“I’m Not An Expert On Pandemics But…”: Global Stocks Slide, Hong Kong Plunges On Coronavirus Fears

The global risk off wave that started late on Monday as the full extent of the Chinese coronavirus scare became apparent to traders, accelerated overnight and global shares took a beating on Tuesday, wiping out all gains made at the start of the week as US equity futures, Asian stocks and European equities all slumped the red.

Authorities in China confirmed that a new virus could be spread through human contact, reporting 15 medical staff had been infected and a fourth person had died. Safe-haven bonds and the yen gained as investors were reminded of the economic damage done by the SARS virus in 2002-2003, particularly given the threat of contagion as hundreds of millions travel for the Lunar New Year holidays.

“I’m not an expert in the pandemics, but you can look at previous examples like the SARS outbreak which also originated from Asia,” said Cristian Maggio, Head of Emerging Markets Strategy at TD Securities in London. Noting that China had initially downplayed the full extent of the SARS outbreak, he said “I think the market might be fearing something similar.”

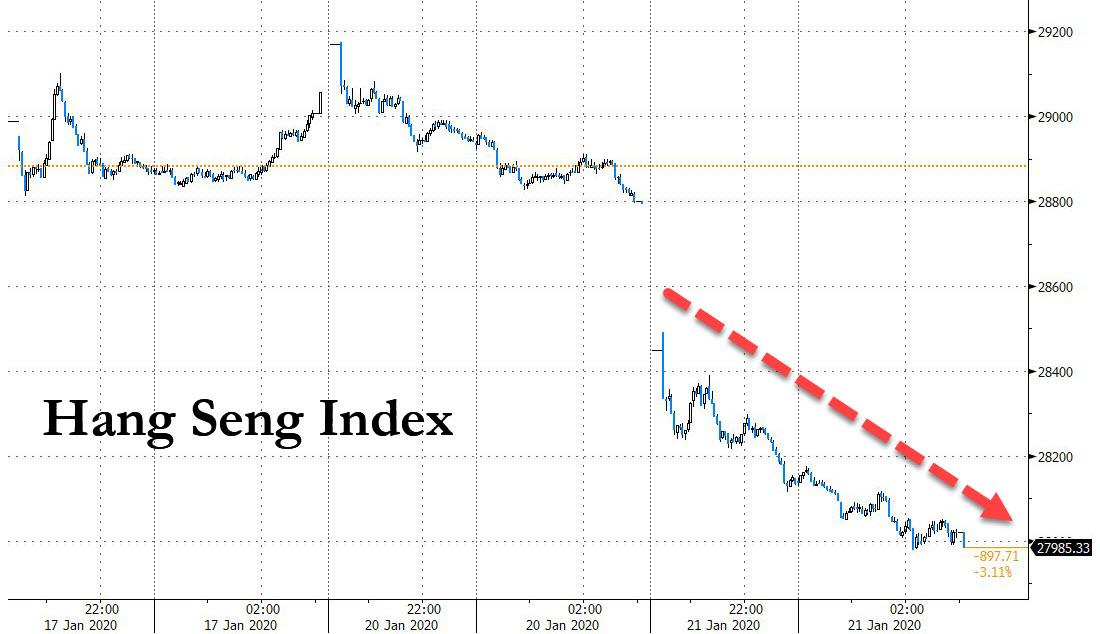

The mood swing saw MSCI’s All-Country World Index slip 0.4%, wiping out gains made at the start of the week on Monday. Asian markets were hit particularly hard, with Hong Kong – which suffered badly during the SARS outbreak – stocks tumbling 2.8% following a rating downgrade and as the coronavirus panic was seen impacting real estate, casino and car stocks, and with Chinese New Year coming up the situation could get even worse. Indeed, the coronavirus outbreak from central China entered a new phase of severity as multiple medical workers were reported to have been infected. Four people have died.

For those who are still unfamiliar, an unknown virus started small in Wuhan, China, back in mid-December 2019 with the Chinese health authorities later saying that the virus was related to SARS. Initial expectations were muted and human-to-human transmission was not presumed, but yesterday Chinese authorities announced that human-to-human transmission had taken place between patient and health worker. In addition the number of infected people was on rise. The reaction function has been prompt with Hang Seng futures down 2.8% in today’s session led by real estate, casino and car stocks. While we don’t know the direction in equities from here related to the coronavirus, Rabobank’s Peter Garnry notes that there are many unknowns and that the initial reaction often fails to discount the true extent and warns that “short-term this could get much worse for Asian equities as the Chinese New Year means that millions of people will be traveling potentially spreading the virus fast over large areas.”

