Investors Face “Grave Danger” – Wait 30 Years For Nothing Or Lose 67% Now

As the market is levitated by central bank liquidity to record high after record high despite stagnant fundamentals, one asset manager is quantifying the mass hypnosis and warns investors are in “grave danger.”

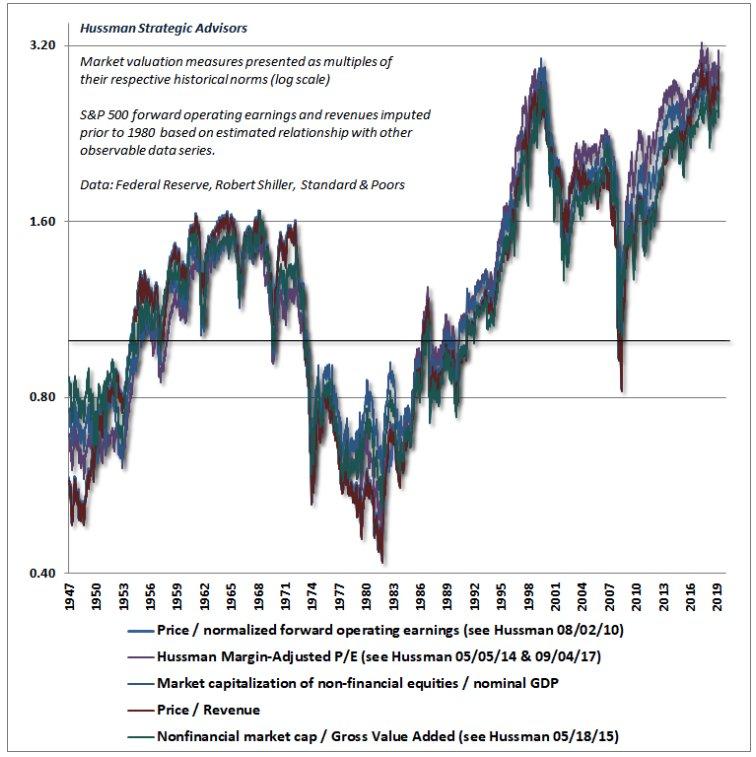

“Investors should keep in mind that market valuations stand nearly three times the historically run-of-the-mill valuation levels from which stocks have historically generated run-of-the-mill long-term returns,” says John Hussman, president of the Hussman Investment Trust, in his latest note to investors.

“In fact, the highest level of valuation ever observed at the end of any market cycle in history was in October 2002, and even that level is less than half of present valuation extremes.”

To Hussman, this indicates that there’s a wide disconnect between valuations and underlying fundamentals.

“This doesn’t mean that valuations have ‘stopped working,'” he said.

“It means that speculative psychology plays an important role over shorter segments of the market cycle, and that investors place themselves in grave danger if they assume, at points of extreme confidence, that valuations can be ignored.“

The business media is awash with asset-gatherers and commission-rakers arguing that low interest rates “justify” higher stock market valuations, but as Hussman explains

“…that’s really equivalent to saying that ‘low prospective returns in the bond market justify low prospective returns in the stock market‘… Emphatically, nothing about that argument changes the fact that elevated stock market valuations imply lower future investment returns. We also have to ask how much of a valuation premium is actually ‘justified’ by low interest rates.”

Adding that…

“It’s there that investors have inadvertently created a world of future pain for themselves.”

So just how much pain?

