Futures Hit Record High On Optimism That “Corona Is Contained”

Just yesterday we predicted that it is only a matter of time before we get a headline like “stocks surge on optimism China epidemic is contained”

You know it’s coming:

“Stocks surge on optimism China epidemic is contained”— zerohedge (@zerohedge) January 21, 2020

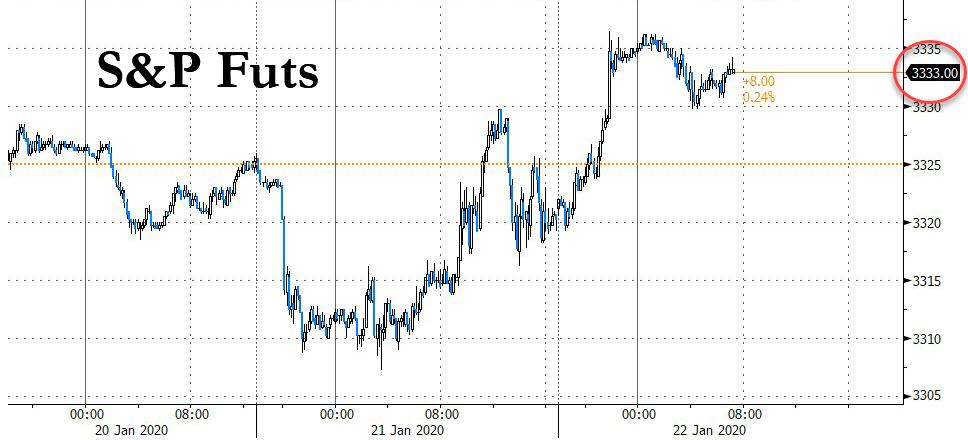

And sure enough, less than 24 hours later, in an attempt to explain the return of overnight market euphoria Reuters writes that “world stock markets looked to be getting back to full strength on Wednesday, as updates from China about the spread of a new flu-like coronavirus raised hopes the outbreak would be contained” and Bloomberg doubled-down that “U.S. equity-index futures gained on Wednesday as China took steps to contain the spread of a deadly virus”, which is ironic since just moments ago China’s CCTV reported that there are now 473 confirmed Coronavirus cases in China, with many cases now observed internationally, and most recently, a Coronavirus case were confirmed in Hong Kong as the epidemic spreads. And yet, after dropping by 9 points yesterday, S&P futures have more than made up those losses and are up 14 points as of Wednesday morning.

China’s National Health Commission said on Wednesday there were 440 cases of the new virus, with nine deaths so far, and added that measures are now in place to minimize public gatherings in the most-affected regions. How one can prevent people from gathering in China, the world’s most congested nation, remains unclear. Meanwhile, the outbreak has spread from its origin in Wuhan, China, to the United States, Thailand, South Korea, Japan and Taiwan. The World Health Organization meets later on Wednesday to consider whether the outbreak is an international emergency.

In other words, despite what a handful of algos would like to telegraph, the Coronavirus is anything but contained, with the outbreak reviving memories of the SARS epidemic in 2002-03, a coronavirus outbreak that killed nearly 800 people. And the punchline: according to Reuters, “this time China’s response and candour — in contrast to the SARS epidemic — have helped reassure investors concerned about the possible global fallout.” Actually, the “response and candour” confirm, if anything, that China is panicking, but as usual the market is never wrong, until it is.

“The call here is not that the virus is done or nipped in the bud by any means,” said Kay Van-Petersen, global macro strategist at Saxo Capital Markets. “But there have been no big further reported outbreaks, and the response from the Chinese authorities has been very, very positive”.

“I would expect a lot of people – candidly, like we are – that are looking for opportunities to buy rather than sell” amid the dip in stocks caused by virus-contagion worries, Lamar Ville re, partner and portfolio manager at Villere & Co., said on Bloomberg TV. “I don’t think this is going to be the beginning of the end.”

Because one obviously “buys rather then sells” when stocks are trading at never before seen highs.

