Stocks Give Up Early Gains As “Contained” Coronavirus Death-Count Doubles Overnight

“It’s contained” was apparently the narrative-du-jour…

…never mind the actual facts on the ground as cases soar, deaths spike, and China declares martial law in all but name…Stocks were steady so all is well…

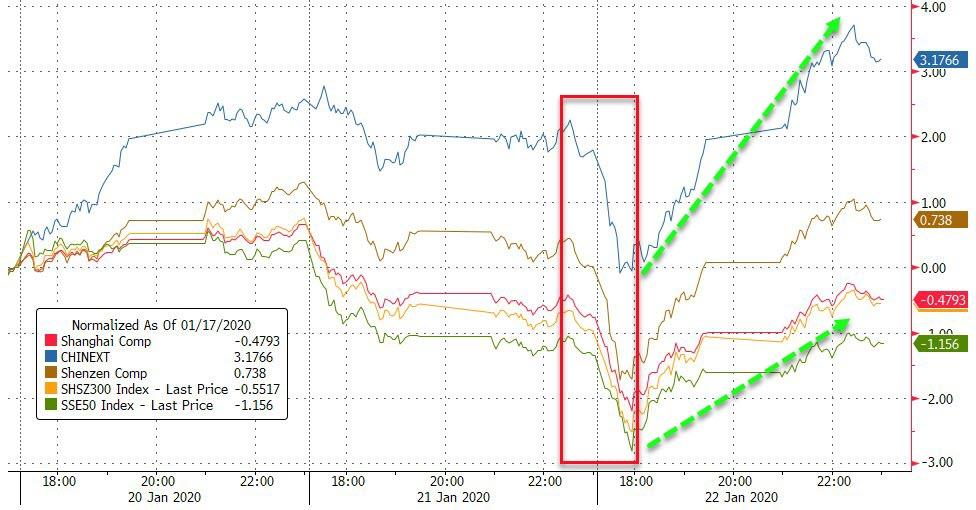

Chinese stocks rose because “contained”…

Source: Bloomberg

European markets opened higher because “contained” but faded as the day wore on…

Source: Bloomberg

US markets were buoyant on hopes of “contained” but as reality hit during the day, and the WHO press conference, stocks faded…

Futures show the price action a little clearer – from the moment it was announced that the virus had reached US…

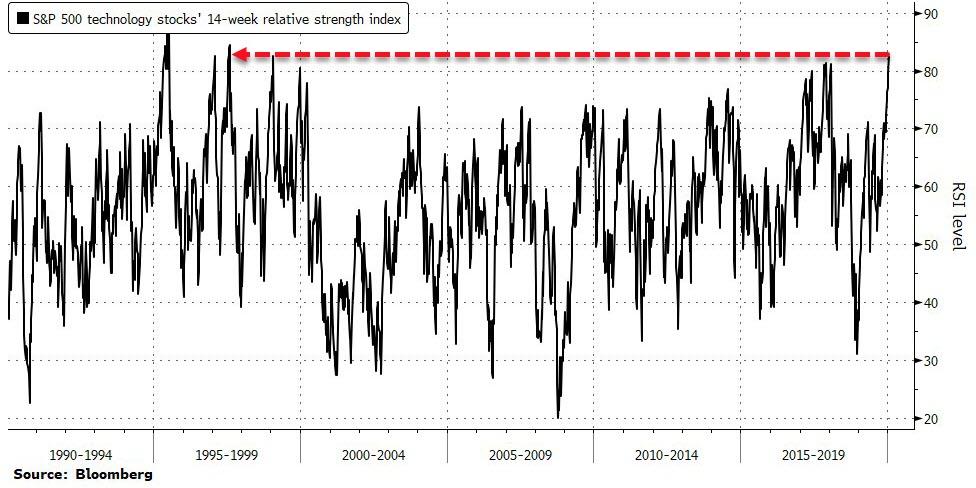

Bloomberg reports that demand for U.S. technology stocks has become so relentless that it’s time for “pulling in the horns,” according to Tony Dwyer, Canaccord Genuity LLC’s chief market strategist. “A temporary correction” is to be expected, Dwyer wrote.