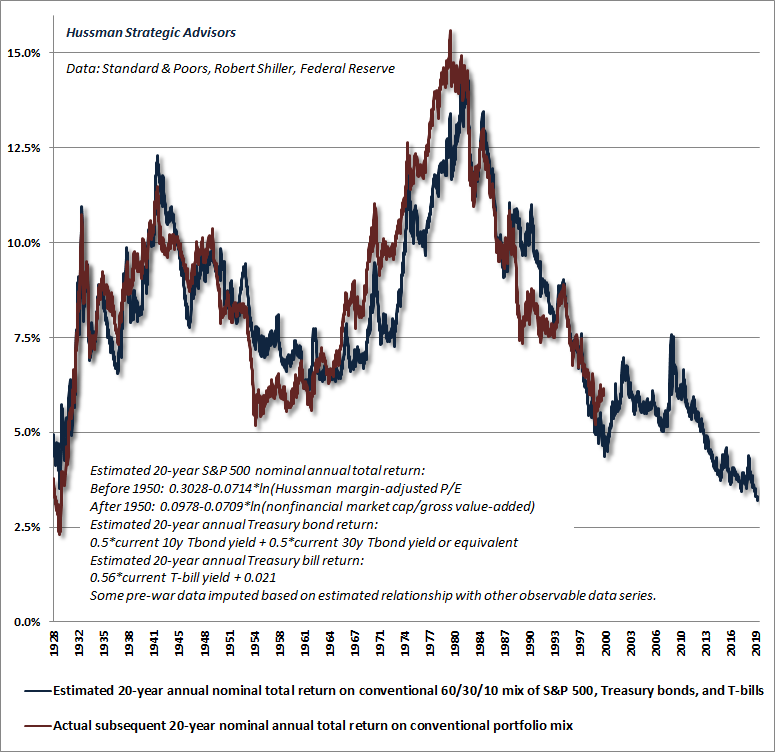

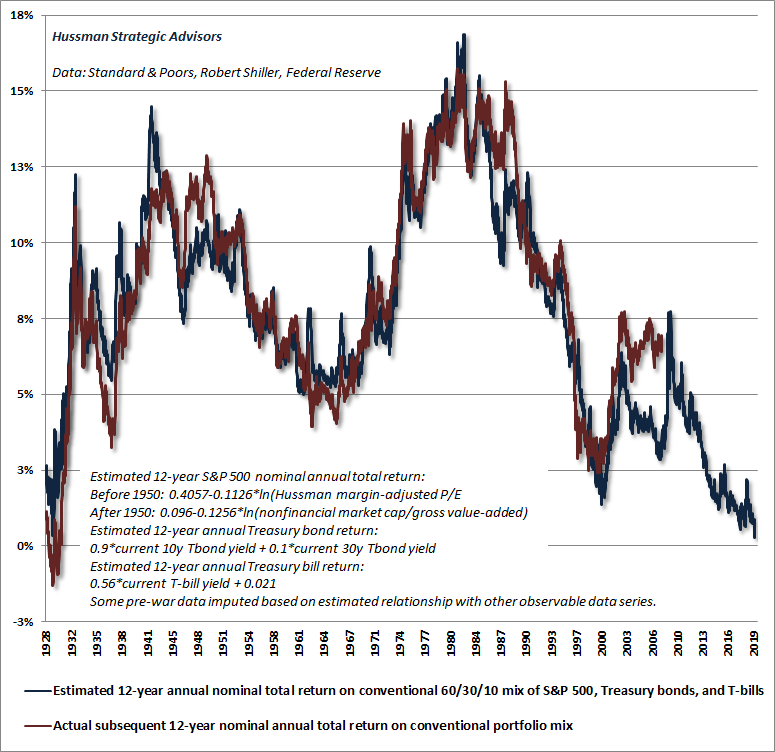

“The risks that investors face don’t care whether their investment horizon is 10 years, or 12 years, or 20 years,” he said. “The problem is that at present valuation extremes, passive investors are locking in dismal future return prospects regardless of their investment horizon.”

And so how do we get back to historically run-of-the-mill valuation norms?

The answer is simple:

“Wait nearly 30 years, allowing both the U.S. economy and U.S. corporate revenues to grow at the same rate as the past two decades, while stock prices remain unchanged, with no intervening periods of recession or investor risk-aversion, or alternatively (and far more likely), watch the S&P 500 lose two-thirds of its value over the completion of this market cycle.”

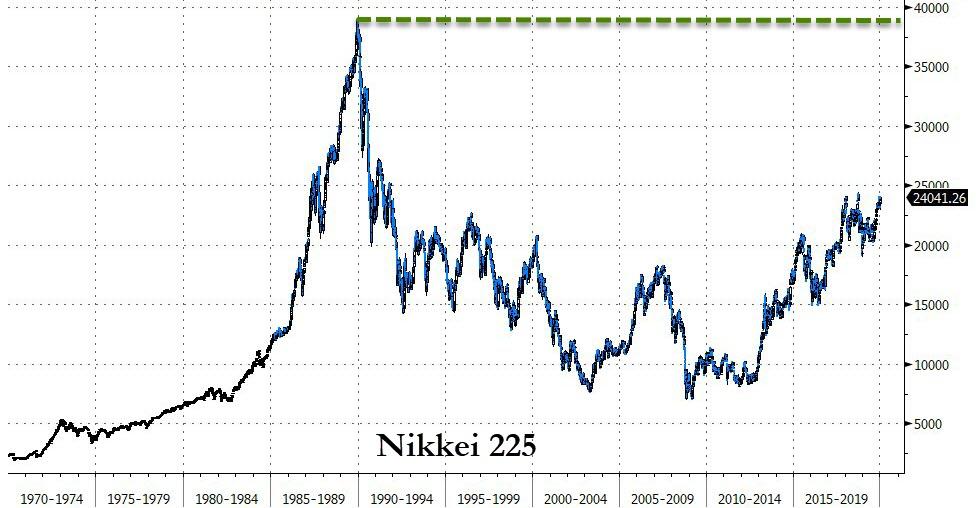

Couldn’t happen? Ask the Japanese…

Buy… and wait passively.

Presently, Hussman estimates that S&P 500 total returns will fall short of Treasury bond returns by about 2.5% annually over the coming 12-year period, which is equivalent to saying that we estimate negative total returns for the S&P 500 itself over that horizon.

Future generations, Hussman argues, seeing the collapse of this bubble in hindsight, will marvel that today’s speculative extremes were ever possible; that they were ever invited and embraced by investors.

They will look back on the entire episode, just as we look at the aftermath 1929, and 2000, and 2007, shaking their heads at the utter madness of it all.

“What QE actually did was to amplify yield-seeking speculation: in the attempt of each successive holder to get rid of their zero-interest hot potatoes, the valuations of stocks and bonds were progressively bid up until everything – all of it – is now priced at levels that promise near-zero future long-term returns. That’s exactly where we are today.”

Finally, Hussman concludes, one thing is clear: the Federal Reserve seems to have little grasp of the non-linearities involved in managing such a deranged balance sheet.

Tyler Durden

Sat, 01/18/2020 – 16:00

via ZeroHedge News https://ift.tt/2NF3Nmd Tyler Durden