In any case, optimism that “Corona is Contained” helped European stocks in London, Frankfurt and Paris score early gains of 0.1% to 0.2%. European equities first erased initial gains to mirror whiplash price action for stocks in Asia, where early losses reversed after Beijing outlined measures to contain the outbreak of the Wuhan coronavirus, however it has since rebounded again.

Earlier in the session, Asian stocks resumed their climb, rebounding from the last session led by consumer-staples and technology companies. The benchmark stock gauge recovered about half of Tuesday’s losses, with most markets in the region gaining. Shares in Hong Kong also rebounded, with technology stocks and insurers boosting the Hang Seng Index. Chinese shares erased losses after Beijing said it will start a nationwide screening effort to tackle the outbreak.

MSCI’s airline industry index .posted its biggest daily drop in more than three months on Tuesday. Airline shares were still falling on Wednesday.

“While details on the coronavirus are scant, we reckon that the SARS period could offer some clues as to how markets could pan out,” analysts at Singapore’s DBS Bank said. “The trends are clear: Yields and stock prices fell in the first few months of the SARS outbreak and rebounded thereafter.”

And yes, the return of Fed-backstopped euphoria means a new record high in the US too where S&P 500 futures just hit a new all time high, reaching Michael Hartnett’s target of 3,333 more than one month ahead of schedule (March 3).

In rates, US 10Y Treasurys were unchanged with the yield on U.S. 10-year government bonds stabilizing after Tuesday’s drop, sitting at 1.78% US10YT=RR in European trading. Core European and U.K. bond yields are also little changed across most of the curves. Italian government bond yields rose as much as 8 basis points on reports the leader of the country’s 5-Star party and foreign minister, Luigi Di Maio, will step down, however they recovered all losses after it was confirmed that he is indeed stepping down. It was the biggest, if brief, sell-off in a month and raised the risk of another snap election in Europe’s fourth-largest economy, since 5-Star is part of Italy’s coalition government.

“The initial reaction was to sell because of the heightened political uncertainty,” said Luca Cazzulani, a strategist at UniCredit in Milan. “But there is no outright link between de Maio’s resignation and a collapse of the government.”

In FX, with markets generally rising, safe plays such as gold and the Japanese yen were weaker. The dollar was rising toward the highs it reached in December against the other top world currencies. The yen dipped after gaining Tuesday on news of the contagion and potential disruption to spending during China’s week-long Lunar New Year. The yuan steadied, after tumbling the most in almost five months Tuesday in onshore trading.

In commodities, gold gave back some gains to trade at $1,555 per ounce; West Texas Intermediate crude fell 0.7% to $58 a barrel and natural gas gained 1% to $1.91 per mmbtu.

Expected data include mortgage applications and existing home sales. Abbott, J&J and Prologis are among companies reporting earnings

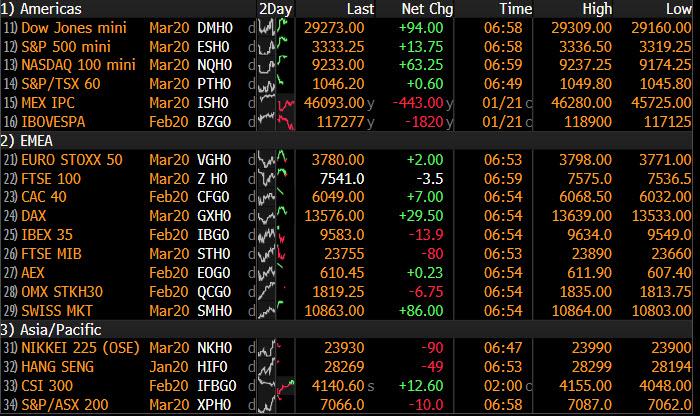

Market Snapshot

- S&P 500 futures up 0.4% to 3,332.25

- STOXX Europe 600 down 0.04% to 423.20

- MXAP up 0.6% to 173.55

- MXAPJ up 0.7% to 566.22

- Nikkei up 0.7% to 24,031.35

- Topix up 0.5% to 1,744.13

- Hang Seng Index up 1.3% to 28,341.04

- Shanghai Composite up 0.3% to 3,060.75

- Sensex down 0.4% to 41,143.43

- Australia S&P/ASX 200 up 0.9% to 7,132.73

- Kospi up 1.2% to 2,267.25

- German 10Y yield rose 0.3 bps to -0.245%

- Euro up 0.08% to $1.1091

- Italian 10Y yield rose 1.7 bps to 1.201%

- Spanish 10Y yield rose 1.0 bps to 0.433%

- Brent futures down 0.7% to $64.17/bbl

- Gold spot little changed at $1,558.10

- U.S. Dollar Index little changed at 97.56

Top Overnight News from Bloomberg

- Chinese officials stepped up monitoring of transportation links in China and ordered a nearly complete shutdown of the city of Wuhan where the virus originated, as the death toll increased to nine

