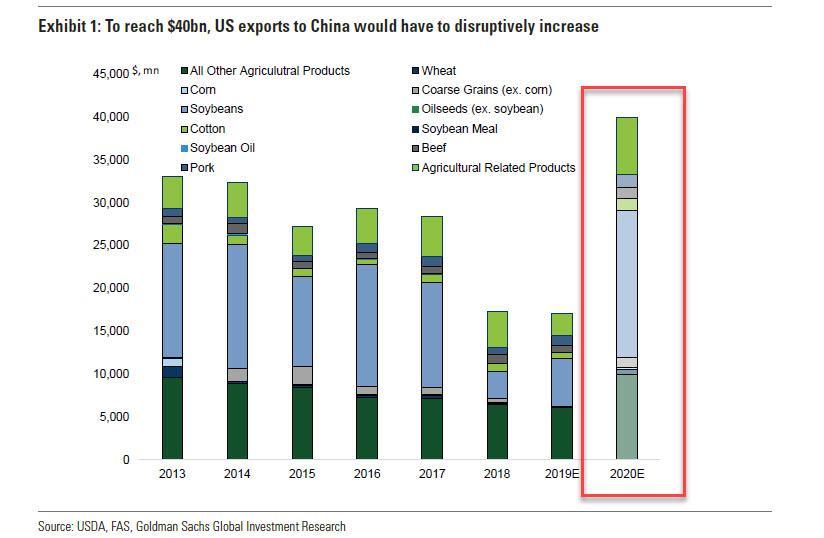

The $200 billion includes $77.7 billion of manufactured goods, $32 billion of agriculture goods, and $52.4 billion of energy products, including LNG, crude, petroleum products, and coal.

Peter Sand, the chief shipping analyst at BIMCO, said: “don’t expect an instant push to the demand from this, but a lift for coming years if the volumes will get traded and shipped.”

“The phase 1 deal clearly holds a potential upside for the global shipping industry in all sectors. As more crude oil and agriculture products will get seaborne. Let’s hope for this deal to succeed. But recovering from two years of trade war is not easy,” Sand said.

Ralph Leszczynski, head of research at shipbroking house Banchero Costa, said details of the Phase one agreement are vague, and the implementation of the deal could take some time.

“There is apparently this headline figure of $200bn of extra imports from the U.S. If actually realized, it would mean essentially doubling imports from the 2017 figure. There is no guarantee that this will actually happen, but if yes, than it would translate into more agricultural and energy imports from the U.S., It would, however, be at the expense of replacing other exporters such as Brazil for soybeans, Saudi Arabia for crude oil, Qatar for LNG, more than increasing overall trade volumes,” Leszczynski said.

“China will, however, need to be very careful in not allowing this to disrupt its other trade and political relationships with other countries, so I expect things to move slowly,” Leszczynski added.

And what this all means is that the instant economic growth projected by the Trump administration might not show up in early 2020 that could lead to repricing event for risk assets, namely stocks.

Tyler Durden

Thu, 01/16/2020 – 18:10

via ZeroHedge News https://ift.tt/2NBM0MG Tyler Durden