【令人恐惧的一句话】我刚从武汉回来!🙏🙏 pic.twitter.com/Zc94TlIySr

— 一叶一追寻 (@RaynardToddnay1) January 20, 2020

Markets, which for weeks ignored any geopolitical developments, were duly “shocked” to catch up to the newsflow out of China, and Asian stocks extended declines as risk-off sentiment dominated amid worries about China’s spreading coronavirus. The MSCI Asia Pacific Index dropped the most in two weeks, with three-fourths of its stocks trading in the red. As noted above, Hong Kong was the worst-performing market in the region, as its benchmark Hang Seng Index posted its worst decline in five months. Elsewhere, the Shanghai Composite Index sank the most since November, and Japan’s Topix completely erased Monday’s advance. “Safe-haven and defensive sectors might outperform the riskier assets in the days to come,” said Margaret Yang Yan, a market analyst at CMC Markets Singapore Pte. “Consumer discretionary, hospitality, retail, aviation and entertainment sectors are likely to suffer from a reduced number of social activities and outings.”

The chill in Asia carried over to European markets, where shares of luxury goods makers – which have large exposure to China – were among the biggest fallers. The French CAC 40 lagged peers, as luxury names weigh amid ongoing concern that the China virus will disrupt travel and spending. Sector-wise, mining stocks, household and personal goods, oil and banking names lead losses, with all Eurostoxx 600 sectors posting declines. Despite an initial dip, haven assets continue to be sought after.

Among the viral din, markets ignored the best German ZEW Economic Sentiment print in almost five years, since 2015, which ironically enough was just 5 months after the worst ZEW print in 8 years.

As stocks slumped, risk havens were in demand, and 10Y yields dropped below 1.80% again, while Germany’s 10-year government bond yield touched one-week lows. Bund, Treasury and Gilt curves all bull flattened and peripheral spreads widened to core with Italy the weakest link.

Investors had already been guarded after the International Monetary Fund trimmed its global growth forecasts, mostly due to a surprisingly sharp slowdown in India and other emerging markets, although there was some relief as U.S. President Donald Trump and French President Emmanuel Macron seemed to have struck a truce over a proposed digital tax. The two agreed to hold off on a potential tariffs war until the end of the year.

Trump also spoke at the World Economic Forum in Davos on Tuesday, with trade and tariffs on the agenda among more self-congratulatory remarks. In a tweet late on Monday, Trump said he would be bringing “additional Hundreds of Billions of Dollars back to the United States of America! We are now NUMBER ONE in the Universe, by FAR!!”

Also overnight the Bank of Japan issued its latest policy statement, which modestly lifted forecasts for economic growth. As widely expected, the BOJ maintained its short-term interest rate target at -0.1% and a pledge to guide 10-year government bond yields around 0%, by a 7-2 vote. Japan’s yen picked up a bid on the safe-haven move and the dollar dipped to 109.93 from an early 110.17. It also gained on the euro, leaving the single currency lower to the dollar at $1.1090.

Elsewhere in FX, the dollar rose alongside haven bids and the yuan dropped as investors assessed the implications of a deadly virus in China ahead of the Lunar New Year holidays. AUD was the weakest on the G-10 scoreboard, AUDUSD finding support around its 100DMA as the Australian dollar took a knock from the flu worries since it attracts large numbers of Chinese tourists, who tend to be big spenders over the Lunar New Year holidays. Australia said it would step up screening of some flights from Wuhan. The Chinese yuan, predictably, tumbled and suffered one of its worst sessions since August as USDCNH rose as high as 6.9128.

In commodities, spot gold hit a 2-week high of $1,568.35 per ounce, but traded 0.2% lower in early deals in London. Oil prices slid nearly 1%, having earlier gained on the risk of supply disruption in Libya.Brent crude futures fell 1% to $64.60 a barrel, while U.S. crude fell 0.92% to $58.09 a barrel.

