“Everywhere Euphoria”: Bank of America Warns Of “Echoes Of 2000”

With the S&P hitting daily record highs, the financial media has been flooded with analogies to January 2018 which was the last time that the market saw a similar “blow-off top” meltup, one which ended in tears in the first week of February when the negative gamma complex imploded as a result of massive vol selling and inverse VIX ETFs blew up overnight, sending the S&P lower by 10% in days. Perversely, that VIXtermination event removed what was traditionally a handbrake to market meltups and without a market manifestation of the retail “short vol” trade, it is quite possible that the current meltup will continue indefinitely.

Which is why the correct comp to the current market move may be not to Jan 2018, but to January 2000.

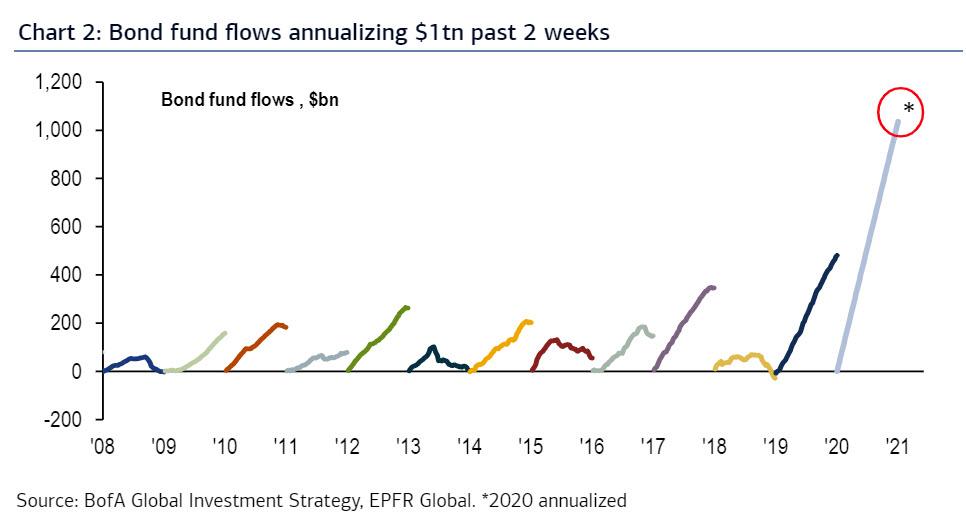

At least that’s the assessment of BofA’s chief investment strategist, Michael Hartnett, who writes in his weekly Flow Show that “Q1’2020 = Q1’2000” and notes that inflows to bond funds are annualizing at a remarkable $1tn in the past 2 weeks…

… resulting in echoes of 2000, with investor euphoria sending bond yields lower despite stronger global macro, such as a rebound in Asian export cycle, and a 30%+ surge in US mortgage applications.

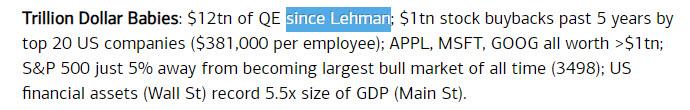

But the clearest indication that this is the second coming of the tech bubble is the rampage of “trillion dollar babies“, the direct result of $12 trillion of QE “since Lehman” – in this case, Hartnett’s term, not ours:

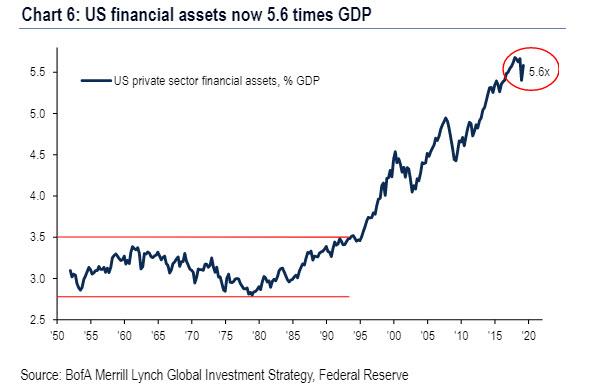

… in addition to $1 trillion in stock buybacks past 5 years by top 20 US companies (amounting to $381,000 per employee), and resulting in APPL, MSFT, GOOG all worth >$1tn; meanwhile, the S&P 500 is just 5% away from becoming largest bull market of all time (3498) even as the Fed is now stuck and can never again allow stocks to drop as US financial assets (i.e., Wall Street) is a record 5.5x size of GDP (Main St). In short, the entire market is now “too big to fail.”

Looking at the market, Hartnett then divides assets into two categories:

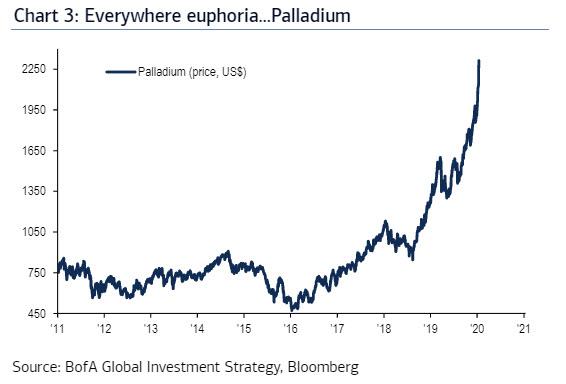

- The froth: assets that deliver “growth” & “yield”…palladium, global tech (SOX, QQQ, KWEB), CCC-rated HY bonds; record lows in IG & HY CDX…

- The sloth: oil, commodity currencies, banks, materials, value all lagging.

And as long as “the sloth” refuses to rise, the market is telegraphing that there is no organic growth possible (i.e., inflation), that the Fed remains in charge of everything, and that growth will continue to trounce value, making a mockery of active investing.

Looking ahead, Hartnett sees more of the same, i.e., a “Rotation-less 2020” in which there is no Main St inflation, no rotation from IG→HY, US→EAFE, large→small, tech→banks, growth→value (EM the anomaly driven by “peak US$” belief), as a result price action implies new lows in government bond yields, which paradoxically means that a crash – which sends yields to new record lows – may well be bullish for stocks.

So how does one trade all of this? Two ways, first the bullish one.

As Hartnett puts it, “we stay irrationally bullish until peak Positioning & peak Liquidity incite a spike in bond yields & a 4-8% equity correction; sell into strength as MOVE Index <40, IG CDX <40, SPX approaches 20x (3500) all challenge Fed financial stability mandate.“

Unfortunately, judging by Neel Kashkari’s tweets today, the last thing the Fed is worried about is financial stability, which brings us to the second point, namely the end of the rally, which according to Hartnett will play out as follows:

Feb’18 & Oct’18 sell-offs driven by QT and combination of higher yields & lower stocks; best trading strategy was long cash, gold, copper; short credit, tech, private equity, oil…

Finally, on timing, Hartnett sees the above trading pattern repeat once we reach the top…. sometime in Q1 2020.

Tyler Durden

Fri, 01/17/2020 – 13:40

via ZeroHedge News https://ift.tt/2u5JreX Tyler Durden