Corona-Contagion Crashes Commodity/Stock Markets Worldwide, Bonds & Bullion Bid

As @GreekFire32 correctly mocked:

“Of all the fundamental catalysts like sliding economic growth, inflation, earnings, cash flow… the bears had to wait for a virus from humans eating bat soup to get a 1% sell-off “

A black bat or black cat spoiled the party…

— Yawn Connor (@SPF2Million) January 22, 2020

Doesn’t look so bad…

— 思雪 (@a524952) January 24, 2020

“probably nothing…”

For a sense of the damage (or perhaps more of the calm we have encountered in the last few months)…

-

Shanghai Comp’s worst week in 8 months

-

S&P 500’s worst week in 5 months

-

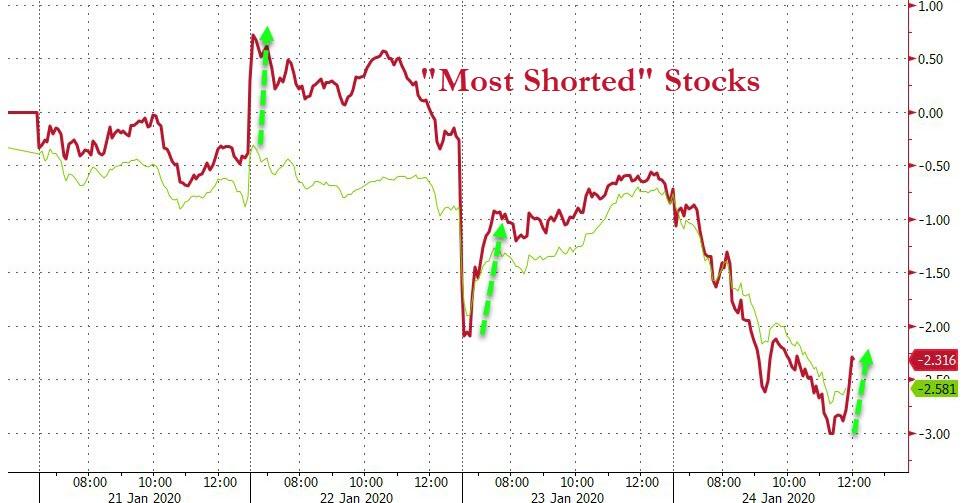

“Most Shorted” stocks had their biggest weekly drop in 4 months

-

France’s CAC 40 worst week in almost 4 months

-

VIX’s biggest weekly spike in almost 6 months

-