To the day ahead now which is a quiet one for data, with no releases of note in the US; earnings highlights include Netflix, IBM, Halliburton, United Airlines and UBS.

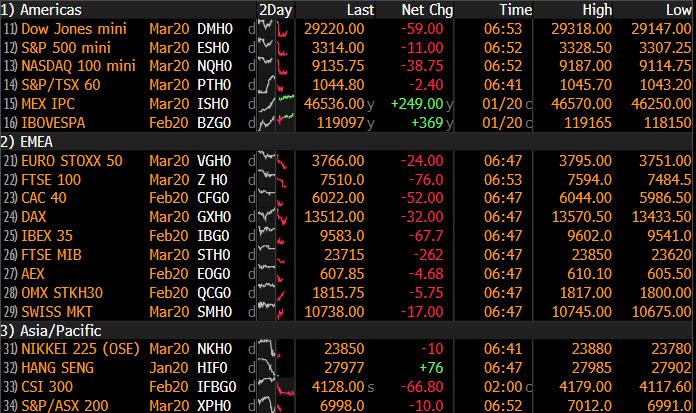

Market Snapshot

- S&P 500 futures down 0.4% to 3,311.75

- STOXX Europe 600 down 0.7% to 421.08

- MXAP down 1% to 172.70

- MXAPJ down 1.4% to 563.53

- Nikkei down 0.9% to 23,864.56

- Topix down 0.5% to 1,734.97

- Hang Seng Index down 2.8% to 27,985.33

- Shanghai Composite down 1.4% to 3,052.14

- Sensex down 0.4% to 41,367.74

- Australia S&P/ASX 200 down 0.2% to 7,066.35

- Kospi down 1% to 2,239.69

- German 10Y yield fell 1.6 bps to -0.234%

- Euro down 0.06% to $1.1088

- Italian 10Y yield fell 2.2 bps to 1.184%

- Spanish 10Y yield fell 2.1 bps to 0.424%

- Brent futures down 1.2% to $64.41/bbl

- Gold spot down 0.3% to $1,555.85

- U.S. Dollar Index little changed at 97.62

Top Overnight News from Bloomberg

- Six people have died in China’s virus outbreak and more than 200 have been infected, including fifteen medical professionals. Health-care workers contracting the illness indicates that it is more easily transmitted than previously thought. That puts the disease — part of the coronavirus family — on a higher risk level, reminiscent of the Severe Acute Respiratory Syndrome, or SARS, pandemic in Asia 17 years ago that killed 800 people.

- Reports from BOE agents — a cross-country network that holds confidential conversations with businesses and community organizations — could be key for officials trying to judge whether economic sentiment has rebounded since December’s general election

- The Bank of Japan left rates unchanged Tuesday and painted a brighter picture of the economic outlook, offering a further indication that the likelihood of additional stimulus has receded

- Presidents Emmanuel Macron and Donald Trump agreed to a truce in their dispute over digital taxes that will mean neither France nor the U.S. will impose punitive tariffs this year, a French diplomat said

- The International Monetary Fund predicted the world economy will strengthen in 2020, albeit at a slightly weaker pace than previously anticipated amid threats related to trade and tensions in the Middle East

- Oil edged lower as plentiful global supplies offset the loss of exports from Libya, while Europe considered a military mission to help enforce an arms embargo and a potential cease-fire in the OPEC producer

- Senate Majority Leader Mitch McConnell plans to give House impeachment managers just two days to prosecute their case against President Donald Trump — a move that accelerates the timetable for a trial Republicans intend to end in a quick acquittal

- A panel of the Italian Senate voted to allow the start of prosecution of League party chief Matteo Salvini for refusing to allow stranded migrants to dock when he was interior minister, Ansa news agency reported

- President Vladimir Putin is likely to demote the man seen as the architect of the tight-budget policies that have made Russian bonds an investor favorite, fueling fears the Kremlin is planning a spending spree

