VC Bubble Cracks, Funding Plunges In Late 2019

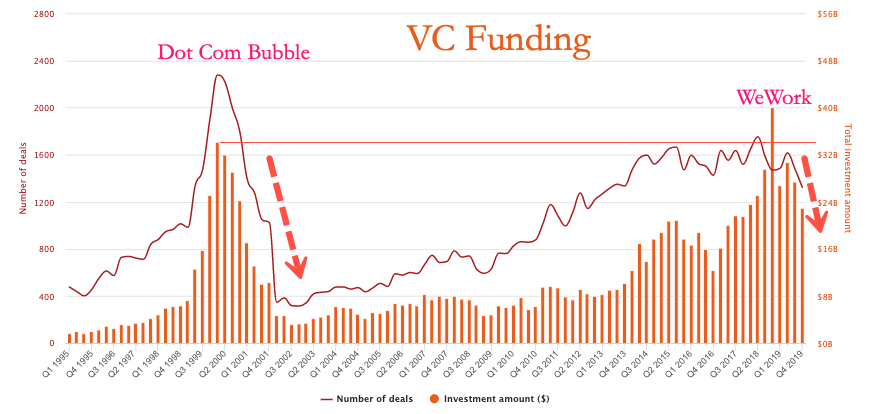

Venture capital funding for early-stage U.S. companies saw a dramatic reduction in late 2019 thanks to the combination of inflated valuations, the WeWork implosion, and IPO meltdowns.

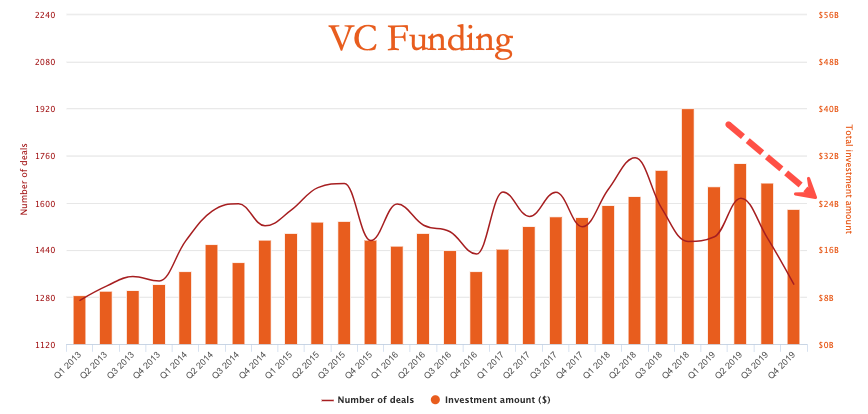

CB Insights and PWC published new data that showed venture capital-backed companies raised $23 billion in 4Q19, down 42.5% Y/Y.

On a much larger timeframe, WeWork’s ridiculous $47 billion valuation likely marked the top of the VC bubble in late 2018/1Q19.

Despite VC firms pulling back on funding because valuations were stretched, startups in 2019 received approximately $108 billion in funding, making it the third-largest year ever, even dating back to the Dot Com bubble.

At the end of 2019, there were more than 199 U.S.-base unicorns, and these are startups with valuations over $1 billion, which was up from 149 at the end of 2018.

Large funding rounds over $100 million also dropped in 4Q19 to 38 with a total of $7.3 billion raised, opposed to 54 in 4Q18, with a total of $25.3 billion.

WeWork’s implosion, IPO disasters, and the pricking of the VC bubble are all coming at a time when central banks are plowing trillions of dollars into global markets and cutting interest rates at a pace not seen since the last financial crisis. Maybe the VC bubble cracking is a sign that a market top is nearing.

Tyler Durden

Wed, 01/15/2020 – 20:05

via ZeroHedge News https://ift.tt/3aapEvg Tyler Durden