“Big Short’s” Eisman Top-Ticks Tesla, Covers Short As Carmaker Enters Bear Market

Update (1015ET): Tesla crashes into a bear market on Wednesday morning, down 21.57% from tagging the 968-handle on Tuesday. It appears Steve Eisman covered his short a little too early.

* * *

“The Big Short’s” Steve Eisman, known for shorting the housing market before the 2008 financial crash, was forced to cover his bearish bet on Tesla.

Tesla has plunged nearly 15% or has lost $142, or about $25 billion in market cap since yesterday’s 968 print.

“Look, everybody has a pain threshold,” Eisman, a senior portfolio manager at Neuberger Berman Group, told Bloomberg TV’s Tom Keene.

“When a stock becomes unmoored from valuation because it has certain dynamic growth aspects to it, and has cult-like aspects to it, you have to just walk away.”

Eisman said his firm owns GM and calls it a “reality on the ground” relative to the “dream” Tesla bulls have: dominate the electric vehicle market.

GM “used to be a poorly run company with a terrible balance sheet and terrible products, and today it’s got a great balance sheet, it’s got very good management and it’s no longer in Europe,” he said.

Eisman is a GM bull. He opened long trades on the carmaker about a year and a half ago. “It’s really not a car company anymore, it’s really a truck company that also sells SUVs very profitably and it has a real division called Cruise which is a real option on autonomous driving,” he said.

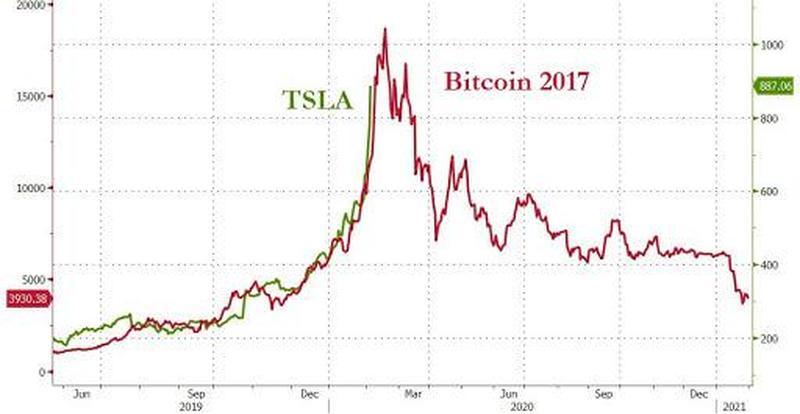

The parabolic melt-up seen in Tesla’s shares in the last several weeks is starting to unwind. The catalyst today could be due to production delays at Tesla Giga Shanghai because of the coronavirus.

However, we must note, investors have been well aware of possible production woes in Shanghai for the last week.

And maybe Eisman, who timed the 2008 financial crisis with precision, might have been stopped out of his Tesla short right before all the fun starts…

Tyler Durden

Wed, 02/05/2020 – 10:18

via ZeroHedge News https://ift.tt/31qaVZg Tyler Durden