Asian equity markets weakened across the board following a non-existent handover from their peers on Wall St, while further reports of coronavirus cases added to the subdued tone. ASX 200 (-0.2%) pulled back from record highs amid broad sector weakness and with BHP pressured after quarterly iron ore production fell short of analyst estimates, while Nikkei 225 (-0.9%) retreated below 24k as Japanese exporters suffered from safe-haven flows into the domestic currency. Elsewhere, Hang Seng (-2.8%) and Shanghai Comp. (-1.4%) also declined with the former reeling after Moody’s downgraded Hong Kong’s sovereign rating by 1 notch to Aa3, and amid heightened concerns surrounding the ongoing coronavirus outbreak which has spread to more Chinese cities with 224 cases confirmed so far resulting to 4 deaths. Finally, 10yr JGBs rose back above the 152.00 level as the risk averse tone spurred similar strength in T-notes, while prices largely ignored the BoJ policy announcement in which the central bank kept all policy settings unchanged as widely expected and reaffirmed its forward guidance but suggested that overseas risks somewhat eased.

Top Asian News

- BOJ Raises Growth Forecast, Maintains Key Policy Settings

- China Sentences Ex-Interpol Chief Meng to 13.5 Years in Prison

- Saudi Arabia Returns to Eurobond Market as Gulf Tensions Ease

- Toshiba Machine Vows to Battle Activist With Poison Pill

European equities post losses across the board [Eurostoxx 50 -0.8%] following on from a similar APAC lead, with subdued sentiment also attributed to the ramifications of the spreading coronavirus, with Taiwan now the latest country to report its first case. UK’s FTSE 100 (-1.2%) lags its peers amid unfavourable currency effects induced by the UK Labour Market Report. Meanwhile, the SMI’s losses are somewhat cushioned by earnings from Lonza (+4.0%) – providing some support to the Swiss healthcare names which in total accounts for 37.5% of the index. Sectors are all in the red with defensives lower to a lesser extent when compared to cyclicals. Consumer discretionary names are hit on the back of dampening demand expectations on the back of the China virus outbreak, with LVMH (-2.7%), Kering (-3.7%), Swatch (-2.5%) and Richemont (-3.4%) among the worst hit. In terms of other individual movers, UBS (-5.0%) shares fell despite topping net expectations and announcing a share buyback alongside a sale of its stake in UBS Fondcenter – amid lower 2022 CET1– forecast at 12-15%, down from 2021’s 17%. On the flip side, Hugo Boss (+5.6%) shares rose to the top of the Stoxx 600 after earnings topped forecasts, with the company noting that FY19 targets were achieved.

Top European News

- Lagarde Prepares to Modernize ECB With a Plan for the 2020s

- BP’s New Generation Takes Control as CFO Announces Retirement

- U.K.’s Javid Says He Wants Comprehensive EU Free-Trade Agreement

- EU Financial Tax Faces New Trouble as Austria Threatens to Quit

In FX, GBP/JPY/EUR/CHF – The Pound has regained some poise thanks to the latest UK jobs and earnings report that beat consensus almost across the board and came with a healthy revision to the previous claimant count in contrast to the recent run of sub-forecast/BoE rate cut supportive macro releases. Cable has reclaimed 1.3000+ status after flirting with 1.2955 early January lows only yesterday and Eur/Gbp is eyeing 0.8500 from 0.8550+ at one stage on Monday, even though the Euro has also gleaned some traction via an encouraging German/Eurozone ZEW survey to retest 1.1100 and offers above vs the Dollar. Meanwhile, the Yen is back in favour and over 110.00 after another dead rubber BoJ policy meeting as the YUAN pares more gains amidst the spread of China’s coronavirus that has claimed more lives and reached Australia, with safe-haven demand also returning to the Franc within a 0.9668-89 range.

- AUD/CAD/NZD/NOK – All weaker against their US counterpart, and especially the Aussie given closer links to China and the reported case of the potentially fatal illness in Brisbane noted above. Aud/Usd has retreated further towards sub-0.6850 troughs not seen since mid-December (0.6849 and 0.6838) and is only just holding above the 100 DMA (0.6844) ahead of Thursday’s labour data that forms one of the last major inputs for the RBA next month. Similarly, the Loonie and Kiwi are trading defensively into Canadian manufacturing sales and the NZ GDT auction, with the latter also wary about Q4 CPI in 2 days time and its implications for the RBNZ in February. Usd/Cad is meandering between 1.3044-77, as Nzd/Usd straddles 0.6600 and Aud/Nzd slips back below 1.0400. Elsewhere, the Norwegian Crown is underperforming against the backdrop of receding oil prices and pre-Norges Bank caution in wake of a marked downturn in industrial sentiment, with Eur/Nok up above 9.9400 at the peak and through decent 9.9300 option expiry interest (680 mn).