- President Trump tells CNBC in interview from Davos that “I want this dollar to be strong. I want it to be so powerful. I want it to be great. But if you lower the interest rates, so many good things would happen,” he says, according to transcript provided by the network

- U.S. Treasury Secretary Steven Mnuchin said there are no deadlines to start talks on a phase-two agreement, during a panel discussion at the World Economic Forum in Davos, Switzerland

- The Federal Reserve averted a year-end liquidity crunch by pumping $256 billion into repurchase markets. The consequences are now rippling across the globe as Japanese bonds have become less attractive to U.S.-based investors, while yen-funded investors now find European bonds and U.S. credit more alluring

- Xavier Rolet is stepping down as chief executive officer of billionaire Michael Hintze’s hedge fund firm, just a year after taking the role. Rolet is leaving for “reasons unconnected with CQS,” according to an emailed statement from the hedge fund.

- Former UBS Group AG trader Kweku Adoboli fought to avoid deportation from the U.K. to the nation of his birth after his conviction for a $2.3 billion loss at the Swiss bank. Now, he is seeking a comeback in Ghana with a plan to kick-start its mortgage-backed bond market

- Malaysia’s central bank unexpectedly cut its benchmark interest rate Wednesday, the latest emerging market to ease monetary policy amid an uncertain global economy.

Asian equity markets gradually improved and shrugged off the lacklustre lead from Wall St, where all major indices snapped their streak of record closes amid jitters related to the coronavirus with 440 cases reported in China and the death toll now at 9, while the CDC also confirmed the first case of the virus in the US. Nonetheless, ASX 200 (+0.9%) and Nikkei 225 (+0.7%) managed to rebound from opening weakness as outperformance in Consumer Staples, Tech and Healthcare underpinned the Australian benchmark to a fresh all-time high, while Tokyo sentiment was mainly driven by currency moves but with weakness seen in some automakers including Mitsubishi Motors after several of its locations were raided in Germany on suspicion of using emission cheating devices. KOSPI (+1.2%) gained with Hyundai Motor boosted amid earnings despite missing expectations on Q4 net as it still showed a turnaround from the loss Y/Y and both its operating profit and revenue topped forecasts. Elsewhere, Hang Seng (+1.3%) nursed some of the prior day’s near-3% losses and Shanghai Comp. (+0.3%) eventually joined in on the recovery after it initially slipped to its lowest levels so far this year due to the ongoing outbreak fears and after experts suggested the possibility of a mutation in the coronavirus. Finally, 10yr JGBs were indecisive amid a pullback in T-notes which retraced some of the prior day’s advances after hitting resistance around 129.20 and with prices also failing to benefit despite slightly firmer demand at the enhanced-liquidity auction for longer dated JGBs.

Top Asian News

- India’s Painful Double Whammy Grips More Emerging Markets

- Malaysia Follows Turkey, South Africa With Interest Rate Cut

- Tencent Offers 27% Premium to Take Over Game Maker Funcom

A choppy session for European stocks thus far [EuroStoxx 50 -0.2%], with a mixed performance across regional bourses and following on from a mostly positive APAC handover. Italy’s FTSE MIB (-0.6%) lags its peers with the Italian Banking Index hitting 6-week lows – on the back of Di Maio’s resignation as the Italian 5SM leader. On the other end of the spectrum, SMI (+0.6%) outperforms with almost all of its stocks in positive territory. Sectors are mixed with no clear reflection of the overall market sentiment. In terms of individual movers, Airbus (+1.7%) shares are supported after a source noted that Boeing doesn’t expect regulators to sign off on the 737 Max until June or July, months later than the manufacturer previously expected. Traders also attribute the losses in Tui (-4.3%) to the Boeing news. Elsewhere, Daimler (-1.7%) reversed opening gains on the back of another profit warning in which it expects FY19 results to be below forecasts, with the return on sales of Mercedes-Benz vans also forecast below prior guidance. Meanwhile, ASML (-1.2%) shrugged off a mostly in-line earnings report and a EUR 6bln share buy-back programme, potentially on concerns that the Co. may not completed this programme given that the FY19 share buy-back was incomplete.