HY Bond Prices worst week in almost 5 months

-

Treasury yields biggest weekly drop in 4 months

-

Yield curve’s biggest weekly flattening in 2 months

-

USD’s best week in 2 months

-

Yuan’s worst week in 4 months

-

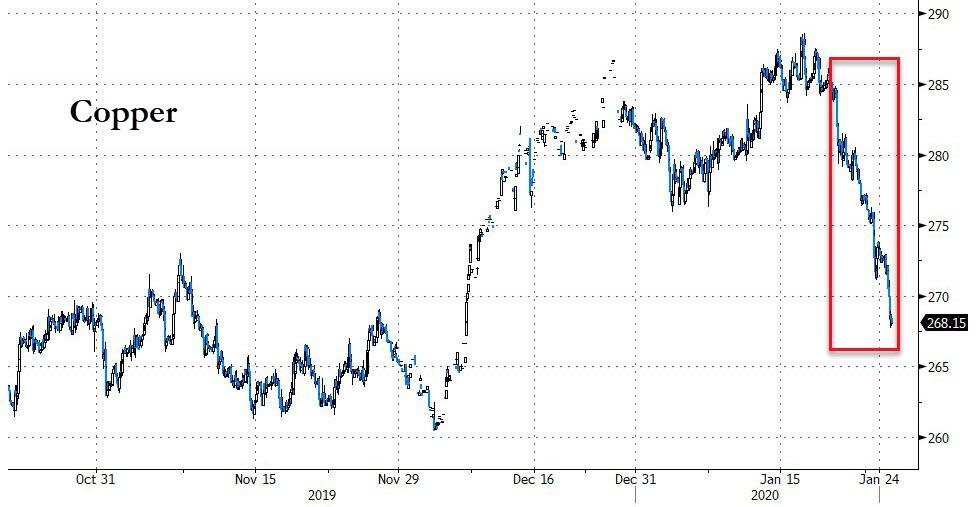

Copper’s worst week in over 5 years

-

Oil’s biggest weekly drop in 8 months

-

Gold’s 6th weekly rise in last 7 weeks

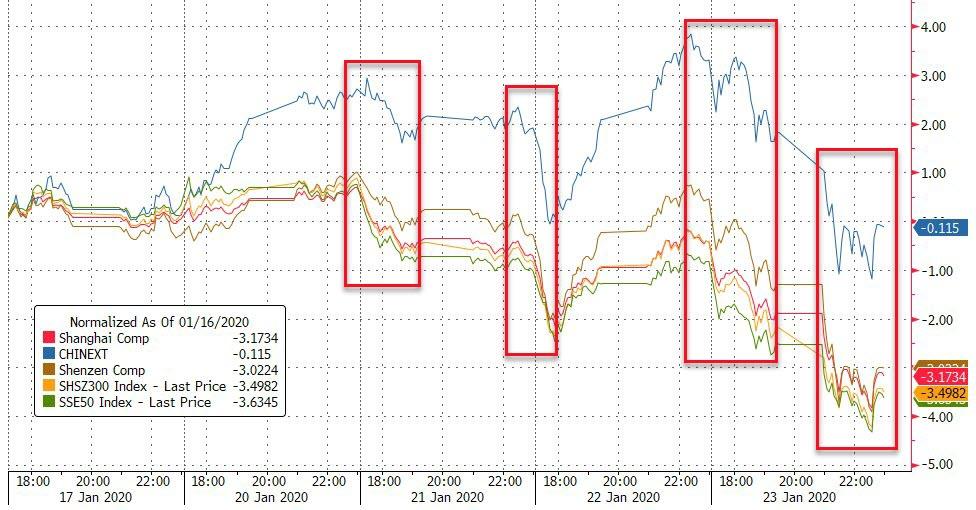

China ended notably weaker this week (China closed on Friday for lunar new year celebration)…

Source: Bloomberg

Mixed picture in Europe this week with Germany clinging to gains while France and Spain tumbled…

Source: Bloomberg

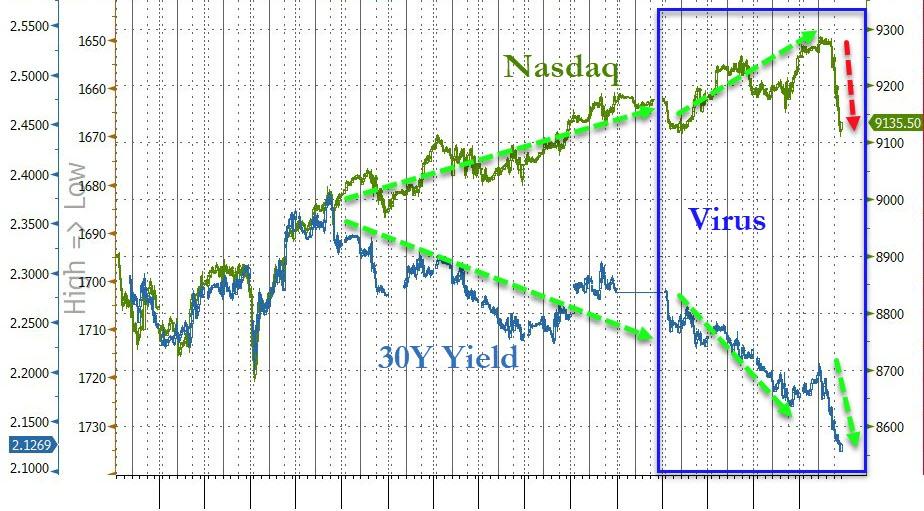

US Equity majors were all down on the week, unable to hold the hope-filled gains…Nasdaq ended its 6-weekly gain in a row (and AAPL broke its 9 week streak)