- USD – The DXY has drifted back down from MLK day peaks largely due to the aforementioned recoveries in G10 currency peers, like Sterling and the Euro on positive fundamentals and the Yen and Franc due to risk-off positioning/hedging. The index is pivoting 97.500 after peering above key chart levels yesterday, but not sustaining bullish momentum.

- EM – Although the Greenback has conceded ground to several major rivals, risk aversion is keeping regional currencies suppressed, with the Rand extending declines towards it 200 DMA (14.6000) before clawing back amidst more SAA flight cancellations to cut costs, while the Lira fell below 5.9300 after remarks from Turkey’s Economy Minister expressing a desire for a more competitive Try.

In commodities, commodities are lower on the day, with the energy market dampened more-so on sentiment – with the outbreak of the coronavirus playing a part. Brent Mar’20 futures reside just under USD 64.50/bbl, having taken out its 50 DMA at ~USD 64.50/bbl ahead of the 200 DMA at USD 64/bbl. Meanwhile, WTI front-month futures dipped below the USD 58/bbl mark with eyes on its 200 DMA at USD 57.60/bbl and 100 DMA at USD 57.25/bbl. Elsewhere, spot gold gravitates back to 1550/oz as a firmer USD weighs on the precious metal. Finally, base metals declined amid the aforementioned negative sentiment – with copper prices diving from around USD 2.8350/lb to sub-2.80/lb levels.

US Event Calendar

- Nothing major scheduled

DB’s Jim Ried, live from Davos, concludes the overnight wrap

Morning from Davos and the highest city in Europe. The good news is that the sun has been shining and that my apartment is right next to the golf course. So after I press send this morning I’ll be off to play a quick 9 before breakfast. Oh… just been told it’s under 2 meters of snow. Shame! A reminder that DB will be talking all things growth related (especially the side effects and the need for sustainability) here at Davos and our piece we published ahead of this can be found here.

In terms of what’s on in Davos today, the highlight will be an early address from Mr Trump (11am CET) which will no doubt attract plenty of headlines. Apparently for security, snippers are on the rooftop so I’ll be wearing my bullet proof bobble hat. Away from Mr Trump, Greta Thunberg’s lunchtime panel will attract interest. Later BoE Governor Carney will be speaking on a panel which may also be interesting ahead of a delicate interest rate decision next week and the U.K. leaving the EU a few days later. He is going to be the climate finance adviser to the U.K. government ahead of the COP 26 summit in Glasgow in November so he may have things to say on that, especially given the focus in Davos this year.

Ahead of the shindig, the Bank of International Settlements published an interesting paper saying that climate change threatens to provoke “green swan” events that could trigger a systemic financial crisis unless authorities act against such risks. The paper said that “traditional approaches to risk management consisting of extrapolating historical data and on assumptions of normal distributions are largely irrelevant to assess future climate-related risks” while adding that green swans are different from black swans because there is some certainty that climate change risks will one day materialise, which could endanger humanity more than financial crises, and they threaten even more complex and unpredictable chain reactions. Whether you agree with this or not such reports and views are only going to grow over time. As we said last week, this will be the topic of our age. Meanwhile, the Bank of France Governor Francois Villeroy de Galhau said in an introduction to the paper that “in order to navigate these troubled waters, more holistic perspectives become essential,” and advocated two solutions which the ECB could discuss in its upcoming strategy review: integrating climate change in all economic and forecasting models, and overhauling the collateral framework to reflect climate-related risks. The ECB President Lagarde is expected to announce the strategic policy review of monetary policy at its meeting on Thursday.

Also ahead of Davos the IMF trimmed its global growth forecast for 2020 to 3.3% versus a forecast of 3.4% made back in October. It also cut the 2021 forecast from 3.6% to 3.4% although both forecasts would mark an improvement on the 2.9% growth achieved last year. The report did highlight that risks are now “less skewed” but the list of downside risks still includes geopolitical tensions, most notably between the US and Iran, as well as intensifying social unrest, trade relations worsening and deepening economic frictions.

