Tesla Now Valued More Than World’s Largest Automaker After Volkswagen-Like Short Squeeze

In a delightful turn of irony, the relentless short squeeze that has gripped Tesla shares ever since the Fed launched QE4 in October, a squeeze many have compared to the infamous Volkswagen short squeeze of 2008, sent TSLA shares another 5% higher in the process pushing the electric vehicle maker’s market cap above $100 billion for the first time ever, $103BN to be precise, rising above the world’s largest automaker Volkswagen (at $100BN), bigger than Toyota. It is now also bigger than GM ($50BN) and BMW ($51BN) combined, and is almost 3 times bigger than Ford ($36.5BN).

The record milestone came less than a month after Tesla”s stock crossed the infamous “funding secured” bogey of $420, the fake LBO price tweeted by Musk in 2018 which put got in much trouble for securities fraud, and which cost Musk his position as Tesla Chairman

More importantly, by surpassing a $100BN market cap, a record-breaking $346MM pay package for Elon Musk is now triggered. However, according to the fine print, the $100 billion valuation must stay for both one-month and six-month average in order to help Musk get the first of 12 tranches of this massive payout.

Putting Tesla’s valuation in context, Volkswagen delivered just over 10.8 million vehicles in 2019. By contrast, Tesla deliveres 367,200 cars in 2019, although investors have now bet the farm on the Chinese auto market where Tesla is betting the next leg of its growth will come from.

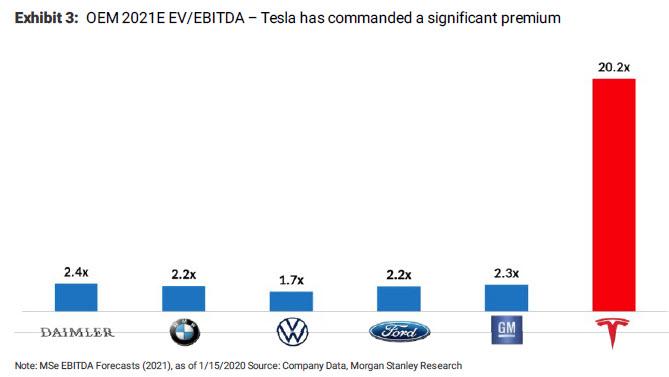

Last week, Morgan Stanley looked at Tesla’s valuation relative to other OEMs and came up with this chart:

Fast forward to today, when the red bar is now about 10% higher.

Tyler Durden

Wed, 01/22/2020 – 08:20

via ZeroHedge News https://ift.tt/3azSdTd Tyler Durden