WeWork’s Lease Activity Crashed 93% In 4Q After Failed IPO

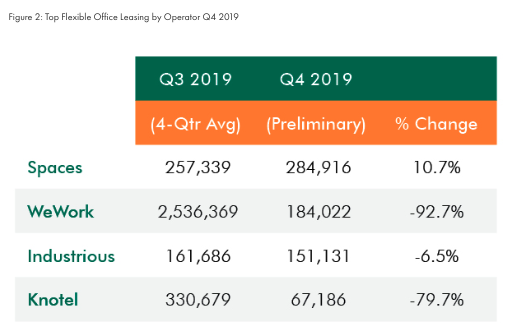

Several months after WeWork’s failed IPO — resulting in a bailout from SoftBank, the money-losing office-sharing company leased just four new sites for a combined 184,00 sq. Ft. of space in 4Q19, marking a 93% plunge from its quarterly average rate of 2.54 million sq. Ft. over the last four quarters, according to data from real estate firm CBRE shared with CNBC.

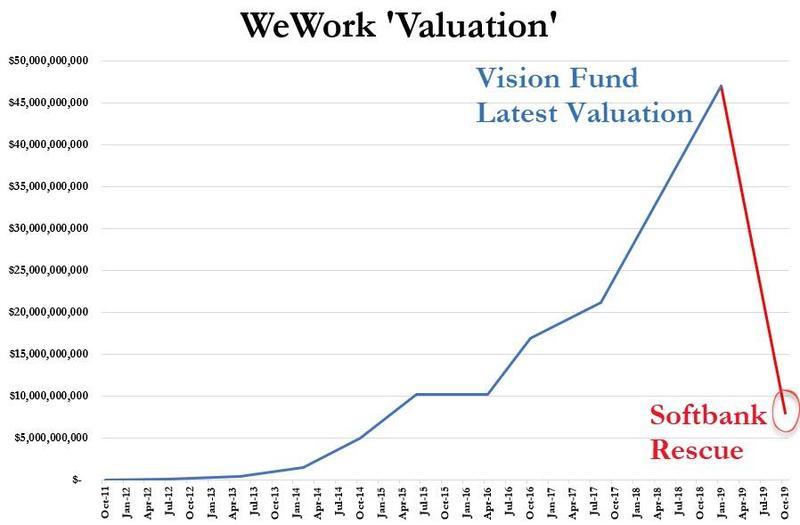

The abrupt slowdown in leasing activity comes as the WeWork’s valuation imploded last August after it shelved its IPO and ran out of cash a month later, forcing its largest investor, SoftBank, to conduct an emergency bailout to rescue the company.

With a questionable business model and no plans on turning a profit, WeWork’s valuation plunged from $47 billion in late 2018 to $8 to $10 billion by 4Q19.

In 4Q19, WeWork had to cut costs, lay off workers, and scale back operations across the world to avoid going bankrupt. In return, the company lost the top spot in the flexible office leasing space to Regus, which in 4Q19, increased lease footprint by 11% to 284,916 sq. Ft.

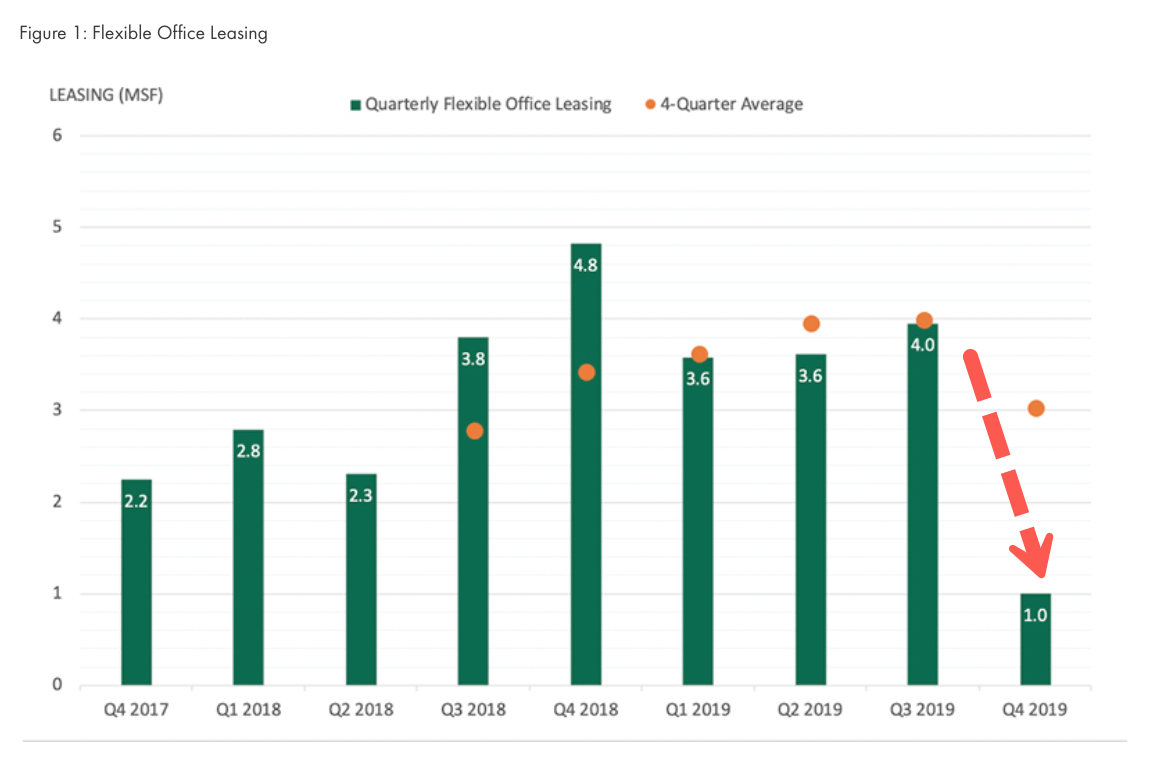

CBRE showed that industrywide, there was a significant pullback in office space leasing, mainly due to WeWork’s implosion.

Data shows office sharing operators declined to 1 million sq. Ft. in 4Q19 from 4 million sq. ft. in 3Q19.

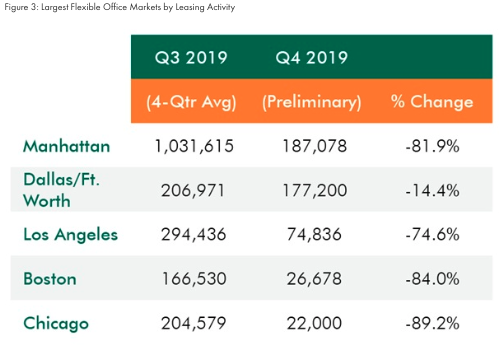

Manhattan was the top city for office sharing space, even though new space leased dropped 82% to 187,078 sq. Ft., on average, the prior four quarters. Activity in Chicago, Boston, and Los Angeles also saw notable declines over the period.

“We had seen this coming right after the IPO news,” said Julie Whelan, senior director of research at CBRE, who warned it could be a bumpy ride for WeWork and other office space sharing companies in 2020.

Tyler Durden

Fri, 01/17/2020 – 11:45

via ZeroHedge News https://ift.tt/2RpKXQR Tyler Durden