Labor Market Hits A Brick Wall: Job Openings Crater The Most Since The Financial Crisis

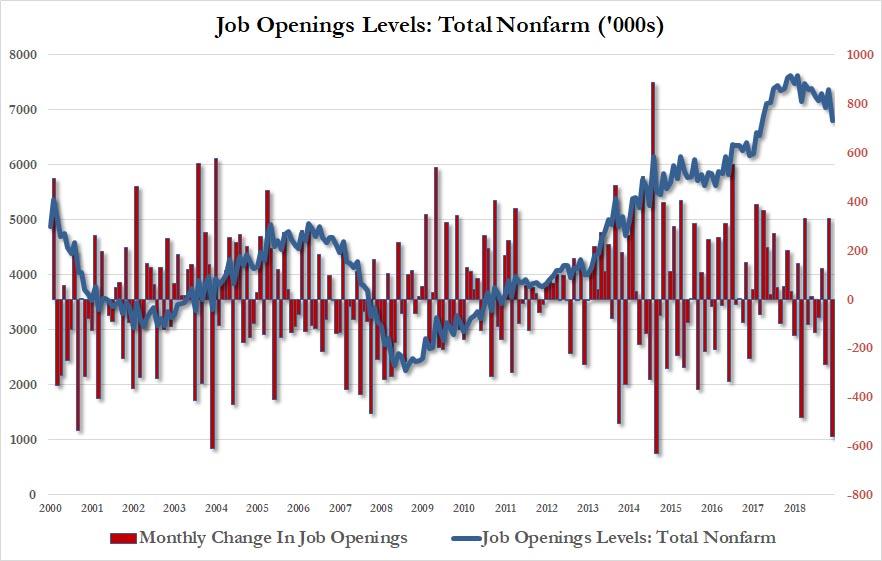

While one wouldn’t know it by looking at the BLS’ jobs report, which in November showed that a whopping 256K jobs were added, the JOLTS report issued moments ago showed a vastly different picture, one which if one didn’t know better would suggest that the US labor market hit a brick wall. Why? Because according to JOLTS, traditionally Janet Yellen’s favorite labor market report, job openings in November plunged by a massive 561K, from an upward revised 7.361MM to 6.800MM, the lowest monthly total since February 2018…

… the biggest sequential drop since August 2015…

… and the biggest annual drop since the financial crisis!

Is it possible that the BLS was simply caught fabricating data? Certainly: as a reminder, it was back in September 2013 that we caught the BLS lying about labor market data precisely when looking at the JOLTS report, although it is just as likely that after overrepresenting the strength of the labor market for the past two years, the BLS decided to finally catch down to reality at the end of 2019.

Commenting on the data, the BLS said that the job openings level decreased for total private (-520,000) and edged down for government (-42,000). The largest decreases in job openings were in retail trade (-139,000) and construction (-112,000). The number of job openings fell in the South and Midwest regions.

