Hard Data Defies Confidence Consensus – The Slowdown Ain’t Over

Via Economic Cycle Research Institute (ECRI),

The consensus is that the U.S. consumer is still strong enough to propel the economy forward even though the manufacturing sector has weakened. This view underpins expectations for improved corporate earnings in 2020. But the hard economic data strikes a discordant note.

In particular, growth in industrial production on a year-over-year basis remains in a decisive downturn, sliding deeper into negative territory. Indeed, the production actually declined in 2019 amid losses in manufacturing job in recent months, fueling talk of a recession in that part of the economy.

The undeniable weakness in manufacturing has caused the consensus to trumpet the strength of the consumer. Yet, the consumer, while reportedly confident, is not spending hand over fist. Rather, weakening sales trends [which we flagged ahead of the holiday season] underscore a sustained slowdown in consumer spending.

Real retail sales growth fell to a six-month low of 1.25% in November on a year-over-year basis, dropping from 3.75% two years earlier. Yes, there was a big rebound in December, but that was mostly due to a highly favorable comparison to the disastrous December 2018 plunge in retail sales. Plus, that doesn’t negate the fact that spending growth has been tailing off even though surveys report a confident consumer and the stock market is at record highs.

So, what gives? The lifeblood of the average consumer is job growth, not stock prices. So it’s important to recognize that year-over-year growth in nonfarm payrolls has dropped to its lowest level in 2.25 years. Not only that, but growth in total hours worked – which reflects growth in both jobs and the length of the workweek – hasn’t been this weak since 2010, dropping to 0.9% in December from just over 2% a year earlier.

Worse still, growth in total pay has fallen even faster over the past year or so than growth in hours worked, slowing to a 3.8% pace from almost 5.5%. As a result, the year-over-year growth in average hourly earnings – the ratio of total pay to total hours worked – has fallen to 1.1% from 1.6%. This is the math behind the worrisome downturn in wage growth even in the face of a very low 3.5% jobless rate that has furrowed the brows of many economists.

For the average American, that sharp slowdown in the growth of total pay limits spending growth. No matter how confident consumers might feel, there’s only so much fresh debt they can realistically incur to support even more spending. The hard data shows growth in jobs, total pay and total hours worked are stuck in cyclical downswings. It also shows weakening trends in consumer spending and industrial production growth.

So while financial markets buoyed by increasingly accommodative central banks may be supportive of higher-income consumers, the average American is under considerable strain. Despite low yields on U.S. Treasury securities, average credit card rates have climbed inexorably in the last five years, surging above 15% in 2019. Meanwhile, one third of those buying new vehicles have negative equity in the used ones they are trading in, up from about one quarter before the financial crisis. And farm debt has topped $400 billion, up almost 40% since 2012.

All this is why the boost to the economy from the Federal Reserve’s dovish pivot a year ago has primarily aided relatively narrow parts of the economy, such as financial services, residential construction and affluent consumers. But it has not helped business investment or average consumers, making it difficult to ignite an acceleration in overall economic growth.

Regardless of the consensus view that the consumer is “strong,” there’s actually little indication that the deceleration in economic growth is over. As long as that’s the case, the risk of a recession – while not a clear and present danger – can’t be taken off the table for 2020.

* * *

Wall Street has prematurely gone all-in on the “strong” consumer narrative at a time when a manufacturing recession has triggered an employment slowdown that could start weighing on consumer spending.

Money managers and leverage funds have front-run a V-shape economic rebound thanks to an abundance of Federal Reserve liquidity.

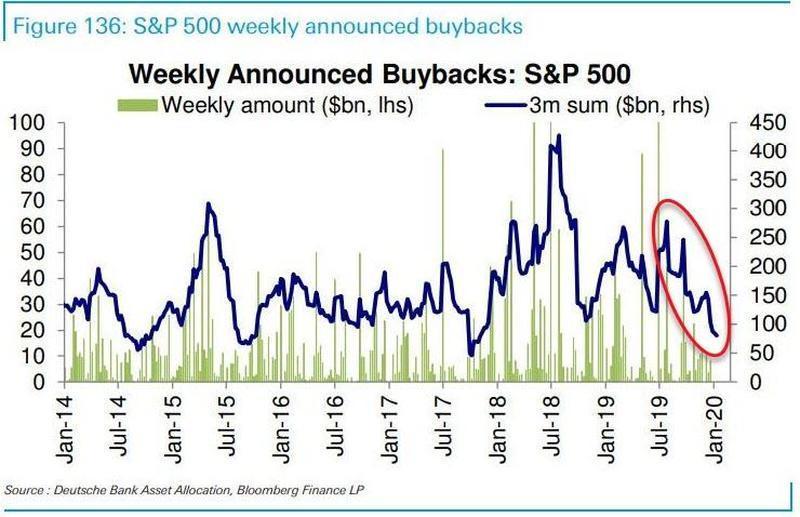

With the economy continuing to decelerate and no signs of a significant upturn – and the threat the consumer could start weakening – the stock market’s most important support – buybacks – are rapidly declining.

If Fed liquidity shrinks, buybacks continue to decline, and a manufacturing recession transmits weakness into consumers — it seems that a blow-off top similar to the Dot Com era could be nearing.

Tyler Durden

Wed, 01/22/2020 – 19:25

via ZeroHedge News https://ift.tt/30MvDlI Tyler Durden