Source: Bloomberg

Tesla soared to a new record high – topping $100bn market cap and VW for the first time as the world’s largest carmaker…

Source: Bloomberg

Beyond Meat puked…

Source: Bloomberg

Boeing was all over the place despite CEO confidence…

Source: Bloomberg

The flu-shot makers tumbled back to earth today because “contained”…

Source: Bloomberg

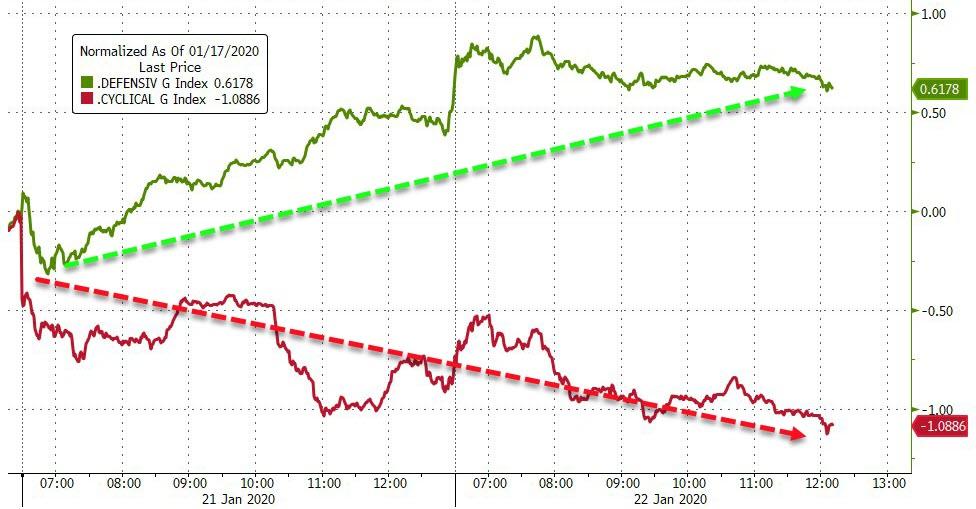

Second day in a row, defensive stocks dominated cyclicals…

Source: Bloomberg

HY credit protection is notably decoupling from equity protection costs…

Source: Bloomberg

And HYG (US HY Bond ETF) is flashing a warning message)…

Source: Bloomberg

The decoupling between bonds and stocks has become ridonculous…

Source: Bloomberg

Treasury yields tumbled further today

Source: Bloomberg

30Y Yield closed at its lowest since Dec 3rd…

Source: Bloomberg

2Y Yields closed at 3mo lows…

Source: Bloomberg