A rare 2020 risk off move is dominating Asia this morning with equities down while gold (+0.34%) and the Japanese yen (+0.19%) are up. The Nikkei (-0.87%), Hang Seng (-2.30%), Shanghai Comp (-1.11%) and Kospi (-0.91%) are all lower. Impacting sentiment is the outbreak of a deadly virus which originated in central China and entered a new phase of severity as evidence has shown that it can be transmitted by humans. Also, as the Lunar New Year holidays approach there is a growing concern amongst market participants that China won’t be able to control the spread of the virus as its citizen travel within and outside the country. There are already 217 confirmed cases of the coronavirus in China with 7 more suspected. Additional cases have already been detected in Japan and Thailand. In addition, the Hang Seng is leading the declines as Moody’s downgraded the country’s long term rating by one notch to Aa3 from Aa2, with a “stable” outlook citing that “The absence of tangible plans to address either the political or economic and social concerns of the Hong Kong population that have come to the fore in the past nine months may reflect weaker inherent institutional capacity than Moody’s had previously assessed.” As for Fx, the onshore Chinese yuan is down -0.37% to 6.8925 and briefly went over the 6.9 mark. Elsewhere, futures on the S&P 500 are down -0.40% after yesterday’s holiday and yields on 10y USTs are down -2.9bps this morning.

This morning we’ve also had the BoJ meeting where the central bank kept its monetary policy toolkit unchanged and raised the growth projections for FY 2020 (+0.9% yoy from +0.7% yoy earlier) and FY 2021 (+1.1% yoy from +1.0% yoy) on the back of the government’s earlier announced stimulus. Meanwhile the inflation projections for both FY 2020 and FY 2021 were revised down by one tenth to +1.0% yoy and +1.4% yoy respectively. On risks, the BoJ said that even as overseas risks have reduced somewhat they still remain significant and reaffirmed that it wouldn’t hesitate to take additional easing action if risks increased.

With US markets shut, yesterday was always likely to be a bit of slow moving day. The majority of European equity markets posted small losses on well below average volumes, with the STOXX 600 in particular ending -0.14%. The CAC (-0.36%), IBEX (-0.23%) and FTSE MIB (-0.57%) also closed lower although the DAX (+0.17%) did manage to stay onside, just. The FTSE 100 also retreated -0.30% as Sterling hovered just below $1.30 following Chancellor Javid’s comments over the weekend that the U.K. would not seek alignment with the EU in many areas. Bond markets weren’t much more exciting with yields a shade lower. Indeed 10y Bunds ended at -0.221% and -0.4bps on the day. Yields have essentially moved sideways for four days now. Credit was also slightly weaker – iTraxx Crossover 1bp wider – while in commodities Oil swung around with Brent crude touching as high as $66.00/bbl overnight before dropping back towards $65.00/bbl during the European session. This morning it’s down -0.51% to $64.87.

In other news, the French and the US agreed a ceasefire over digital taxation and neither side will impose tariffs on each other this year as a result. Another Trump agreement that will take us past the 2020 election. Maybe this will continue to be a theme where he postpones battles and is interesting in light on the ongoing US/EU trade tensions. On tax the hope will be that the OECD can come up with a global solution to the global taxation issue. This will be an interesting story this year.

Finally, it’s worth highlighting that at a company level yesterday CNBC reported that Boeing had secured borrowing of at least $6bn from banks and is in further talks about borrowing $10bn in total. This of course follows two fatal 737 Max crashes and very weak orders data last week which was the worst in decades. The stock price has also failed to get a bump from the US/China trade deal having declined another -1.75% last week.

To the day ahead now which is a quiet one for data. With no releases of note in the US the focus will be firstly on the November and December labour market data in the UK. With the market increasingly pricing in a BoE rate cut, the consensus expects no change in the unemployment rate of 3.8% and earnings to dip to 3.4%. Following that we’ll get the January ZEW survey in Germany which is expected to show further improvement. Finally, earnings highlights include Netflix, IBM and UBS.

Tyler Durden

Tue, 01/21/2020 – 07:45

via ZeroHedge News https://ift.tt/3az6TlA Tyler Durden