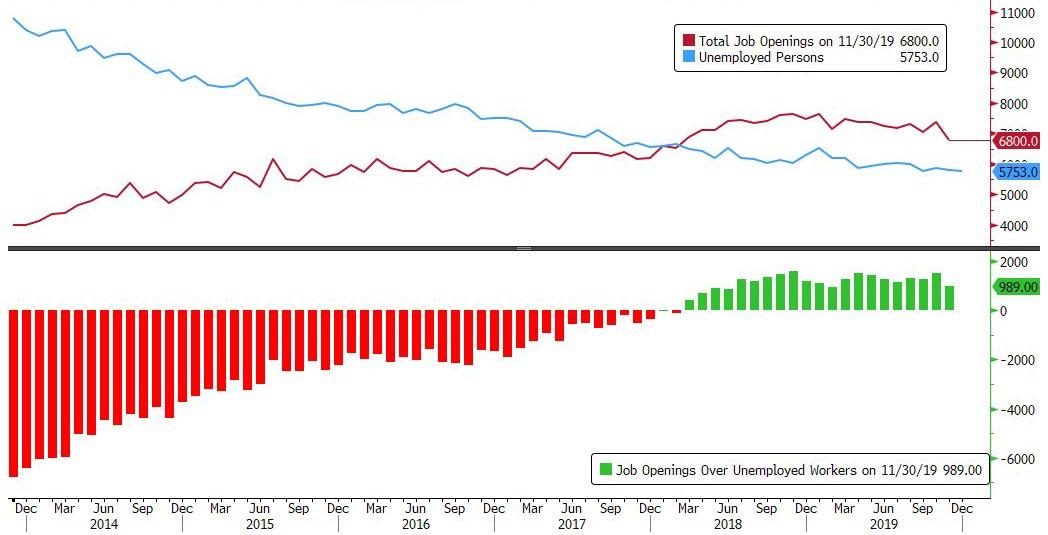

That said, there was a silver lining to today’s report: even at 6.8MM job openings this was still well above the total number of unemployed workers; in fact in November was the 21st consecutive month in which job openings surpassed unemployed workers.

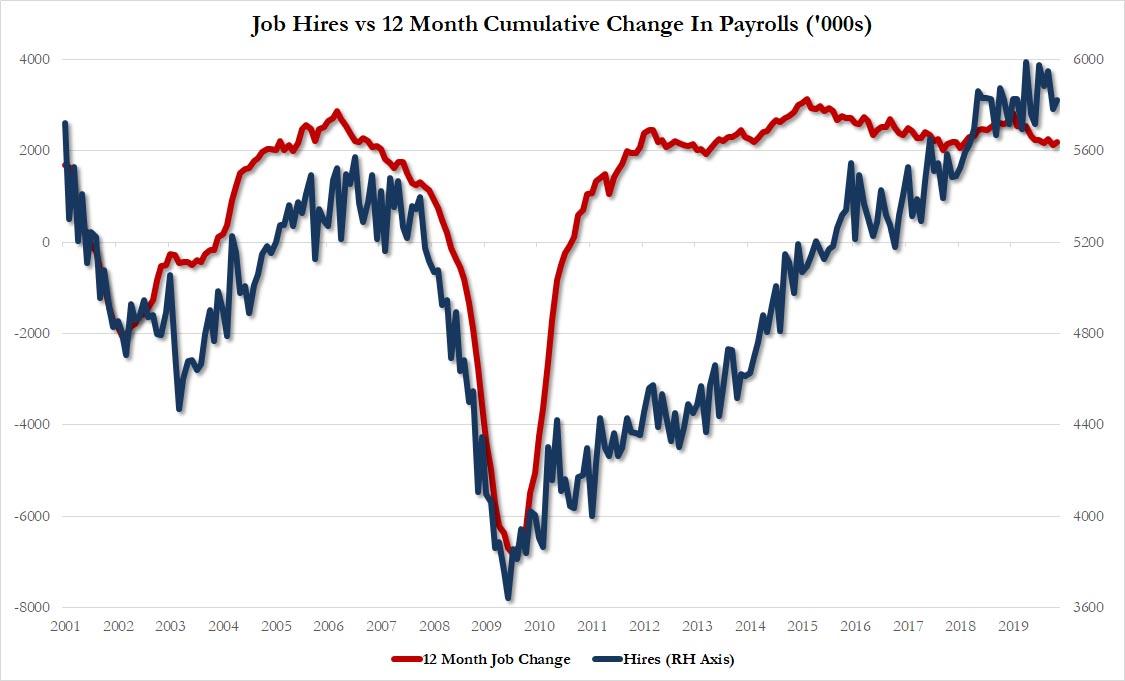

Some more good news: the number of hires in November actually rose by 39K, and remains slightly above where the cumulative change in payrolls over the past 12 months suggests it should be.

Still, despite these two offsets, the near record plunge in job openings is a very loud, and very clear signal that something is breaking in the labor market, and if this trend continues, then the next logical escalation is a surge in layoffs as US employers retrench and force their existing workers to boost their productivity further.

Needless to say, a nearly 600K drop in job openings is not something one would see if the economy was firing on all cylinders as the stock market represents every single day.

Tyler Durden

Fri, 01/17/2020 – 10:23

via ZeroHedge News https://ift.tt/35ZQ9jB Tyler Durden