Top European News

- Rolet to Step Down as CEO of Billionaire Hintze’s Hedge Fund CQS

- U.K. Government Spending Soars as Austerity Continues to Thaw

- ECB Hits Fifth Anniversary of QE Still Puzzled by Inflation Gap

- Greece’s Lawmakers Elect Country’s First Woman Head of State

In FX, although safe-haven flows are unwinding amidst less acute concern about China’s coronavirus and knock-on effects, partly due to Chinese efforts to contain the spread and extent of contamination, the scale of Swiss Franc declines suggest that something else is afoot. Indeed, Usd/Chf has rebounded firmly above 0.9700 to around 0.9730 and Eur/Chf is hovering nearer a circa 1.0790 peak vs 1.0735 trough even though the single currency has retreated further from 1.1100+ highs vs the Dollar towards key technical support (100 DMA at 1.1070) and recent lows (1.1066 from December 20). Eur/Usd has been undermined to a degree by renewed Italian political instability awaiting an official 5-Star Movement announcement that is expected to confirm the resignation of leader Di Maio and leave one of the coalition Government parties without a head. No evidence to support the theory until next Monday’s weekly Swiss sight deposit statement, but perhaps the Franc has been sold in advance of anticipated FTQ positioning?

- JPY/NZD/AUD/GBP/CAD – The Yen has also conceded some ground on renewed risk appetite premises, but holding close to 110.00 against the Greenback, while the Aussie and Kiwi remain depressed below 0.6600 and 0.6850 respectively as the clock ticks down to Thursday’s major Antipodean data points in the form of CPI and jobs. Elsewhere, Sterling is rangy in Cable and Eur/Gbp cross terms either side of 1.3050 and 0.8500 awaiting Friday’s preliminary UK PMIs that could well be the final jigsaw pieces for next week’s BoE policy meeting, and similarly the Loonie is biding time between 1.3050-1.3100 in the run up to Canadian CPI just before the BoC.

- EM – The Rand continues its recovery from worst levels after in line SA CPI and last week’s surprise SARB ease prompted Usd/Zar upside to test the 200 DMA yesterday, but also as the Dollar stalls after another look at the same DXY chart resistance level around 97.720. However, the Rouble is fading after a fleeting relief rally on the formation of a new Russian Government alongside oil prices towards 62.0000 again.

In commodities, WTI and Brent front-month futures remain lacklustre in mid-week trade – with participants pointing dampened sentiment on the coronavirus outbreak alongside demand woes for the complex, amid lower demand from airlines in light of cancelled flights ahead of the Chinese Lunar Year. Bearish supply-side fundamentals also weigh on the futures as EIA expects US total shale oil production to rise by 22k BPD in February to 9.2mln, with a predominant increase by the Permian. WTI meanders around USD 58/bbl ahead of its 200 DMA at 57.57/bbl and the 100 DMA at 57.29, whilst the Brent contract fell below its 100 DMA (62.79/bbl) with eyes on its 200 DMA at 63.97/bbl as Mar’20 futures test yesterday’s low just above 64/bbl. As a reminder, the weekly API Private crude inventories will be released later today on account of Monday’s MLK US market holiday. Spot gold prices have clambered off overnight lows after a test of the 1550/oz to the downside and ahead of potential modest resistance at its 50 HMA (~1559/oz) which did cap gains in the yellow metal during yesterday’s session. Meanwhile, copper prices found an overnight base around 2.8/lb but ultimately remains flat intraday.

