China Growth Slows To 29 Year Low In 2019 Despite Q4 Rebound

With phase-one talks completed in October (and signed this week), tonight’s Q4 GDP and December smorgasbord of data is being keenly watched by the market for any signs that China’s massive credit stimulus has actually done any good at all.

Ahead of tonight’s key China data dump, State Grid, China’s largest utility company, has warned the rate of economic growth in the country could plunge to 4% within the next four years, according to internal forecasts.

“We were upbeat about China’s power demand five years ago because the economy was still robust and 7 or 8 percent GDP growth was the bottom line,” the official said. “No one expected growth to decelerate so sharply.” He warned that 4% growth by 2024 was the utility’s worst-case scenario.

And despite a YoY rise in China’s credit impulse, shadow financing continues to contract, while loans in the banking sector expanded, but not enough, expectations are for 6.0% GDP growth in Q4, the same as Q3…

Source: Bloomberg

The jump in credit is a year-end headfake however, and thus is not expected to be sustained…

Source: Bloomberg

But expectations for the rest of the China data is to slide from impressive November data (that lifted the ECO surprise index)…

Source: Bloomberg

Despite plenty of volatility, Q4’s average for offshore yuan was modestly weaker than Q3…

Source: Bloomberg

But the Chinese stock market refuses to play along with the credit impulse…

Source: Bloomberg

Ahead of the print, we note that the two manufacturing purchasing-manager indexes indicated that activity was picking up that month; and exports and imports also both gained.

So, with the trade-deal finally signed (whatever that means), are tonight’s December (and Q4 data) signaling optimism?

-

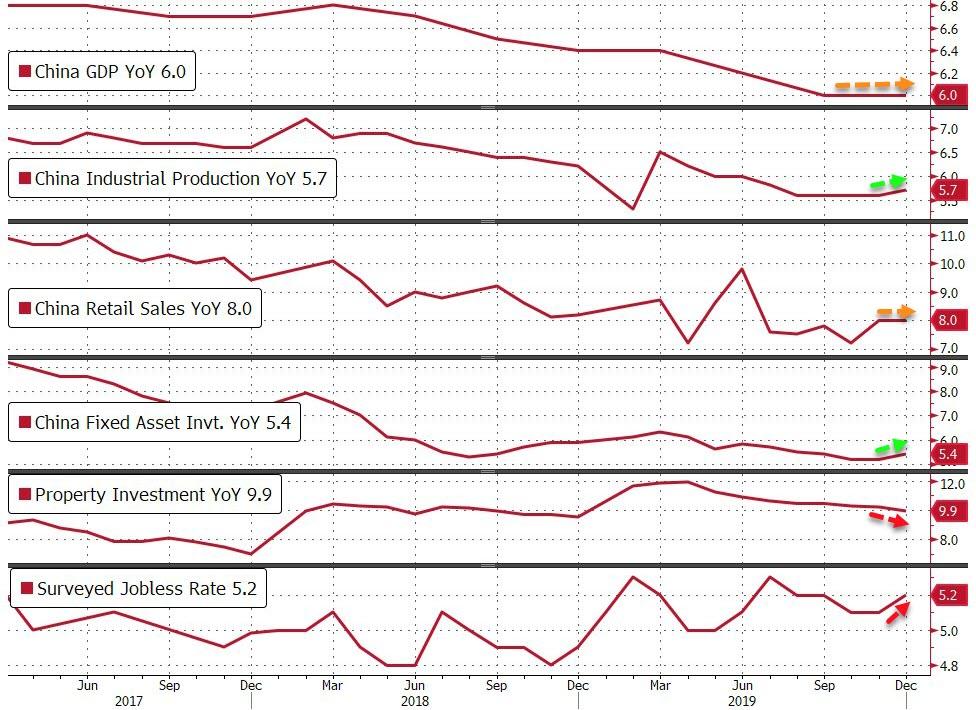

China Q4 GDP YoY MEET +6.0% vs +6.0% exp and +6.0% prior.

