Eric Peters: Peter Navarro Was Right – Tariffs Have Spurred Growth, Not Hampered It

Submitted by Eric Peters, CIO of One River Asset Management

“Conventional economic models ignore how Trump’s tariffs boost investment and national security,” wrote Peter Navarro, the President’s Director of Trade and Manufacturing Policy.

His Jan 13th WSJ opinion piece, like most things Navarro publishes, provide real insight into Trump policy/thinking. But Navarro is an annoying hothead, so most people dismiss him.

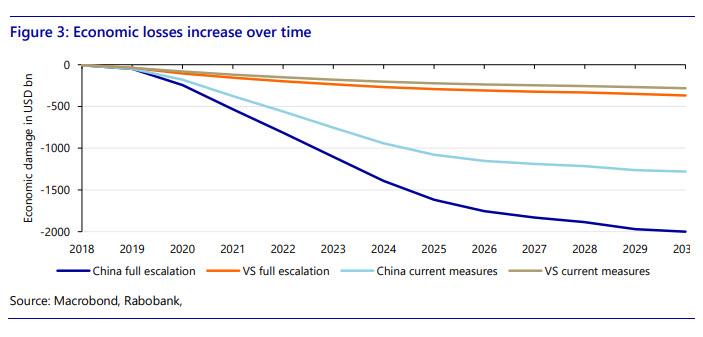

I’ve condensed his piece: “Critics of Trump’s transformational trade policies continue to insist that the tariffs are hindering rather than helping the boom. Yet with each new tariff the economy remains robust, wages continue to rise, and inflation stays muted (while the economic losses for China continue to grow).

Tariffs have spurred growth, not hampered it. Why have the gloom-and-doom forecasters been so wrong? The errors come from flaws in traditional economic models. Anti-tariff analysts typically rely on static “partial equilibrium” models. While a tariff on steel might boost employment in that industry, for example, the price of steel would rise for car makers downstream, which would then suffer lower production and fewer jobs.

Each tariff shrinks total employment, depresses wages, and increases inflation—or at least that’s how these forecasts typically go. Yet what is missing from these forecasts is a ‘general equilibrium’ analysis of tariffs, which would assess the whole economy, with a concomitant ‘dynamic scoring’ of their effects, to account for the new investment tariffs induce. Over time this tariff-induced investment, along with lower taxes and sensible deregulation, will boost growth and job creation. Higher domestic production will also help offset any price hikes from the tariffs.

Trump’s imposition of actual tariffs has made the threat of tariffs more credible, and a variety of tariff threats have borne robust results. In addition to missing the upside of supporting American industries, critics overlook the ways the US has suffered under open trade. Expanded trade with China in the 2000s contributed to the loss of tens of thousands of American factories and millions of manufacturing jobs and the hollowing out of many communities. What followed was an associated rise in the rates of divorce, drug addiction, crime, depression and death, particularly among blue-collar men no longer able to support their families at a decent wage.

The national-security externalities associated with Trump trade policy may be even more consequential. A case in point is the tariffs being used as leverage to defend America’s technological crown jewels from being forcibly transferred to Chinese companies—from artificial intelligence, robotics and autonomous vehicles to quantum computing and blockchain. These industries comprise the core of the next generation of weapons systems needed to repel threats from rivals like China, Russia and Iran.

One must ask the anti-tariff forecasters: Where are the benefits of a freer and more secure American homeland counted in your models? An honest, modern analysis of the Trump tariffs would acknowledge the widespread market distortions that currently disadvantage American workers, parse the complex ways tariffs affect trade partners’ behavior, appropriately discount short-term price impacts, and dynamically score the many long-term positive effects.

Tyler Durden

Sun, 01/19/2020 – 18:10

via ZeroHedge News https://ift.tt/37lQpLe Tyler Durden