US Event Calendar

- 7am: MBA Mortgage Applications, prior 30.2%

- 8:30am: Chicago Fed Nat Activity Index, est. 0.1, prior 0.6

- 9am: FHFA House Price Index MoM, est. 0.3%, prior 0.2%

- 10am: Existing Home Sales, est. 5.43m, prior 5.35m

- 10am: Existing Home Sales MoM, est. 1.5%, prior -1.7%

DB’s Jim Reid concludes the overnight wrap

A look at my Davos stats from yesterday shows around 20,000 steps and 10 miles of trekking around town to various meetings and events. I think 3 miles of that was taking a forced detour as Mr Trump’s motorcade came through town. We hosted a fascinating panel on sustainability pitting NYT best selling author Andrew McAfee who’s written an optimistic tome (More From Less) against Tim Jackson – an ecological economist – who has written a more pessimistic book (Prosperity Without Growth). It made for a lively debate and in all my interactions its clear that the number of these conversations are rising exponentially. In talking about our Davos piece on this topic (link here) at a separate meeting, one client explained one of the dilemmas they face. They invest in African development and mentioned that surely everyone would want health improvements in the continent – especially the poorer parts. However his assertion was that the only way that can happen in the immediate future is if their energy consumption increases which in turn potentially damages the planet. Raising the awareness of such trade-offs is one of the main themes of our report and this is where more and more attention needs to be focused.

It’s fair to say that the two headline grabbers of Davos yesterday have different views on the issue. President Trump said that “we must reject the perennial prophets of doom and their predictions of the apocalypse”. It’s fair to say Greta Thunberg took the polar opposite view. Elsewhere in Mr Trump’s speech, he trumpeted the achievements of his administration, criticised the Federal Reserve once again for not cutting rates fast enough, and also said that talks with China on phase two would start “very shortly”. Later on, ahead of a meeting with European Commission President Ursula von der Leyen, Trump said that “we’re going to talk about a big trade deal” and that it was “something that we all want to be able to make.” However, Trump also said in an interview with the Wall Street Journal that he was “absolutely serious” when it comes to putting tariffs on European cars if a trade deal couldn’t be reached.

In terms of today at Davos, Von der Leyen will actually be one of the main speakers, with an address at 11:30 CET, while there’s a potentially interesting panel on the future of financial markets a bit earlier at 10:30 CET, which includes IMF Managing Director Kristalina Georgieva, along with the US and UK finance ministers, Steven Mnuchin and Sajid Javid.

Back to markets, and equities sold off yesterday as the US returned from a holiday, with investors becoming a bit more cautious around the world amidst the continued spread of a new coronavirus in China. Reports that a case had been discovered in the US helped reverse a gradual rally back in markets prior to the last couple of hours of US trading. More on the US session below but the latest on the virus is that with the death toll increasing to 9 from 6, China is likely to start nationwide screening as officials are stepping up the monitoring of transportation links in the country. The confirmed cases of the infection have reached 440 as of January 21 (from 218 on January 20) and 1,394 patients are under medical observation. Including the detection in the US, the virus has now stretched to 5 additional countries with Macau reporting its first case overnight. Elsewhere, the WHO is going to decide today as to whether to declare the virus an international public health emergency. China has said that as of now it has seen no evidence of “super spreaders” – infected people who pass on the disease rapidly to many other people – but could not rule out that some would emerge. Super spreaders played a key role in the SARS pandemic 17 years ago, which killed almost 800 people and hurt economies across the region.

Assessing the economic impact of the coronavirus, our Asian economists draw conclusions from the past outbreaks of SARS and MERS (link here) and conclude that the impact from any spread of the disease would be felt most in the form of a sharp decline in retail sales, tourism, hotel & catering and travel activities as people try to avoid infection by restricting travel and people to people contact. Also, if necessary, public health measures might get introduced to reduce infections by imposing quarantines and closing schools which could result in a higher impact. But most other services and trade and manufacturing activities are unlikely to be affected much, in their view; and consumption and travel can be expected to recover quickly, even before the authorities give the all clear as observed during the SARS and MERS outbreak. The big problem is that as the Lunar New Year holidays approach it might prove hard for China to contain. Some good news is that China have been forthcoming and transparent about the spread of this coronavirus as they involved the WHO very early on and have also shared the genetic sequencing of the virus to allow early detection of cases in other countries. This is unlike what happened with SARS which first came to light in China in November 2002 but only got widespread attention after the first cases were detected in Hong Kong in February 2003.