Source: Bloomberg

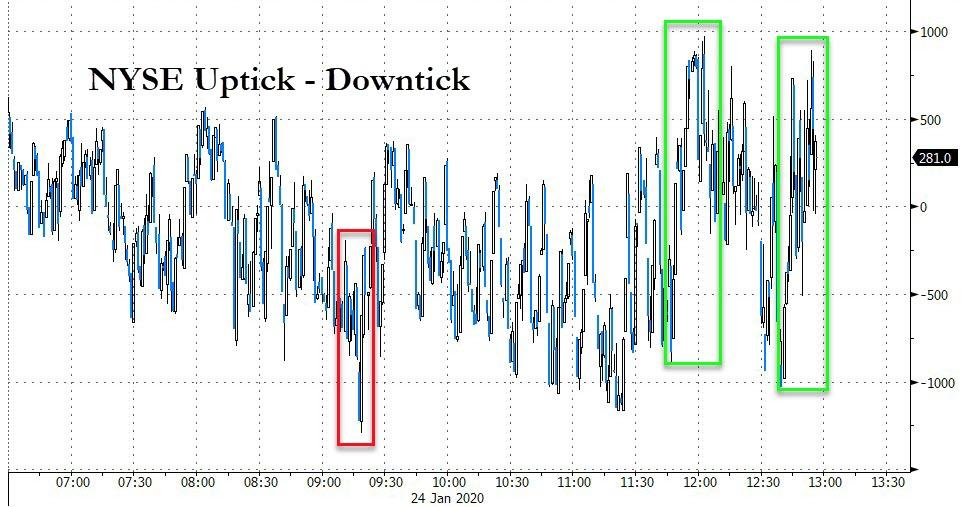

Two big buy programs in the last hour did their best to lift stocks…

Source: Bloomberg

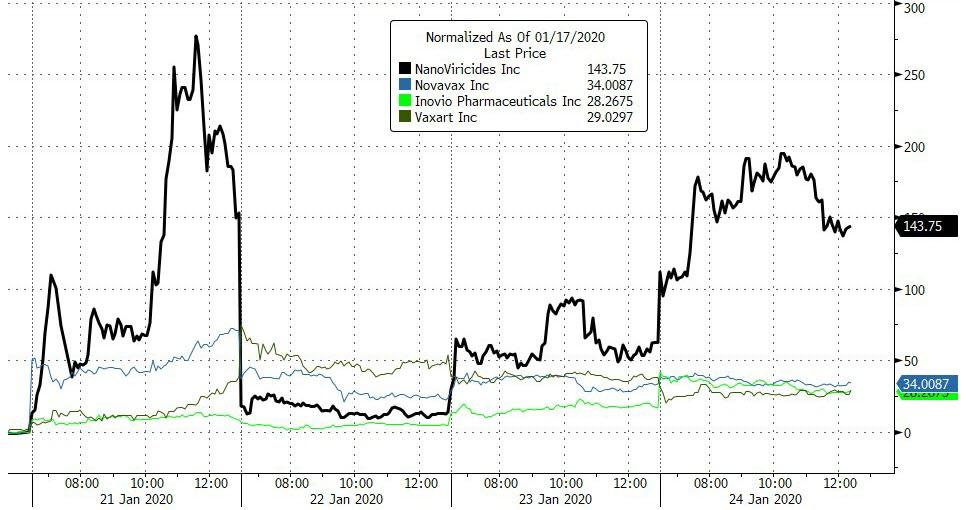

Flu-makers shot higher on the week…

Source: Bloomberg

Boeing rescued The Dow from its worst levels after the machines read FAA comments as extremely positive…

Source: Bloomberg

Managing to magically lift The Dow back above the crucial 29k level (but couldn’t hold it)…

So to clarify – The Dow rebounds on hopes that a plane which is designed by clowns, who are in turn supervised by monkeys, will fly again.

Will you ever fly in a 737 MAX again?