-

China Dec Industrial Production YoY BEAT +5.7% vs +5.6% exp and +5.6% prior.

-

China Dec Retail Sales YoY BEAT +8.0% vs +7.9% exp and +8.0% prior.

-

China Dec Fixed Asset Investment YoY BEAT +5.4% vs +5.2% exp and +5.2% prior.

-

China Dec Property Investment FELL YoY +9.9% vs +10.2% prior.

-

China Dec Surveyed Jobless Rate WORSENED 5.2% vs 5.1% prior.

Source: Bloomberg

Dec. industrial output grew faster than all 41 estimates (with grain output reached a record high in 2019 as pork output fell 21.3% last year).

Bloomberg notes that within retail sales, “daily use” items saw weaker gains, while tobacco and alcohol accelerated. Jewelry spending saw its best gain since June, so it seems like Chinese consumers were opening up their wallets for non-necessities last month.

Amongst all data releases today what caught ANZ Chief Economist Raymond Yeung’s attention is surveyed jobless rate which rose to 5.2% from 5.1%. For such a big country with more than 400m urban employment workforce, a small change in jobless rate means a lot.

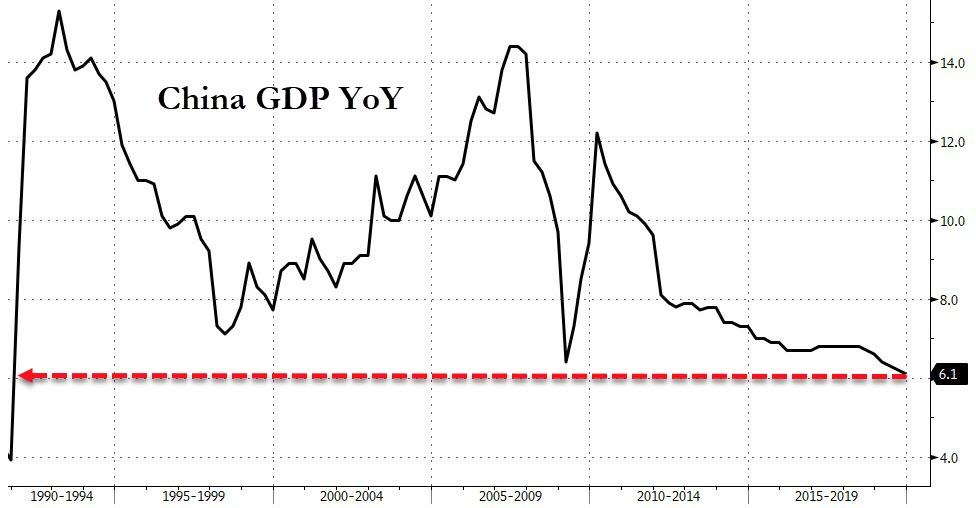

As a reminder, the official target range for China GDP growth for the year was 6.0-6.5%, with tonight’s slightly disappointing data (vs +6.2%) confirming 2019’s +6.1% is the weakest annual expansion since 1990…

Source: Bloomberg

So, is bad news good news? (more non-economically-catalytic stimulus?)

How Chinese GDP is ‘created’ – We’re gonna need moar M2…

Source: Bloomberg

But even that is not working as even though M2 has been rising since 2017, GDP continues to slide, which means efficiency of debt is collapsing.

Seems like nothing really matters though as we note that 10Y Taiwan debt traded down to a 60bps yield – a record low – as the Taiwan stock market hit new record highs…

Source: Bloomberg

Congrats global central bankers.

Additional data released tonight shows that China’s birth rate dropped to a new record low (Birth rate fell to 10.48 births per 1,000 population in 2019 ). The shrinking working-age population and ageing society threaten to hurt growth in the long term.

Tyler Durden

Thu, 01/16/2020 – 21:10

via ZeroHedge News https://ift.tt/2R070P0 Tyler Durden