Overnight in Asia, markets are making advances as investors are moderating their concerns over the virus. The Nikkei (+0.59%), Hang Seng (+1.25%) and Kospi (+1.00%) are all up. Meanwhile, the CSI (+0.08%) and Shanghai Comp (-0.02%) are trading flattish. As for Fx, the Japanese yen is down -0.15% while most Asian currencies are making modest advances. Elsewhere, futures on the S&P 500 are up +0.47% and yields on 10y USTs are up +1.2bps while, gold is trading down -0.33% and oil prices are down -0.40%. As for overnight data releases, South Korea’s preliminary 4Q GDP printed at +2.2% yoy (vs. +1.9% yoy expected).

Before this the S&P 500 fell back from its record high from Friday, ending the session down -0.26%. It was a similar story elsewhere, with the NASDAQ (-0.19%) and the Dow Jones (-0.52%) also seeing declines. Boeing (-3.33%) saw another tough session. Before this in Europe, the STOXX 600 pulled back from its intraday low of -0.99% to close just -0.14% lower. Nevertheless the risk-off sentiment supported sovereign debt, with 10yr Treasuries down -5.7bps to 1.766%, while the 2s10s curve flattened by -2.5bps. Gilt yields fell -1.9bps to their lowest level since October, while bunds (-3.1bps) and OATs (-3.0bps) also saw yields move lower. Italy was the exception, where the spread of BTPs over bunds widened by +4.9bps ahead of lots of political news flow of late and a regional election on Sunday. That said, they’re still holding the 150-170bps range seen since mid-November so it’ll be interesting to see if political risk leads to a break out.

Looking at yesterday’s earnings, UBS shares fell -4.53% after the company reported that last year’s net profit attributable to shareholders was down -5% year-on-year, with the bank also lowering their targets moving forward. Bank stocks were subdued generally yesterday, with the STOXX Banks index closing down -0.47% at a one-month low, though UBS isn’t a member of that particular index.

Staying with earnings, Netflix reported overnight and said that it added 8.76mn subscribers in 4Q (+20% yoy). However, it forecasted slower subscriber growth in the current quarter at 7mn (vs. 7.82mn) expected. The stock was up +2.38% in afterhours trading. IBM also reported with a slight beat. The stock was up +3.83% after hours.

Over in FX, sterling was the strongest-performing G10 currency yesterday, as the UK employment numbers ended a run of pretty weak data from the country. The 3m/3m employment change rose to +208k (vs. +110k expected) in November, its highest rate since January, while the unemployment rate remained at 3.8%, in line with expectations. In response, investors lowered the odds of a rate cut from the BoE at next week’s meeting after the data release, with the chances falling to around 60%, having been at 70.5% at the close on Friday. Our economists point out (link here) though that most of yesterday’s announced employment gains have been government led so it shouldn’t change the view on a necessary rate cut too much. The last big data release before the BoE meeting will be the preliminary January PMIs on Friday, so the market will be paying close attention.

Meanwhile in Germany, the ZEW Survey beat expectations, with the current situation reading rising to -9.5 (vs. -13.5 expected), while the expectations reading rose to 26.7 (vs. 15.0 expected), the strongest reading for the expectations indicator since July 2015. So a note of optimism ahead of tomorrow’s ECB meeting.

In terms of the day ahead there are a number of key highlights. From central banks, the Bank of Canada will be deciding on rates, while Bank of England Governor Carney will be speaking at the Bloomberg Climate Forum in Davos. Earnings releases out today include Johnson & Johnson, Abbott Laboratories, ASML and Texas Instruments. Finally on the data, we’ll get French business confidence in January, Italian industrial sales and industrial orders from November, UK public sector net borrowing for December, Canada’s December CPI reading, and finally US existing home sales for December and the FHFA house price index for November.

Tyler Durden

Wed, 01/22/2020 – 07:48

via ZeroHedge News https://ift.tt/2RkRpdj Tyler Durden