The dollar trod water once again, ending very modestly lower…

Source: Bloomberg

Despite stocks arguing that the virus is “contained”, Yuan tumbled…

Source: Bloomberg

Cable rallied on the Brexit vote today…

Source: Bloomberg

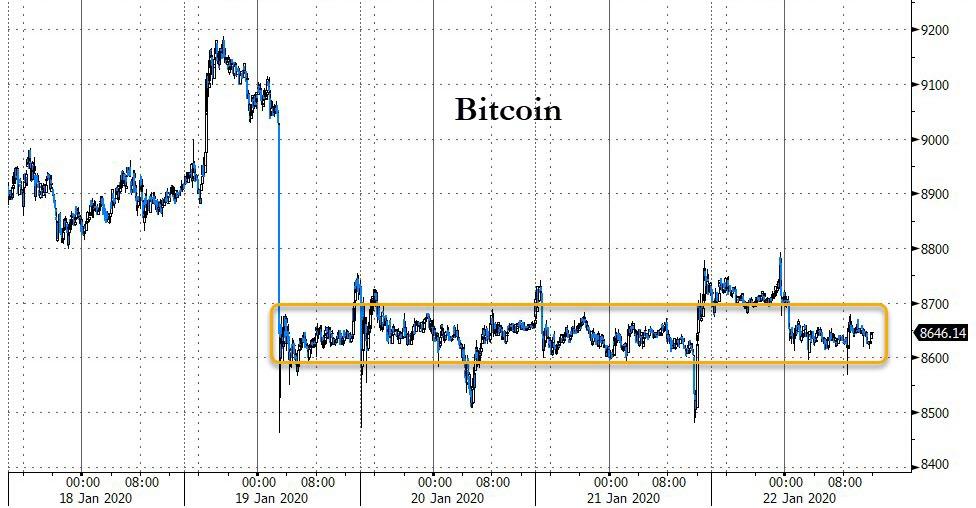

Bitcoin remained ‘steady’ around $8600-8700…

Source: Bloomberg

Copper and Crude sank notably today (not “contained”) with PMs flat to slightly higher…

Source: Bloomberg

WTI traded down to a $56 handle ahead of tonight’s API inventory data…

Platinum and Paladium bounced back today from their significant drops yesterday…

Source: Bloomberg

Finally, we note that ‘hard’ data is not buying what ‘soft’ survey data is selling…hope remains!

Source: Bloomberg

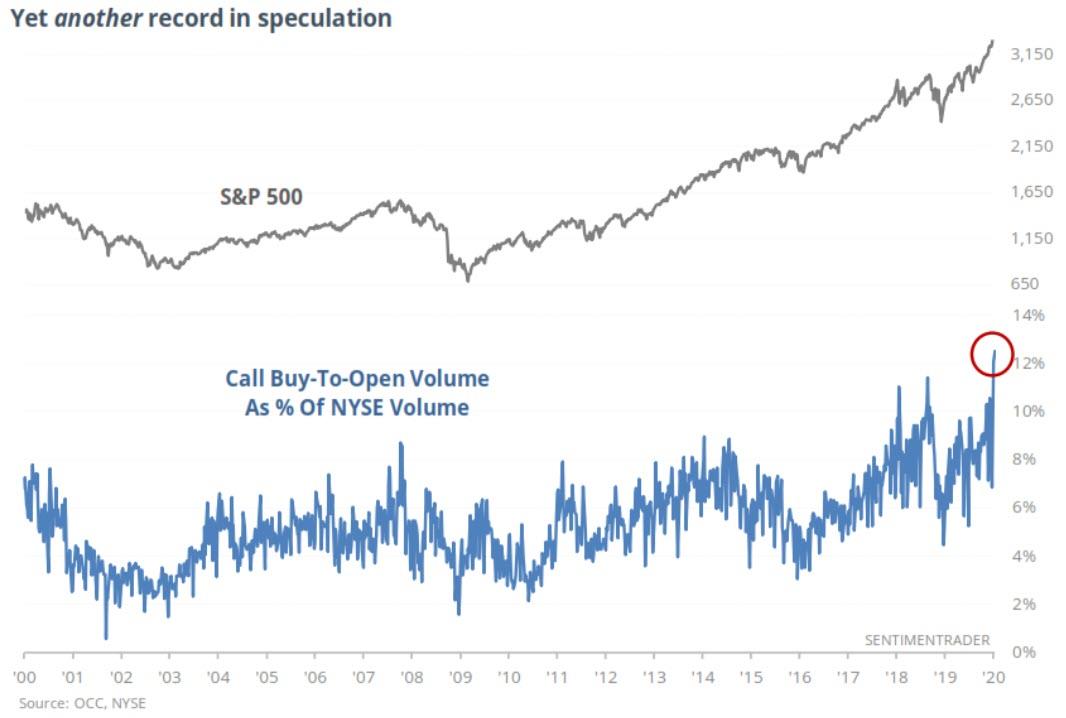

Specs are record levered long…

What could go wrong?

Tyler Durden

Wed, 01/22/2020 – 16:01

via ZeroHedge News https://ift.tt/2Gclkhi Tyler Durden