Hubris Defined

Authored by Sven Henrich via NorthmanTrader.com,

One day this bull market will end and the age of the central banking enabled debt bubble will be exposed for the hubris that it is and all the sins of “potential side effects” that central bankers warn about but never do anything about will come back to haunt all of us.

It’ll be the age of the great unwind. Nobody will tell us in the moment when it peaks and I suspect it will not start with a bang, rather a whimper, but only end with a bang.

And this great unwind will not last a month or a year, but many years as all the excesses will have to work themselves through the system and all the systematic buy programs will turn into systematic sell programs that will be just as relentless on the way down as they were on the way up.

The very notion of the permanent can kicking we are witnessing now will reveal itself to have been a fantasy. People forget that 2019 and into 2020 came about because of systemic failure of epic proportions. The single one time central bankers tried to tighten blew up in their faces. And the Fed’s forced re-expansion of their balance sheet has now bestowed this blow-off top that has pushed asset prices the farthest distance above the underlying size of the economy that we’ve ever seen. A perversion of the financial system that has created wealth for the few not seen since the 1920s.

I can’t know when this process begins. Nobody can. For all I know it begins today. Or it could be months from now. The price action will tell us. Economically, technically, structurally it’s all set up for it.

Global growth keeps structurally weakening. Plain obvious fact. Demographics are changing and have been changing and continue to change and they are not conducive to new organic growth. Technology remains deflationary. Debt burdens keep exploding and ALL of it is held up by central bankers, none of it would be sustainable at this point without all these interventions that we keep seeing. It’s a crisis. Full stop. If you have to intervene you are fighting a crisis. And they are intervening as much as they did in the depths of the financial crisis.

The Fed’s now been exposed by all the major banks to be the driver of this rally. Even last week when I was personally being arrogantly dismissed as a “swashbuckling pirate QE conspiracist” by a US Fed president on twitter (sometimes all one can do is laugh) major banks have all come out and have called the Fed’s action QE and directly responsible for goosing asset prices.

Even today the CEO of Morgan Stanley called it QE:

Morgan Stanley CEO James Gorman says the Fed’s balance sheet expansion is quantitative easing and one of the only tools they have left to work with. He spoke to @FerroTV and @tomkeene at #WEF2020 https://t.co/O9yXfG5P1D pic.twitter.com/lMHu3ZnjQM

— Bloomberg TV (@BloombergTV) January 22, 2020

People have resigned themselves to believing that central banks will forever prevent downturns and busts. No literally.

Here’s Bridgewater’s Prince declaring the boom-bust cycle to be over while in the same breath admitting that central bank tightening is a virtual impossibility as it causes market pain:

The boom-bust economic cycle is over, says Bridgewater Co-CIO Bob Prince. He spoke to @tomkeene and @FerroTV at #WEF2020 https://t.co/4GaCR4Ux8W pic.twitter.com/CVAWDUA7km

— Bloomberg TV (@BloombergTV) January 22, 2020

Why is that? Because central banks are trapped, the entire world is trapped.

This part of the cycle is the most dangerous. Why? Because it has now produced the most dangerous investor behavior. Chasing vertical charts irrespective or price or valuations, $TSLA being an example of many.

“this is nothing like 2000”https://t.co/4CScTEiMfi pic.twitter.com/XaU9Ueo74t

— Sven Henrich (@NorthmanTrader) January 22, 2020

While many investors and participants may not have been around during the bubble in 2000, they may well end up re-learning its lessons that hard way.

This is not a rally born from strength and growth. It is born out of desperation, fear and failure. Failure to normalize balance sheets and interest rates. Fear of a larger market downturn. Desperation to keep a liquidity starved overnight market under control.

In process multiples have massively expanded over the past year:

Over the last year trailing P/E multiples have increased by 30% and 33% for $SPX and $NDX respectively. pic.twitter.com/RfFCzTPXn9

— Sven Henrich (@NorthmanTrader) January 22, 2020

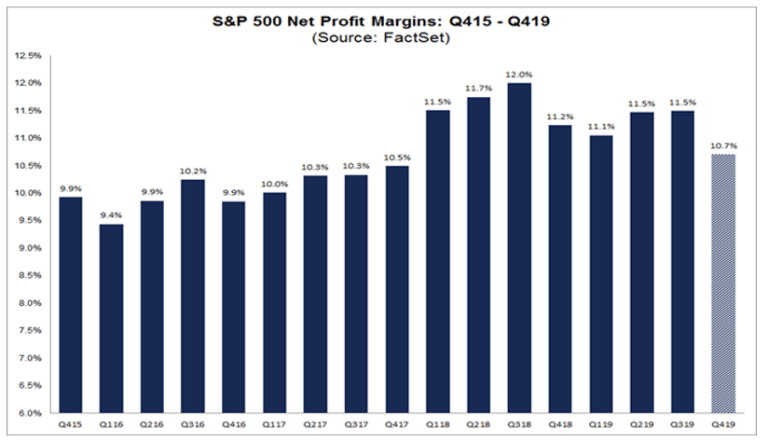

While profit margins have continued to decline:

None of these concerns will matter until complacency gets punished for in the end math matters, valuations matter and technicals matter. And then the age of hubris will come undone.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Wed, 01/22/2020 – 16:25

via ZeroHedge News https://ift.tt/2GcoTUI Tyler Durden