Stocks Shrug Off Global Pandemic Fears As Gold ETF Holdings Hit Record High

Despite GOOGL’s demise, the exuberance in TSLA sent Nasdaq back to record highs today, shrugging off any anxiety over global pandemics, trade collapses, and the second-largest economy in the world basically closed.

But while stocks soared, bonds were not buying it…

Source: Bloomberg

Nor was copper…

Source: Bloomberg

Nor crude (WTI traded back below $50)…

Source: Bloomberg

And finally, Yuan suggests this is far from over…

Source: Bloomberg

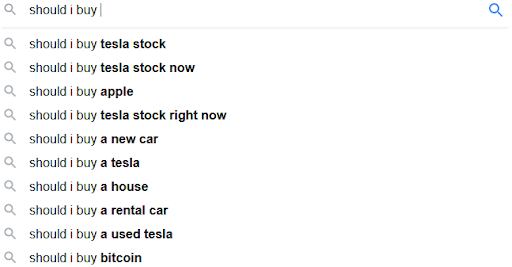

But what really matters is this…

Retail is getting sucked back in…

The IMX is TD Ameritrade’s proprietary, behavior-based index, aggregating Main Street investor positions and activity to measure what investors actually were doing and how they were positioned in the markets.

So it’s rug-pulling time for the big boys…

* * *

Another CNY400 Billion net liquidity injection juiced China stocks…

Source: Bloomberg

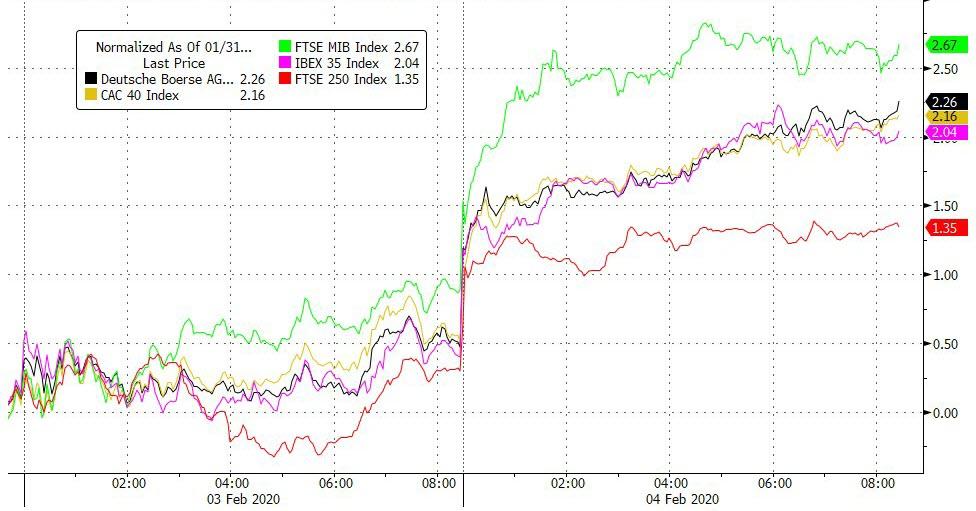

European markets uniformly soared today extending Monday;s modest gains…

Source: Bloomberg

And US stocks smashed higher at the open and largely trod water (except Nasdaq which kept pushing to record-er highs)…

Nasdaq broke out to new record highs… as if the coronavirus never happened (we’ve seen this pattern before)…

It did seem like Dow 29k was important for Trump ahead of tonight’s SOTU, but once again it just couldn’t get there…

For the second day in a row, a giant squeeze of the shorts at the open…

Source: Bloomberg

While GOOGL stole the headlines with disappointing earnings, it was TSLA that dominated traders’ minds…

Source: Bloomberg

TSLA’s short-squeeze is beginning to be on par with VW’s infamous move in 2008…

Source: Bloomberg

Source: Bloomberg

Treasury yields surged today…

Source: Bloomberg

30Y Yields spiked off the 2.00% level…

Source: Bloomberg

The dollar held yesterday’s gains back into its tight range…

Source: Bloomberg

Yuan rebounded today after China’s gigantic liquidity injection…

Source: Bloomberg

Cryptos were broadly lower today with the notable outlier of Ripple surging early on…

Source: Bloomberg

Copper was higher today (China liquidity) but PMs and crude were knocked lower…

Source: Bloomberg

Palladium soared today back towards record highs…

Source: Bloomberg

WTI traded down below $50…quite a swing from the Soleimani killing and Iran missile strike highs…

Source: Bloomberg

And while traders show no fear whatsoever piling into the most expensive and most overbought stock market ever, global gold holdings in ETFs has risen to record highs…

Source: Bloomberg

And finally, we note that, just like during The Fed’s Y2K Liquidity splurge, Nasdaq has rebounded right on time…

Source: Bloomberg

It also seems like stocks have come to terms with Bernie getting the nod!!?? Or are they revelling in Iowa’s ‘good start’ at rigging it away from Sanders once again.

Source: Bloomberg

Tyler Durden

Tue, 02/04/2020 – 16:02

via ZeroHedge News https://ift.tt/2UlrzI1 Tyler Durden