— zerohedge (@zerohedge) January 24, 2020

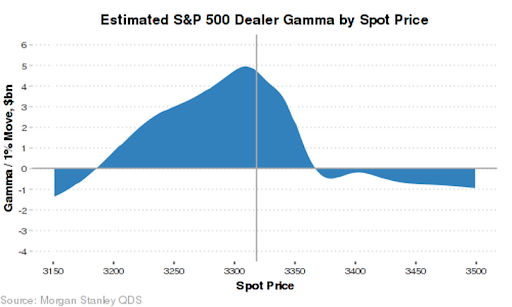

And the S&P desperately tried to get back to 3300 (but couldn’t hold it)…

Where ‘peak’ gamma is…

“Most Shorted” stocks plunged this week

Source: Bloomberg

Defensive dominated the week’s price action, despite every effort to levitate cyclicals…

Source: Bloomberg

As Dow Earnings expectations plunge…

Source: Bloomberg

VIX touched 16.00 intraday before fading…

The divergence between stocks and bond yields failed to narrow as while stocks fell, bond yields plunged…

Source: Bloomberg

Meanwhile, credit markets are getting clubbed like a baby seal…

Source: Bloomberg

Overall, an ugly week for credit and equity protection markets…

Source: Bloomberg

Treasury yields plunged their most in 4 months this week…

Source: Bloomberg

30Y Yields broke to its lowest yield since Oct 10th…

Source: Bloomberg

Yield curve flattened dramatically this week…

Source: Bloomberg

The Dollar surged to key December resistance, up 3 weeks in a row…

Source: Bloomberg

Yuan plunged on the week…

Source: Bloomberg

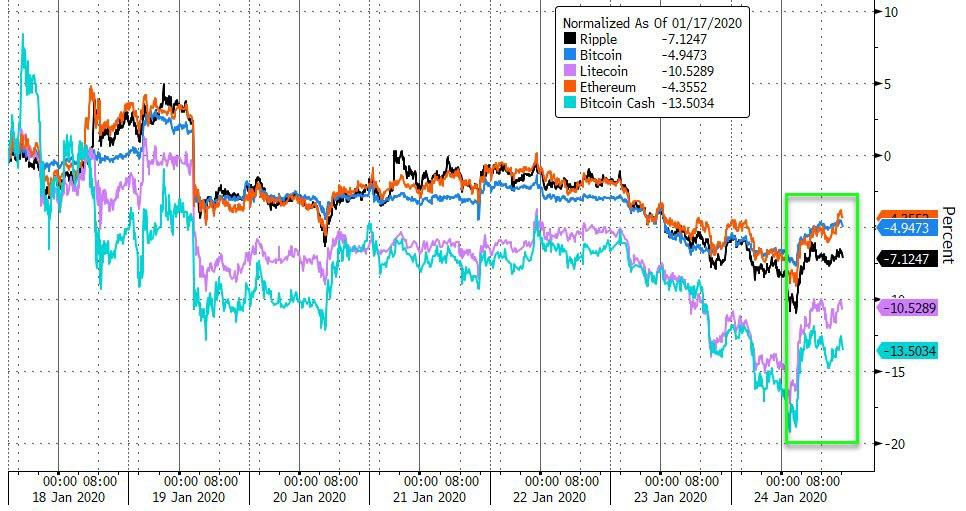

A big bounce back in crypto today rescued the week but there was red across the board still…

Source: Bloomberg

Commodities were wildly mixed this week with PMs bid as copper and crude crashed…

Source: Bloomberg

WTI crude futs tumbled to a $53 handle intraday today, lowest in 3 months…

And as black gold plunged, the yellow metal spiked…

This was Copper’s worst week since Nov 2014…

Source: Bloomberg

Finally, it seems the markets hate Liz Warren and don’t think Bernie stands a chance…

Source: Bloomberg

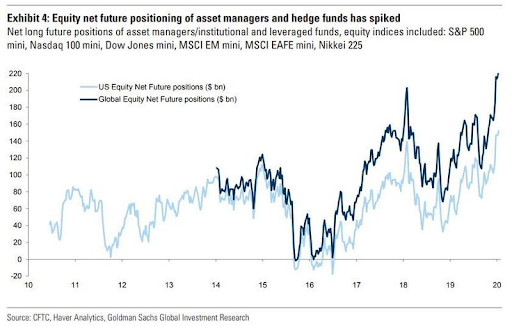

And, as a gentle reminder, everyone and their pet (edible) bat is all-in…

Here’s to the weekend…

Tyler Durden

Fri, 01/24/2020 – 16:01

via ZeroHedge News https://ift.tt/2GjaXrV Tyler Durden